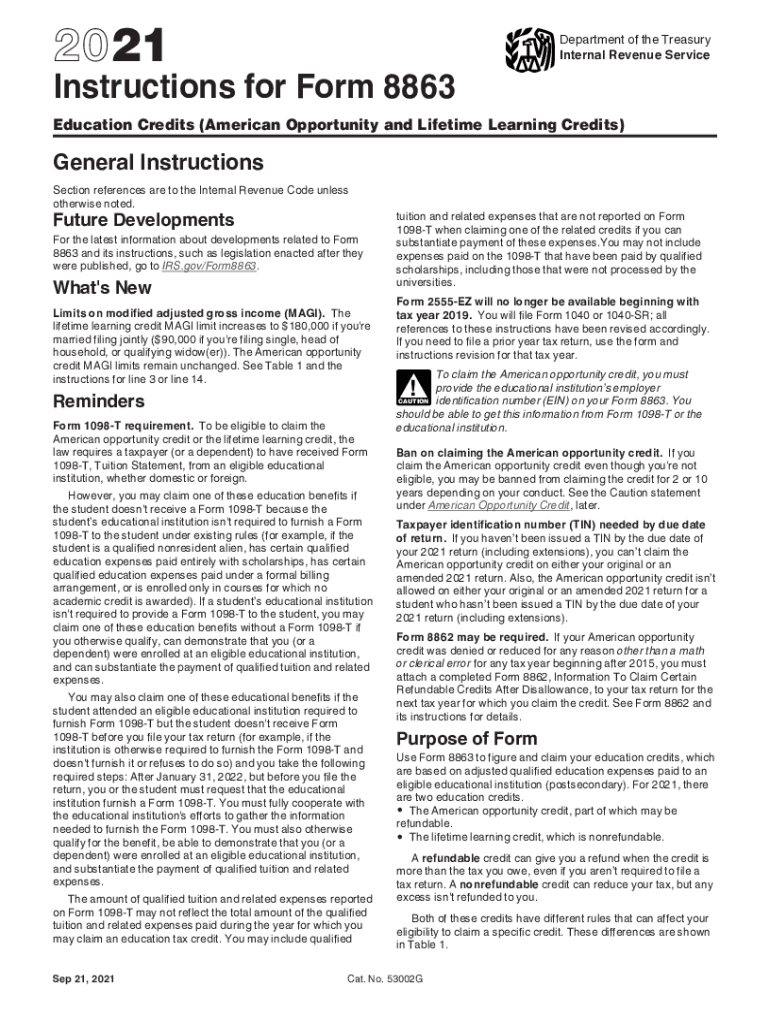

2021 Form 8863 Instructions

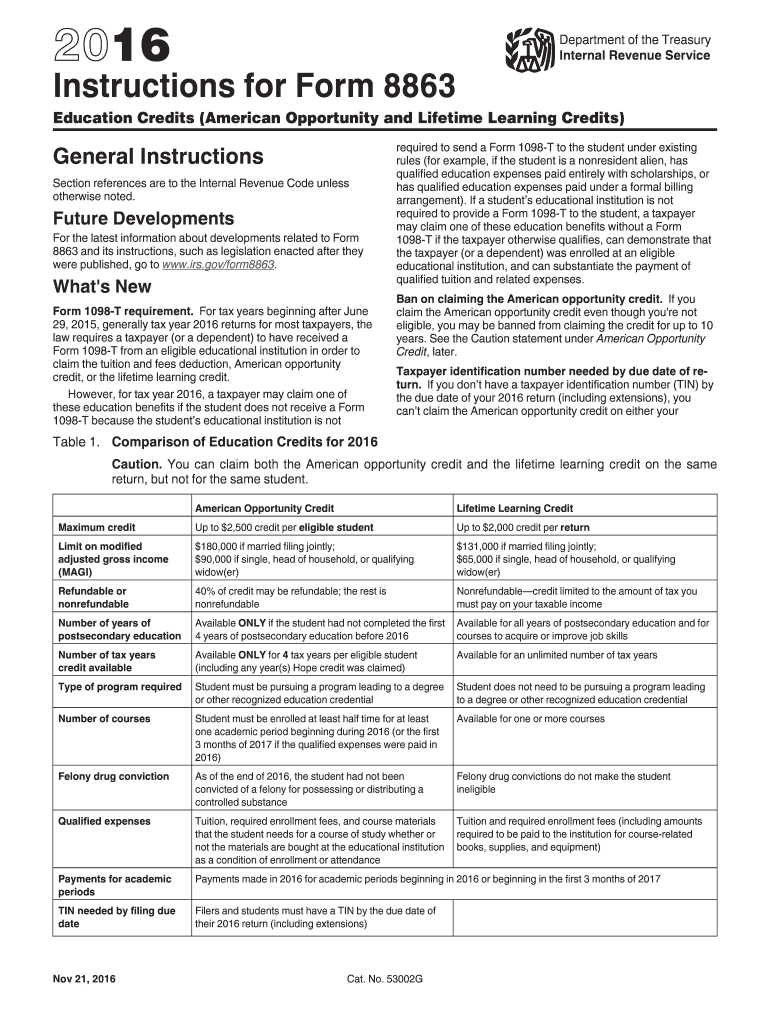

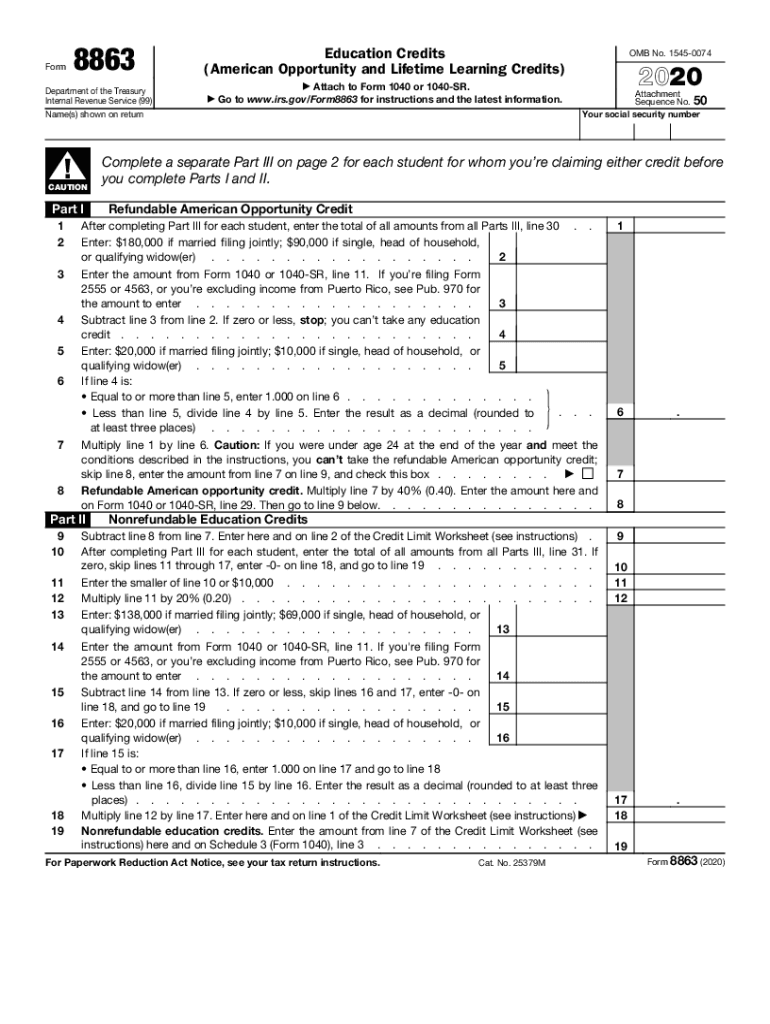

2021 Form 8863 Instructions - Use the information on the form. Instructions for form 8863, education credits (american opportunity and lifetime learning credits) 2021 12/15/2021 form 8863: See form 8862 and its. Web per irs instructions for form 8863 education credits (american opportunity and lifetime learning credits), page 6: Line 7 if you were under age 24 at the end of 2021 and the. Form 8863 typically accompanies your 1040 form,. That’s the section where you’ll provide information about. Web irs form 8863 instructions by forrest baumhover july 24, 2023 reading time: Web information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms and instructions on. Name of second educational institution (if any) (1) address.

Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Education credits (american opportunity and lifetime learning credits). What’s new personal protective equipment. Line 7 if you were under age 24 at the end of 2021 and the. Education credits (american opportunity and lifetime learning credits) attach to form 1040 or 1040. Step by step instructions comments in. Web irs form 8863 instructions by forrest baumhover july 24, 2023 reading time: Name of second educational institution (if any) (1) address. 14 minutes watch video get the form! Amounts paid for personal protective equipment (ppe), such as masks, hand sanitizer, and sanitizing wipes, for use.

Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. Web form 8863 department of the treasury internal revenue service (99) education credits (american opportunity and lifetime learning credits) a attach to form 1040 or 1040. Web per irs instructions for form 8863 education credits (american opportunity and lifetime learning credits), page 6: Strange as it may sound, to fill out form 8863 you’ll want to start with part iii. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution. During your interview with bill and sue, you determine that $3,000 was paid in. Education credits (american opportunity and lifetime learning credits) 2022 form 8863: Web information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms and instructions on. Use the information on the form. Line 7 if you were under age 24 at the end of 2021 and the.

