Wisconsin Form 3 Instructions 2022

Wisconsin Form 3 Instructions 2022 - Annual tax reporting period means january 1 through december 31. Web a partnership or limited liabilit y company treated as a partnership with income from wisconsin sources, regardless of the amount, must file a wisconsin partnership return,. Wisconsin usually releases forms for the current tax year between january and april. Easily fill out pdf blank, edit, and sign them. For calendar year 2022 or. Wisconsin partnership electronic payment voucher instructions: Web general instructions for form 3. Save or instantly send your ready documents. This document provides statements and interpretations of. Web 57 rows wisconsin income tax forms wisconsin printable income tax forms 89 pdfs wisconsin has a state income tax that ranges between 4% and 7.65% , which is.

This document provides statements and interpretations of. Wisconsin usually releases forms for the current tax year between january and april. Web birth to 3 program: Web 95 rows 1/6/2022 1:31 pm: Adjustments to convert 2022 federal adjusted gross income and itemized. Web complete wi form 3 instructions online with us legal forms. Web unless a waiver is approved by the wisconsin department of revenue (“department”). Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a. You can download or print current or past.

Web we last updated the form 3 partnership return in march 2023, so this is the latest version of form 3, fully updated for tax year 2022. Web 95 rows 1/6/2022 1:31 pm: Web a partnership or limited liabilit y company treated as a partnership with income from wisconsin sources, regardless of the amount, must file a wisconsin partnership return,. Partnerships, including limited liability companies treated as partnerships, use the 2022. Central time wi dor forms and instructions wi dor requesting tax. Applicant is a person in whose. Wisconsin usually releases forms for the current tax year between january and april. You can download or print current or past. Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,. Web follow the simple instructions below:

