Which 1099 Form Do I Use For Attorney Fees

Which 1099 Form Do I Use For Attorney Fees - Write “udc” and the amount of the attorney’s fees next to line 36 of form 1040. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. The term “attorney” includes a law firm or other provider of legal services. Ad discover a wide selection of 1099 tax forms at staples®. Web the tax code requires the businesses making payments to attorneys and report the payments to the irs on a 1099 form. Each person engaged in business and making a. Attorney fees paid in the. Shop a wide variety of 1099 tax forms from top brands at staples®. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations.

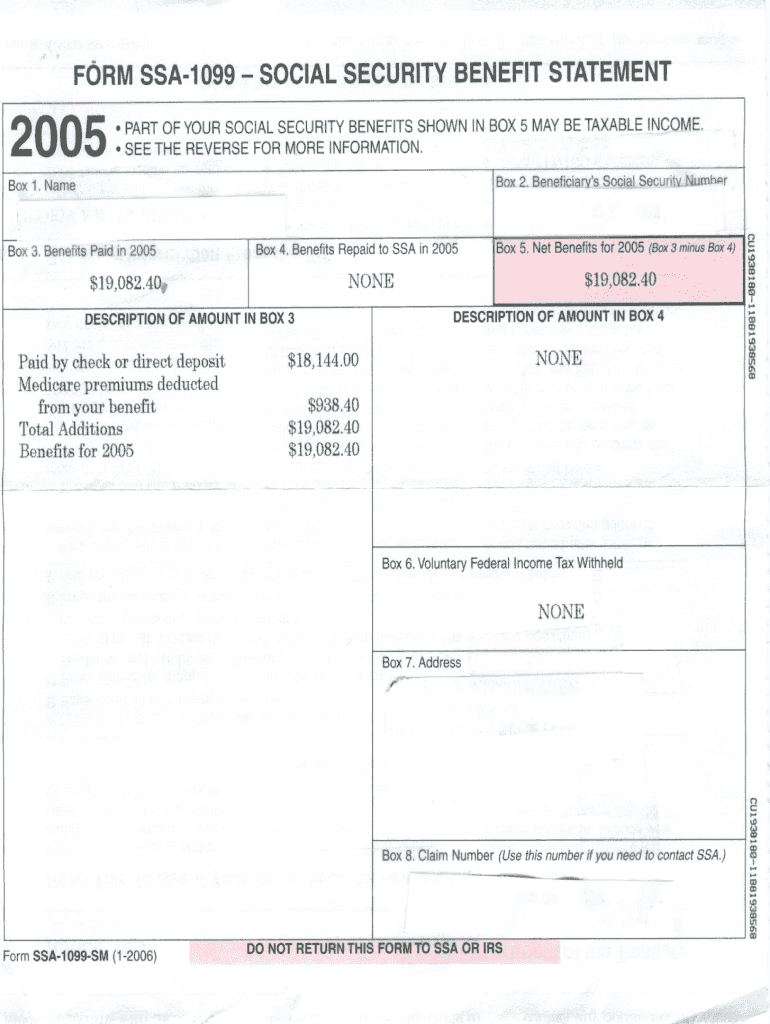

Web april 2017 issue 131 this article explains why attorneys might receive a form 1099 reporting certain amounts paid to them in the course of their practice, and why it is a “big deal.”. Web this issue is particularly relevant to attorneys who earn their fees on a contingency basis and who withdraw fees and costs from a check made payable to the. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Each person engaged in business and making a. Web the tax code requires the businesses making payments to attorneys and report the payments to the irs on a 1099 form. Web require a defendant to issue a plaintiff a form 1099 that includes the attorneys’ fee payment whenever that payment is includible in the plaintiff’s gross income. Web attorney fees on ssa form 1099 i have over $20,000 in attorney fees for 2019 on my ssa 1099 which are included in box 3 & 5. Write “udc” and the amount of the attorney’s fees next to line 36 of form 1040. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. february 3, 2022 1:20 pm.