2021 Form IRS Instruction 8863 Fill Online, Printable, Fillable, Blank

During your interview with bill and sue, you determine that $3,000 was paid in. Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. Use the information on the form. Web attach a completed form 8862, information to claim certain credits after disallowance,.

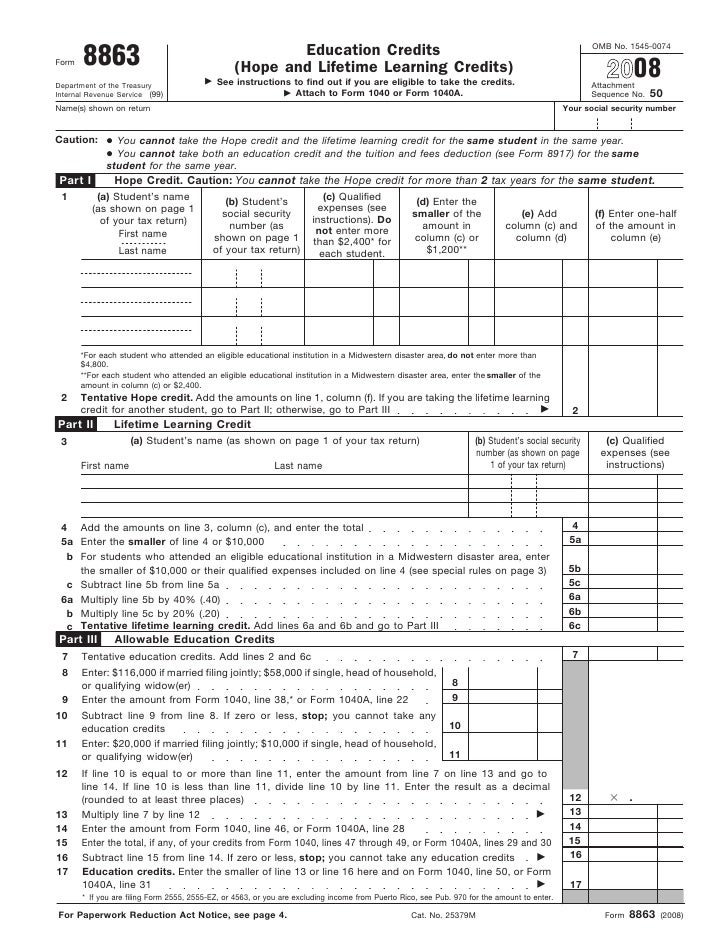

Form 8863Education Credits

Line 7 if you were under age 24 at the end of 2021 and the. What’s new personal protective equipment. Department of the treasury internal revenue service. See form 8862 and its. Web how to fill out form 8863.

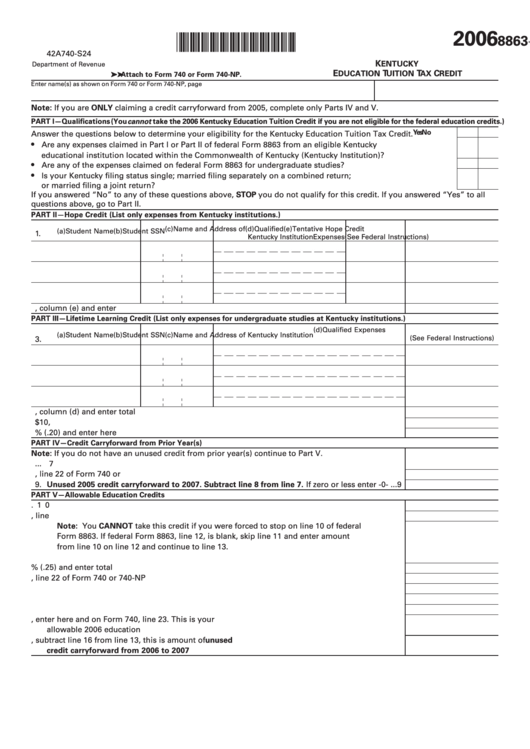

Form 8863K Education Tuition Tax Credit printable pdf download

Web form 8863 department of the treasury internal revenue service (99) education credits (american opportunity and lifetime learning credits) a attach to form 1040 or 1040. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution. Form 8863 typically accompanies your 1040 form,. Step by.

