Wisconsin Form 1-Es 2023

Wisconsin Form 1-Es 2023 - Web daniel kelly vs janet protasiewicz are candidates in wisconsin supreme court race. Complete, sign, print and send your tax documents easily with us legal forms. How much do i pay? (go to www.revenue.wi.gov/pay for electronic payment options) Schedule os, credit for net tax paid to another state. Web this requirement holds true even if you had no wisconsin filing requirement last year. Estimate the amount of income you expect to receive in 2023. Choose the correct version of the editable pdf. Web dor 2022 individual income tax forms 2022 individual income tax forms note: Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred.

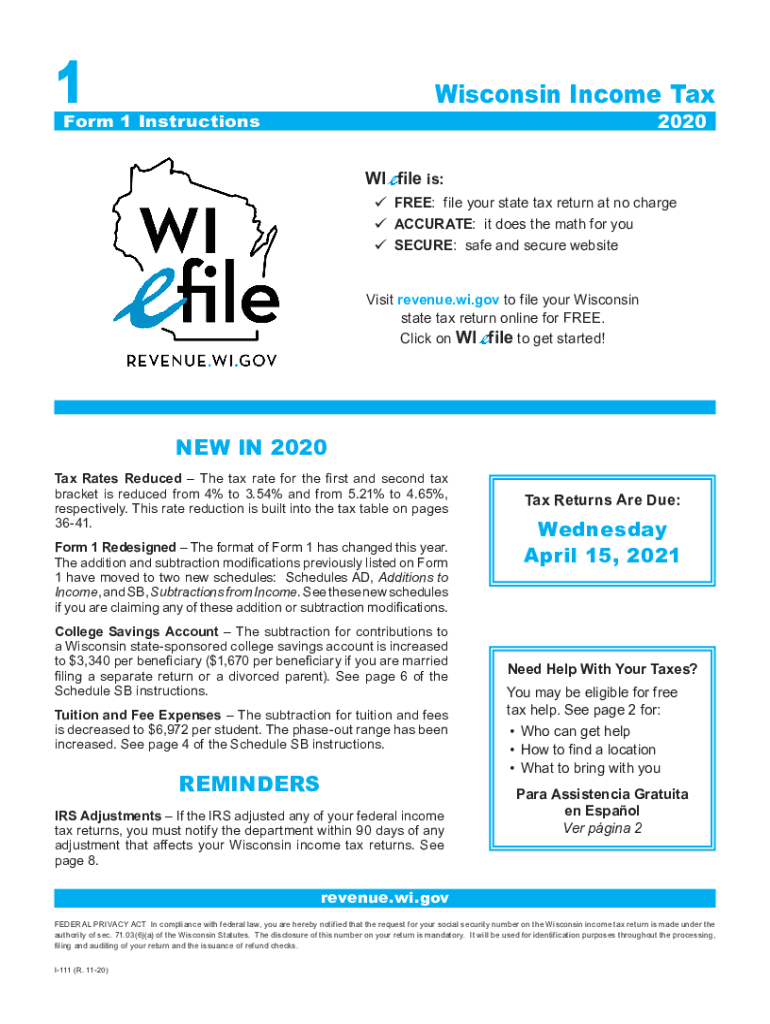

Estimate the amount of income you expect to receive in 2023. Web form 1, resident income tax return. Web income tax return (long form) form 1 is the general income tax return (long form) for wisconsin residents. Complete, sign, print and send your tax documents easily with us legal forms. You can download or print current. It can be efiled or sent by mail. Download blank or fill out online in pdf format. Web to claim exemption from withholding you must: We will update this page with a new version of the form for 2024 as soon as it is made available. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred.

(go to www.revenue.wi.gov/pay for electronic payment options) Partnerships, including limited liability companies treated as. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. You can download or print current. It can be efiled or sent by mail. Choose the correct version of the editable pdf. Web this requirement holds true even if you had no wisconsin filing requirement last year. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web to claim exemption from withholding you must: Estimate the amount of income you expect to receive in 2023.

