Form 8812 For 2022

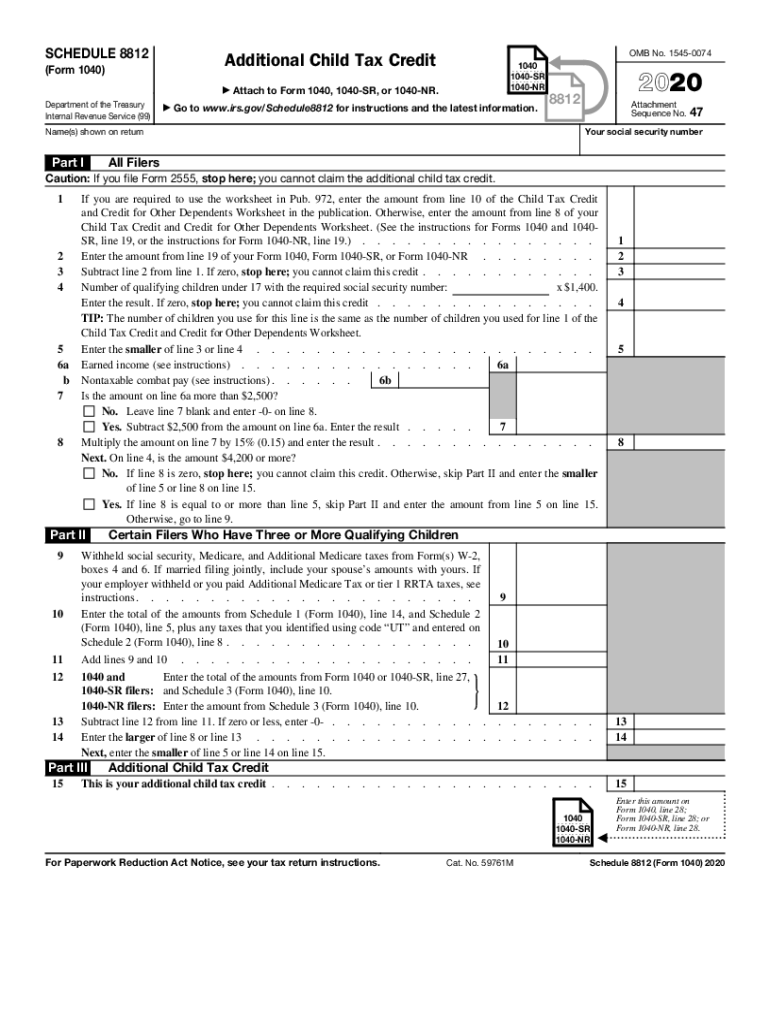

Form 8812 For 2022 - If you file form 2555, stop here; Web what's new for 2022 returns? Web schedule 8812 (form 1040) 2021 credits for qualifying children and other dependents department of the treasury internal revenue service (99) attach to form 1040, 1040. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional. For tax years 2020 and prior: Get ready for tax season deadlines by completing any required tax forms today. We will update this page with a new version of the form for 2024 as soon as it is made available. Choose the correct version of the editable pdf. The child tax credit is a partially refundable credit offered. Get ready for tax season deadlines by completing any required tax forms today.

