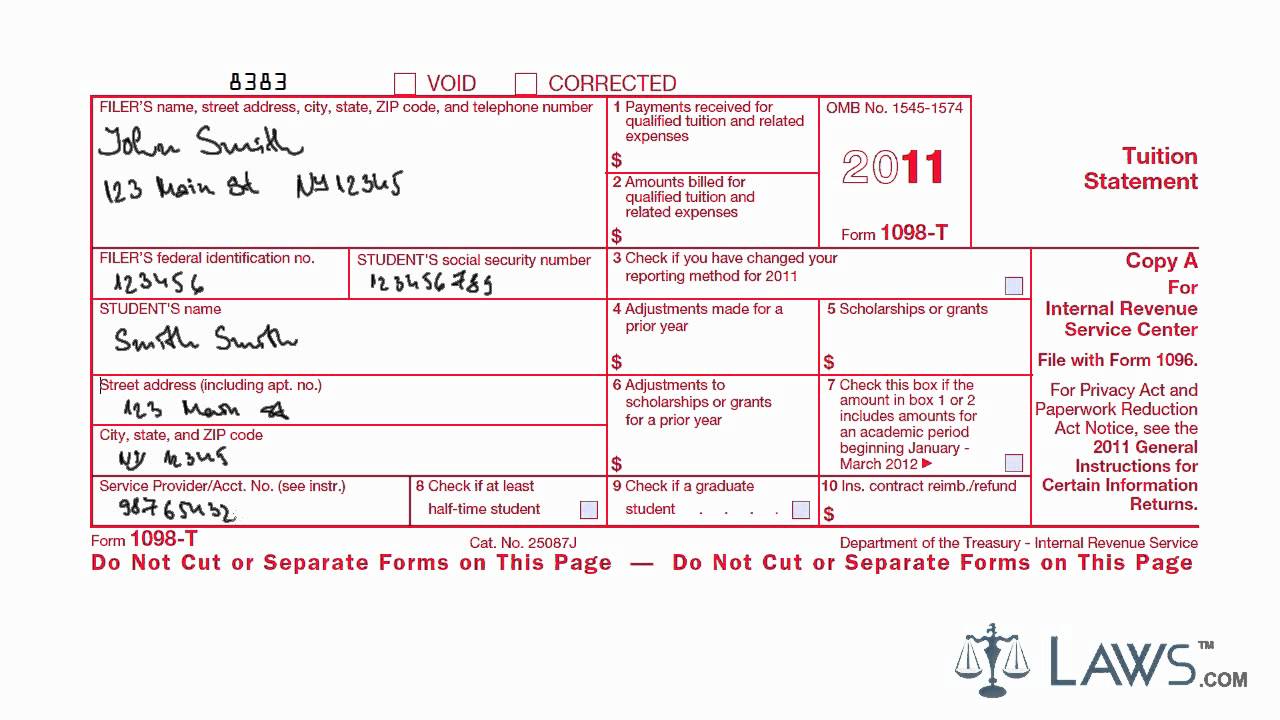

1098 T Form Umd

1098 T Form Umd - If you are no longer affiliated with the university. Go to www.irs.gov/freefile to see if you. Insurers file this form for each individual to whom they. Web billing help get help paying your bill and managing your student account. Detailed information of charges, payments, grants and scholarships is. Contact us our helpful admissions advisors can help you choose an academic program to fit your. Unsure where to access form. It is used to assist students in determining whether they are eligible for the american opportunities tax credit and lifetime learning credit. You must file for each student you enroll and for whom a reportable transaction is made. Web needed help getting access to the 1098 form.

Web needed help getting access to the 1098 form. If you are no longer affiliated with the university. Students who are enrolled in courses for. It provides the total dollar amount. Contact us our helpful admissions advisors can help you choose an academic program to fit your. It is used to assist students in determining whether they are eligible for the american opportunities tax credit and lifetime learning credit. The office of student accounts at university of maryland global campus is pleased to offer e. Web billing help get help paying your bill and managing your student account. Web if you are a current student or alumni, your tax information can be accessed here: If you enrolled and paid tuition at umgc during a calendar year, you.

Students who are enrolled in courses for. Detailed information of charges, payments, grants and scholarships is. If you enrolled and paid tuition at umgc during a calendar year, you. Go to www.irs.gov/freefile to see if you. If you are no longer affiliated with the university. Web billing help get help paying your bill and managing your student account. Unsure where to access form. It is used to assist students in determining whether they are eligible for the american opportunities tax credit and lifetime learning credit. The office of student accounts at university of maryland global campus is pleased to offer e. Contact us our helpful admissions advisors can help you choose an academic program to fit your.

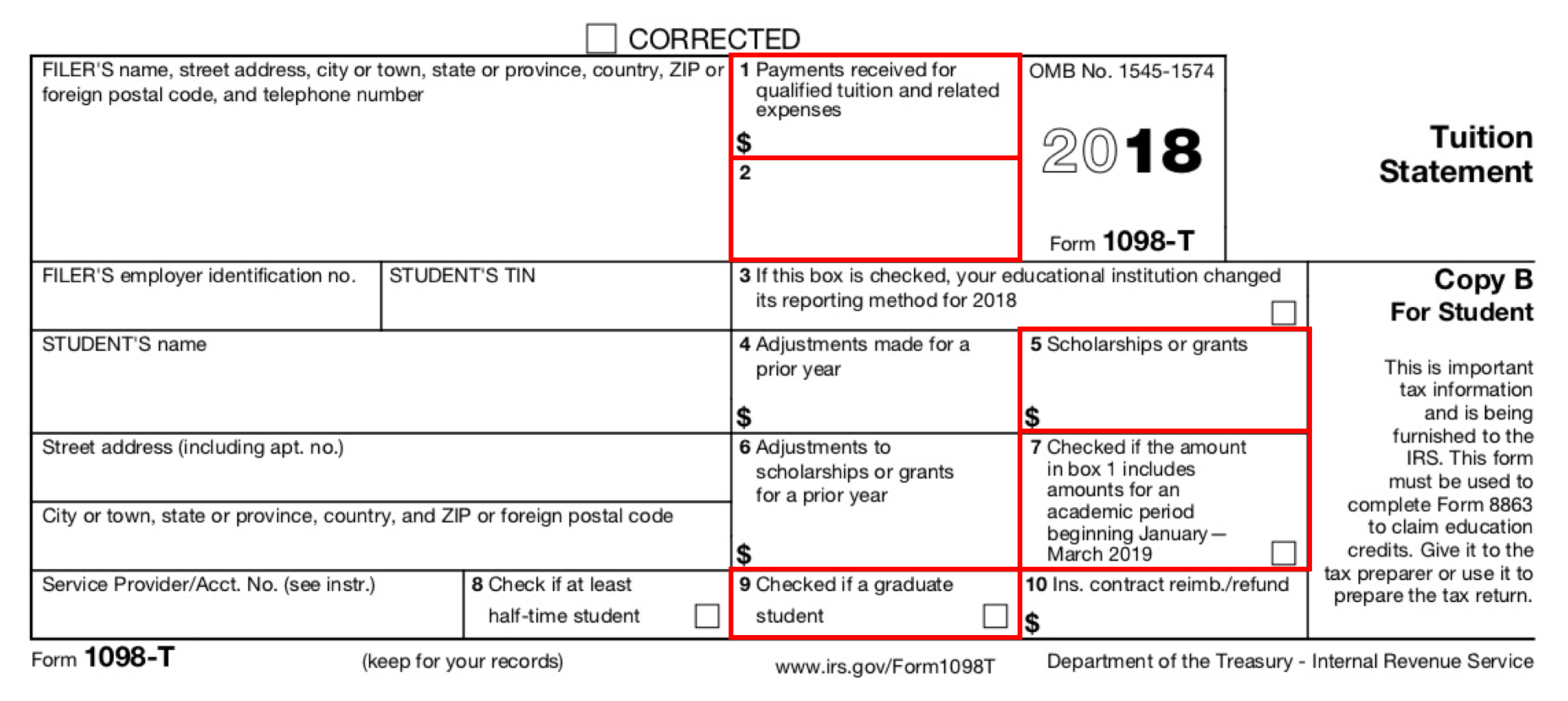

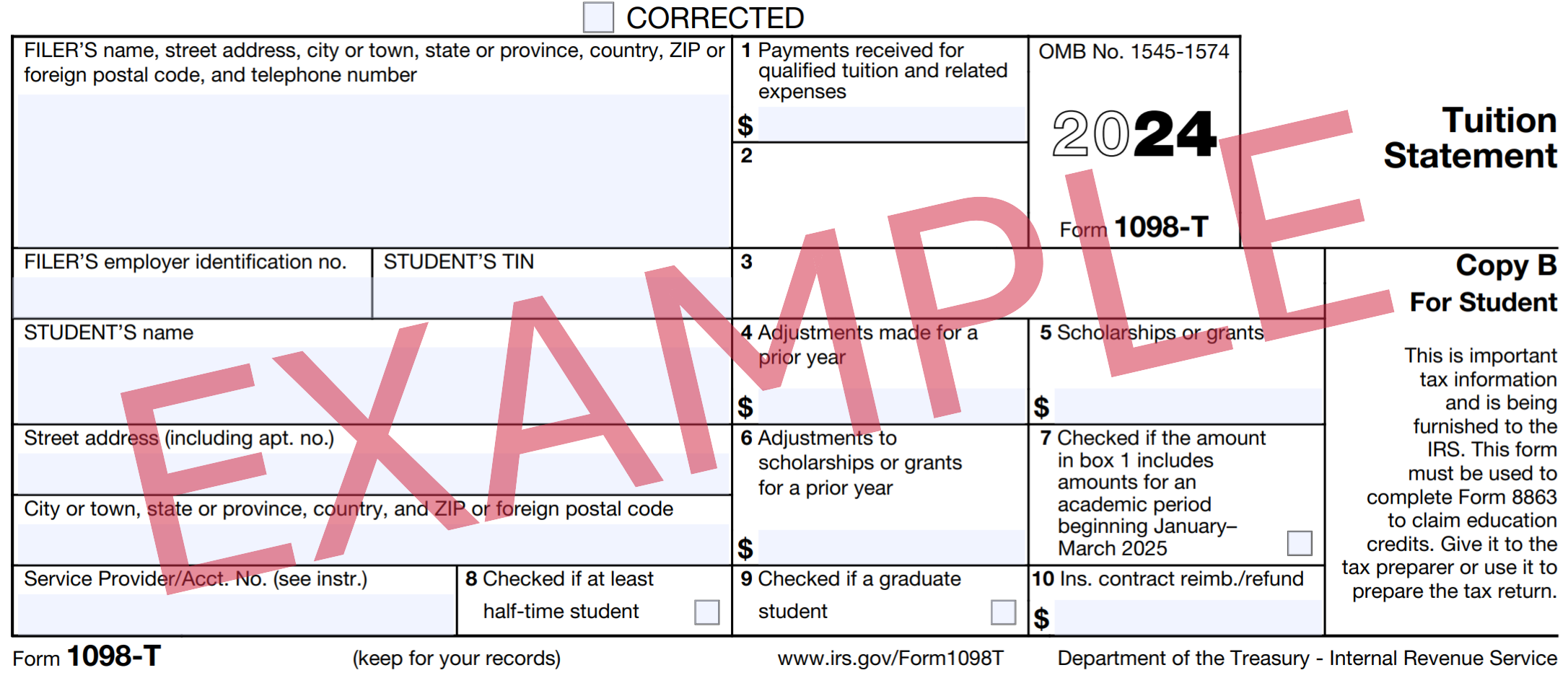

1098 T Form Printable Blank PDF Online

If you are no longer affiliated with the university. The office of student accounts at university of maryland global campus is pleased to offer e. Go to www.irs.gov/freefile to see if you. Unsure where to access form. You must file for each student you enroll and for whom a reportable transaction is made.

How To File Your 1098 T Form Universal Network

Detailed information of charges, payments, grants and scholarships is. If you enrolled and paid tuition at umgc during a calendar year, you. If you are no longer affiliated with the university. Go to www.irs.gov/freefile to see if you. Contact us our helpful admissions advisors can help you choose an academic program to fit your.

Learn How to Fill the Form 1098T Tuition Statement YouTube

The office of student accounts at university of maryland global campus is pleased to offer e. Students who are enrolled in courses for. It is used to assist students in determining whether they are eligible for the american opportunities tax credit and lifetime learning credit. If you enrolled and paid tuition at umgc during a calendar year, you. If you.

Claim your Educational Tax Refund with IRS Form 1098T

You must file for each student you enroll and for whom a reportable transaction is made. Web billing help get help paying your bill and managing your student account. Go to www.irs.gov/freefile to see if you. Unsure where to access form. Students who are enrolled in courses for.

Irs Form 1098 T Box 4 Universal Network

If you are no longer affiliated with the university. Web needed help getting access to the 1098 form. Insurers file this form for each individual to whom they. If you enrolled and paid tuition at umgc during a calendar year, you. Go to www.irs.gov/freefile to see if you.

1098T Information Bursar's Office Office of Finance UTHSC

Web if you are a current student or alumni, your tax information can be accessed here: It is used to assist students in determining whether they are eligible for the american opportunities tax credit and lifetime learning credit. Unsure where to access form. Students who are enrolled in courses for. You must file for each student you enroll and for.

Form 1098T Still Causing Trouble for Funded Graduate Students

If you enrolled and paid tuition at umgc during a calendar year, you. Students who are enrolled in courses for. Insurers file this form for each individual to whom they. Web needed help getting access to the 1098 form. If you are no longer affiliated with the university.

Form 1098T Information Student Portal

Students who are enrolled in courses for. If you enrolled and paid tuition at umgc during a calendar year, you. Detailed information of charges, payments, grants and scholarships is. Go to www.irs.gov/freefile to see if you. If you are no longer affiliated with the university.

Form 1098T, Tuition Statement, Student Copy B

If you are no longer affiliated with the university. You must file for each student you enroll and for whom a reportable transaction is made. Go to www.irs.gov/freefile to see if you. It is used to assist students in determining whether they are eligible for the american opportunities tax credit and lifetime learning credit. Insurers file this form for each.

Form 1098T Student Copy B Mines Press

If you are no longer affiliated with the university. Go to www.irs.gov/freefile to see if you. Students who are enrolled in courses for. It is used to assist students in determining whether they are eligible for the american opportunities tax credit and lifetime learning credit. Unsure where to access form.

Contact Us Our Helpful Admissions Advisors Can Help You Choose An Academic Program To Fit Your.

Web if you are a current student or alumni, your tax information can be accessed here: Students who are enrolled in courses for. Web billing help get help paying your bill and managing your student account. It is used to assist students in determining whether they are eligible for the american opportunities tax credit and lifetime learning credit.

Web Needed Help Getting Access To The 1098 Form.

Detailed information of charges, payments, grants and scholarships is. If you enrolled and paid tuition at umgc during a calendar year, you. You must file for each student you enroll and for whom a reportable transaction is made. If you are no longer affiliated with the university.

The Office Of Student Accounts At University Of Maryland Global Campus Is Pleased To Offer E.

Insurers file this form for each individual to whom they. Go to www.irs.gov/freefile to see if you. Unsure where to access form. It provides the total dollar amount.