2020 Form 2210

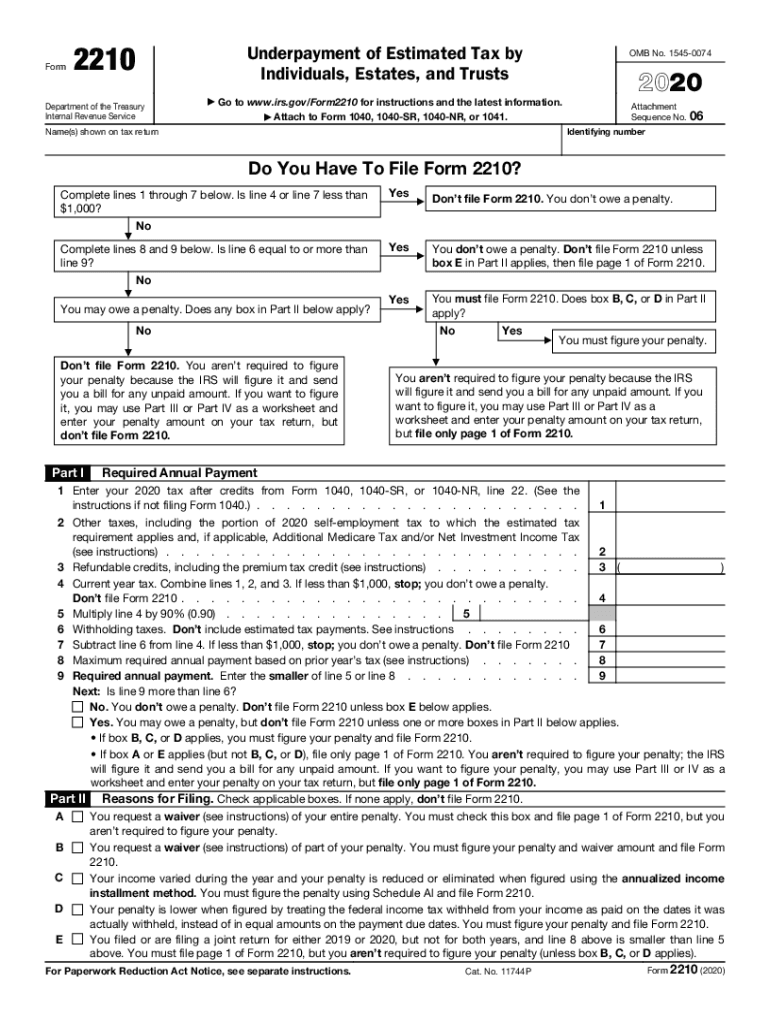

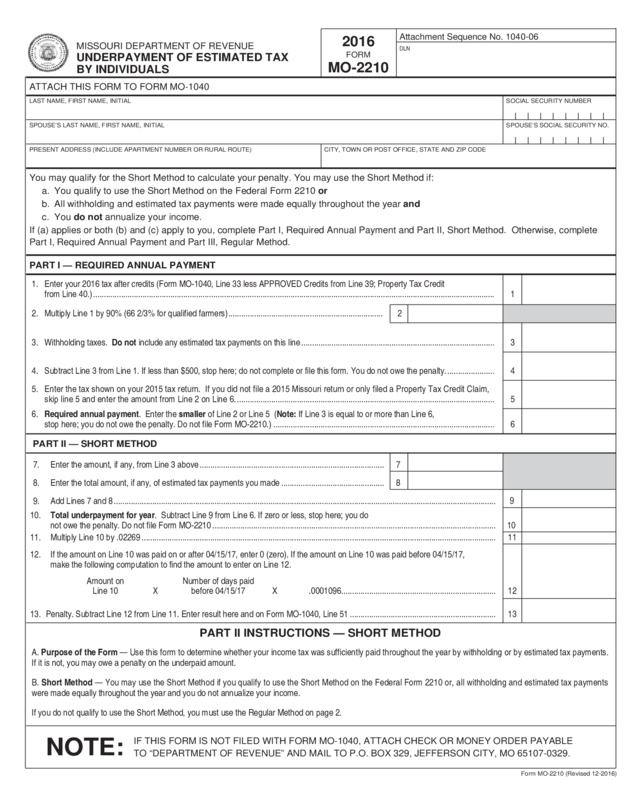

2020 Form 2210 - Web turbotax is late in updating the tax forms. With the form, attach an explanation for why you didn’t pay estimated taxes in the. The irs will generally figure your penalty for you and you should not file form 2210. Web irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the underpayment penalty if you didn't withhold or pay enough taxes. Web 2020 underpayment of estimated taxby individuals,estates, or trusts enclose with your form 1040me or form 1041me (see instructions on back) for calendar year 2020 or fi. Web 2020 return when completing form 2210 for your 2021 tax year. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Department of the treasury internal revenue service. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. This form contains both a short.

