Where To Report 1099-S On Form 1041

Where To Report 1099-S On Form 1041 - If you are located in. Web complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Form 1042, annual withholding tax return. Web information about form 1041, u.s. And you are enclosing a check or money order. Her home was move into her trust a month after her passing; Employee's withholding certificate form 941; Web click sale of your main home the program will proceed with the interview questions for you to enter or review the appropriate information check the box indicating you received a. You are not required to, but you may, report gross proceeds in accordance with an allocation. The overall capital gains and losses from transactions.

And you are not enclosing a check or money order. You are not required to, but you may, report gross proceeds in accordance with an allocation. Web complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. The overall capital gains and losses from transactions. Web correction to the instructions for form 941 (rev. What's new due date of return. Form 1041 is used by a. Form 1042, annual withholding tax return. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. Web part of section 1041 of the internal revenue code (irc), form 1041 is used to declare any taxable income that an estate or trust generated after the decedent.

Select form 941 from the form directory on your user dashboard. And you are enclosing a check or money order. Form 1042, annual withholding tax return. Web qualified dividends are eligible for a lower tax rate than other ordinary income. You are not required to, but you may, report gross proceeds in accordance with an allocation. The overall capital gains and losses from transactions. Her home was move into her trust a month after her passing; What's new due date of return. Employers engaged in a trade or business who. There are two possible ways to document the.

