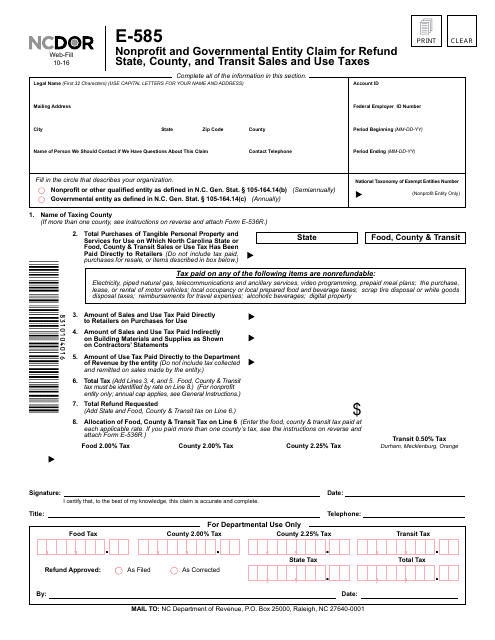

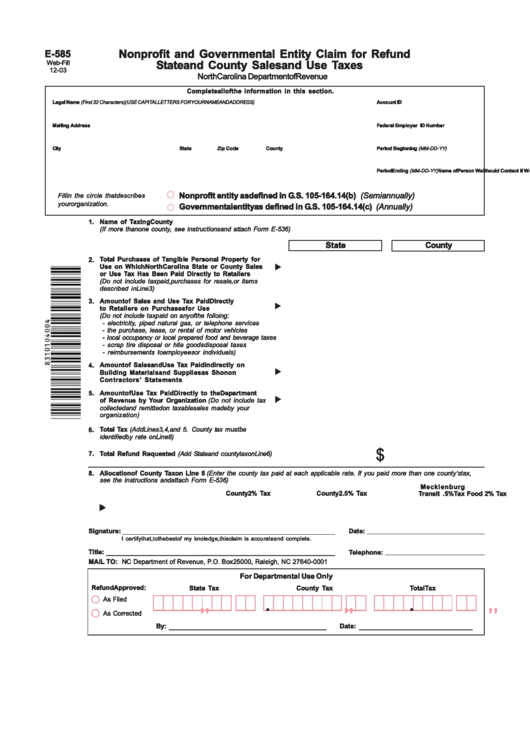

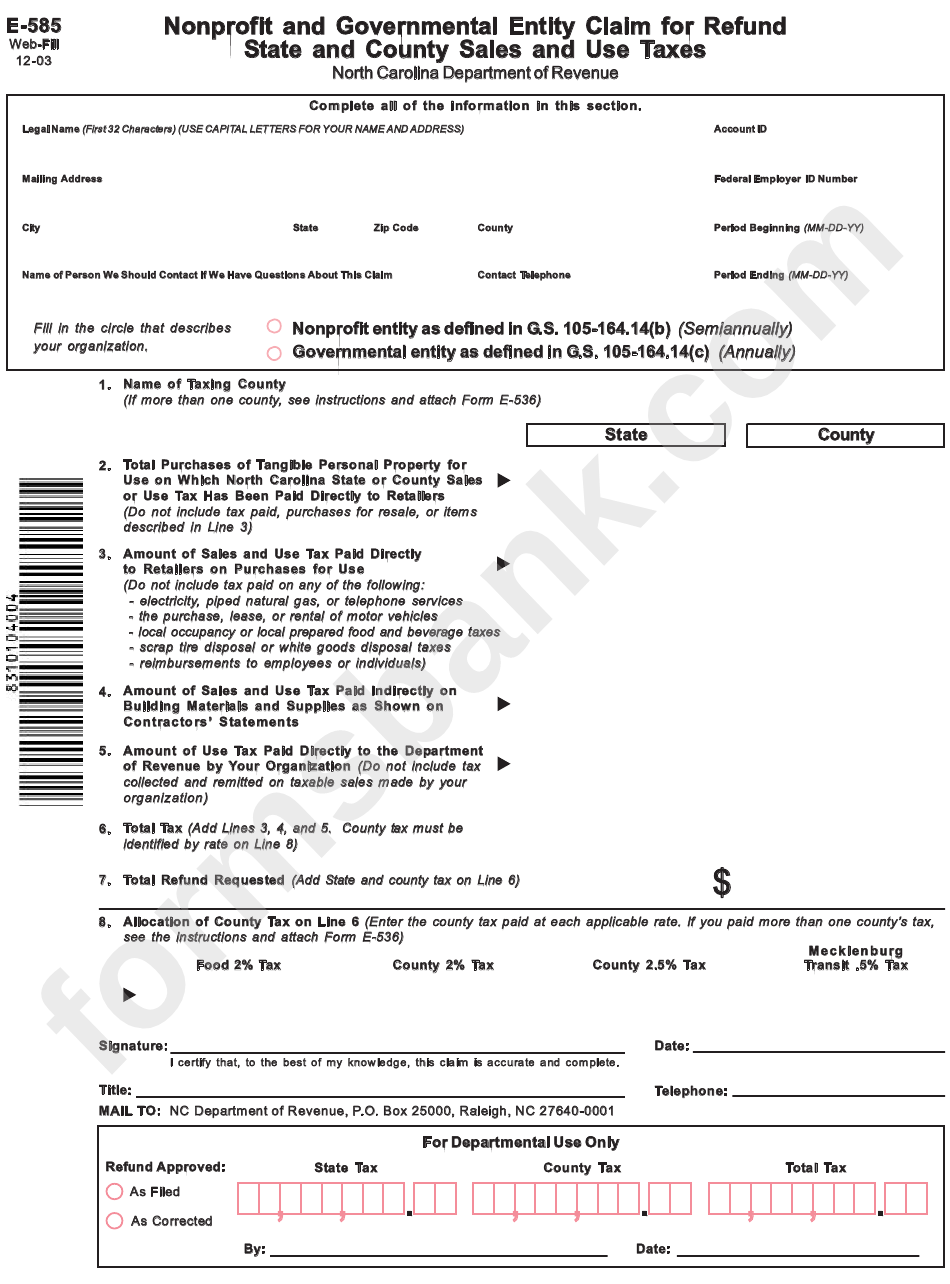

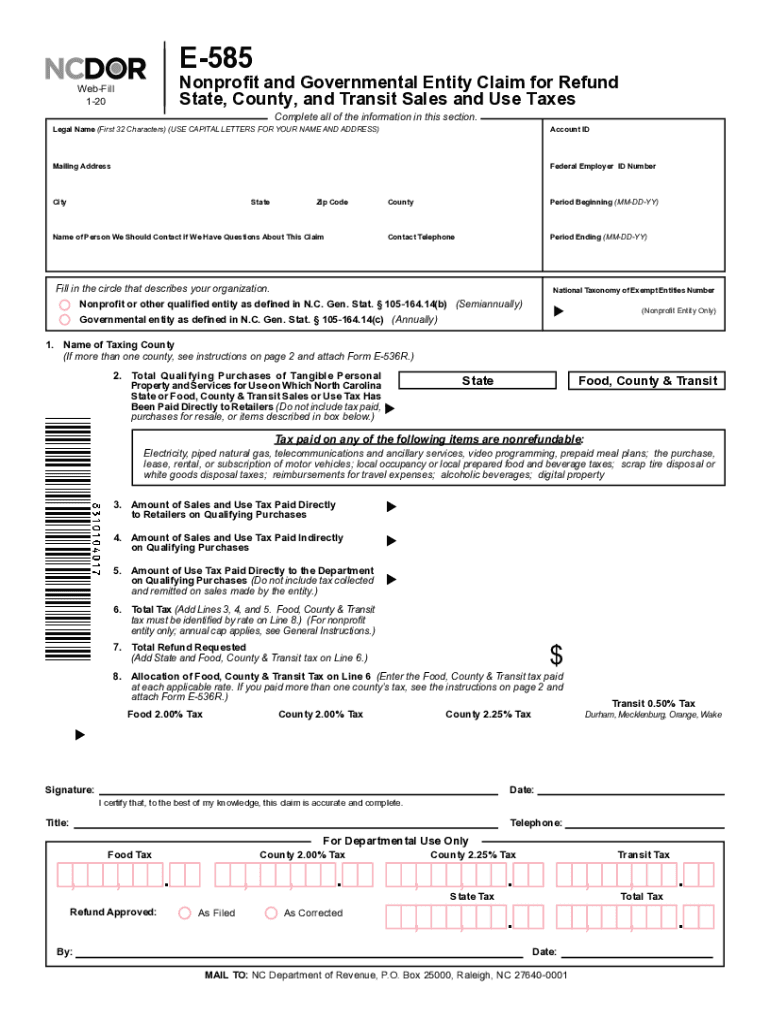

E-585 Form 2022

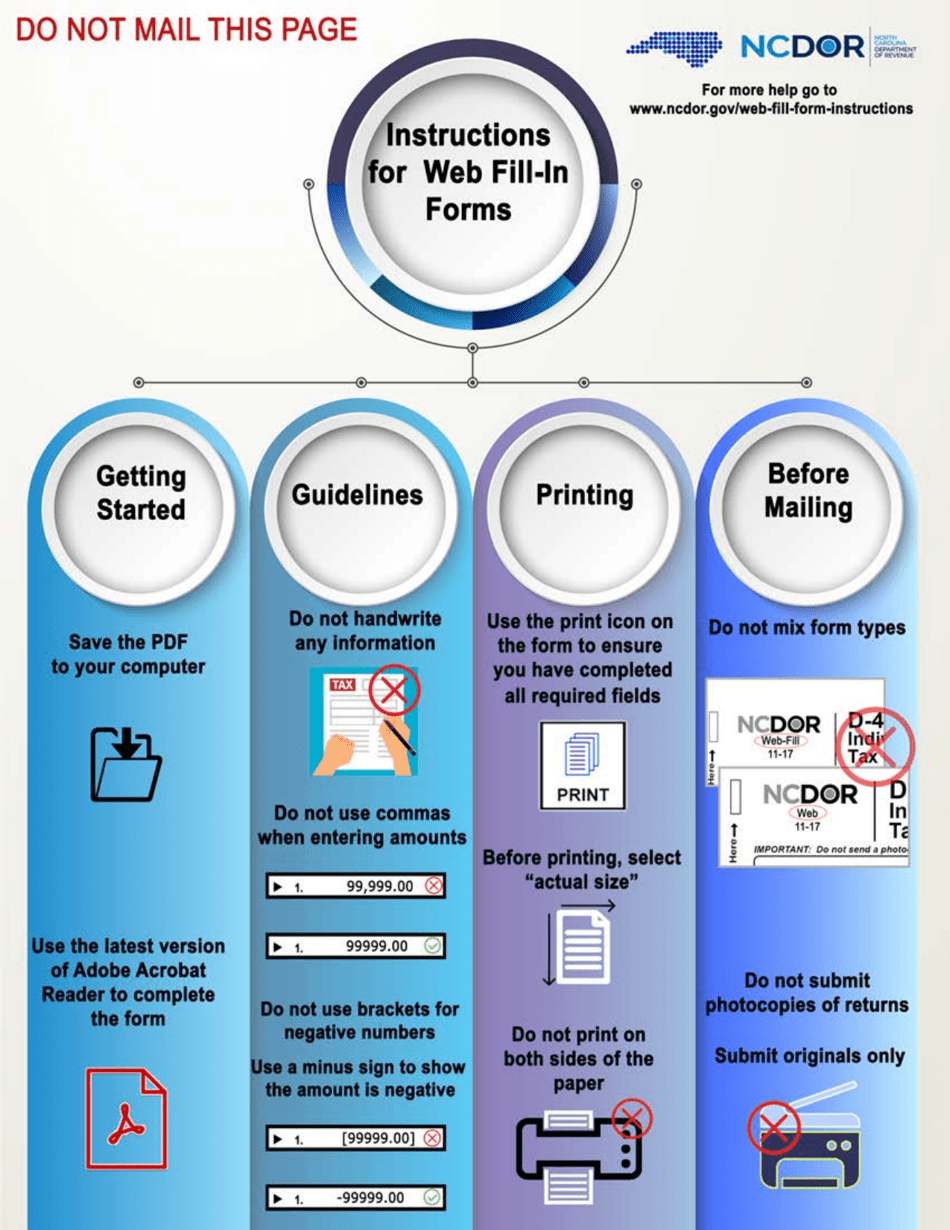

E-585 Form 2022 - Web participants will focus on the process for completing the nonprofit and governmental entity claim for refund of state and county sales and use taxes. The claim must identify the taxpayer, the type and amount. Web find and fill out the correct e 585 form 2022. Sign it in a few clicks draw your signature, type. 31, 2022) can be prepared online via efile along with a federal or irs individual tax return. Choose the correct version of the editable pdf form from the list. Quickly add and highlight text, insert pictures, checkmarks, and icons, drop new fillable