Why Does A Balance Sheet Have To Balance

Why Does A Balance Sheet Have To Balance - Web 5 minutes of reading. In this lesson, i explain how the different elements of a balance sheet are organized. Web why do we need a balance sheet? For example, if a transaction is mistakenly omitted or a particular liability or asset is overlooked,. The name balance sheet is based on the fact that assets will equal. This is an important document for potential investors and loan. Web balance sheets provide the basis for computing rates of return for investors and evaluating a company's capital structure. The balance sheet is a report that gives a basic snapshot of the company’s finances. In short, the balance sheet is a financial statement that provides a. Web updated may 24, 2021 reviewed by charlene rhinehart fact checked by amanda jackson a balance sheet should always balance.

The name balance sheet is based on the fact that assets will equal. Understanding why a balance sheet is always expected to balance can be hard to grasp especially for beginners. Web balance sheets provide the basis for computing rates of return for investors and evaluating a company's capital structure. Web updated may 24, 2021 reviewed by charlene rhinehart fact checked by amanda jackson a balance sheet should always balance. Web why do we need a balance sheet? For example, if a transaction is mistakenly omitted or a particular liability or asset is overlooked,. This is an important document for potential investors and loan. Web if certain transactions or items are not included in the balance sheet, it can cause an imbalance. The balance sheet is a report that gives a basic snapshot of the company’s finances. In this lesson, i explain how the different elements of a balance sheet are organized.

Web updated may 24, 2021 reviewed by charlene rhinehart fact checked by amanda jackson a balance sheet should always balance. This is an important document for potential investors and loan. Understanding why a balance sheet is always expected to balance can be hard to grasp especially for beginners. For example, if a transaction is mistakenly omitted or a particular liability or asset is overlooked,. Web balance sheets provide the basis for computing rates of return for investors and evaluating a company's capital structure. In this lesson, i explain how the different elements of a balance sheet are organized. Web why do we need a balance sheet? In short, the balance sheet is a financial statement that provides a. Web if certain transactions or items are not included in the balance sheet, it can cause an imbalance. The name balance sheet is based on the fact that assets will equal.

