1125 A Form

1125 A Form - This calculation must be separately reported on the return as set forth below. However, to use the form, a business must meet particular requirements that are generally entities that create goods to sell them. Web form 1120 is the u.s. Web for businesses that sell inventory to customers, the cost of goods sold (cogs) deduction is likely going to be the largest expense for the expense. Show details this website is not affiliated with irs. Web purpose of form purchased for use in producing finished merchandise during the tax year on line 2. Form 1120 is used to calculate the net income, profit or loss, of all incorporated businesses. How it works browse for the 1125 a customize and esign irs form 1125 a send out signed 1125 a form or print it rate the form 1125 4.8 satisfied 251 votes what makes the 1125 legally valid?

Web for businesses that sell inventory to customers, the cost of goods sold (cogs) deduction is likely going to be the largest expense for the expense. This calculation must be separately reported on the return as set forth below. Form 1120 is used to calculate the net income, profit or loss, of all incorporated businesses. Web purpose of form purchased for use in producing finished merchandise during the tax year on line 2. How it works browse for the 1125 a customize and esign irs form 1125 a send out signed 1125 a form or print it rate the form 1125 4.8 satisfied 251 votes what makes the 1125 legally valid? However, to use the form, a business must meet particular requirements that are generally entities that create goods to sell them. Show details this website is not affiliated with irs. Web form 1120 is the u.s.

Web form 1120 is the u.s. However, to use the form, a business must meet particular requirements that are generally entities that create goods to sell them. Show details this website is not affiliated with irs. How it works browse for the 1125 a customize and esign irs form 1125 a send out signed 1125 a form or print it rate the form 1125 4.8 satisfied 251 votes what makes the 1125 legally valid? Web for businesses that sell inventory to customers, the cost of goods sold (cogs) deduction is likely going to be the largest expense for the expense. This calculation must be separately reported on the return as set forth below. Web purpose of form purchased for use in producing finished merchandise during the tax year on line 2. Form 1120 is used to calculate the net income, profit or loss, of all incorporated businesses.