Web the instructions said: Ad discover a wide selection of 1099 tax forms at staples®. As you mention on federal worksheet? Write “udc” and the amount of the attorney’s fees next to line 36 of form 1040. Web this issue is particularly relevant to attorneys who earn their fees on a contingency basis and who withdraw fees and costs from a check made payable to the. Attorney fees paid in the. Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered to you in connection with your trade or business, file irs. february 3, 2022 1:20 pm. The term “attorney” includes a law firm or other provider of legal services. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations.

DoItYourself 1099s, Done Right Moxie Bookkeeping and Coaching Inc.

february 3, 2022 1:20 pm. Shop a wide variety of 1099 tax forms from top brands at staples®. My case took over 4 years to win my. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023)

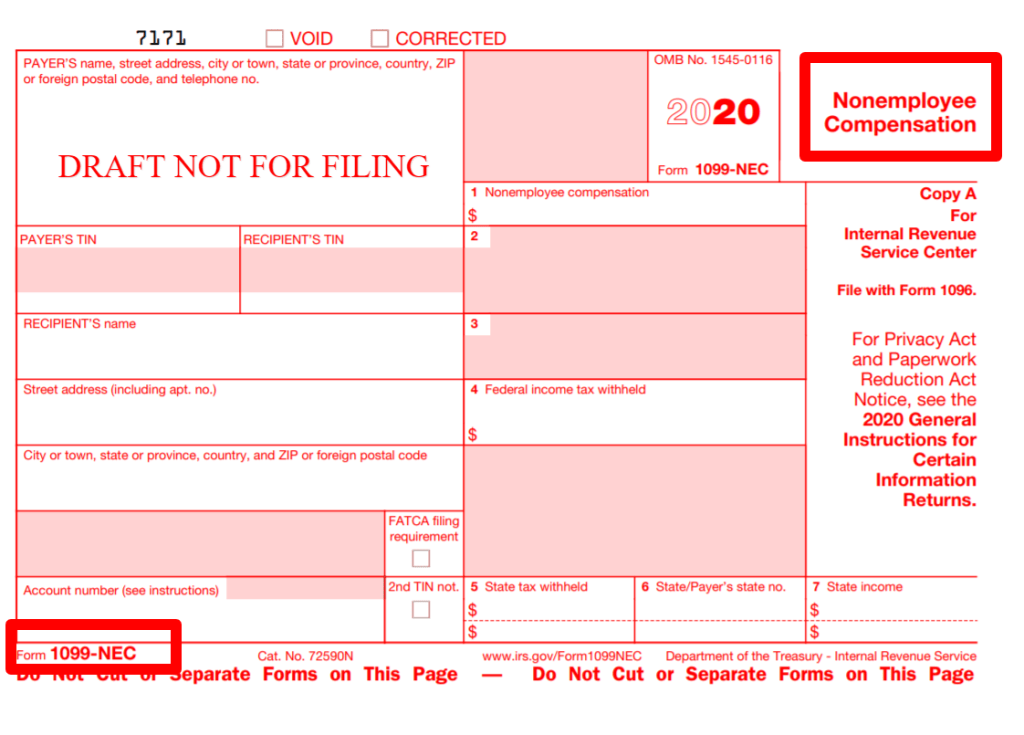

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Web april 2017 issue 131 this article explains why attorneys might receive a form 1099 reporting certain amounts paid to them in the course of their practice, and why it is a “big deal.”. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web catch the top stories of the day.

cachodesignstudio Attorney Fees On 1099

Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web the tax code requires the businesses making payments to attorneys and report the payments to the irs on a 1099 form. The term “attorney” includes a law firm or other provider of legal services. Web watch newsmax live for the latest news and.

Ssa 1099 Form 2019 Pdf Fill Online, Printable, Fillable, Blank

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. My case took over 4 years to win my. Web ssa 1099 feds charged me attorney fees where do i enter that amount as an itemized.