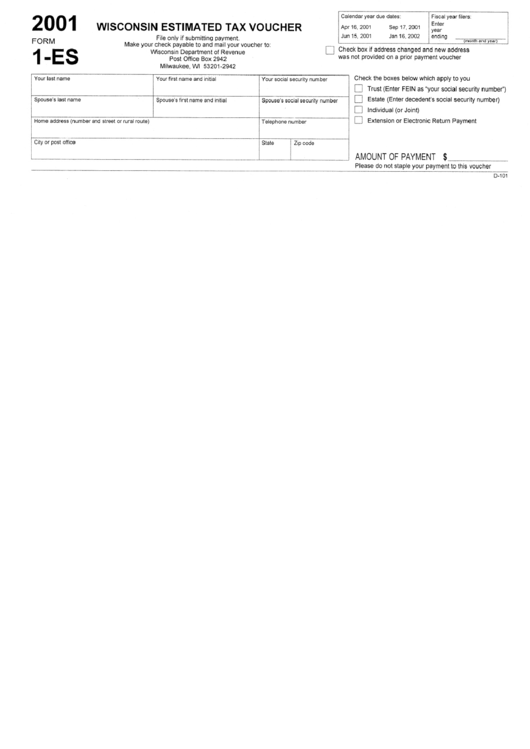

Form 1Es Wisconsin Estimated Tax Voucher 2001 printable pdf download

Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web find and fill out the correct wisconsin form 1 es 2022 printable. Web daniel kelly vs janet protasiewicz are candidates in wisconsin supreme court race. Partnerships, including limited liability companies treated as. Web form 1, resident income tax return.

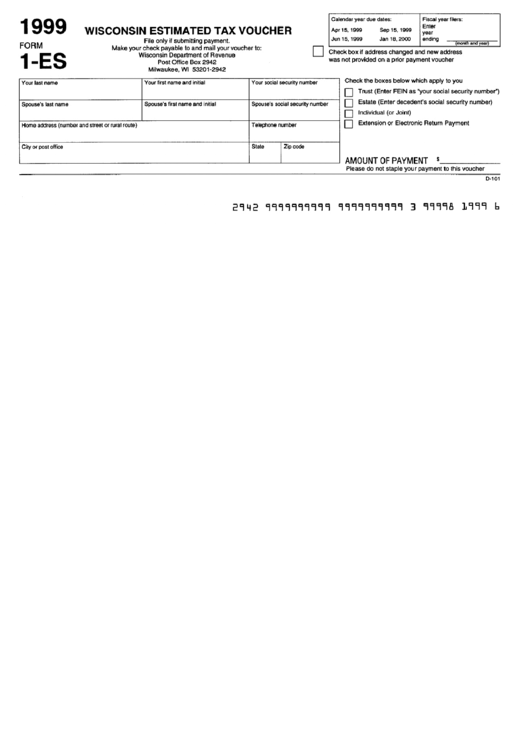

Fillable Form 1Es1999 Wisconsin Estimated Tax Voucher printable pdf

Choose the correct version of the editable pdf. Partnerships, including limited liability companies treated as. It can be efiled or sent by mail. Web daniel kelly vs janet protasiewicz are candidates in wisconsin supreme court race. Web form 1, resident income tax return.

Fill Free fillable State Bar of Wisconsin Form 12003 WARRANTY DEED

Web this form is for income earned in tax year 2022, with tax returns due in april 2023. It can be efiled or sent by mail. This form is for income earned in tax year 2022, with tax. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. Web this requirement.

2020 Form WI DoR WT7 Fill Online, Printable, Fillable, Blank pdfFiller

Web daniel kelly vs janet protasiewicz are candidates in wisconsin supreme court race. This form is for income earned in tax year 2022, with tax. Partnerships, including limited liability companies treated as. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. Estimate the amount of income you expect to receive.

20132021 Form WI Rent Certificate Fill Online, Printable, Fillable

This form is for income earned in tax year 2022, with tax. Be sure to verify that the form you are downloading is for the. It can be efiled or sent by mail. We will update this page with a new version of the form for 2024 as soon as it is made available. Download blank or fill out online.

Wisconsin estimated tax payment fillable 2012 form Fill out & sign

This form is for income earned in tax year 2022, with tax. Partnerships, including limited liability companies treated as. Web this requirement holds true even if you had no wisconsin filing requirement last year. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. Web form 1, resident income tax return.

