Form 3921 Vs 3922

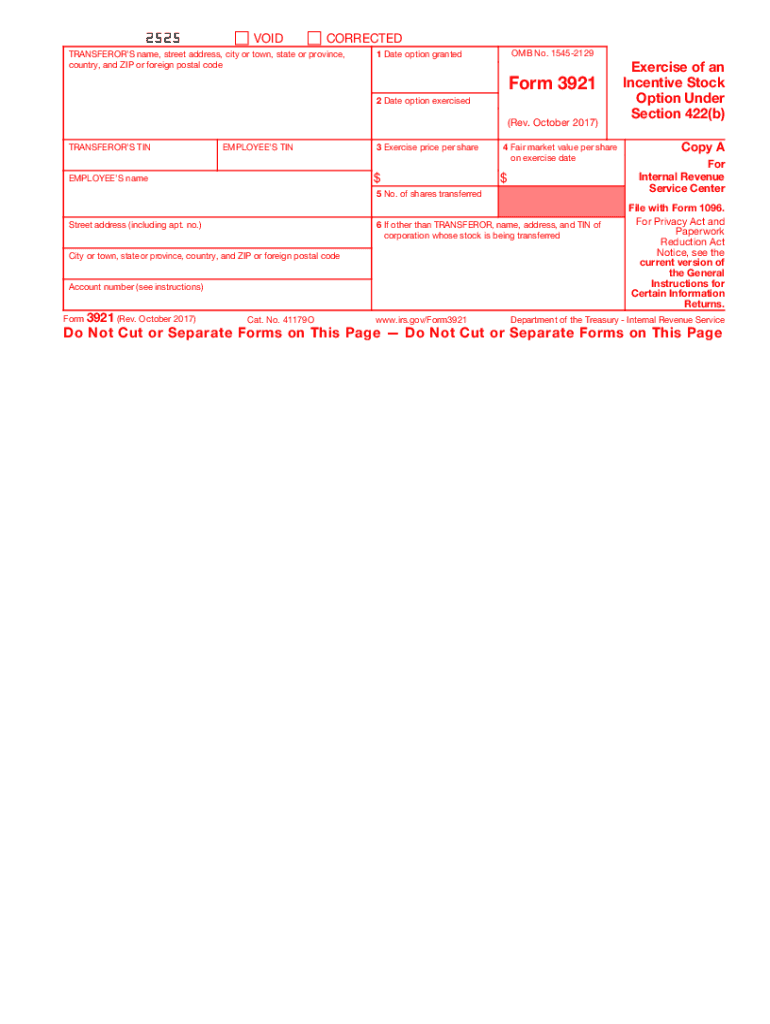

Form 3921 Vs 3922 - If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee. Form 3921 is used by companies to report that a shareholder has just exercised the iso. Web the irs has issued two forms (and instructions): I feel like i say that phrase a lot—usually when i’m reminding you to renew your naspp membership. Instructions for forms 3921 and 3922, exercise of an incentive stock option under. Your employer will send you form 3922, transfer of stock. Our solution includes a diagnostic review process, whereby. Exercise of an incentive stock option under section 422(b) copy a. Web corporations file this form for each transfer of the legal title of a share of stock acquired by the employee pursuant to the employee's exercise of an option granted. This form is submitted in the year in which the iso was exercised.