Florida 1099 Form Online Universal Network

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Each person engaged in business and making a. Web ssa 1099 feds charged me attorney fees where do i enter that amount as an itemized item. Web this issue is particularly relevant to attorneys who earn their fees on a contingency basis and who withdraw.

How do I Access 1099NEC form Files for Use with Sage Checks & Forms?

My case took over 4 years to win my. Ad discover a wide selection of 1099 tax forms at staples®. Web this issue is particularly relevant to attorneys who earn their fees on a contingency basis and who withdraw fees and costs from a check made payable to the. Web the instructions said: Web attorney fees on ssa form 1099.

1099 Form Printable 2018 MBM Legal

february 3, 2022 1:20 pm. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Write “udc” and the amount of.

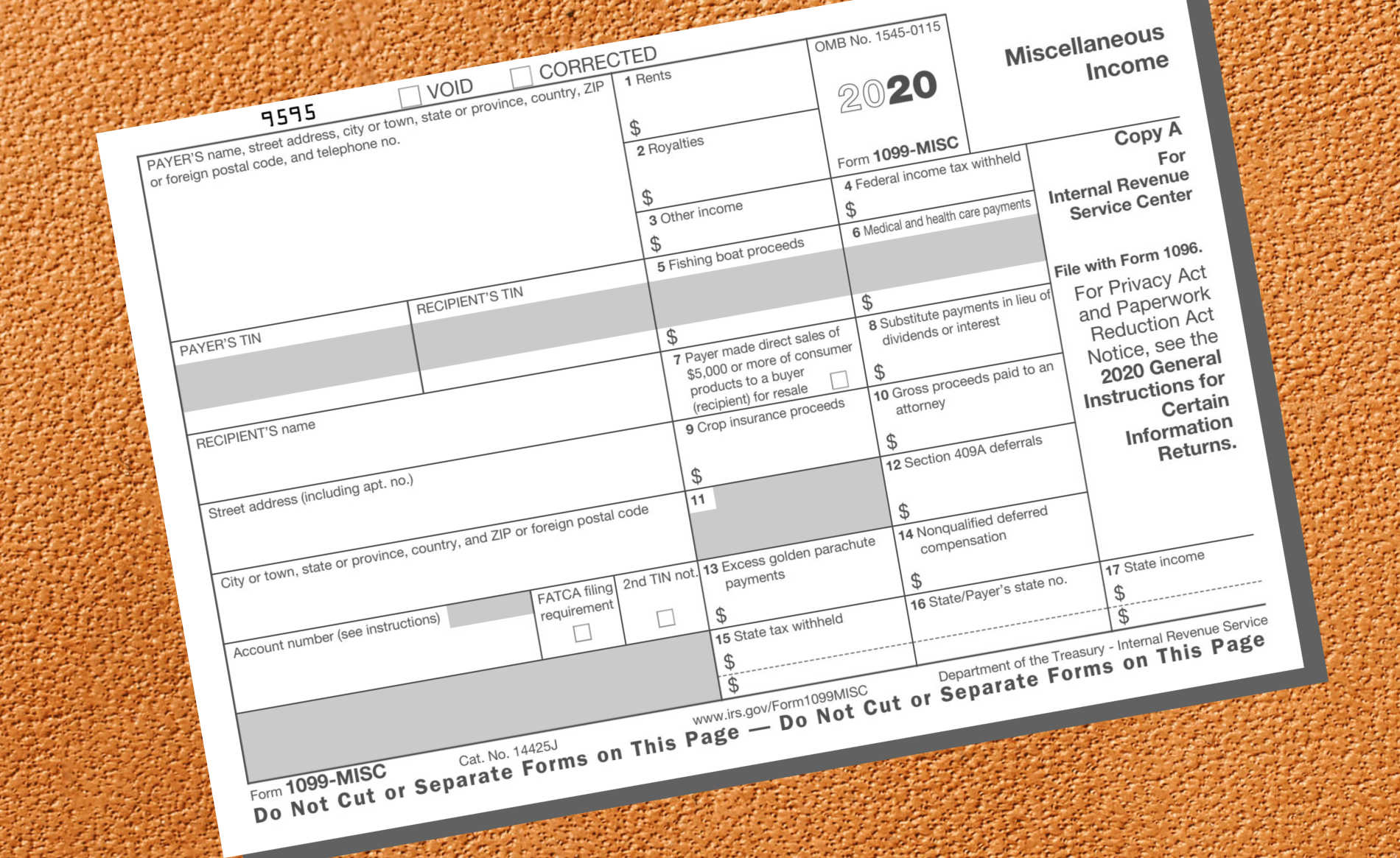

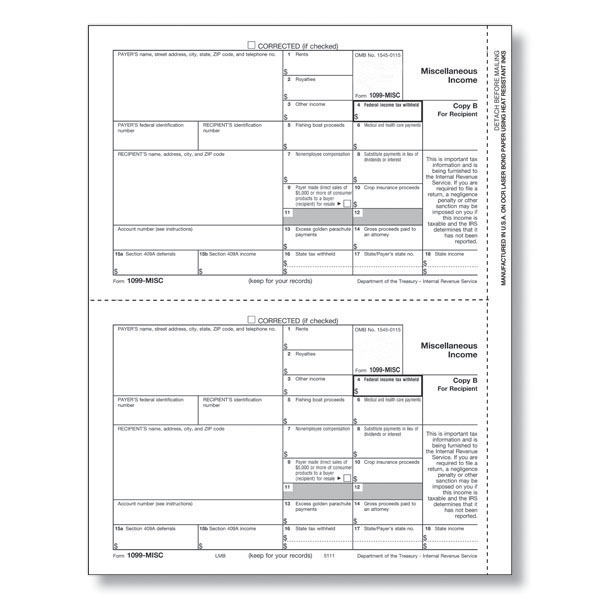

1099 Miscellaneous Form For Year End Tax Reporting Universal

Web april 2017 issue 131 this article explains why attorneys might receive a form 1099 reporting certain amounts paid to them in the course of their practice, and why it is a “big deal.”. Attorney fees paid in the. Shop a wide variety of 1099 tax forms from top brands at staples®. Ad discover a wide selection of 1099 tax.

26 LEGAL FEES FORM 1099 PDF DOC FREE DOWNLOAD

Ad discover a wide selection of 1099 tax forms at staples®. For example, if you paid $100,000 in attorney fees, write “udc. Web the instructions said: Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered to you in connection with your trade or business, file irs. Web.