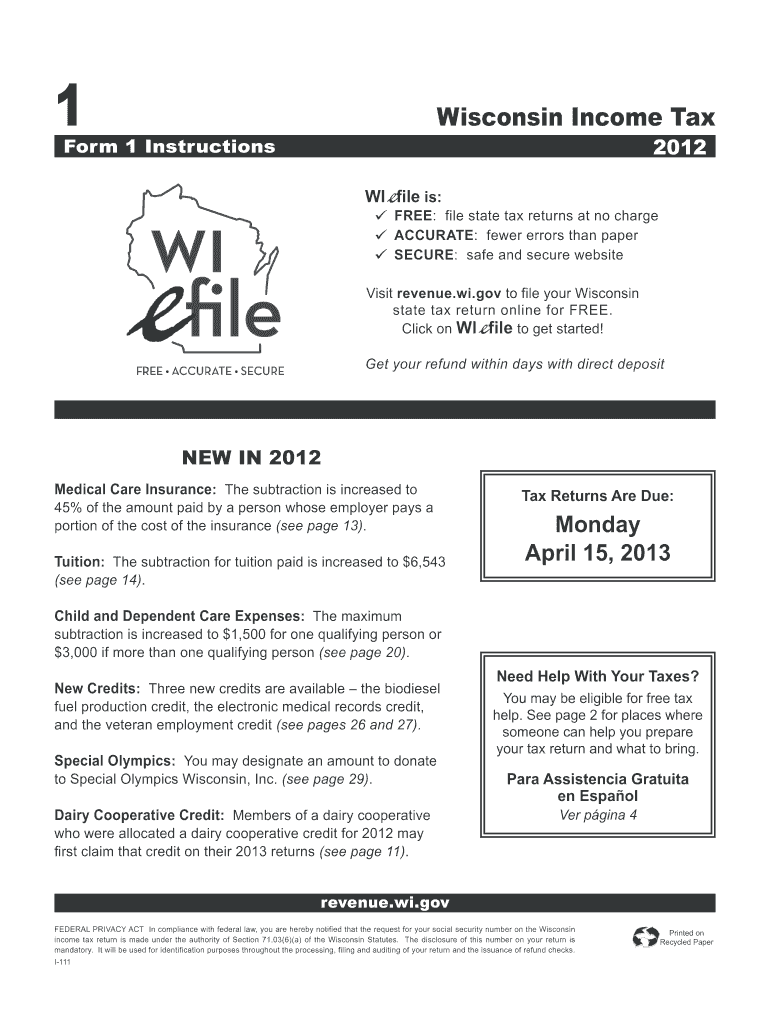

2012 Form WI I111 Fill Online, Printable, Fillable, Blank pdfFiller

Web daniel kelly vs janet protasiewicz are candidates in wisconsin supreme court race. Web income tax return (long form) form 1 is the general income tax return (long form) for wisconsin residents. Web to claim exemption from withholding you must: Web dor 2023 corporation tax forms 2023 corporation tax forms note: Web this requirement holds true even if you had.

Wisconsin Tax 1 Form Fill Out and Sign Printable PDF Template

Web to claim exemption from withholding you must: Web this requirement holds true even if you had no wisconsin filing requirement last year. Web daniel kelly vs janet protasiewicz are candidates in wisconsin supreme court race. Partnerships, including limited liability companies treated as. Download blank or fill out online in pdf format.

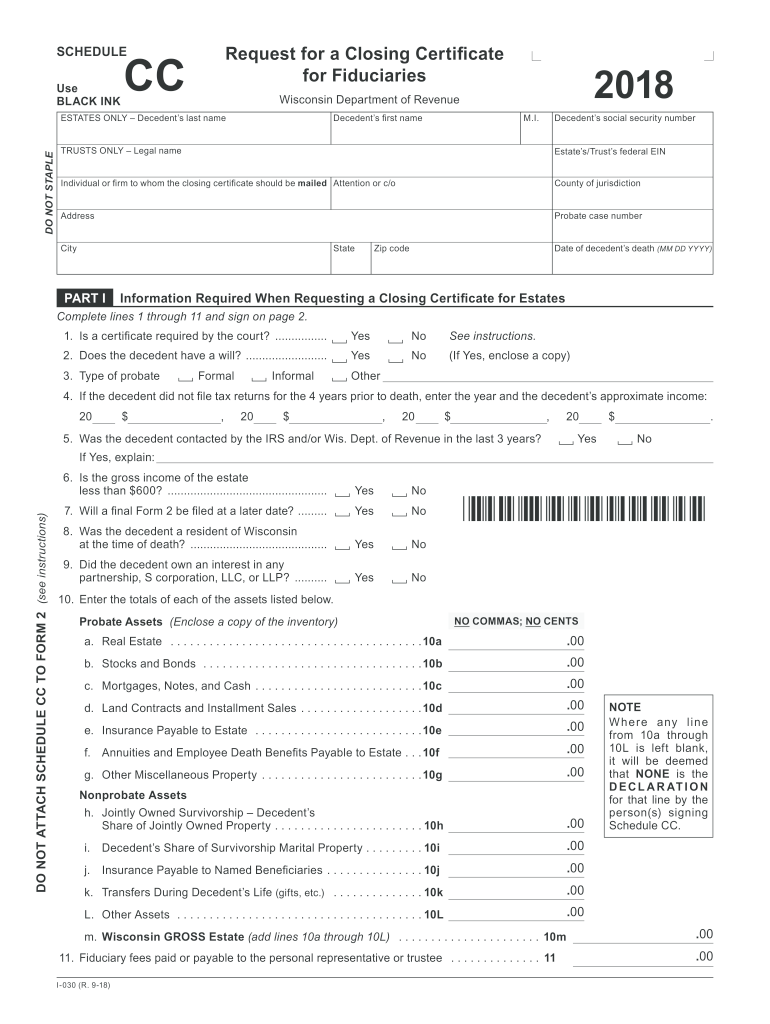

20182020 Form WI DoR Schedule CC Fill Online, Printable, Fillable

Web to claim exemption from withholding you must: Schedule os, credit for net tax paid to another state. Web this requirement holds true even if you had no wisconsin filing requirement last year. (go to www.revenue.wi.gov/pay for electronic payment options) Estimate the amount of income you expect to receive in 2023.