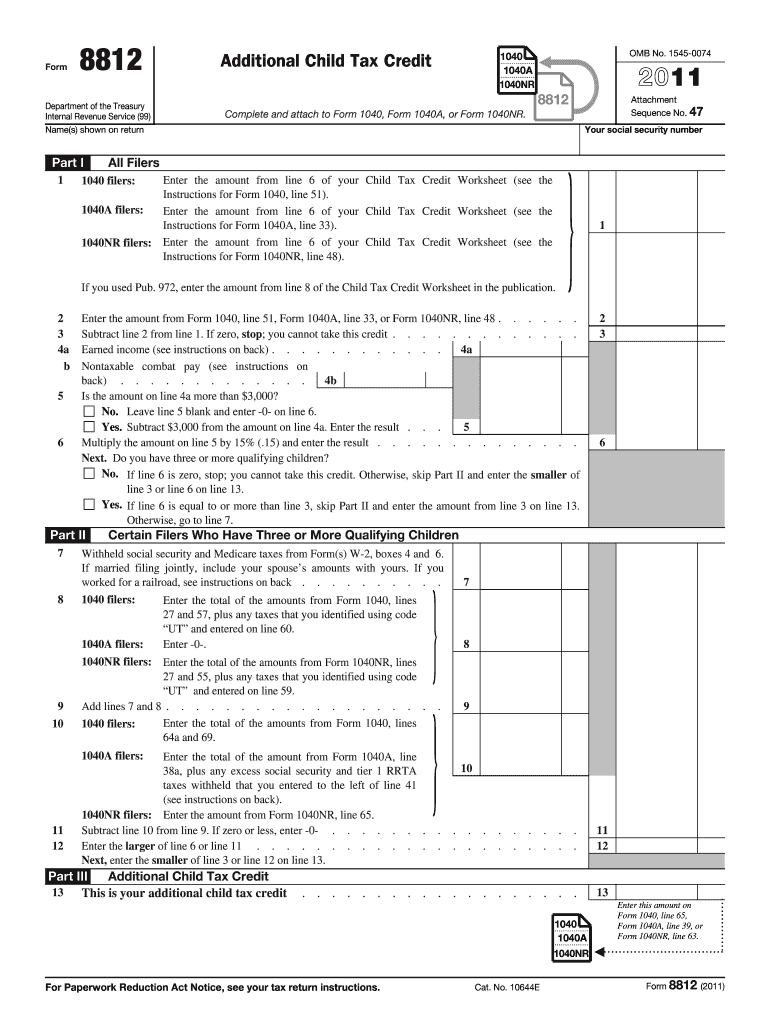

Ad upload, modify or create forms. Complete, edit or print tax forms instantly. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. You cannot claim the additional child tax credit. The increased age allowance for qualifying children ended. If you file form 2555, stop here; Web child tax credit for 2022 how to file 2021 child tax credit with letter 6419 explained! The ins and outs of the child and dependent care credit. Tax tips when sending kids to private or public schools. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional.

