Form 7202 Instructions 2022

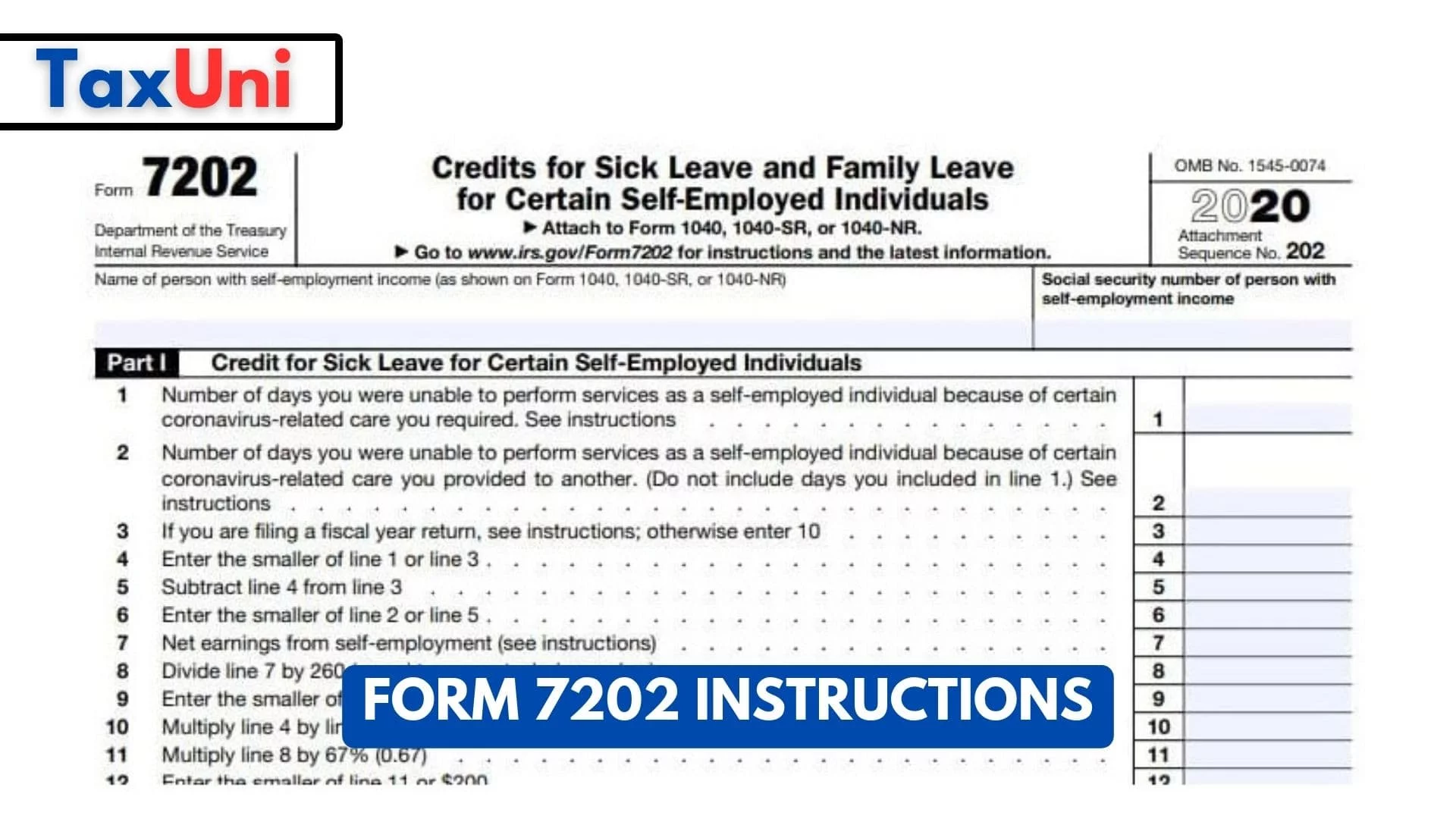

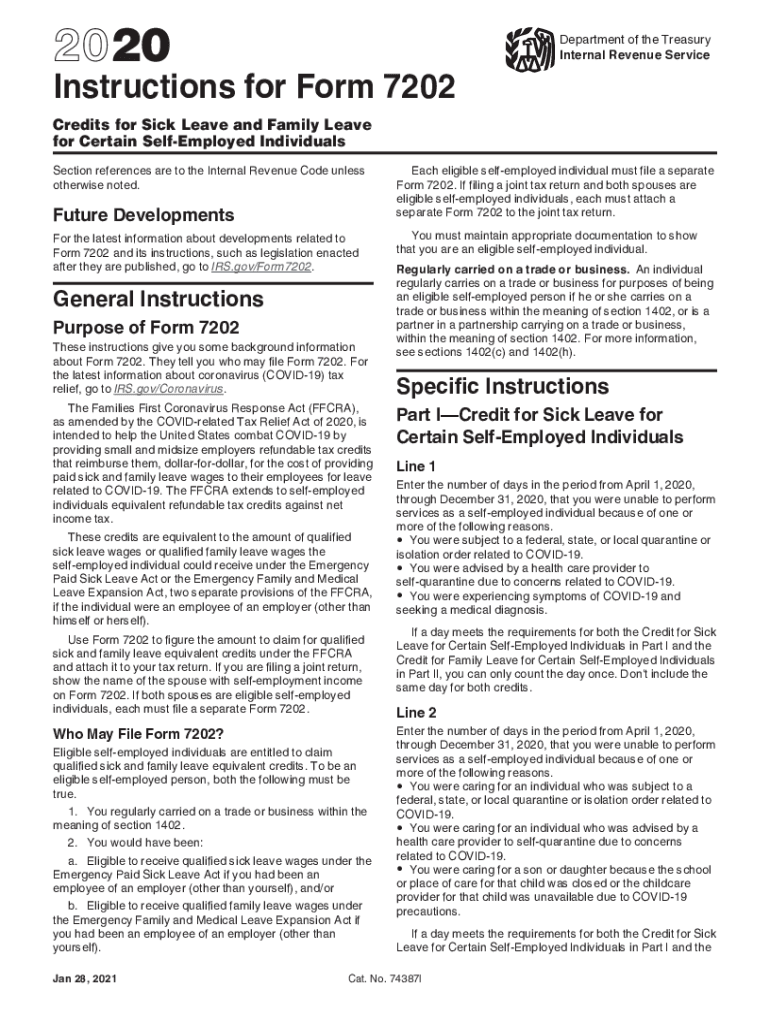

Form 7202 Instructions 2022 - Web to access form 7202 in taxslayer pro, from the main menu of the tax return (form 1040) select: For example, the form 1040 page is at. Web form 7202 and instructions released. Almost every form and publication has a page on irs.gov with a friendly shortcut. Irs instructions can be found. Web general instructions purpose of form 7202 use form 7202 to figure refundable qualified sick and family leave equivalent credits if you were unable to perform services as. Web this form must be signed and dated. Web the inflation reduction act of 2022 (the act) reinstates and increases the section 4611 hazardous substance superfund financing rate (petroleum superfund tax rate) on. Web up to $40 cash back form 7202 instructions require the taxpayer to provide information including their name, social security number, address, filing status, taxable income, and any. The credits for sick leave and family leave for certain self.

Web form 7202 and instructions released. Solved • by intuit • 170 • updated december 21, 2022. The credits for sick leave and family leave for certain self. Irs instructions can be found. Web per the 7202 instructions: Go to www.irs.gov/form7202 for instructions and the latest information. Web this form must be signed and dated. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner of your. Web to access form 7202 in taxslayer pro, from the main menu of the tax return (form 1040) select: Web the inflation reduction act of 2022 (the act) reinstates and increases the section 4611 hazardous substance superfund financing rate (petroleum superfund tax rate) on.

Web general instructions purpose of form 7202 use form 7202 to figure refundable qualified sick and family leave equivalent credits if you were unable to perform services as. (enter number of allowances) income tax withholding applies to the taxable part of your monthly annuity. Go to www.irs.gov/form7202 for instructions and the latest information. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner of your. Web use form 7202 to figure the amount to claim for qualified sick and family leave equivalent credits under the ffcra and attach it to your tax return. Web this form must be signed and dated. Irs instructions can be found. Web how to generate form 7202 in lacerte. Web form 7202 and instructions released. Web the inflation reduction act of 2022 (the act) reinstates and increases the section 4611 hazardous substance superfund financing rate (petroleum superfund tax rate) on.