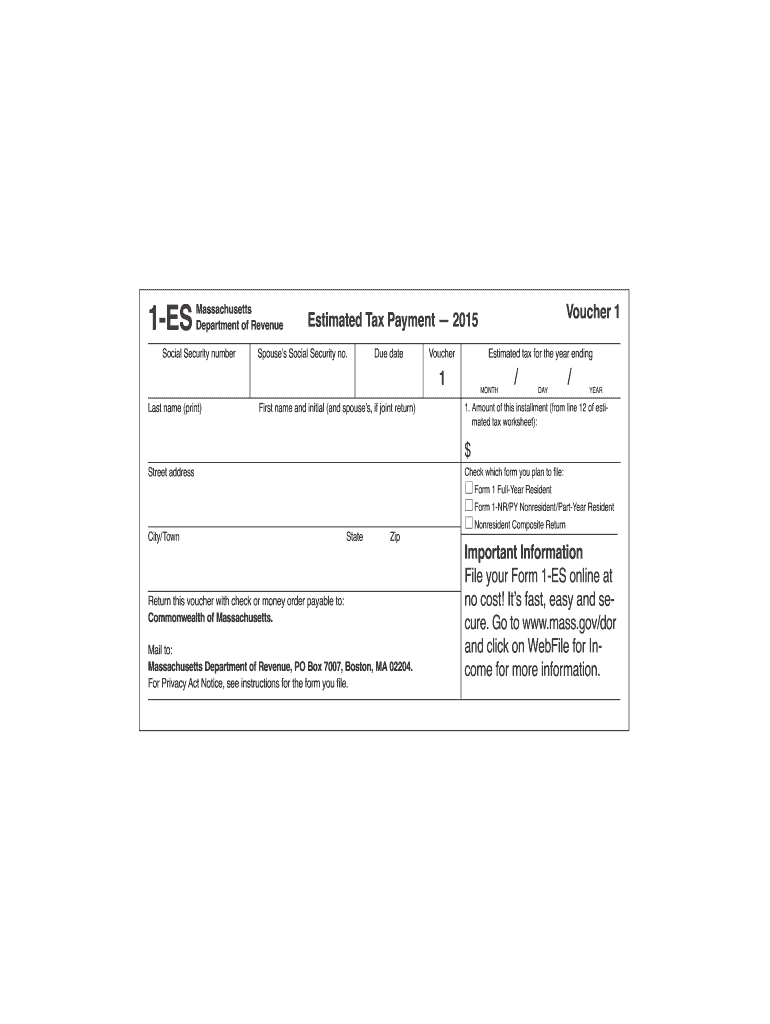

2015 wisconsin form 1 es Fill out & sign online DocHub

You can download or print current. Web to claim exemption from withholding you must: Partnerships, including limited liability companies treated as. (go to www.revenue.wi.gov/pay for electronic payment options) Choose the correct version of the editable pdf.

Web Income Tax Return (Long Form) Form 1 Is The General Income Tax Return (Long Form) For Wisconsin Residents.

Web daniel kelly vs janet protasiewicz are candidates in wisconsin supreme court race. Partnerships, including limited liability companies treated as. You can download or print current. Web this form is for income earned in tax year 2022, with tax returns due in april 2023.

It Can Be Efiled Or Sent By Mail.

Web this requirement holds true even if you had no wisconsin filing requirement last year. (go to www.revenue.wi.gov/pay for electronic payment options) How much do i pay? We will update this page with a new version of the form for 2024 as soon as it is made available.

Schedule Os, Credit For Net Tax Paid To Another State.

Web dor 2023 corporation tax forms 2023 corporation tax forms note: Partnerships, including limited liability companies treated as. This form is for income earned in tax year 2022, with tax. Estimate the amount of income you expect to receive in 2023.

Be Sure To Verify That The Form You Are Downloading Is For The.

Web dor 2022 individual income tax forms 2022 individual income tax forms note: Web find and fill out the correct wisconsin form 1 es 2022 printable. Web form 1, resident income tax return. Web to claim exemption from withholding you must: