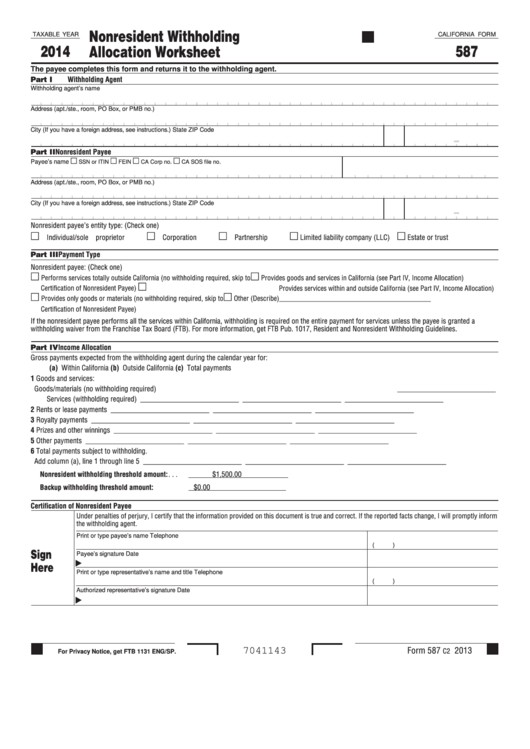

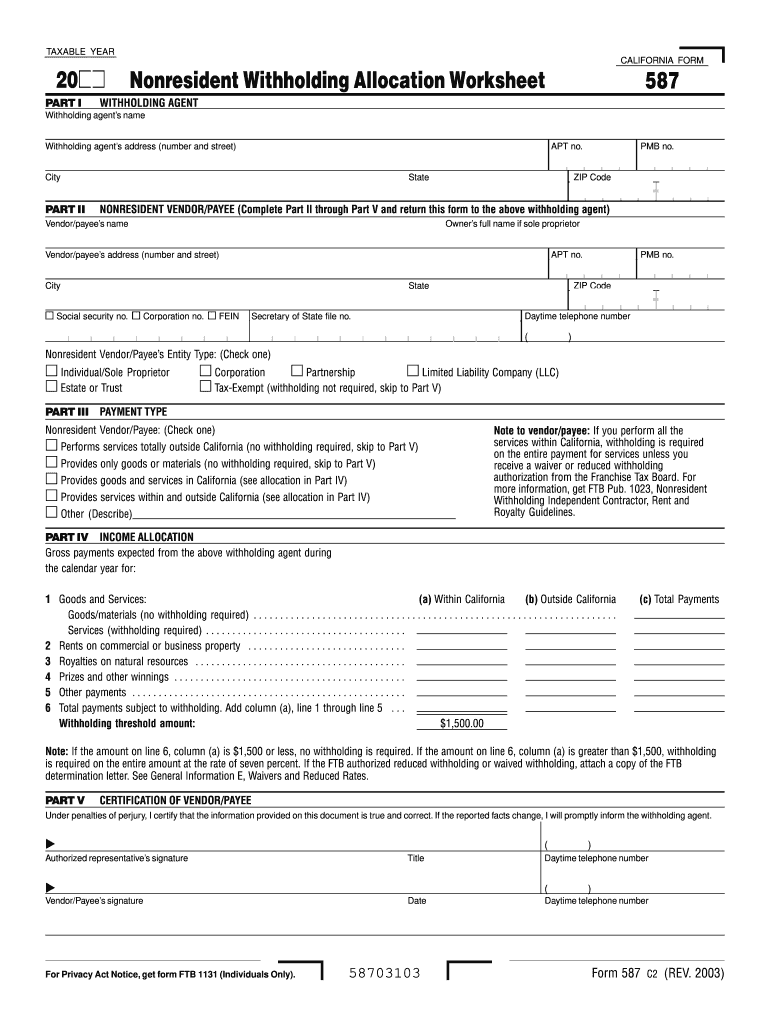

Ca Form 587

Ca Form 587 - Web we last updated california form 587 in february 2023 from the california franchise tax board. General information a purpose use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income subject to Retain the completed form 587 for your records for a minimum of four years and provide it to the ftb upon request. Once this form is completed, the payee must submit it to the withholding agent. Web use form 587 if any of the following apply: (check one) the payee completes this form and returns it to the withholding agent. General information a purpose use form 587, nonresident withholding allocation worksheet, to determine if withholding is required on. You sold california real estate. Web california form 587 part i withholding agent information part ii nonresident payee information part iii payment type part iv income allocation certification of nonresident payee nonresident payee’s entity type: Withholding is not required if payees are residents or have a permanent place of business in california.

Do not use form 587 if any of the following applies: Once this form is completed, the payee must submit it to the withholding agent. Use form 590, withholding exemption certificate. This form requires the withholding agent's information, nonresident payee information, payment type, and income allocation. The payee is a resident of california or is a nongrantor trust that has at least one california resident trustee. Retain the completed form 587 for your records for a minimum of four years and provide it to the ftb upon request. Web signed form 587 is accepted in good faith. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. The withholding agent keeps this form with their. Use form 593, real estate withholding statement.

Use form 593, real estate withholding statement. 2003) page 1 instructions for form 587 nonresident withholding allocation worksheet references in these instructions are to the california revenue and taxation code (r&tc). This form requires the withholding agent's information, nonresident payee information, payment type, and income allocation. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. Once this form is completed, the payee must submit it to the withholding agent. The withholding agent keeps this form with their. Web we last updated california form 587 in february 2023 from the california franchise tax board. Web performs services totally outside california (no withholding required, skip to certification of nonresident payee) provides only goods or materials (no withholding required, skip to certification of nonresident payee) provides goods and services in california (see part iv, income allocation) • you sold california real estate. You sold california real estate.

ftb.ca.gov forms 09_587

Web california form 587 part i withholding agent information part ii nonresident payee information part iii payment type part iv income allocation certification of nonresident payee nonresident payee’s entity type: • you sold california real estate. Retain the completed form 587 for your records for a minimum of four years and provide it to the ftb upon request. Web use.

Fillable California Form 587 Nonresident Withholding Allocation

Web more about the california form 587 individual income tax nonresident ty 2022. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. • payment to a nonresident is only for the purchase of goods. Web 2020 instructions for form 587 nonresident withholding allocation worksheet.

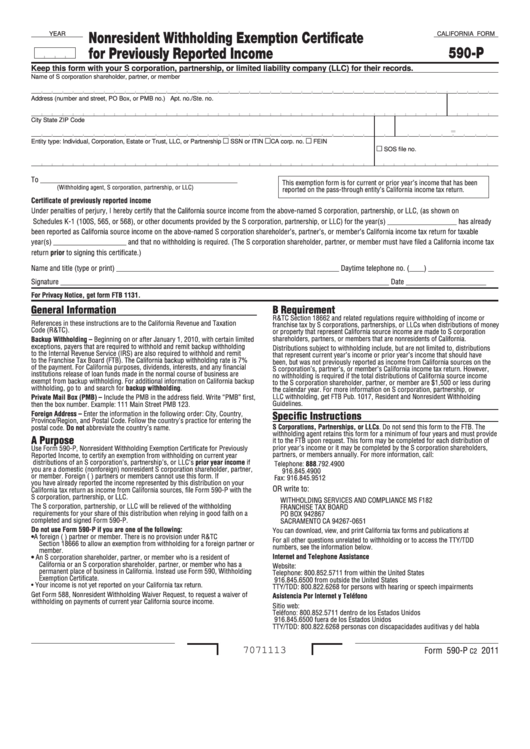

Fillable California Form 590P Nonresident Withholding Exemption

• payment to a nonresident is only for the purchase of goods. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. Withholding is not required if payees are residents or have a permanent place of business in california. This form is for income earned.