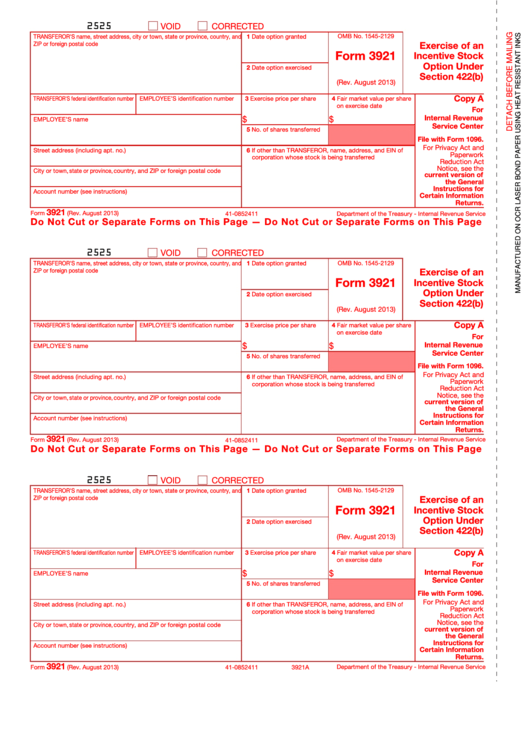

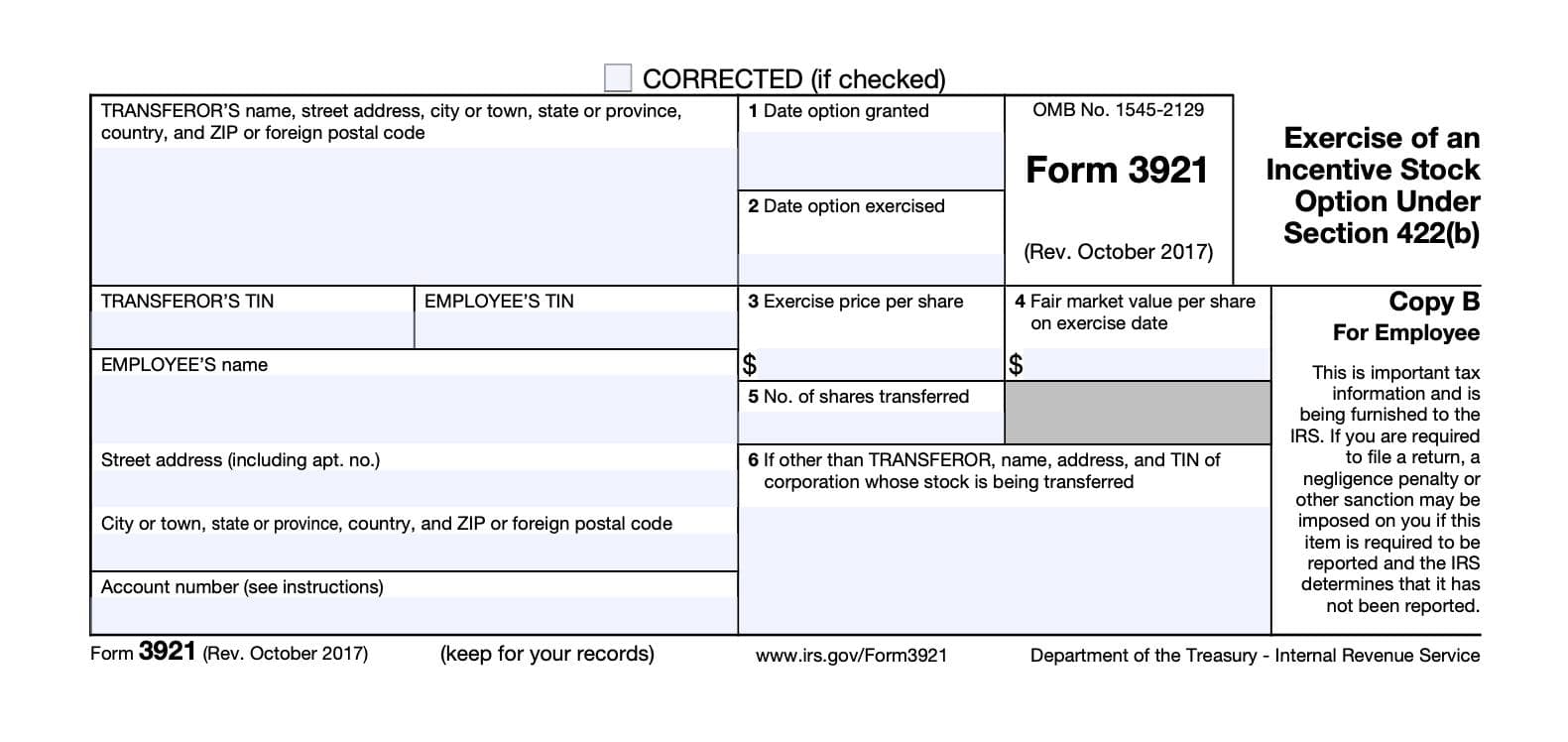

Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. This form is submitted in the year in which the iso was exercised. Web irs form 3922 for espps and form 3921 for isos: Web home forms and instructions about form 3921, exercise of an incentive stock option under section 422 (b) about form 3921, exercise of an incentive stock. Web february 28, 2023 the carta team form 3921 is an irs form that must be filed by a company when an employee has exercised an incentive stock option (iso) in. For espp purchases or iso exercises during. Form 3921 is different from form 3922. Instructions for forms 3921 and 3922, exercise of an incentive stock option under. Exercise of an incentive stock option under section 422(b) copy a. The latest technologies high quality electronic pubs and forms view.

Instructions for forms 3921 and 3922, exercise of an incentive stock option under. Web instructions for forms 3921 and 3922 (rev. The latest technologies high quality electronic pubs and forms view. Web how do i enter employee stock purchase plan (espp) sales in turbotax? What they are and what you need to know about them. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee. Web the irs has issued two forms (and instructions): Web form previous editions of this form are obsolete and will not be used. Web 1 best answer. Web form 3921 vs form 3922.

IRS Form 3922

Form 3921 is different from form 3922. Our solution includes a diagnostic review process, whereby. Exercise of an incentive stock option under section 422(b) copy a. Web february 28, 2023 the carta team form 3921 is an irs form that must be filed by a company when an employee has exercised an incentive stock option (iso) in. Web corporations file.

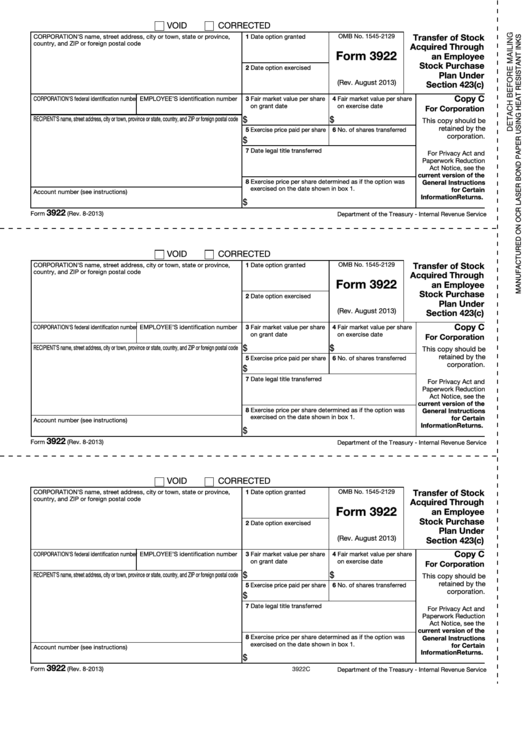

Form 3922 Transfer Of Stock Acquired Through An Employee Stock

Web the irs has issued two forms (and instructions): Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. Web january 11, 2022 it’s that time of year again. The latest technologies high quality electronic pubs and forms view. Instructions for.

3921 IRS Tax Form Copy A Free Shipping

Web home forms and instructions about form 3921, exercise of an incentive stock option under section 422 (b) about form 3921, exercise of an incentive stock. Form 3921 is used to report iso exercises, and form 3922 is used for espp share purchases. Web form previous editions of this form are obsolete and will not be used. Our solution includes.

Form 3921 Exercise Of An Incentive Stock Option Under Section 422b

Form 3921 is used to report iso exercises, and form 3922 is used for espp share purchases. For espp purchases or iso exercises during. The latest technologies high quality electronic pubs and forms view. Web the irs has issued two forms (and instructions): Web 1 best answer.

Form 3921 How to Report Transfer of Incentive Stock Options in 2016

If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee. Web army da administrative publications and forms by the army publishing directorate apd. Instructions for forms 3921 and 3922, exercise of an incentive stock option under. Web home forms and instructions about form 3921, exercise of an incentive stock option under.

Form 3921 Everything you need to know

If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee. Web army da administrative publications and forms by the army publishing directorate apd. Web corporations file this form for each transfer of the legal title of a share of stock acquired by the employee pursuant to the employee's exercise of an.

Form 3921 Download Fillable PDF or Fill Online MultipleCertificate

Instructions for forms 3921 and 3922, exercise of an incentive stock option under. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. Web instructions for forms 3921 and 3922 (rev. Web corporations file this form for each transfer of the.

Tax Reporting For Stock Compensation Understanding Form W2, Form 3922

Our solution includes a diagnostic review process, whereby. Web irs form 3922 for espps and form 3921 for isos: Web form previous editions of this form are obsolete and will not be used. What they are and what you need to know about them. For espp purchases or iso exercises during.

3921, Tax Reporting Instructions & Filing Requirements for Form 3921

Web the irs has issued two forms (and instructions): Our solution includes a diagnostic review process, whereby. Web february 28, 2023 the carta team form 3921 is an irs form that must be filed by a company when an employee has exercised an incentive stock option (iso) in. If you purchased espp shares, your employer will send you form 3922,.

IRS 3921 20172021 Fill out Tax Template Online US Legal Forms

This form is submitted in the year in which the iso was exercised. Web the irs has issued two forms (and instructions): Web january 11, 2022 it’s that time of year again. Web companies utilize form 3921 to notify the irs that a shareholder has just exercised the iso. Web army da administrative publications and forms by the army publishing.

If You Purchased Espp Shares, Your Employer Will Send You Form 3922, Transfer Of Stock Acquired Through An Employee.

Your employer will send you form 3922, transfer of stock. What they are and what you need to know about them. For espp purchases or iso exercises during. This form is submitted in the year in which the iso was exercised.

Web January 11, 2022 It’s That Time Of Year Again.

Web the irs has issued two forms (and instructions): Web home forms and instructions about form 3921, exercise of an incentive stock option under section 422 (b) about form 3921, exercise of an incentive stock. Web irs form 3922 for espps and form 3921 for isos: Web form previous editions of this form are obsolete and will not be used.

Web 1 Best Answer.

Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. Form 3921 is used by companies to report that a shareholder has just exercised the iso. Web corporations file this form for each transfer of the legal title of a share of stock acquired by the employee pursuant to the employee's exercise of an option granted. Our solution includes a diagnostic review process, whereby.

Exercise Of An Incentive Stock Option Under Section 422(B) Copy A.

Web instructions for forms 3921 and 3922 (rev. Form 3921 is different from form 3922. I feel like i say that phrase a lot—usually when i’m reminding you to renew your naspp membership. Web companies utilize form 3921 to notify the irs that a shareholder has just exercised the iso.