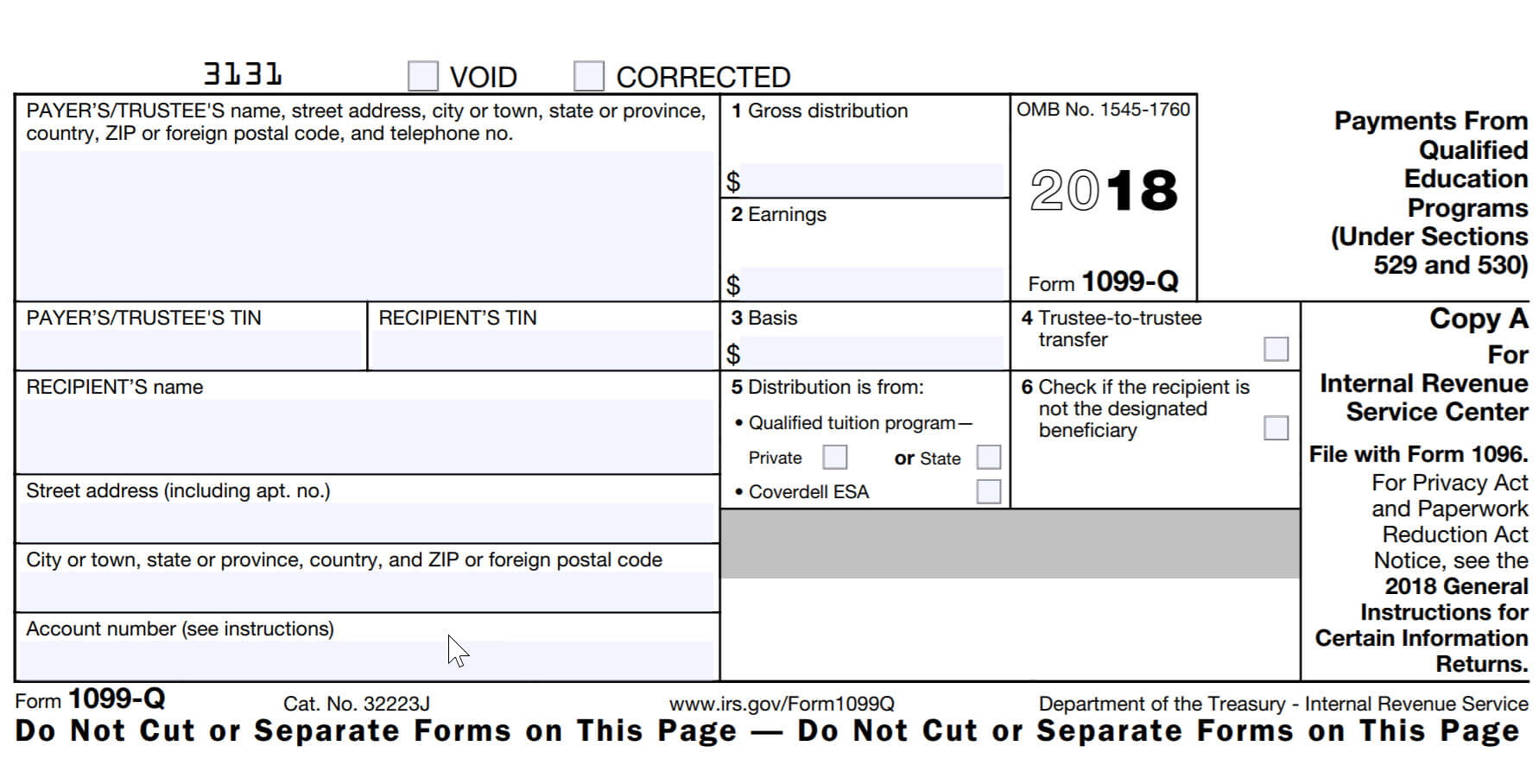

Which 1099 Form Do I Use for Rent

Each person engaged in business and making a. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Write “udc” and the amount of the attorney’s fees next to line 36 of form 1040. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. For example, if you paid.

Web Ssa 1099 Feds Charged Me Attorney Fees Where Do I Enter That Amount As An Itemized Item.

Shop a wide variety of 1099 tax forms from top brands at staples®. Ad discover a wide selection of 1099 tax forms at staples®. Web the instructions said: Web the tax code requires the businesses making payments to attorneys and report the payments to the irs on a 1099 form.

Web Watch Newsmax Live For The Latest News And Analysis On Today's Top Stories, Right Here On Facebook.

My case took over 4 years to win my. Write “udc” and the amount of the attorney’s fees next to line 36 of form 1040. february 3, 2022 1:20 pm. Attorney fees paid in the.

Web April 2017 Issue 131 This Article Explains Why Attorneys Might Receive A Form 1099 Reporting Certain Amounts Paid To Them In The Course Of Their Practice, And Why It Is A “Big Deal.”.

Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. The term “attorney” includes a law firm or other provider of legal services. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered to you in connection with your trade or business, file irs.

Web Attorney Fees On Ssa Form 1099 I Have Over $20,000 In Attorney Fees For 2019 On My Ssa 1099 Which Are Included In Box 3 & 5.

As you mention on federal worksheet? Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web require a defendant to issue a plaintiff a form 1099 that includes the attorneys’ fee payment whenever that payment is includible in the plaintiff’s gross income. Web this issue is particularly relevant to attorneys who earn their fees on a contingency basis and who withdraw fees and costs from a check made payable to the.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)

:max_bytes(150000):strip_icc()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)