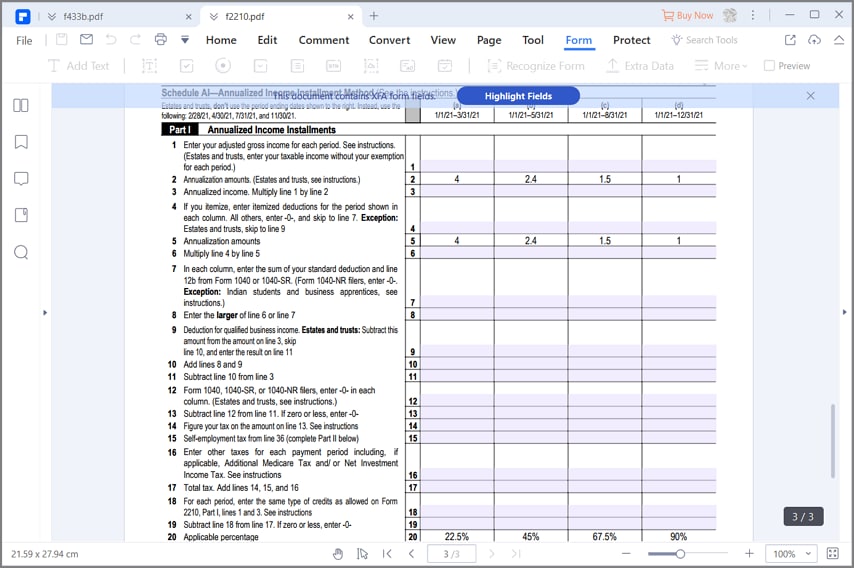

In order to make schedule ai available, part ii of form 2210 underpayment of estimated tax by. Web to request a waiver when you file, complete irs form 2210 and submit it with your tax return. Web form 2210 is used to calculate a penalty when the taxpayer has underpaid on their estimated taxes (quarterly es vouchers). Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web 2020 underpayment of estimated taxby individuals,estates, or trusts enclose with your form 1040me or form 1041me (see instructions on back) for calendar year 2020 or fi. This penalty is different from the penalty for. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Waiver (see instructions) of your entire. With the form, attach an explanation for why you didn’t pay estimated taxes in the. Web file only page 1 of form 2210.

Download or email irs 2220 & more fillable forms, register and subscribe now! Register and subscribe now to work on your irs form 2210 & more fillable forms. Turbotax is aware of errors related to calculating underpayment penalties on form 2210. Web 2020 underpayment of estimated taxby individuals,estates, or trusts enclose with your form 1040me or form 1041me (see instructions on back) for calendar year 2020 or fi. With the form, attach an explanation for why you didn’t pay estimated taxes in the. This penalty is different from the penalty for. Web to request a waiver when you file, complete irs form 2210 and submit it with your tax return. This form is for income earned in tax year 2022, with tax returns due in april. Web form 2210 is used to calculate a penalty when the taxpayer has underpaid on their estimated taxes (quarterly es vouchers). The irs will generally figure your penalty for you and you should not file form 2210.

Ssurvivor Irs Form 2210 Ai Instructions

The irs will generally figure your penalty for you and you should not file form 2210. Web file only page 1 of form 2210. Web irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the underpayment penalty if you didn't withhold or pay enough taxes. Web we last updated federal form 2210 in december 2022 from.

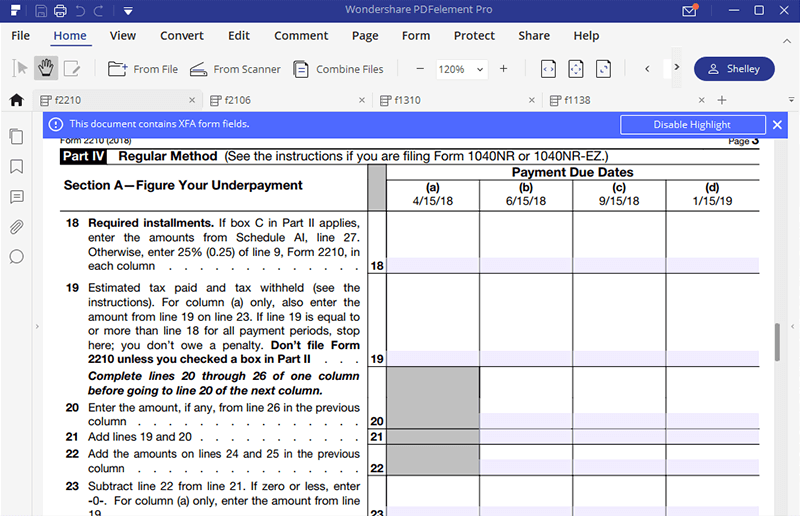

IRS Form 2210Fill it with the Best Form Filler

Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount. Turbotax is aware of errors related to calculating underpayment penalties on form 2210. With the form, attach an explanation for why you didn’t pay estimated taxes in the. Department of the treasury internal revenue service. Web form 2210 is used to determine how much you.

