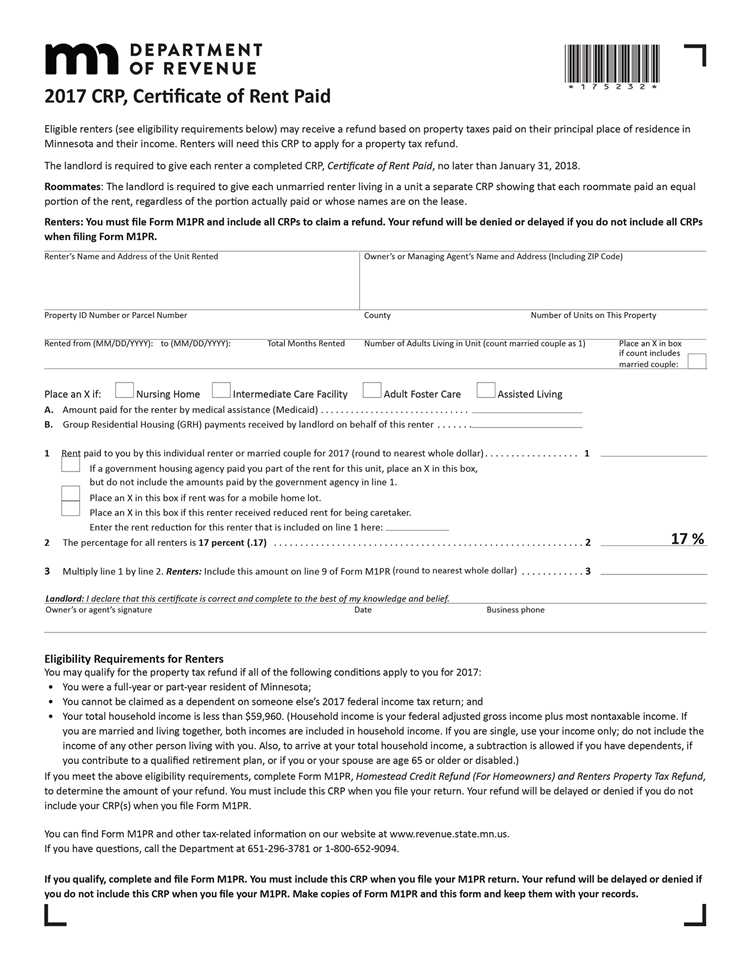

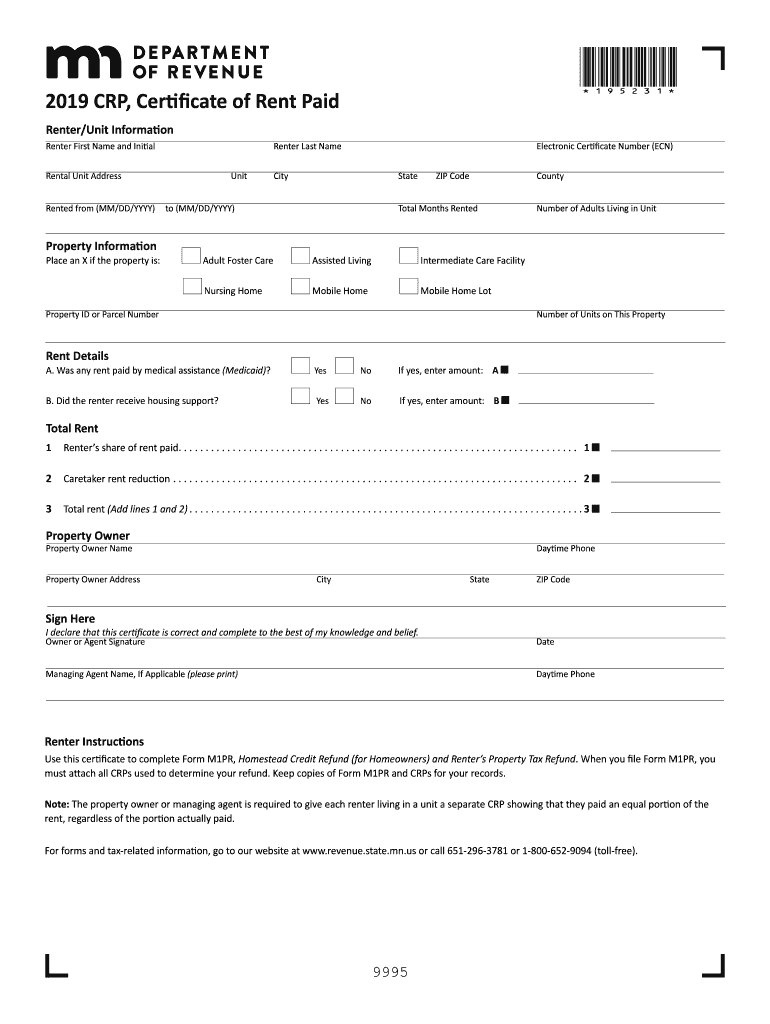

Crp Tax Form

Crp Tax Form - Web forms and manuals find your form. A portion of your rent is used to pay property taxes. The amount of “annual rental payments” must be reported on line 4b, taxable amount, except to the extent it is for the permanent retirement of cropland base and allotment history (generally reportable on form 4797. Web edit your types cr crc crp form online. Look for a page titled other forms you may need. That will take you through the section for the renter's credit. When you file form m1pr, you must attach all crps used to determine your refund. Failure to provide landlord information will result in denial or delay of your claim. Web individuals must report all crp payments on schedule f, profit or loss from farming, line 4a, agricultural program payments. You may qualify for a renter's property tax refund depending on your income and rent paid.

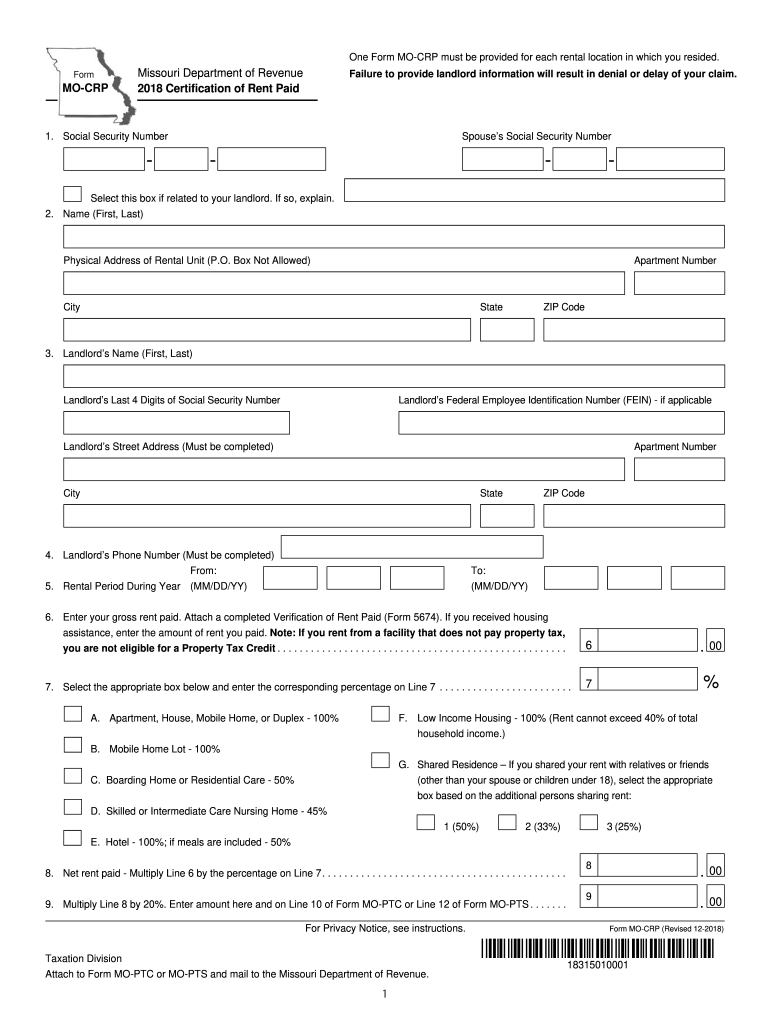

Certification of rent paid for 2022: The amount of “annual rental payments” must be reported on line 4b, taxable amount, except to the extent it is for the permanent retirement of cropland base and allotment history (generally reportable on form 4797. Web we last updated the certificate of rent paid (for landlord use only) in december 2022, so this is the latest version of form crp, fully updated for tax year 2022. Who qualifies [+] claim the refund [+] certificate of rent paid (crp) [+] Household income.) (other than your spouse or children under 18), select the appropriate box based on the additional person(s) sharing rent: A portion of your rent is used to pay property taxes. Web forms and manuals find your form. Web certificate of rent paid (crp) is at the very end of the state return, after the questions about penalties, extensions, etc. That will take you through the section for the renter's credit. Look for a page titled other forms you may need.