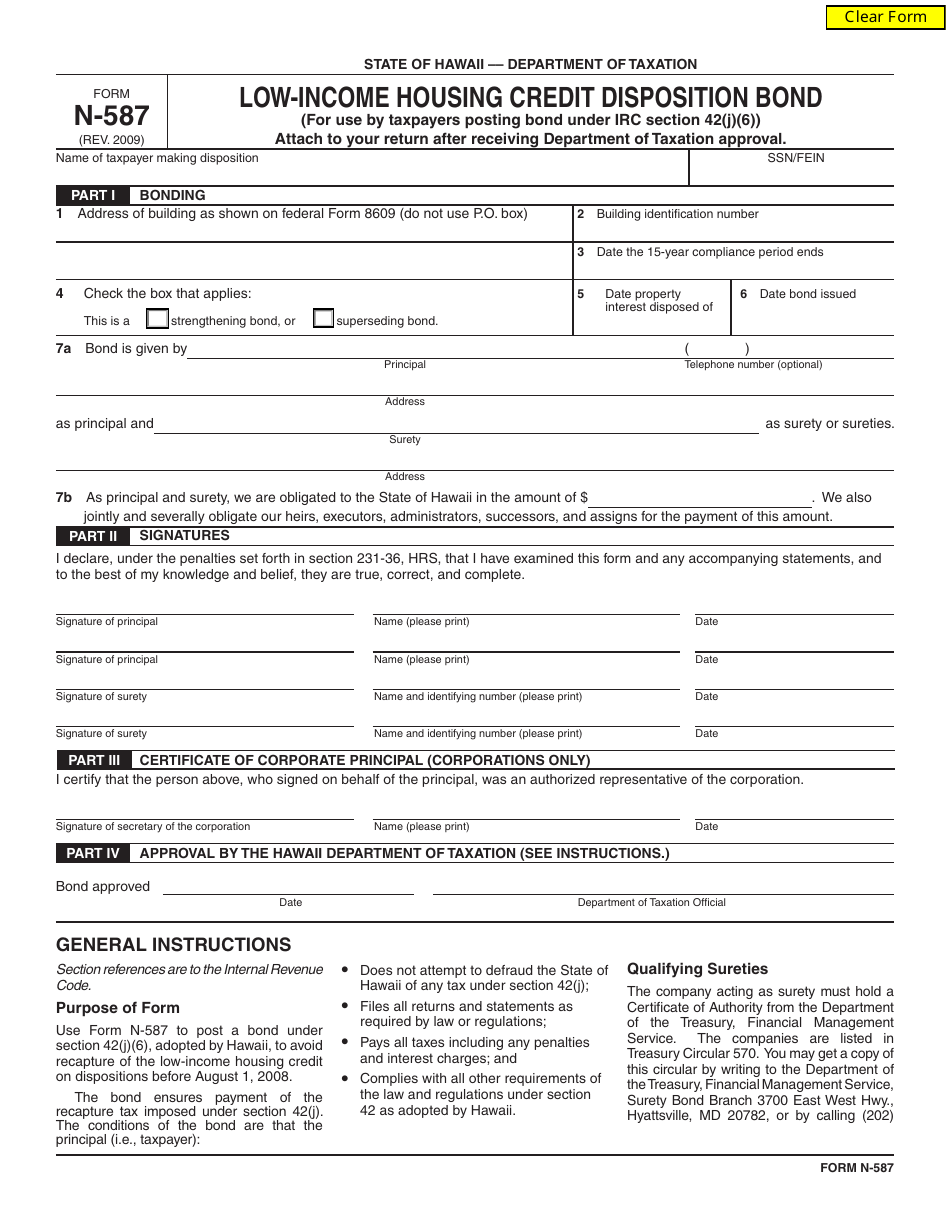

Form N587 Download Fillable PDF or Fill Online Housing

This form requires the withholding agent's information, nonresident payee information, payment type, and income allocation. Web california form 587 part i withholding agent information part ii nonresident payee information part iii payment type part iv income allocation certification of nonresident payee nonresident payee’s entity type: Web use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and.