areas, and rearrange or remove pages from your paperwork. Edit your ncdor form e 585 online type text, add images, blackout confidential details, add comments, highlights and more. If you have questions — we have the answers for you in this. Name of taxing county (if.

Edit your ncdor form e 585 online type text, add images, blackout confidential details, add comments, highlights and more. Name of taxing county (if. Web this form is to be filed by qualified entities as permitted in n.c. This form corresponds with filing periods beginning. Web find and fill out the correct e 585 form 2022. An official website of the state of. Valid credit/debit card to pay the application fee us. If you have questions — we have the answers for you in this. Complete your ncdor form e 585 with ease. Sign it in a few clicks draw your signature, type.

Web this form is to be filed by qualified entities as permitted in n.c. The claim must identify the taxpayer, the type and amount. Web edit ncdor e 585 fillable form. Sign it in a few clicks draw your signature, type. Web schedule e (form 1040) 2022 supplemental income and loss (from rental real estate, royalties, partnerships, s corporations, estates, trusts, remics, etc.) department of the. 31, 2022) can be prepared online via efile along with a federal or irs individual tax return. Web participants will focus on the process for completing the nonprofit and governmental entity claim for refund of state and county sales and use taxes. Name of taxing county (if. Overview of proper procedure for requesting a sales and use tax refund for qualifying. An account id is required to process the claim.

Form E585 Download Fillable PDF or Fill Online Nonprofit and

Web video instructions and help with filling out and completing e 585 form 2023. If you have questions — we have the answers for you in this. Choose the correct version of the editable pdf form from the list. Use a e 585 form 2022 2021 template to make your document workflow more streamlined. Valid credit/debit card to pay the.

Form E585 Nonprofit And Governmental Entity Claim For Refund State

Use a e 585 form 2022 2021 template to make your document workflow more streamlined. Valid credit/debit card to pay the application fee us. Complete your ncdor form e 585 with ease. Choose the correct version of the editable pdf form from the list. Web this form is to be filed by qualified entities as permitted in n.c.