Who qualifies [+] claim the refund [+] certificate of rent paid (crp) [+] Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Web edit your types cr crc crp form online. Web individuals must report all crp payments on schedule f, profit or loss from farming, line 4a, agricultural program payments. Certification of rent paid for 2022: Household income.) (other than your spouse or children under 18), select the appropriate box based on the additional person(s) sharing rent: Web use this certificate to complete form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. Look for a page titled other forms you may need. Keep copies of form m1pr and all crps for your records. You can print other minnesota tax forms here.

Minnesota Certificate of Rent Paid (CRP) EZ Landlord Forms

You can print other minnesota tax forms here. You may also find the following article helpful. Check the first box, property tax refund (form m1pr). The amount of “annual rental payments” must be reported on line 4b, taxable amount, except to the extent it is for the permanent retirement of cropland base and allotment history (generally reportable on form 4797..

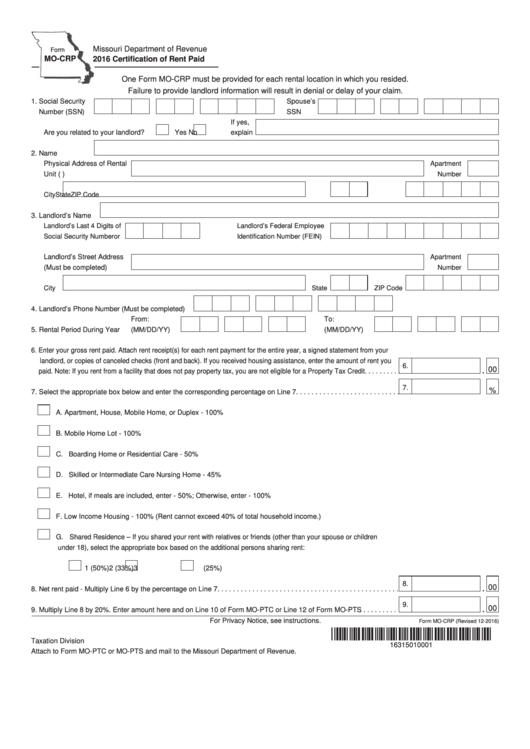

Fillable Form MoCrp Certification Of Rent Paid Missouri Department

Web certificate of rent paid (crp) is at the very end of the state return, after the questions about penalties, extensions, etc. Keep copies of form m1pr and all crps for your records. You can print other minnesota tax forms here. You may also find the following article helpful. When you file form m1pr, you must attach all crps used.

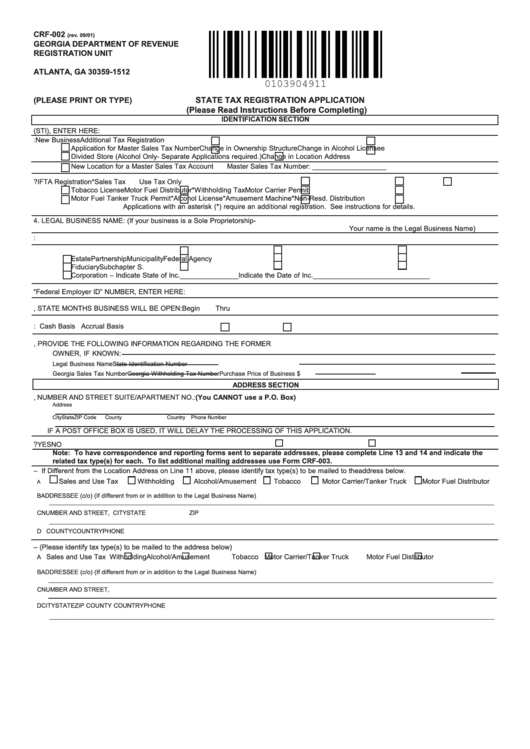

Form Crf002 State Tax Registration Application printable pdf download

You may also find the following article helpful. When you file form m1pr, you must attach all crps used to determine your refund. A portion of your rent is used to pay property taxes. You may qualify for a renter's property tax refund depending on your income and rent paid. Keep copies of form m1pr and all crps for your.