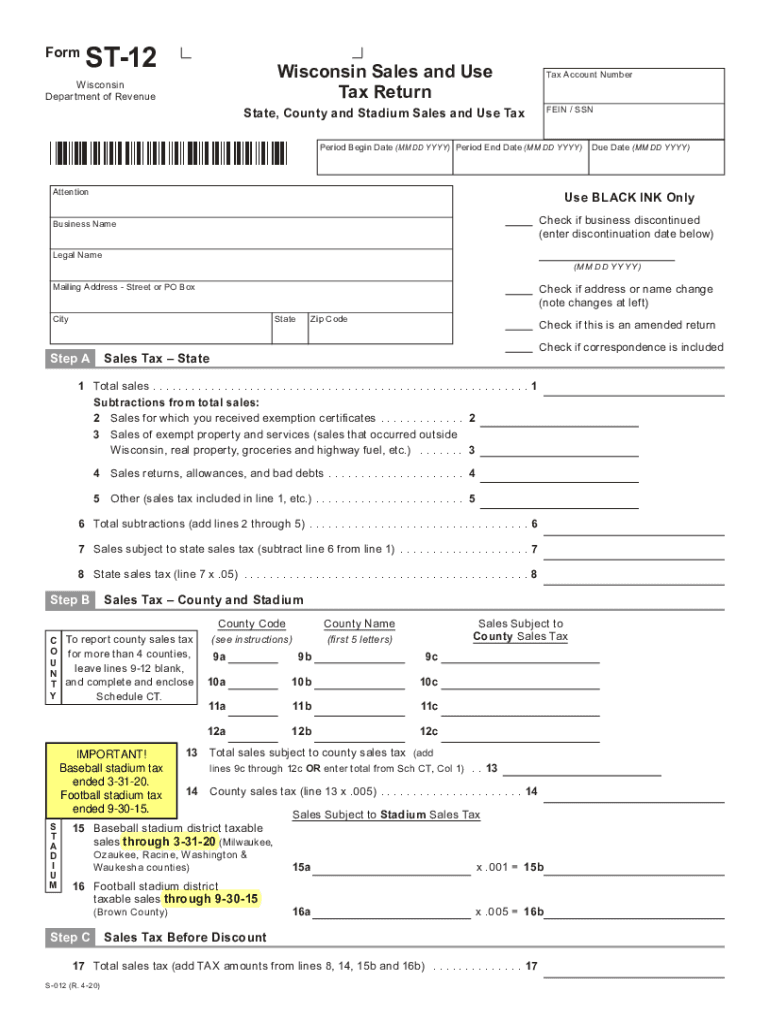

20202022 Form WI DoR ST12 Fill Online, Printable, Fillable, Blank

Below is a list of all birth to 3 forms and publications. Web a partnership or limited liabilit y company treated as a partnership with income from wisconsin sources, regardless of the amount, must file a wisconsin partnership return,. You can download or print current or past. Web most taxpayers are required to file a yearly income tax return in.

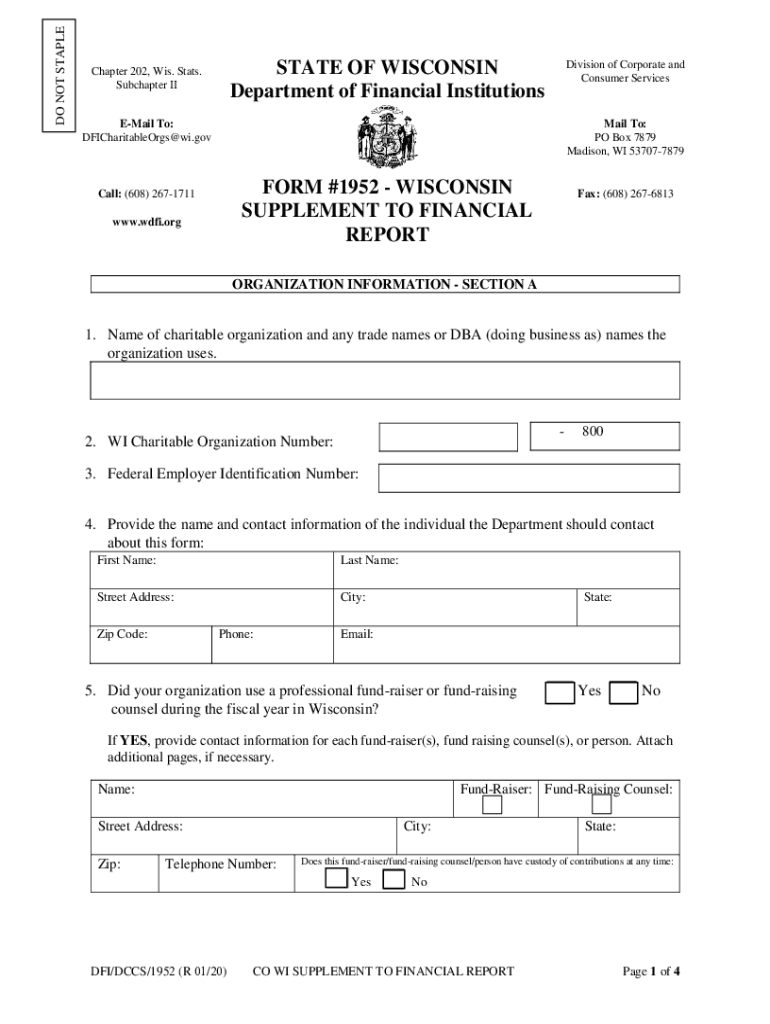

Form 1952 Wisconsin Fill Out and Sign Printable PDF Template signNow

Web wisconsin department of revenue: Web unless a waiver is approved by the wisconsin department of revenue (“department”). Web a partnership or limited liabilit y company treated as a partnership with income from wisconsin sources, regardless of the amount, must file a wisconsin partnership return,. Partnerships, including limited liability companies (llcs) treated as partnerships, use form 3 to report their.

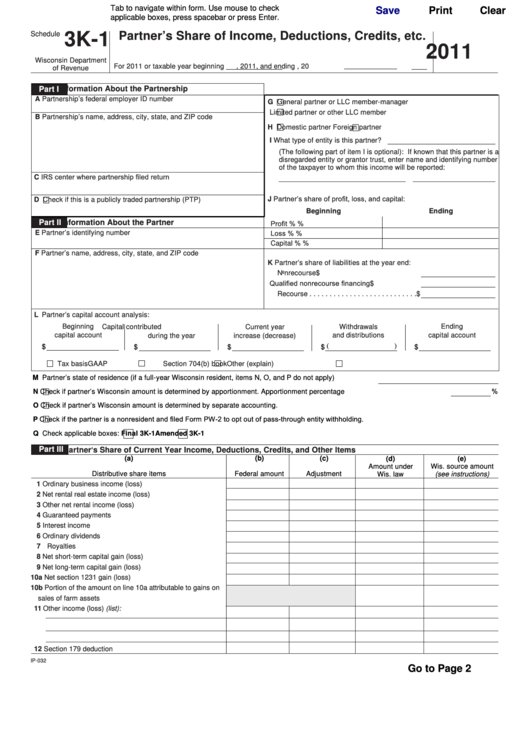

Fillable Form 3k1 Wisconsin Partner'S Share Of Deductions

Annual tax reporting period means january 1 through december 31. Wisconsin partnership electronic payment voucher instructions: Web 57 rows wisconsin income tax forms wisconsin printable income tax forms 89 pdfs wisconsin has a state income tax that ranges between 4% and 7.65% , which is. Web most taxpayers are required to file a yearly income tax return in april to.

Wisconsin Mortgage Form 20202021 Fill and Sign Printable Template

Applicant is a person in whose. Web a partnership or limited liabilit y company treated as a partnership with income from wisconsin sources, regardless of the amount, must file a wisconsin partnership return,. Wisconsin usually releases forms for the current tax year between january and april. Web wisconsin department of revenue: Web we last updated the form 3 partnership return.

20192022 Form WI W9 Fill Online, Printable, Fillable, Blank pdfFiller

Web 95 rows 1/6/2022 1:31 pm: You can download or print current or past. Web a partnership or limited liabilit y company treated as a partnership with income from wisconsin sources, regardless of the amount, must file a wisconsin partnership return,. Wisconsin partnership electronic payment voucher instructions: Annual tax reporting period means january 1 through december 31.