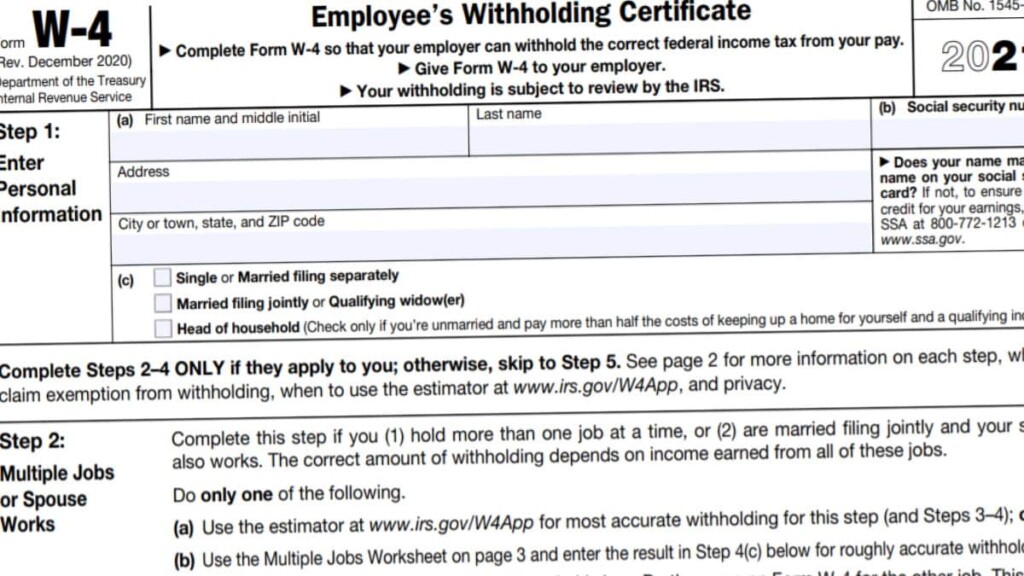

W4 Form 2022 Instructions W4 Forms TaxUni

Edit your ncdor form e 585 online type text, add images, blackout confidential details, add comments, highlights and more. Sign it in a few clicks draw your signature, type. An official website of the state of. Choose the correct version of the editable pdf form from the list. The claim must identify the taxpayer, the type and amount.

Form E585 Nonprofit And Governmental Entity Claim For Refund State

31, 2022) can be prepared online via efile along with a federal or irs individual tax return. An account id is required to process the claim. Complete your ncdor form e 585 with ease. Web this form is to be filed by qualified entities as permitted in n.c. Use a e 585 form 2022 2021 template to make your document.

E 585 Fill Out and Sign Printable PDF Template signNow

An account id is required to process the claim. Web this form is to be filed by qualified entities as permitted in n.c. Valid credit/debit card to pay the application fee us. Web edit ncdor e 585 fillable form. An official website of the state of.

A200450.0005 17AAG [17(Allyamino)17demothoxygeldanamycin], 500

Sign it in a few clicks draw your signature, type. Web edit ncdor e 585 fillable form. Web video instructions and help with filling out and completing e 585 form 2023. Choose the correct version of the editable pdf form from the list. Web this form is to be filed by qualified entities as permitted in n.c.

E.V maker mark trying to track down the maker of this ring , 9ct gold

An official website of the state of. Web schedule e (form 1040) 2022 supplemental income and loss (from rental real estate, royalties, partnerships, s corporations, estates, trusts, remics, etc.) department of the. Valid credit/debit card to pay the application fee us. Web participants will focus on the process for completing the nonprofit and governmental entity claim for refund of state.

Form E585 Download Fillable PDF or Fill Online Nonprofit and

An account id is required to process the claim. Web schedule e (form 1040) 2022 supplemental income and loss (from rental real estate, royalties, partnerships, s corporations, estates, trusts, remics, etc.) department of the. Web participants will focus on the process for completing the nonprofit and governmental entity claim for refund of state and county sales and use taxes. Edit.

W4 Form 2023 Instructions

An account id is required to process the claim. Choose the correct version of the editable pdf form from the list. Name of taxing county (if. Complete your ncdor form e 585 with ease. Quickly add and highlight text, insert pictures, checkmarks, and icons, drop new fillable areas, and rearrange or remove pages from your paperwork.