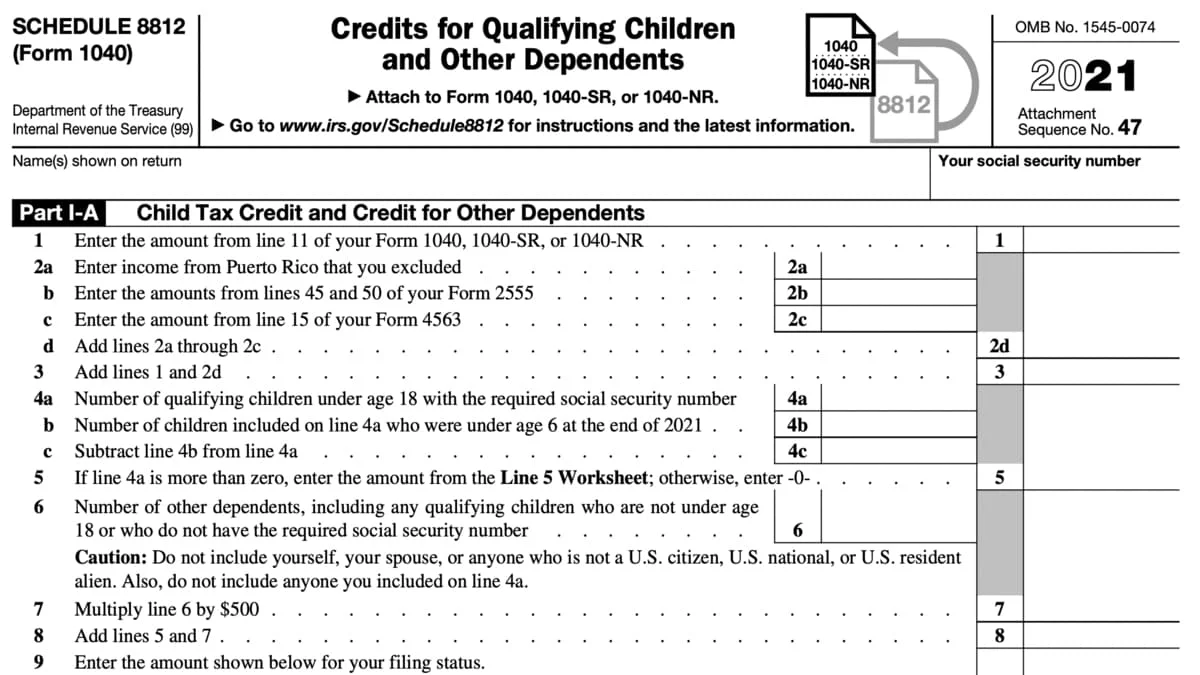

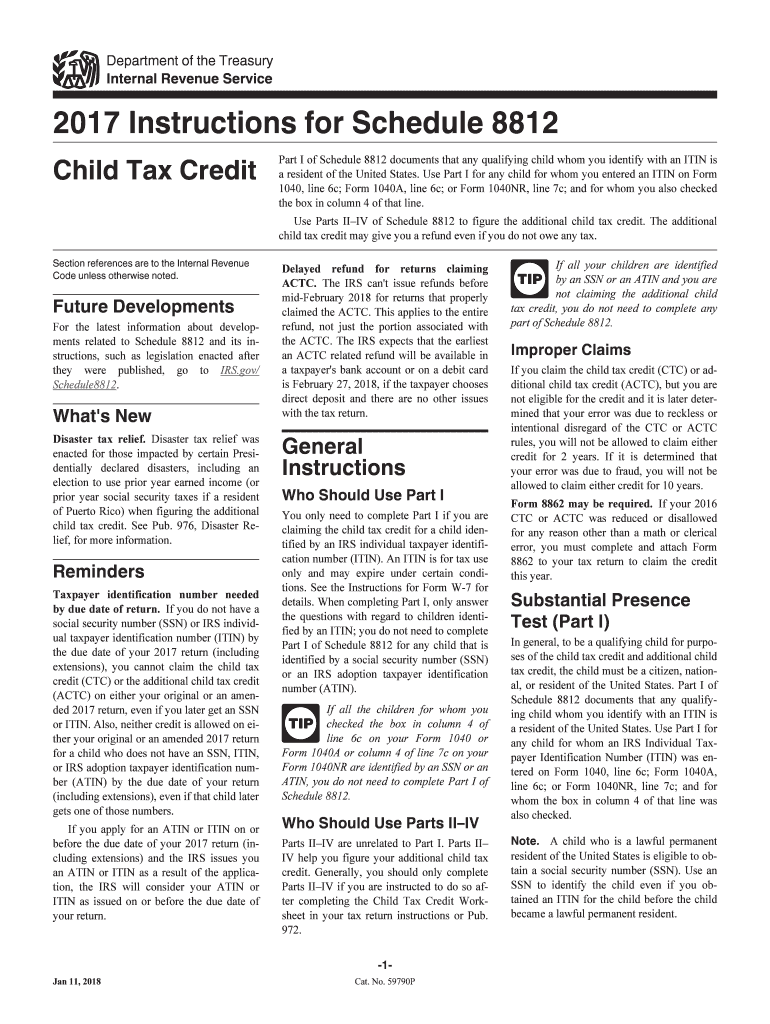

Web we last updated the child tax credit in december 2022, so this is the latest version of 1040 (schedule 8812), fully updated for tax year 2022. From july 2021 to december 2021, taxpayers may have received an advance payment of the child tax credit equal to 50% of the irs. Web irs instructions for form 8812. The child tax credit is a partially refundable credit offered. Should be completed by all filers to claim the basic. Try it for free now! Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web what's new for 2022 returns? Choose the correct version of the editable pdf. Get ready for tax season deadlines by completing any required tax forms today.