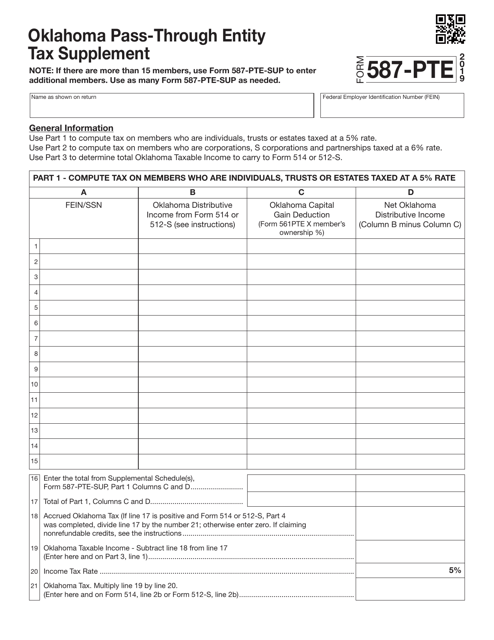

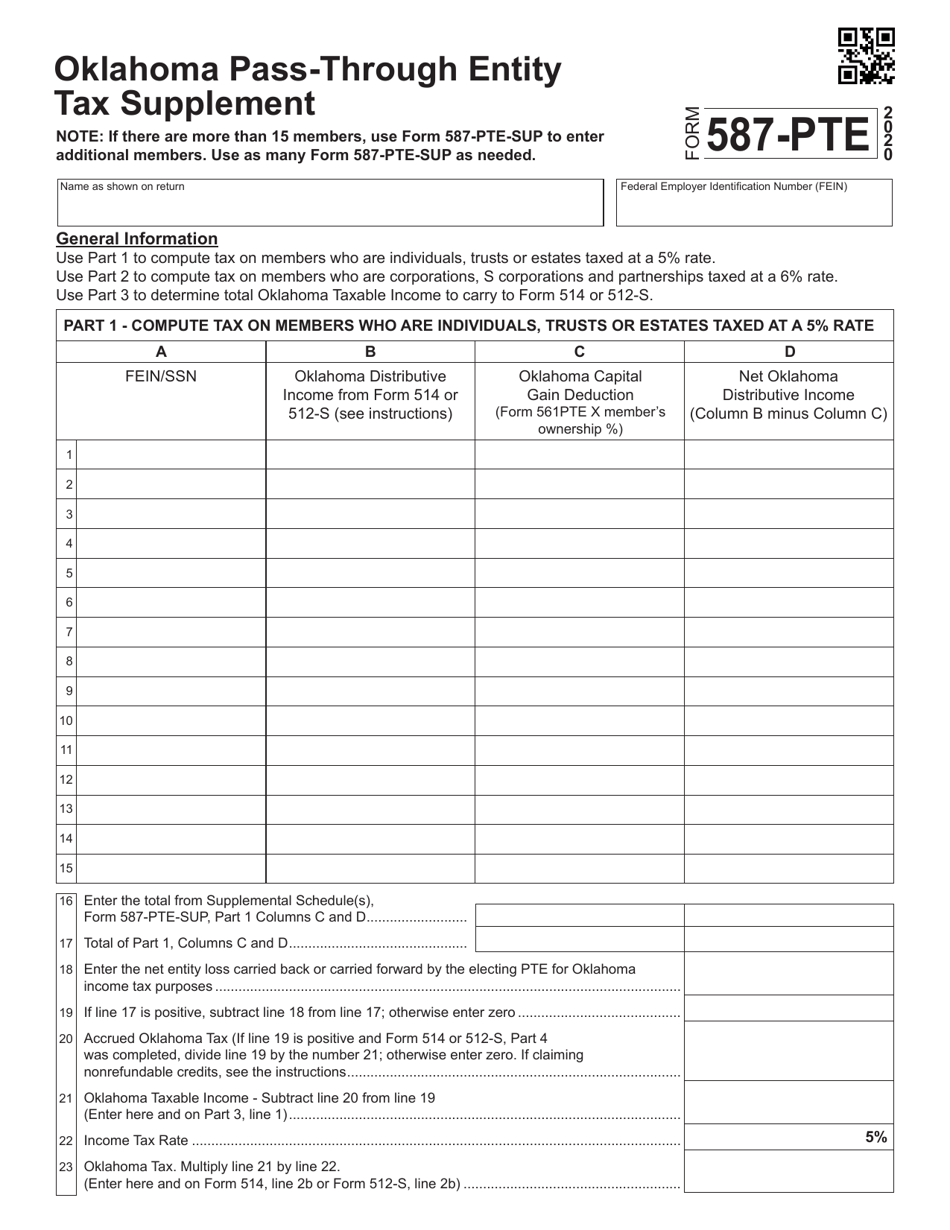

Form 587PTE Download Fillable PDF or Fill Online Oklahoma PassThrough

Use form 590, withholding exemption certificate. Web use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income subject to withholding. Do not use form 587 if any of the following applies: General information a purpose use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the.

ca form 587 Fill out & sign online DocHub

Do not use form 587 if any of the following applies: We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. The withholding agent keeps this form with their. This form requires the withholding agent's information, nonresident payee information, payment type, and income allocation. General.

Form 587PTE Download Fillable PDF or Fill Online Oklahoma PassThrough

General information a purpose use form 587, nonresident withholding allocation worksheet, to determine if withholding is required on. Web california form 587 part i withholding agent information part ii nonresident payee information part iii payment type part iv income allocation certification of nonresident payee nonresident payee’s entity type: This form is for income earned in tax year 2022, with tax.

ftb.ca.gov forms 09_588

The payee is a resident of california or is a nongrantor trust that has at least one california resident trustee. 2003) page 1 instructions for form 587 nonresident withholding allocation worksheet references in these instructions are to the california revenue and taxation code (r&tc). • you sold california real estate. Web use form 587 if any of the following apply:.

Ppq 587 Form ≡ Fill Out Printable PDF Forms Online

Use form 593, real estate withholding statement. • payment to a nonresident is only for the purchase of goods. The payee is a corporation, partnership, or limited liability The withholding agent keeps this form with their. You sold california real estate.

2013 Form 587 Nonresident Withholding Allocation Worksheet Edit

We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. Do not use form 587 if any of the following applies: This form requires the withholding agent's information, nonresident payee information, payment type, and income allocation. Retain the completed form 587 for your records for.

We Will Update This Page With A New Version Of The Form For 2024 As Soon As It Is Made Available By The California Government.

Web use form 587 if any of the following apply: Retain the completed form 587 for your records for a minimum of four years and provide it to the ftb upon request. Web use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income subject to withholding. You sold california real estate.

Once This Form Is Completed, The Payee Must Submit It To The Withholding Agent.

The withholding agent keeps this form with their. The payee is a resident of california or is a nongrantor trust that has at least one california resident trustee. Use form 593, real estate withholding statement. Use form 590, withholding exemption certificate.

Web Form 587 Instructions (Rev.

• you sold california real estate. Web california form 587 part i withholding agent information part ii nonresident payee information part iii payment type part iv income allocation certification of nonresident payee nonresident payee’s entity type: The payee is a corporation, partnership, or limited liability Web signed form 587 is accepted in good faith.

• Payment To A Nonresident Is Only For The Purchase Of Goods.

Web we last updated california form 587 in february 2023 from the california franchise tax board. This form is for income earned in tax year 2022, with tax returns due in april 2023. General information a purpose use form 587, nonresident withholding allocation worksheet, to determine if withholding is required on. Web performs services totally outside california (no withholding required, skip to certification of nonresident payee) provides only goods or materials (no withholding required, skip to certification of nonresident payee) provides goods and services in california (see part iv, income allocation)