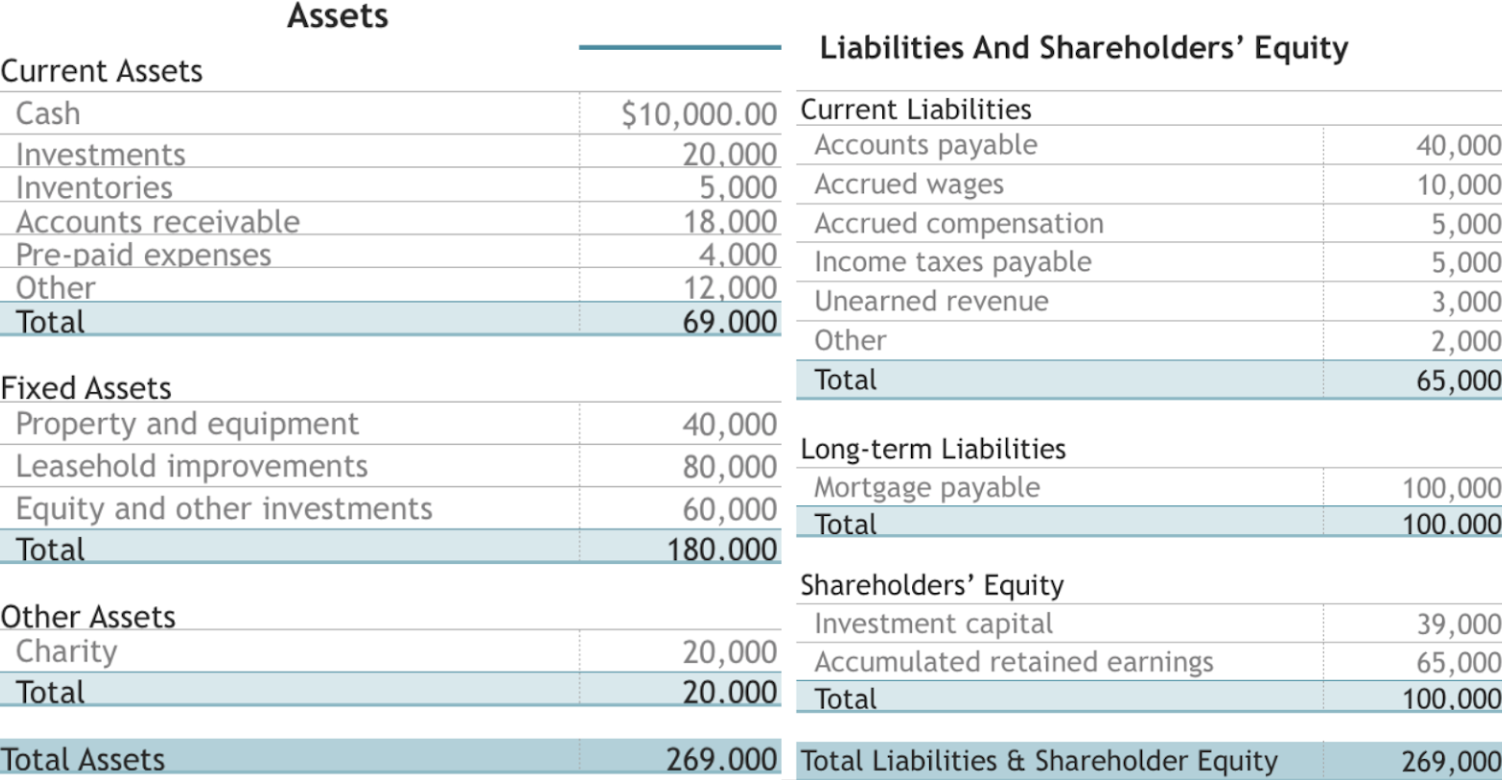

What Is a Balance Sheet? (+Examples and Free Template)

The name balance sheet is based on the fact that assets will equal. In this lesson, i explain how the different elements of a balance sheet are organized. This is an important document for potential investors and loan. Web if certain transactions or items are not included in the balance sheet, it can cause an imbalance. The balance sheet is.

Why Does a Balance Sheet Need to Balance? Brixx

For example, if a transaction is mistakenly omitted or a particular liability or asset is overlooked,. Web updated may 24, 2021 reviewed by charlene rhinehart fact checked by amanda jackson a balance sheet should always balance. The name balance sheet is based on the fact that assets will equal. The balance sheet is a report that gives a basic snapshot.

Amazing T Shape Balance Sheet What Is A Tax Basis

The balance sheet is a report that gives a basic snapshot of the company’s finances. This is an important document for potential investors and loan. Understanding why a balance sheet is always expected to balance can be hard to grasp especially for beginners. In short, the balance sheet is a financial statement that provides a. Web why do we need.

Balance sheet definition and meaning Market Business News

The balance sheet is a report that gives a basic snapshot of the company’s finances. The name balance sheet is based on the fact that assets will equal. Web why do we need a balance sheet? In short, the balance sheet is a financial statement that provides a. Web updated may 24, 2021 reviewed by charlene rhinehart fact checked by.

Solved Complete balance sheet and prepare a statement of

In this lesson, i explain how the different elements of a balance sheet are organized. Understanding why a balance sheet is always expected to balance can be hard to grasp especially for beginners. Web 5 minutes of reading. Web if certain transactions or items are not included in the balance sheet, it can cause an imbalance. Web why do we.

Balance Sheet Definition Formula & Examples

Web why do we need a balance sheet? For example, if a transaction is mistakenly omitted or a particular liability or asset is overlooked,. In this lesson, i explain how the different elements of a balance sheet are organized. Web if certain transactions or items are not included in the balance sheet, it can cause an imbalance. Web balance sheets.