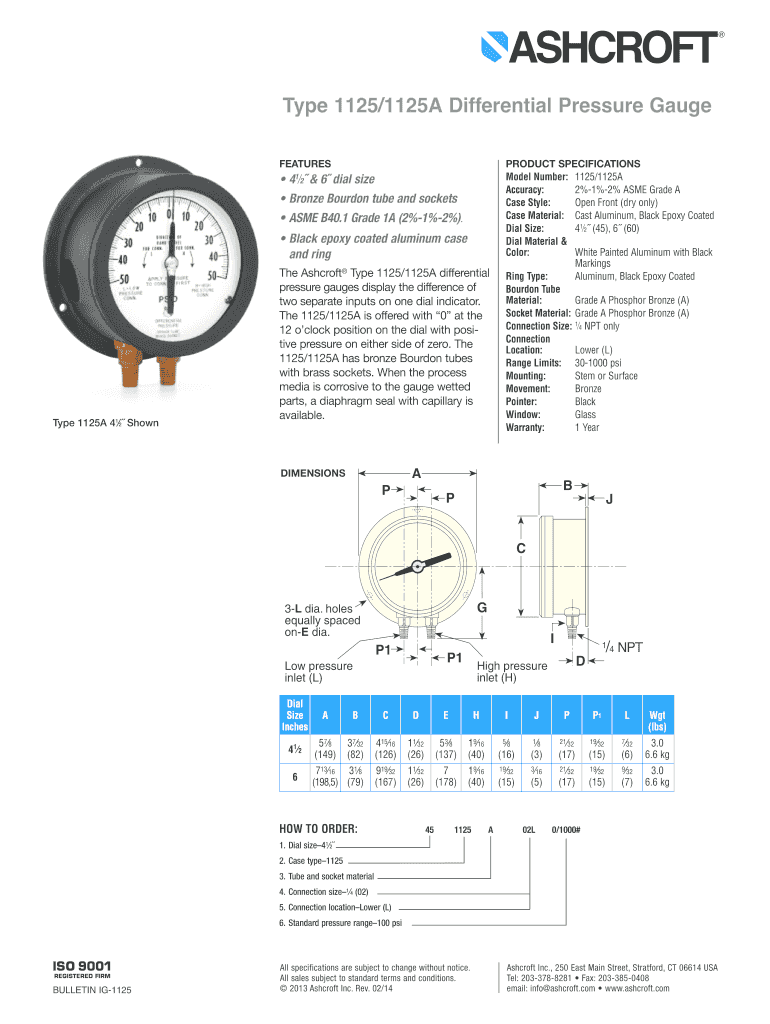

Form 1125 A Fill Out and Sign Printable PDF Template signNow

How it works browse for the 1125 a customize and esign irs form 1125 a send out signed 1125 a form or print it rate the form 1125 4.8 satisfied 251 votes what makes the 1125 legally valid? Web for businesses that sell inventory to customers, the cost of goods sold (cogs) deduction is likely going to be the largest.

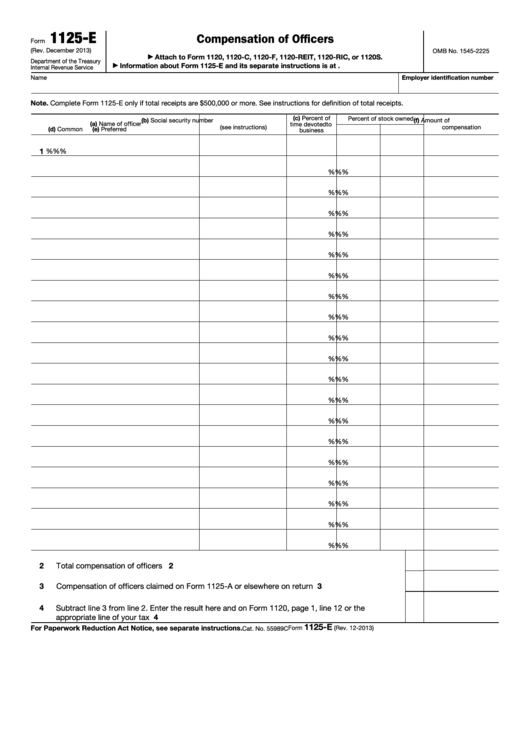

How to find form 1125 E Compensation of officers online YouTube

Web for businesses that sell inventory to customers, the cost of goods sold (cogs) deduction is likely going to be the largest expense for the expense. How it works browse for the 1125 a customize and esign irs form 1125 a send out signed 1125 a form or print it rate the form 1125 4.8 satisfied 251 votes what makes.

1125 A Fillable and Editable PDF Template

Web for businesses that sell inventory to customers, the cost of goods sold (cogs) deduction is likely going to be the largest expense for the expense. How it works browse for the 1125 a customize and esign irs form 1125 a send out signed 1125 a form or print it rate the form 1125 4.8 satisfied 251 votes what makes.

1120S Entering Officer Information Form 1125E

Web purpose of form purchased for use in producing finished merchandise during the tax year on line 2. Show details this website is not affiliated with irs. However, to use the form, a business must meet particular requirements that are generally entities that create goods to sell them. Form 1120 is used to calculate the net income, profit or loss,.

Fillable Form 1125E Compensation Of Officers printable pdf download

Form 1120 is used to calculate the net income, profit or loss, of all incorporated businesses. Show details this website is not affiliated with irs. Web for businesses that sell inventory to customers, the cost of goods sold (cogs) deduction is likely going to be the largest expense for the expense. However, to use the form, a business must meet.