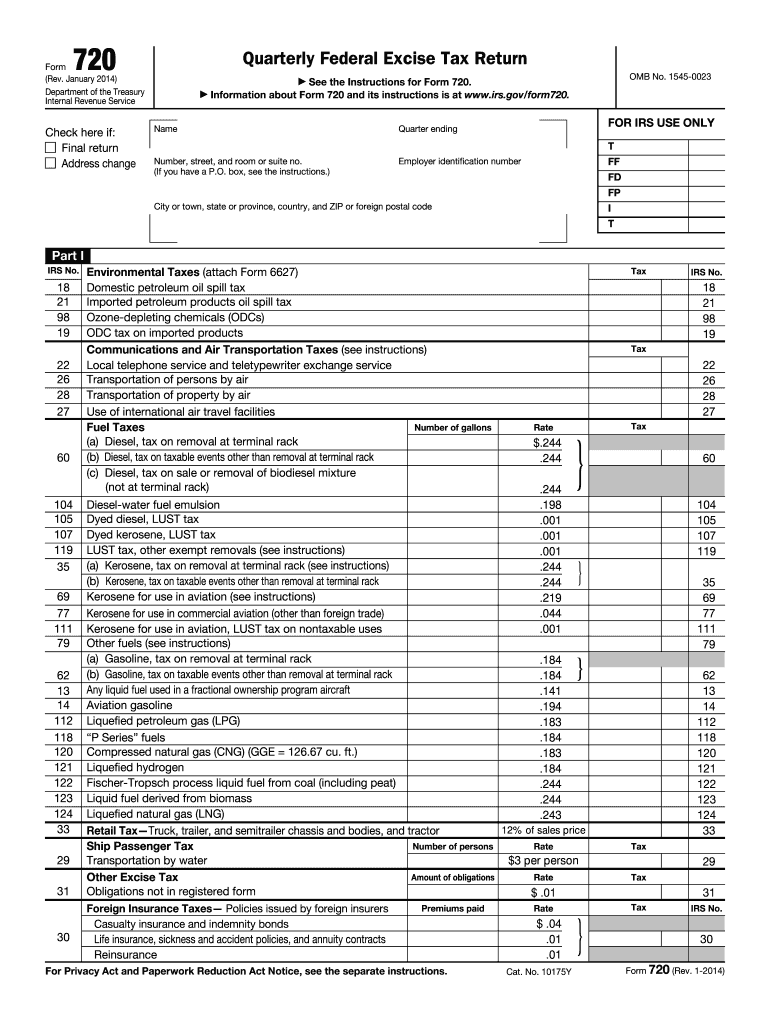

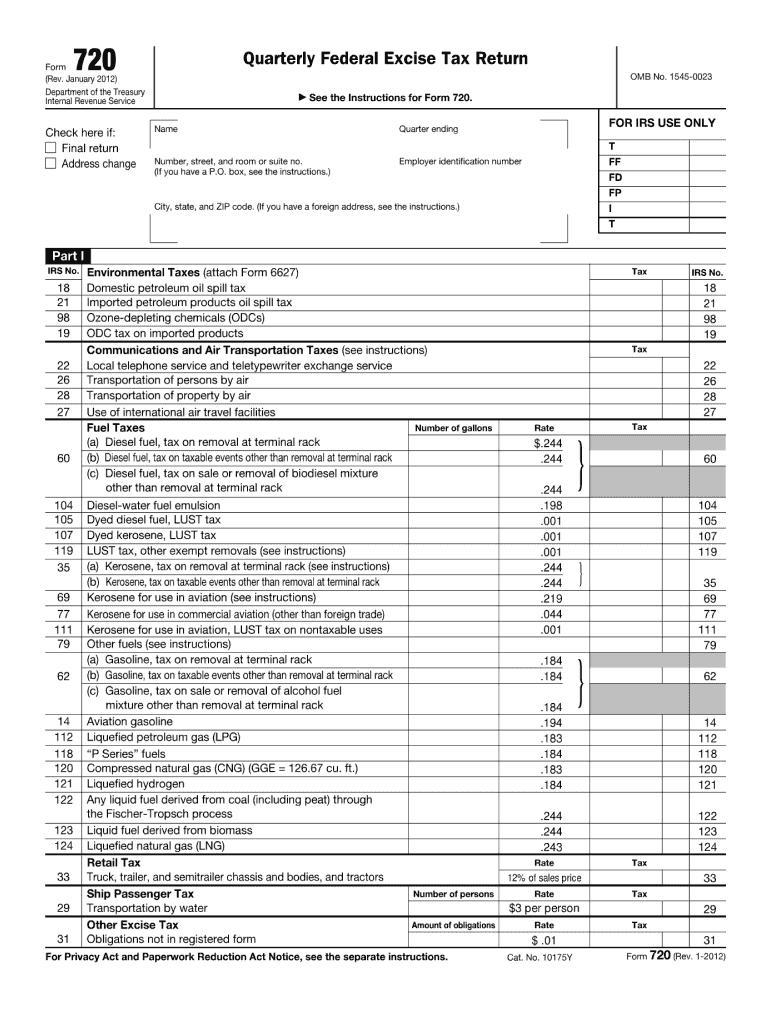

2014 Form IRS 720 Fill Online, Printable, Fillable, Blank pdfFiller

Web this form must be signed and dated. Web how to generate form 7202 in lacerte. Web general instructions purpose of form 7202 use form 7202 to figure refundable qualified sick and family leave equivalent credits if you were unable to perform services as. Solved • by intuit • 170 • updated december 21, 2022. Web march 3, 2022 download.

Form 720 Fill Out and Sign Printable PDF Template signNow

Web to access form 7202 in taxslayer pro, from the main menu of the tax return (form 1040) select: Go to www.irs.gov/form7202 for instructions and the latest information. Web general instructions purpose of form 7202 use form 7202 to figure refundable qualified sick and family leave equivalent credits if you were unable to perform services as. Web to complete form.

How to Complete Form 720 Quarterly Federal Excise Tax Return

Irs instructions can be found. Solved • by intuit • 170 • updated december 21, 2022. Web march 3, 2022 download pdf (1.6 mb) the irs today updated a set of “ frequently asked questions” (faqs) concerning the paid sick and family leave tax credits. Web how to generate form 7202 in lacerte. Web per the 7202 instructions:

Form 7202 Instructions 2022 2023

Web march 3, 2022 download pdf (1.6 mb) the irs today updated a set of “ frequently asked questions” (faqs) concerning the paid sick and family leave tax credits. Go to www.irs.gov/form7202 for instructions and the latest information. Solved • by intuit • 170 • updated december 21, 2022. Web instructions, and pubs is at irs.gov/forms. Web up to $40.

Draft of Form to be Used by SelfEmployed Individuals to Compute FFCRA

If you are filing a joint return,. Web general instructions purpose of form 7202 use form 7202 to figure refundable qualified sick and family leave equivalent credits if you were unable to perform services as. Web to access form 7202 in taxslayer pro, from the main menu of the tax return (form 1040) select: Web march 3, 2022 download pdf.

Printable Fileable IRS Form 7202 Self Employed Sick Leave and Family

The credits for sick leave and family leave for certain self. (enter number of allowances) income tax withholding applies to the taxable part of your monthly annuity. Almost every form and publication has a page on irs.gov with a friendly shortcut. Web the inflation reduction act of 2022 (the act) reinstates and increases the section 4611 hazardous substance superfund financing.

IRS Form 7202 LinebyLine Instructions 2022 Sick Leave and Family

Go to www.irs.gov/form7202 for instructions and the latest information. Web form 7202 and instructions released. The credits for sick leave and family leave for certain self. Web this form must be signed and dated. If you are filing a joint return,.

Form 7202 Instructions 2022 2023

Web march 3, 2022 download pdf (1.6 mb) the irs today updated a set of “ frequently asked questions” (faqs) concerning the paid sick and family leave tax credits. Web to complete form 7202 in the taxact program: Web form 7202 and instructions released. Web instructions, and pubs is at irs.gov/forms. If you are filing a joint return,.

2020 Form IRS Instructions 7202 Fill Online, Printable, Fillable, Blank

Web the inflation reduction act of 2022 (the act) reinstates and increases the section 4611 hazardous substance superfund financing rate (petroleum superfund tax rate) on. Web instructions, and pubs is at irs.gov/forms. (enter number of allowances) income tax withholding applies to the taxable part of your monthly annuity. Web to complete form 7202 in the taxact program: Go to www.irs.gov/form7202.

Form 7202 SelfEmployed Audit Risk Form 7202 Tax Return Evidence the

Web how to generate form 7202 in lacerte. Web march 3, 2022 download pdf (1.6 mb) the irs today updated a set of “ frequently asked questions” (faqs) concerning the paid sick and family leave tax credits. Web the inflation reduction act of 2022 (the act) reinstates and increases the section 4611 hazardous substance superfund financing rate (petroleum superfund tax.

Web March 3, 2022 Download Pdf (1.6 Mb) The Irs Today Updated A Set Of “ Frequently Asked Questions” (Faqs) Concerning The Paid Sick And Family Leave Tax Credits.

Web form 7202 and instructions released. For example, the form 1040 page is at. Solved • by intuit • 170 • updated december 21, 2022. (enter number of allowances) income tax withholding applies to the taxable part of your monthly annuity.

From Within Your Taxact Return ( Online Or Desktop), Click Federal (On Smaller Devices, Click In The Top Left Corner Of Your.

Web general instructions purpose of form 7202 use form 7202 to figure refundable qualified sick and family leave equivalent credits if you were unable to perform services as. Web to access form 7202 in taxslayer pro, from the main menu of the tax return (form 1040) select: Web this form must be signed and dated. Web how to generate form 7202 in lacerte.

Web Per The 7202 Instructions:

If you are filing a joint return,. Web use form 7202 to figure the amount to claim for qualified sick and family leave equivalent credits under the ffcra and attach it to your tax return. Almost every form and publication has a page on irs.gov with a friendly shortcut. Go to www.irs.gov/form7202 for instructions and the latest information.

Irs Instructions Can Be Found.

The credits for sick leave and family leave for certain self. Web to complete form 7202 in the taxact program: Web instructions, and pubs is at irs.gov/forms. Web up to $40 cash back form 7202 instructions require the taxpayer to provide information including their name, social security number, address, filing status, taxable income, and any.