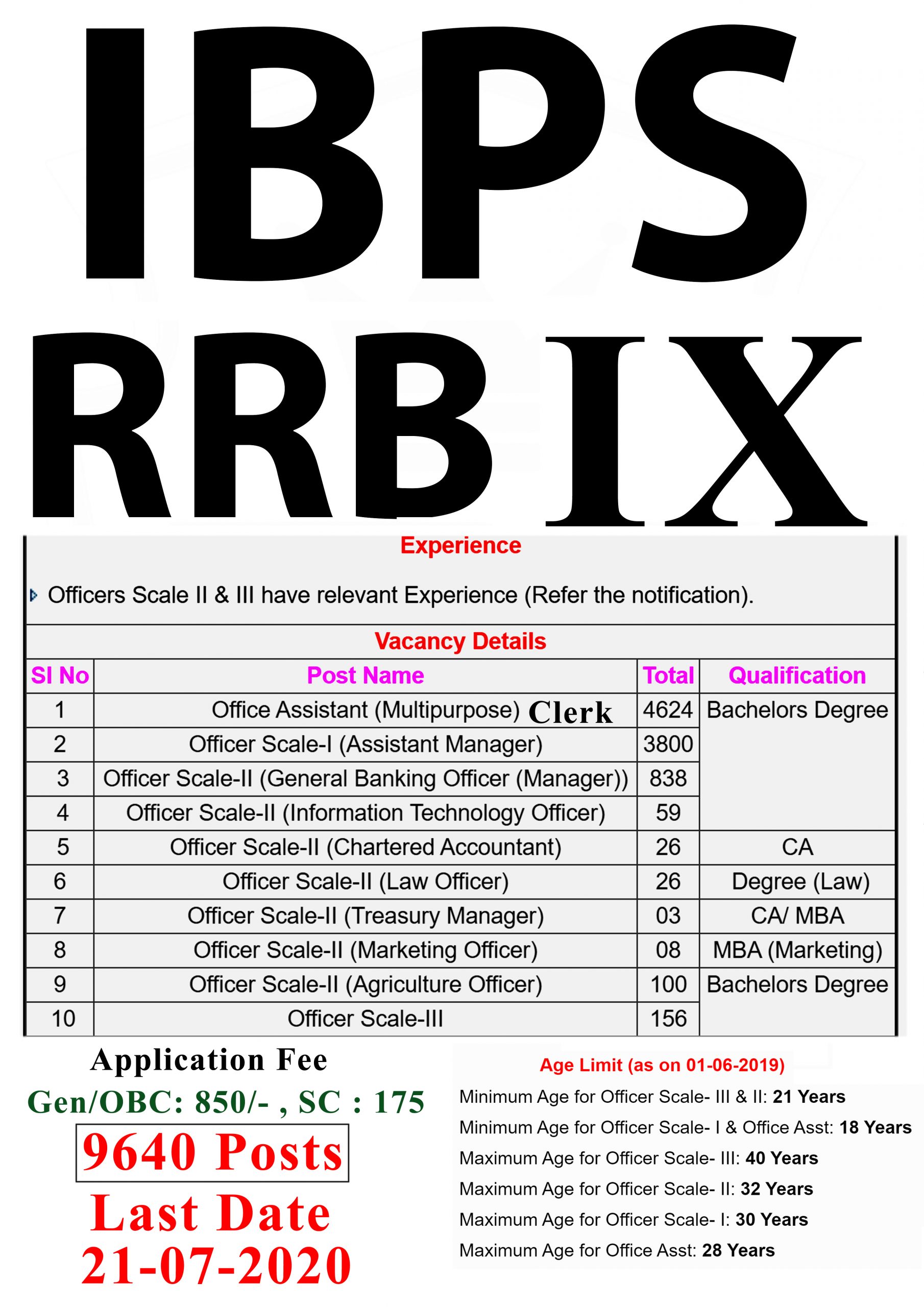

IBPS CRP RRB IX Online Form The Royal Computers & Cyber Cafe

A portion of your rent is used to pay property taxes. Web individuals must report all crp payments on schedule f, profit or loss from farming, line 4a, agricultural program payments. Web we last updated the certificate of rent paid (for landlord use only) in december 2022, so this is the latest version of form crp, fully updated for tax.

MO MOCRP 2018 Fill out Tax Template Online US Legal Forms

Who qualifies [+] claim the refund [+] certificate of rent paid (crp) [+] You can print other minnesota tax forms here. Keep copies of form m1pr and all crps for your records. Web edit your types cr crc crp form online. Web certificate of rent paid (crp) is at the very end of the state return, after the questions about.