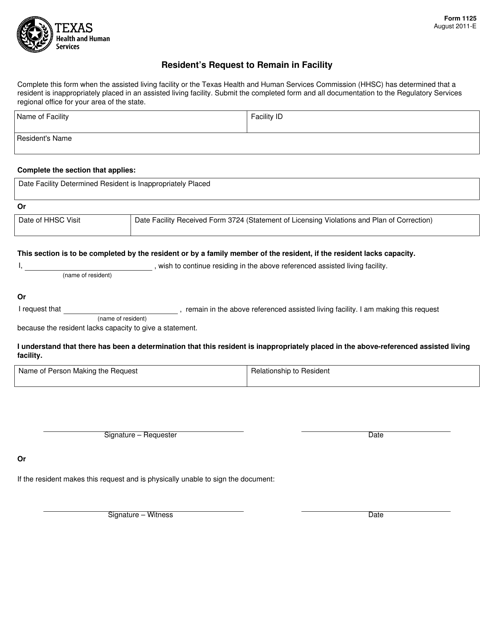

Form 1125 Download Fillable PDF or Fill Online Resident's Request to

This calculation must be separately reported on the return as set forth below. Web purpose of form purchased for use in producing finished merchandise during the tax year on line 2. Show details this website is not affiliated with irs. Form 1120 is used to calculate the net income, profit or loss, of all incorporated businesses. However, to use the.

Fill Free fillable Form 1125A Cost of Goods Sold 2018 PDF form

Show details this website is not affiliated with irs. How it works browse for the 1125 a customize and esign irs form 1125 a send out signed 1125 a form or print it rate the form 1125 4.8 satisfied 251 votes what makes the 1125 legally valid? However, to use the form, a business must meet particular requirements that are.

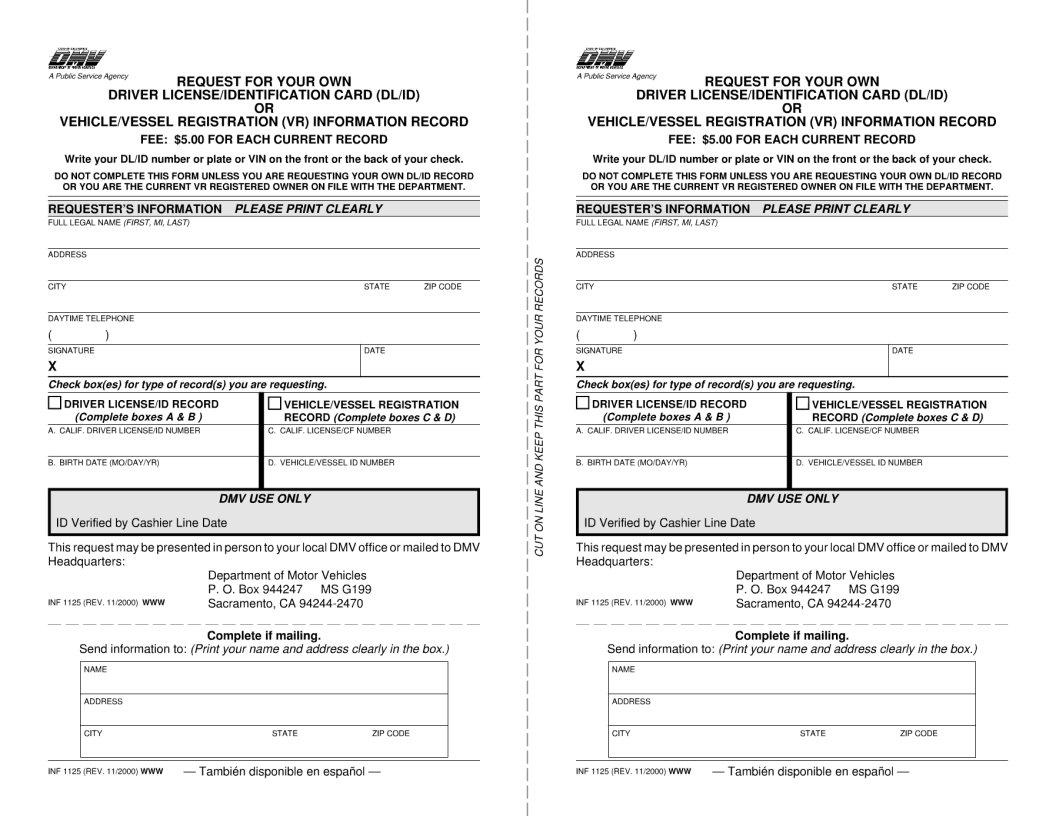

Inf 1125 Form ≡ Fill Out Printable PDF Forms Online

Web form 1120 is the u.s. This calculation must be separately reported on the return as set forth below. How it works browse for the 1125 a customize and esign irs form 1125 a send out signed 1125 a form or print it rate the form 1125 4.8 satisfied 251 votes what makes the 1125 legally valid? Show details this.