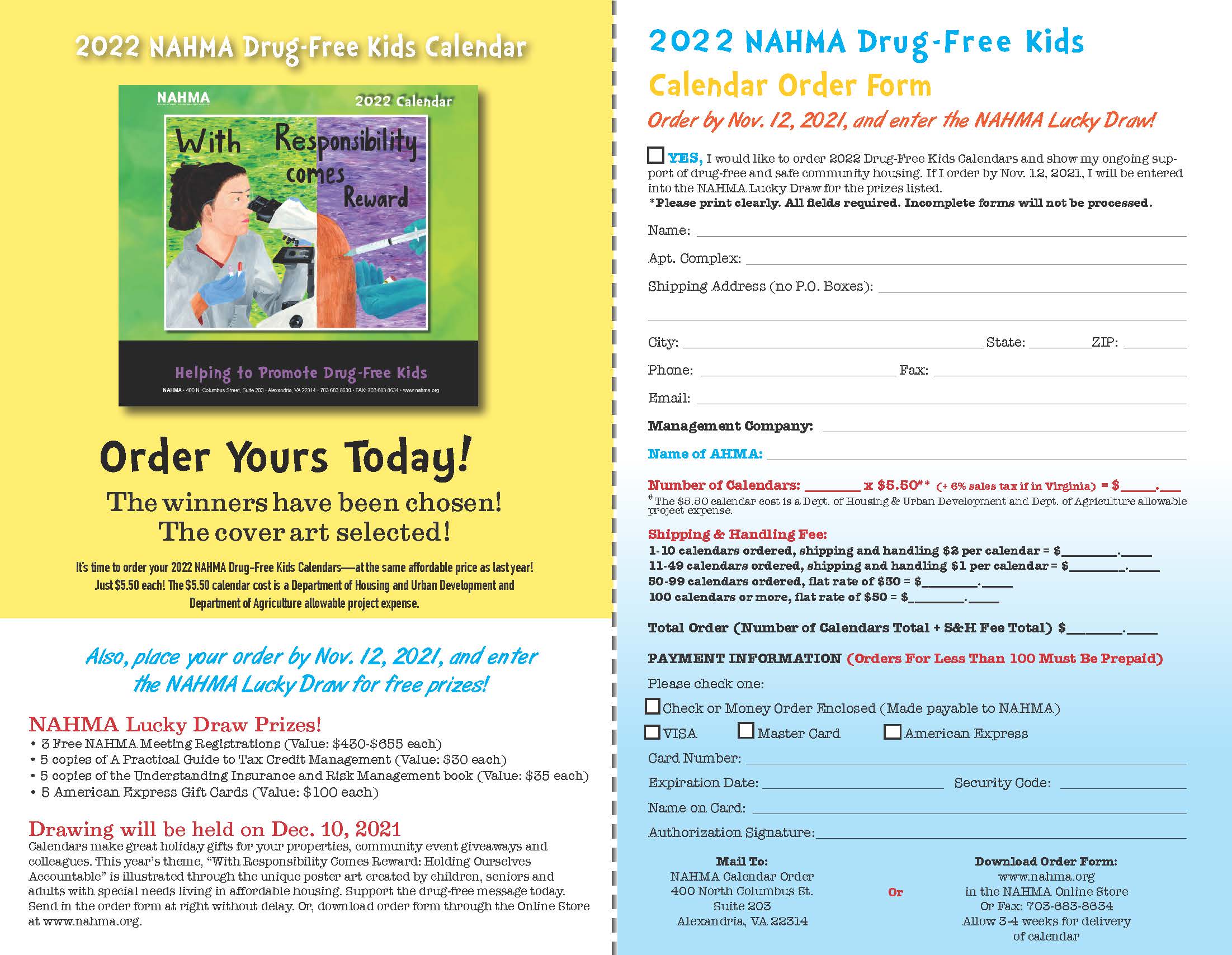

Poster Subthemes NAHMA

Web participants will focus on the process for completing the nonprofit and governmental entity claim for refund of state and county sales and use taxes. Quickly add and highlight text, insert pictures, checkmarks, and icons, drop new fillable areas, and rearrange or remove pages from your paperwork. An official website of the state of. Sign it in a few clicks.

Web Edit Ncdor E 585 Fillable Form.

Choose the correct version of the editable pdf form from the list. If you have questions — we have the answers for you in this. 31, 2022) can be prepared online via efile along with a federal or irs individual tax return. Web this form is to be filed by qualified entities as permitted in n.c.

Valid Credit/Debit Card To Pay The Application Fee Us.

Edit your ncdor form e 585 online type text, add images, blackout confidential details, add comments, highlights and more. Complete your ncdor form e 585 with ease. Web participants will focus on the process for completing the nonprofit and governmental entity claim for refund of state and county sales and use taxes. This form corresponds with filing periods beginning.

Web This Form Is To Be Filed By Qualified Entities As Permitted In N.c.

Web find and fill out the correct e 585 form 2022. Name of taxing county (if. Sign it in a few clicks draw your signature, type. The claim must identify the taxpayer, the type and amount.

Quickly Add And Highlight Text, Insert Pictures, Checkmarks, And Icons, Drop New Fillable Areas, And Rearrange Or Remove Pages From Your Paperwork.

Web video instructions and help with filling out and completing e 585 form 2023. Overview of proper procedure for requesting a sales and use tax refund for qualifying. An account id is required to process the claim. Web schedule e (form 1040) 2022 supplemental income and loss (from rental real estate, royalties, partnerships, s corporations, estates, trusts, remics, etc.) department of the.

![A200450.0005 17AAG [17(Allyamino)17demothoxygeldanamycin], 500](https://www.melford.co.uk/system/images/A20045-0.0005.jpg)