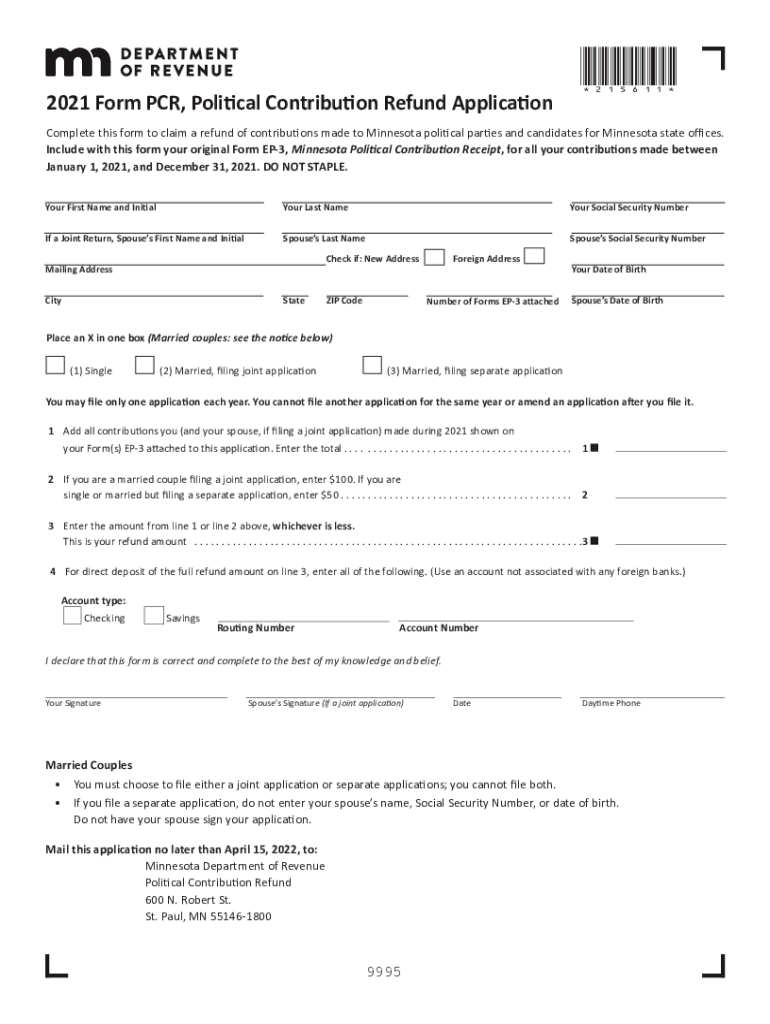

MN DoR PCR 20212022 Fill out Tax Template Online US Legal Forms

Household income.) (other than your spouse or children under 18), select the appropriate box based on the additional person(s) sharing rent: Web individuals must report all crp payments on schedule f, profit or loss from farming, line 4a, agricultural program payments. Web edit your types cr crc crp form online. You may qualify for a renter's property tax refund depending.