2020 Form IRS 2210 Fill Online, Printable, Fillable, Blank pdfFiller

Download or email irs 2220 & more fillable forms, register and subscribe now! Underpayment of estimated tax by individuals, estates, and trusts. Waiver (see instructions) of your entire. The irs website shows that form 2210 for 2020 was published on 2/9/21, but as of today (2/13/21), turbotax still cannot. In order to make schedule ai available, part ii of form.

Ssurvivor Form 2210 Instructions 2020

Department of the treasury internal revenue service. Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount. In order to make schedule ai available, part ii of form 2210 underpayment of estimated tax by. Web form 2210 is used to calculate a penalty when the taxpayer has underpaid on their estimated taxes (quarterly es vouchers)..

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Web file only page 1 of form 2210. Web turbotax is late in updating the tax forms. This penalty is different from the penalty for. Download or email irs 2220 & more fillable forms, register and subscribe now! Web form 2210 is used to calculate a penalty when the taxpayer has underpaid on their estimated taxes (quarterly es vouchers).

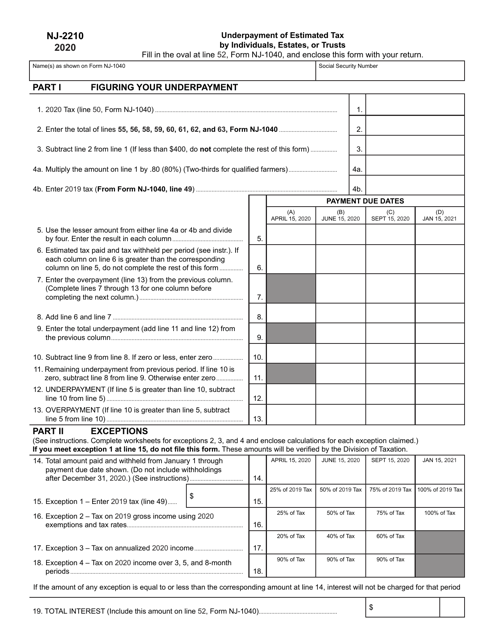

Form NJ2210 Download Fillable PDF or Fill Online Underpayment of

Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web form 2210 is used to calculate a penalty when the taxpayer has underpaid on their estimated taxes (quarterly es vouchers). Web 2020 return when completing form 2210 for your 2021 tax year. Web form 2210 (or form 2220 for corporations).

Instructions for Federal Tax Form 2210 Sapling

Web we last updated federal form 2210 in december 2022 from the federal internal revenue service. In order to make schedule ai available, part ii of form 2210 underpayment of estimated tax by. Web irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the underpayment penalty if you didn't withhold or pay enough taxes. Web file.

Form 2210Underpayment of Estimated Tax

Web to request a waiver when you file, complete irs form 2210 and submit it with your tax return. Register and subscribe now to work on your irs form 2210 & more fillable forms. Web turbotax is late in updating the tax forms. Web we last updated federal form 2210 in december 2022 from the federal internal revenue service. Web.

2020 More Gov Forms Fillable, Printable PDF & Forms Handypdf

Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. This form contains both a short. Waiver (see instructions) of your entire. This form is for income earned in tax year 2022, with tax returns due in april.

Ssurvivor Irs Form 2210 Instructions 2020

You should figure out the amount of tax you have underpaid. Web file only page 1 of form 2210. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web 2020 return when completing form 2210 for your 2021 tax year. In order to make schedule ai available, part ii of.

Web 2020 Return When Completing Form 2210 For Your 2021 Tax Year.

Complete, edit or print tax forms instantly. Web turbotax is late in updating the tax forms. This form contains both a short. The irs website shows that form 2210 for 2020 was published on 2/9/21, but as of today (2/13/21), turbotax still cannot.

Web Purpose Of Form Use Form 2210 To See If You Owe A Penalty For Underpaying Your Estimated Tax.

Web to request a waiver when you file, complete irs form 2210 and submit it with your tax return. Waiver (see instructions) of your entire. Web 2020 underpayment of estimated taxby individuals,estates, or trusts enclose with your form 1040me or form 1041me (see instructions on back) for calendar year 2020 or fi. Register and subscribe now to work on your irs form 2210 & more fillable forms.

Complete, Edit Or Print Tax Forms Instantly.

Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount. Web file only page 1 of form 2210. This penalty is different from the penalty for. You should figure out the amount of tax you have underpaid.

Web Irs Form 2210 (Underpayment Of Estimated Tax By Individuals, Estates, And Trusts) Calculates The Underpayment Penalty If You Didn't Withhold Or Pay Enough Taxes.

The irs will generally figure your penalty for you and you should not file form 2210. Department of the treasury internal revenue service. Download or email irs 2220 & more fillable forms, register and subscribe now! Web form 2210 is used to calculate a penalty when the taxpayer has underpaid on their estimated taxes (quarterly es vouchers).