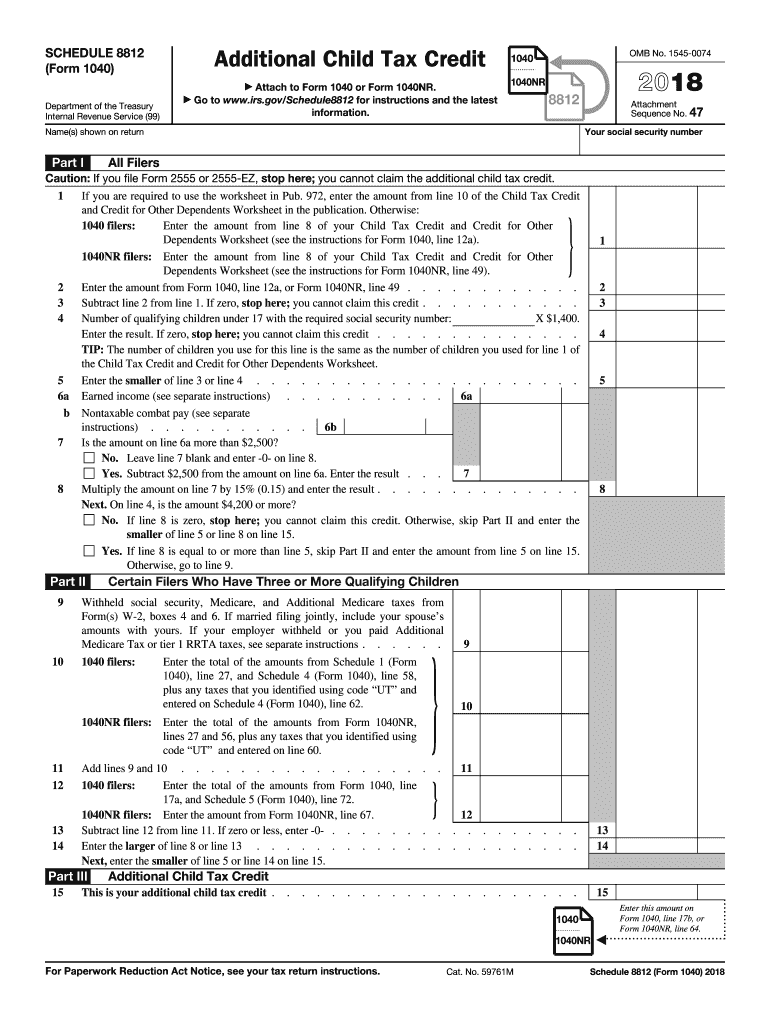

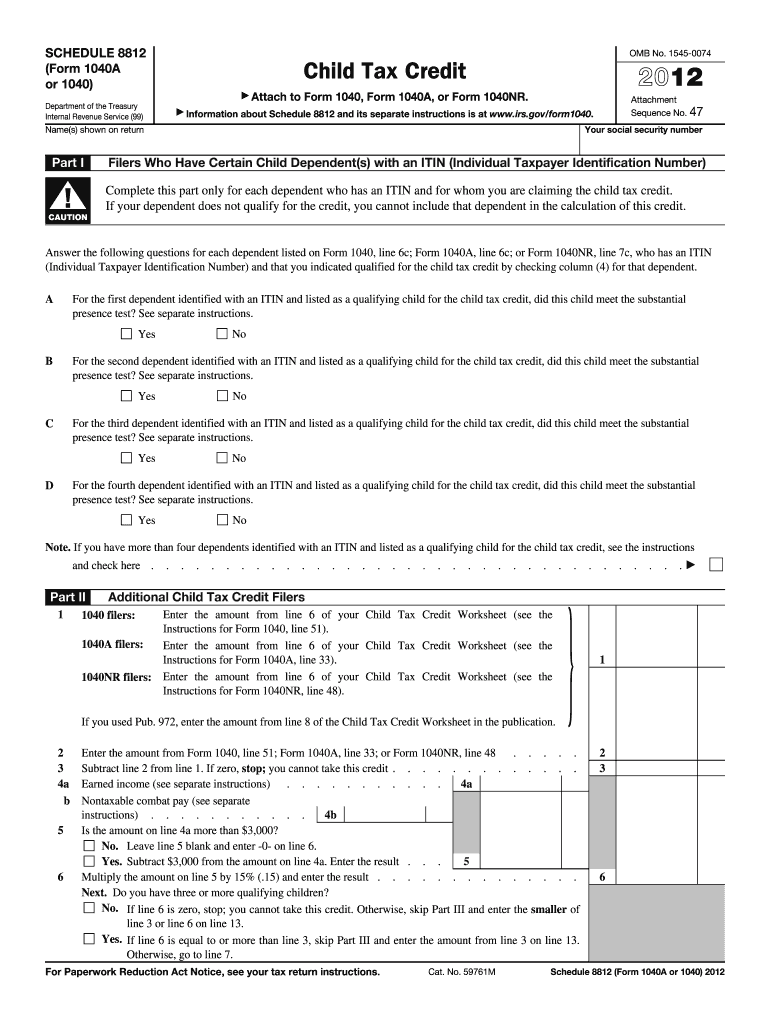

8812 Fill Out and Sign Printable PDF Template signNow

Should be completed by all filers to claim the basic. We will update this page with a new version of the form for 2024 as soon as it is made available. Web you'll use form 8812 to calculate your additional child tax credit. Web what is the irs form 8812? You cannot claim the additional child tax credit.

Publication 972, Child Tax Credit; Detailed Example

Get ready for tax season deadlines by completing any required tax forms today. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional. If you file form 2555, stop here; The increased age allowance for qualifying children ended. You can download or.