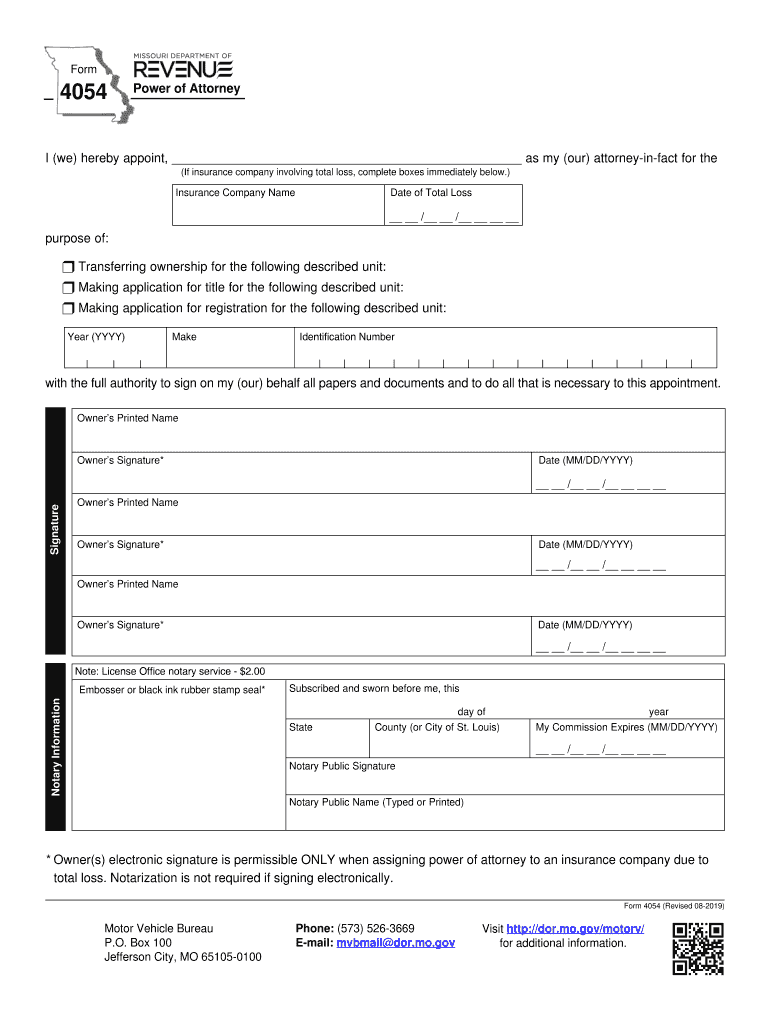

State Farm Total Loss Fill Out and Sign Printable PDF Template signNow

You may also find the following article helpful. You can print other minnesota tax forms here. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more. To search for archived forms from a previous tax year,. If filing an amended return due to claiming an nol carryback, enter the amounts from the original.

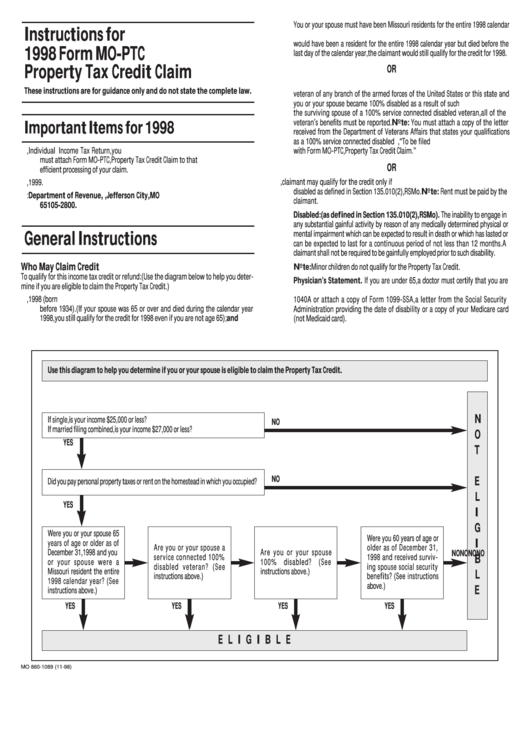

Instructions For Form MoPtc Property Tax Credit Claim 1998

Household income.) (other than your spouse or children under 18), select the appropriate box based on the additional person(s) sharing rent: Look for a page titled other forms you may need. Web forms and manuals find your form. Web use this certificate to complete form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. You may qualify for.

Evidence Clinical Utility of CRP for COVID Patients EmergentC

Web we last updated the certificate of rent paid (for landlord use only) in december 2022, so this is the latest version of form crp, fully updated for tax year 2022. Failure to provide landlord information will result in denial or delay of your claim. You may also find the following article helpful. Check the first box, property tax refund.

MN DoR CRP 2019 Fill out Tax Template Online US Legal Forms

Web individuals must report all crp payments on schedule f, profit or loss from farming, line 4a, agricultural program payments. If filing an amended return due to claiming an nol carryback, enter the amounts from the original lines 5a and 5b. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect.

Check The First Box, Property Tax Refund (Form M1Pr).

That will take you through the section for the renter's credit. To search for archived forms from a previous tax year,. A portion of your rent is used to pay property taxes. Web certificate of rent paid (crp) is at the very end of the state return, after the questions about penalties, extensions, etc.

Look For A Page Titled Other Forms You May Need.

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more. When you file form m1pr, you must attach all crps used to determine your refund. Household income.) (other than your spouse or children under 18), select the appropriate box based on the additional person(s) sharing rent: Who qualifies [+] claim the refund [+] certificate of rent paid (crp) [+]

Certification Of Rent Paid For 2022:

Web renter’s property tax refund. You may qualify for a renter's property tax refund depending on your income and rent paid. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Web forms and manuals find your form.

The Amount Of “Annual Rental Payments” Must Be Reported On Line 4B, Taxable Amount, Except To The Extent It Is For The Permanent Retirement Of Cropland Base And Allotment History (Generally Reportable On Form 4797.

Failure to provide landlord information will result in denial or delay of your claim. Web edit your types cr crc crp form online. Web use this certificate to complete form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. You may also find the following article helpful.