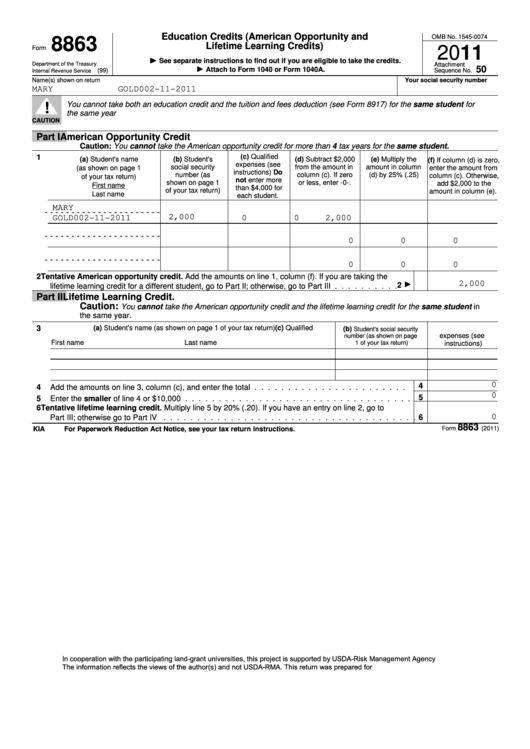

Sample Form 8863 Education Credits (American Opportunity And Lifetime

That’s the section where you’ll provide information about. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Form 8863 typically accompanies your 1040 form,. During your interview with bill and sue, you determine that $3,000 was paid in. Web how to fill out form.

Form 8863 Edit, Fill, Sign Online Handypdf

Step by step instructions comments in. Education credits (american opportunity and lifetime learning credits) attach to form 1040 or 1040. Web irs form 8863 instructions by forrest baumhover july 24, 2023 reading time: Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a..

8863 Instructions Form Fill Out and Sign Printable PDF Template signNow

Form 8863 typically accompanies your 1040 form,. Line 7 if you were under age 24 at the end of 2021 and the. That’s the section where you’ll provide information about. Education credits (american opportunity and lifetime learning credits) attach to form 1040 or 1040. Number and street (or p.o.

Form 8863 Education Credits (American Opportunity and Lifetime

Number and street (or p.o. Education credits (american opportunity and lifetime learning credits). Web how to fill out form 8863. Amounts paid for personal protective equipment (ppe), such as masks, hand sanitizer, and sanitizing wipes, for use. 14 minutes watch video get the form!

Credit Limit Worksheet A Fill Online, Printable, Fillable, Blank

Web form 8863 department of the treasury internal revenue service (99) education credits (american opportunity and lifetime learning credits) a attach to form 1040 or 1040. Use the information on the form. Department of the treasury internal revenue service. Step by step instructions comments in. Line 7 if you were under age 24 at the end of 2021 and the.

Form 8863 Instructions Fill Out and Sign Printable PDF Template signNow

Instructions for form 8863, education credits (american opportunity and lifetime learning credits) 2021 12/15/2021 form 8863: Step by step instructions comments in. Web irs form 8863 instructions by forrest baumhover july 24, 2023 reading time: Education credits (american opportunity and lifetime learning credits). During your interview with bill and sue, you determine that $3,000 was paid in.

Form 8863 Fill out & sign online DocHub

Amounts paid for personal protective equipment (ppe), such as masks, hand sanitizer, and sanitizing wipes, for use. Number and street (or p.o. Use the information on the form. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Education credits (american opportunity and lifetime learning.

Web Use Form 8863 To Figure And Claim Your Education Credits, Which Are Based On Qualified Education Expenses Paid To An Eligible Postsecondary Educational Institution.

Web information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms and instructions on. Line 7 if you were under age 24 at the end of 2021 and the. During your interview with bill and sue, you determine that $3,000 was paid in. Web attach a completed form 8862, information to claim certain credits after disallowance, to your tax return for the next tax year for which you claim the credit.

What’s New Personal Protective Equipment.

Department of the treasury internal revenue service. Form 8863 typically accompanies your 1040 form,. Web how to fill out form 8863. Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a.

Web Use Form 8863 To Figure And Claim Your Education Credits, Which Are Based On Adjusted Qualified Education Expenses Paid To An Eligible Educational Institution.

Web irs form 8863 instructions by forrest baumhover july 24, 2023 reading time: Use the information on the form. 14 minutes watch video get the form! See form 8862 and its.

Strange As It May Sound, To Fill Out Form 8863 You’ll Want To Start With Part Iii.

Step by step instructions comments in. Amounts paid for personal protective equipment (ppe), such as masks, hand sanitizer, and sanitizing wipes, for use. Name of second educational institution (if any) (1) address. Education credits (american opportunity and lifetime learning credits).