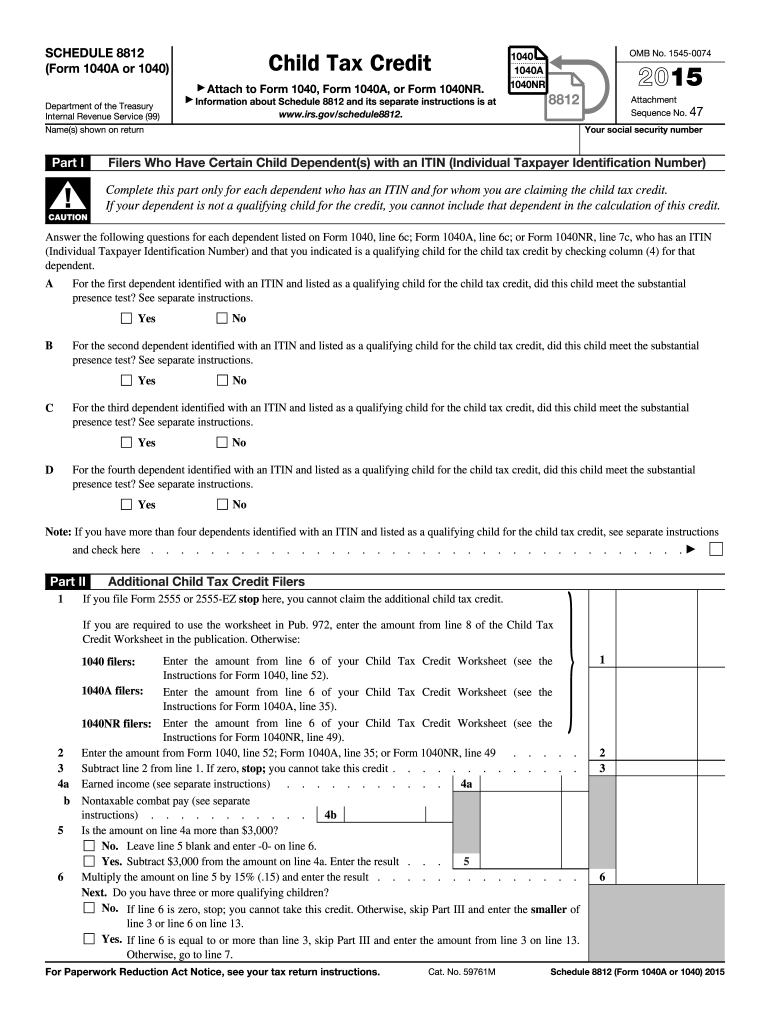

2015 8812 form Fill out & sign online DocHub

If you file form 2555, stop here; Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional. Web for more information on the child tax credit for 2021, please refer to form 8812 instructions. Get ready for tax season deadlines by completing.

2023 Schedule 3 2022 Online File PDF Schedules TaxUni

The ins and outs of the child and dependent care credit. If you file form 2555, stop here; You cannot claim the additional child tax credit. A child must be under age 17 at the end of 2022 to be considered a. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit.

Worksheet For Form 8812

Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web child tax credit for 2022 how to file 2021 child tax credit with letter 6419 explained! The ins and outs of the child and dependent care credit. Try it for free now! Should be completed by all filers to claim the.

Irs Instructions Form 8812 Fill Out and Sign Printable PDF Template

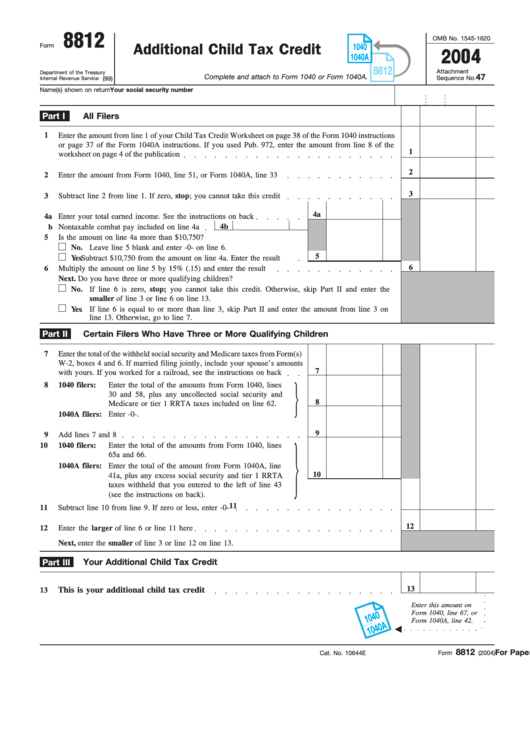

The ins and outs of the child and dependent care credit. You cannot claim the additional child tax credit. Try it for free now! For tax years 2020 and prior: For 2022, there are two parts to this form:

8812 Worksheet

The ins and outs of the child and dependent care credit. Web what is the irs form 8812? Should be completed by all filers to claim the basic. Web below are answers to frequently asked questions about the credits for qualifying children and other dependents, schedule 8812. The child tax credit is a partially refundable credit offered.

Form 8812 Line 5 Worksheet

Web child tax credit for 2022 how to file 2021 child tax credit with letter 6419 explained! You cannot claim the additional child tax credit. Ad upload, modify or create forms. (form 8812) turbotax 2022 tutorials child tax credit bigger tax. The child tax credit is a partially refundable credit offered.

8812 Worksheet

For 2022, there are two parts to this form: Web child tax credit for 2022 how to file 2021 child tax credit with letter 6419 explained! Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional. Web schedule 8812 (form 1040) 2021.

credit limit worksheet Fill Online, Printable, Fillable Blank form

For tax years 2020 and prior: Try it for free now! Get ready for tax season deadlines by completing any required tax forms today. Web child tax credit for 2022 how to file 2021 child tax credit with letter 6419 explained! Web 🚧 schedule 8812 the form type a_1040_schedule_8812_2022 supports data capture from the irs 1040 schedule 8812 only.

A Child Must Be Under Age 17 At The End Of 2022 To Be Considered A.

For tax years 2020 and prior: You cannot claim the additional child tax credit. Complete, edit or print tax forms instantly. Web below are answers to frequently asked questions about the credits for qualifying children and other dependents, schedule 8812.

Try It For Free Now!

Web what's new for 2022 returns? You can download or print current or. Get ready for tax season deadlines by completing any required tax forms today. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional.

Ad Upload, Modify Or Create Forms.

Web irs instructions for form 8812. Web 🚧 schedule 8812 the form type a_1040_schedule_8812_2022 supports data capture from the irs 1040 schedule 8812 only. Should be completed by all filers to claim the basic. Web this form is for income earned in tax year 2022, with tax returns due in april 2023.

For 2022, There Are Two Parts To This Form:

From july 2021 to december 2021, taxpayers may have received an advance payment of the child tax credit equal to 50% of the irs. The child tax credit is a partially refundable credit offered. Web child tax credit for 2022 how to file 2021 child tax credit with letter 6419 explained! Web for more information on the child tax credit for 2021, please refer to form 8812 instructions.