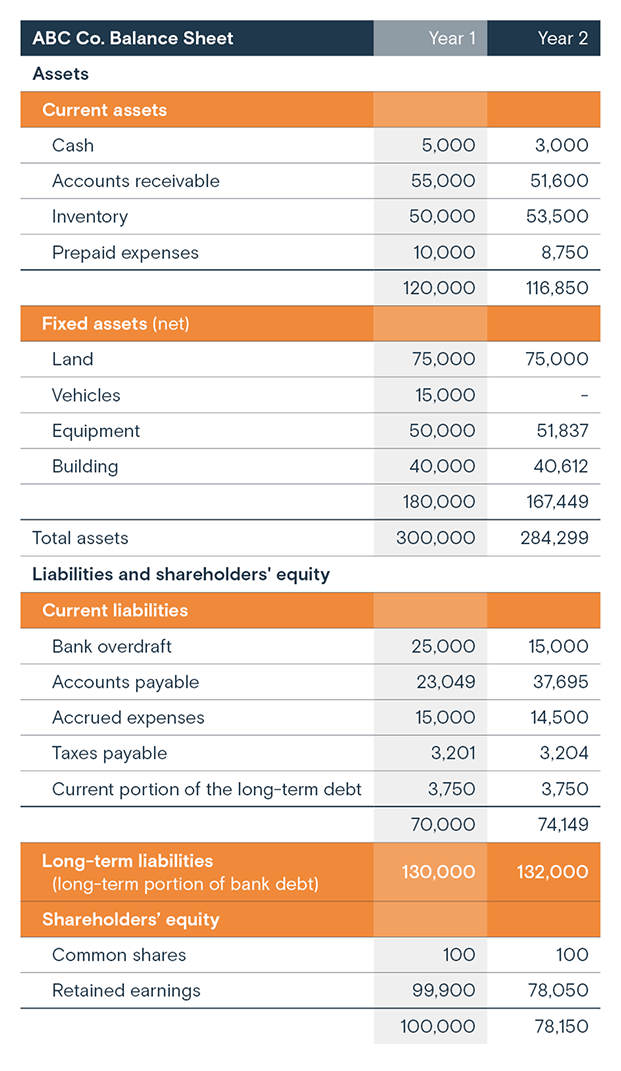

What is a balance sheet? BDC.ca

Web balance sheets provide the basis for computing rates of return for investors and evaluating a company's capital structure. The name balance sheet is based on the fact that assets will equal. This is an important document for potential investors and loan. Web if certain transactions or items are not included in the balance sheet, it can cause an imbalance..

How to Read & Prepare a Balance Sheet QuickBooks

The name balance sheet is based on the fact that assets will equal. Web why do we need a balance sheet? Understanding why a balance sheet is always expected to balance can be hard to grasp especially for beginners. Web balance sheets provide the basis for computing rates of return for investors and evaluating a company's capital structure. This is.

Introduction to Financial Statements Accounting Play

Understanding why a balance sheet is always expected to balance can be hard to grasp especially for beginners. The name balance sheet is based on the fact that assets will equal. For example, if a transaction is mistakenly omitted or a particular liability or asset is overlooked,. In short, the balance sheet is a financial statement that provides a. In.

Main Functions of Accounting

In short, the balance sheet is a financial statement that provides a. The balance sheet is a report that gives a basic snapshot of the company’s finances. This is an important document for potential investors and loan. Web 5 minutes of reading. The name balance sheet is based on the fact that assets will equal.

The Balance Sheet Is A Report That Gives A Basic Snapshot Of The Company’s Finances.

Web balance sheets provide the basis for computing rates of return for investors and evaluating a company's capital structure. The name balance sheet is based on the fact that assets will equal. Understanding why a balance sheet is always expected to balance can be hard to grasp especially for beginners. Web if certain transactions or items are not included in the balance sheet, it can cause an imbalance.

Web 5 Minutes Of Reading.

This is an important document for potential investors and loan. Web why do we need a balance sheet? In short, the balance sheet is a financial statement that provides a. Web updated may 24, 2021 reviewed by charlene rhinehart fact checked by amanda jackson a balance sheet should always balance.

In This Lesson, I Explain How The Different Elements Of A Balance Sheet Are Organized.

For example, if a transaction is mistakenly omitted or a particular liability or asset is overlooked,.

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)