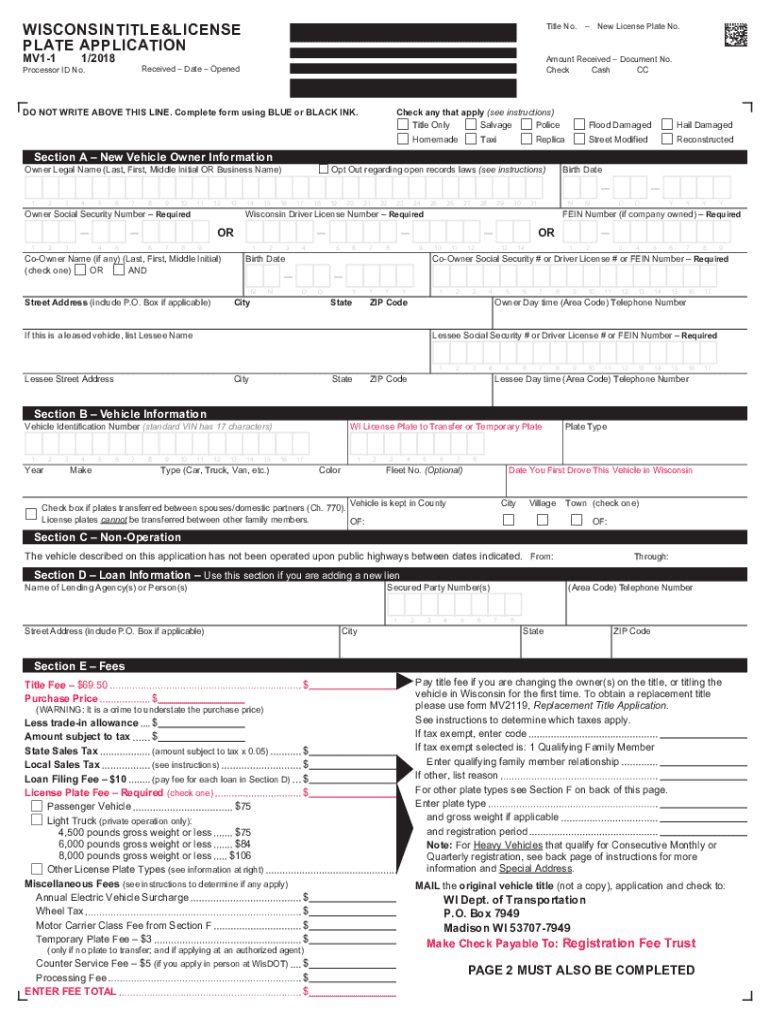

Wisconsin Title License Plate Application Form (MV11) Instructions

This document provides statements and interpretations of. Wisconsin usually releases forms for the current tax year between january and april. Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,. Adjustments to convert 2022 federal adjusted gross income and itemized. Web most taxpayers are required to file a yearly income tax return in april to.

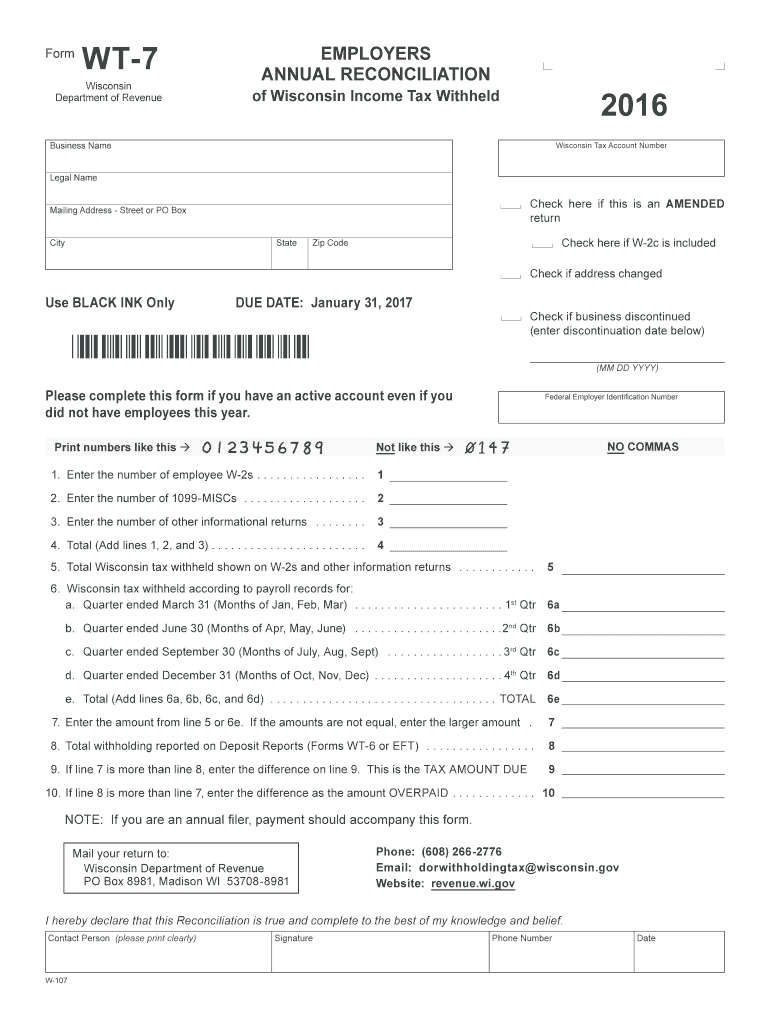

Wisconsin Form Wt 7 Fill Out and Sign Printable PDF Template signNow

If the document is available to order in a paper version, there will. Partnerships, including limited liability companies treated as partnerships, use the 2022. Web complete wi form 3 instructions online with us legal forms. Web birth to 3 program: We last updated wisconsin form 1npr instructions from the department of.

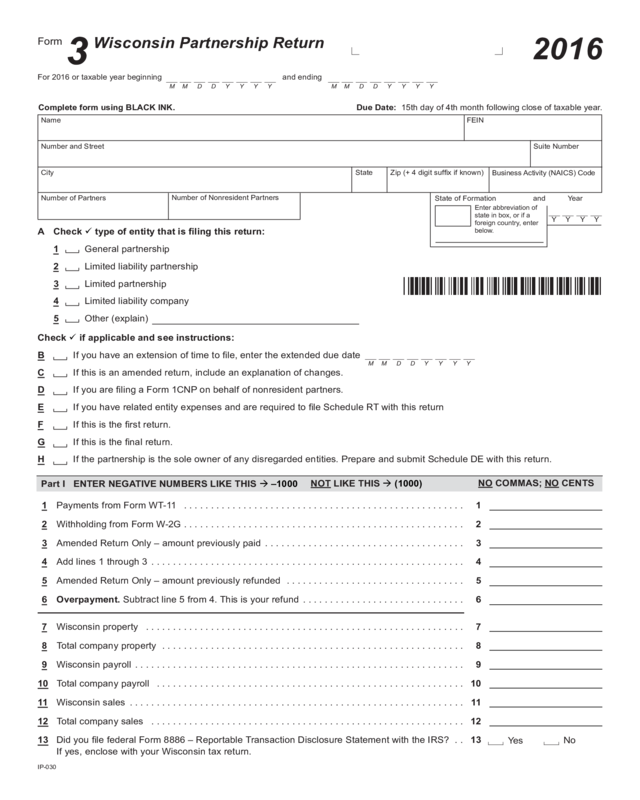

2016 Form 3 Wisconsin Partnership Return Edit, Fill, Sign Online

Annual tax reporting period means january 1 through december 31. Web general instructions for form 3. Applicant is a person in whose. If the document is available to order in a paper version, there will. Web follow the simple instructions below:

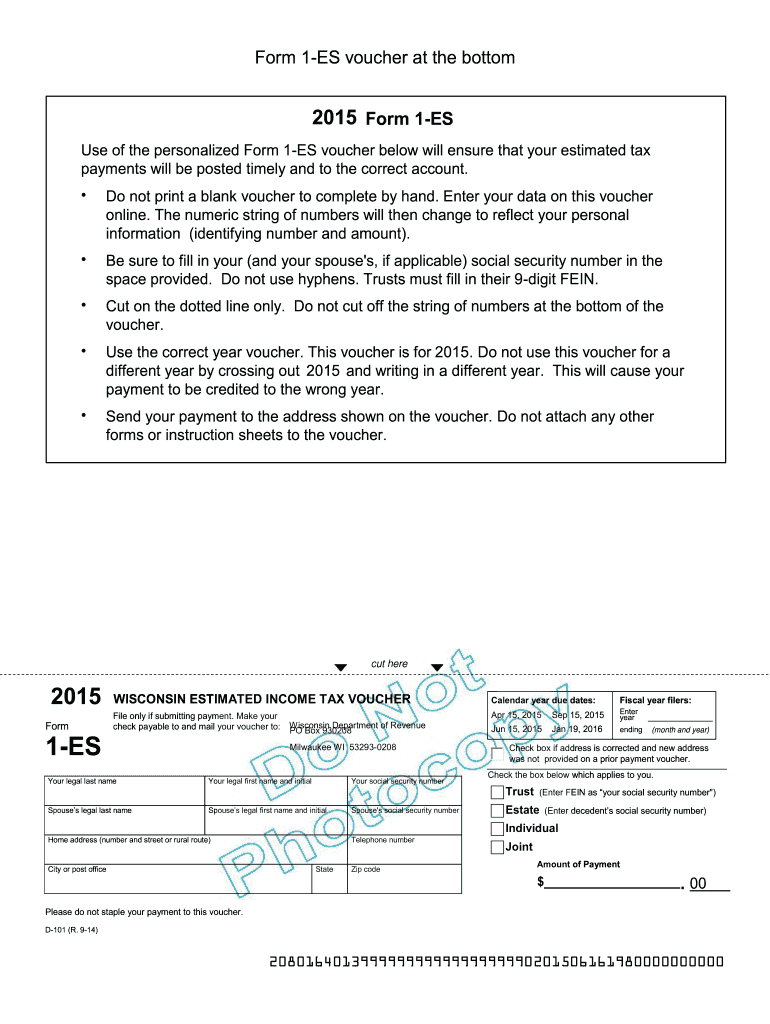

Wisconsin Form 1 Es Fill Out and Sign Printable PDF Template signNow

Wisconsin partnership electronic payment voucher instructions: Web we last updated the form 3 partnership return in march 2023, so this is the latest version of form 3, fully updated for tax year 2022. Web if the partnership reorganized during the tax year, enter type of reorganization (see instructions). This document provides statements and interpretations of. Web wisconsin ifta instruction manual.

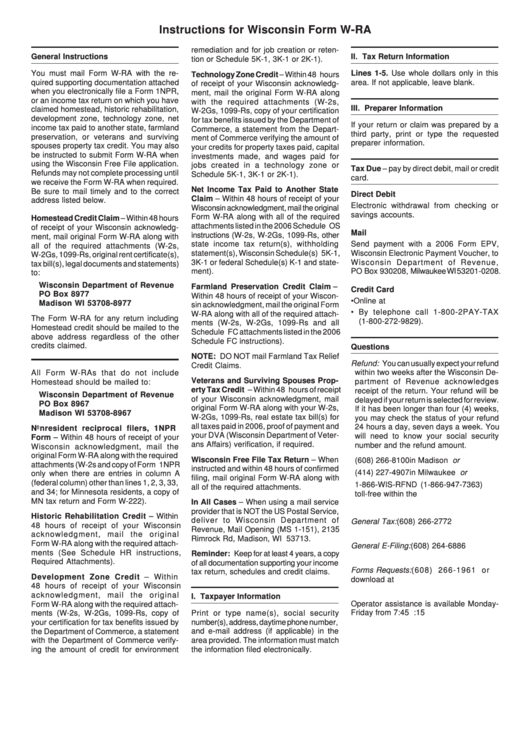

Instructions For Wisconsin Form WRa Required Attachments For

Web general instructions for form 3. We last updated wisconsin form 1npr instructions from the department of. Web 95 rows 1/6/2022 1:31 pm: Easily fill out pdf blank, edit, and sign them. Web we last updated the form 3 partnership return in march 2023, so this is the latest version of form 3, fully updated for tax year 2022.

Web 2020 Wisconsin Form 3 Instructions Page 3.

Web follow the simple instructions below: Easily fill out pdf blank, edit, and sign them. However, with our preconfigured web templates, things get. Web birth to 3 program:

This Document Provides Statements And Interpretations Of.

Web 57 rows wisconsin income tax forms wisconsin printable income tax forms 89 pdfs wisconsin has a state income tax that ranges between 4% and 7.65% , which is. Adjustments to convert 2022 federal adjusted gross income and itemized. Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,. Save or instantly send your ready documents.

We Last Updated Wisconsin Form 1Npr Instructions From The Department Of.

Web 95 rows 1/6/2022 1:31 pm: Central time wi dor forms and instructions wi dor requesting tax. Web complete wi form 3 instructions online with us legal forms. Web we last updated the form 3 partnership return in march 2023, so this is the latest version of form 3, fully updated for tax year 2022.

Web A Partnership Or Limited Liabilit Y Company Treated As A Partnership With Income From Wisconsin Sources, Regardless Of The Amount, Must File A Wisconsin Partnership Return,.

Web it appears you don't have a pdf plugin for this browser. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a. Applicant is a person in whose. Wisconsin usually releases forms for the current tax year between january and april.