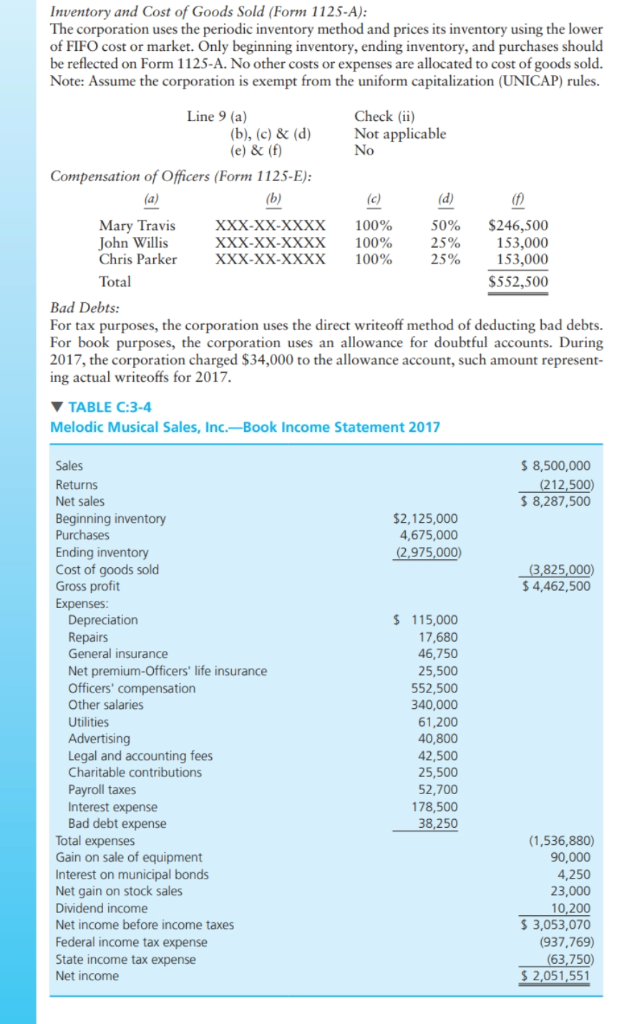

TAX FORM/RETURN PREPARATION PROBLEMS Melodic Musical

Web purpose of form purchased for use in producing finished merchandise during the tax year on line 2. Web form 1120 is the u.s. Web for businesses that sell inventory to customers, the cost of goods sold (cogs) deduction is likely going to be the largest expense for the expense. However, to use the form, a business must meet particular.

Form 1125A Cost of Goods Sold (2012) Free Download

Form 1120 is used to calculate the net income, profit or loss, of all incorporated businesses. How it works browse for the 1125 a customize and esign irs form 1125 a send out signed 1125 a form or print it rate the form 1125 4.8 satisfied 251 votes what makes the 1125 legally valid? However, to use the form, a.

Form 1120 Is Used To Calculate The Net Income, Profit Or Loss, Of All Incorporated Businesses.

Show details this website is not affiliated with irs. Web form 1120 is the u.s. This calculation must be separately reported on the return as set forth below. Web purpose of form purchased for use in producing finished merchandise during the tax year on line 2.

Web For Businesses That Sell Inventory To Customers, The Cost Of Goods Sold (Cogs) Deduction Is Likely Going To Be The Largest Expense For The Expense.

How it works browse for the 1125 a customize and esign irs form 1125 a send out signed 1125 a form or print it rate the form 1125 4.8 satisfied 251 votes what makes the 1125 legally valid? However, to use the form, a business must meet particular requirements that are generally entities that create goods to sell them.