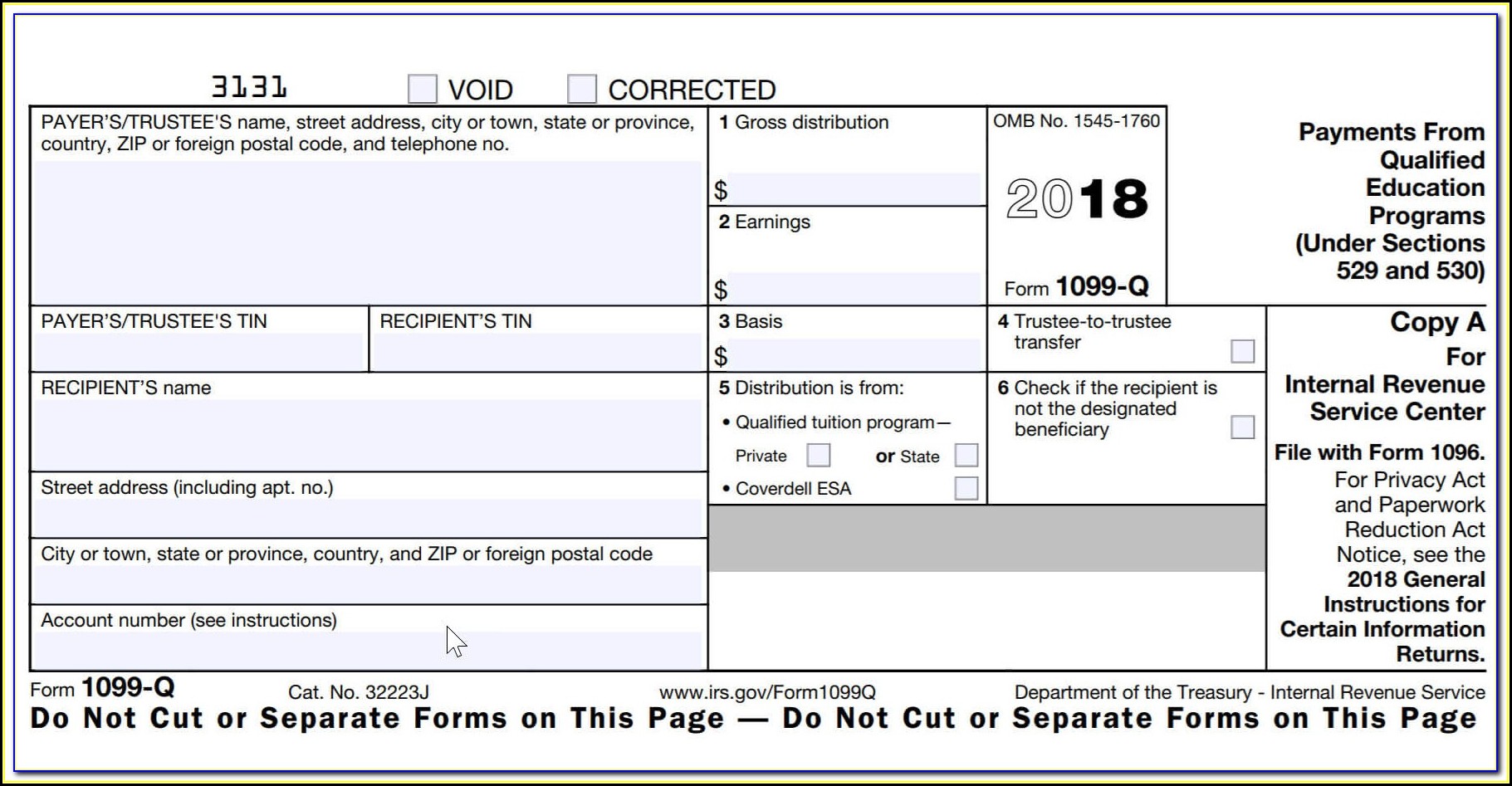

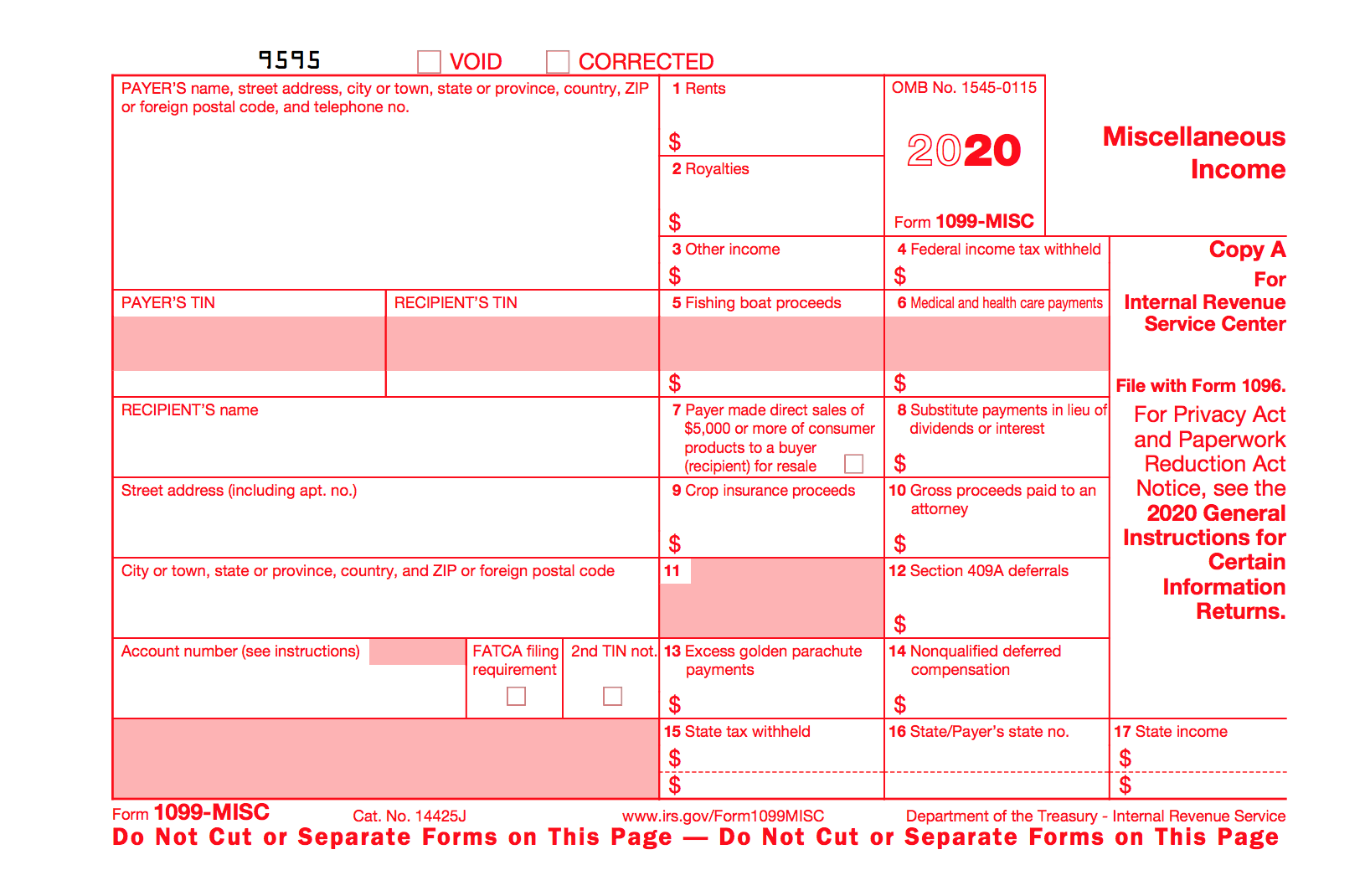

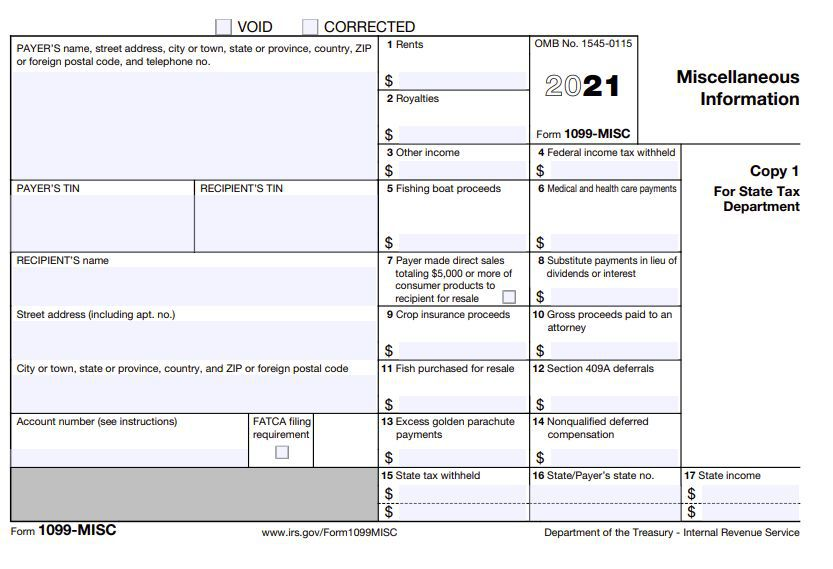

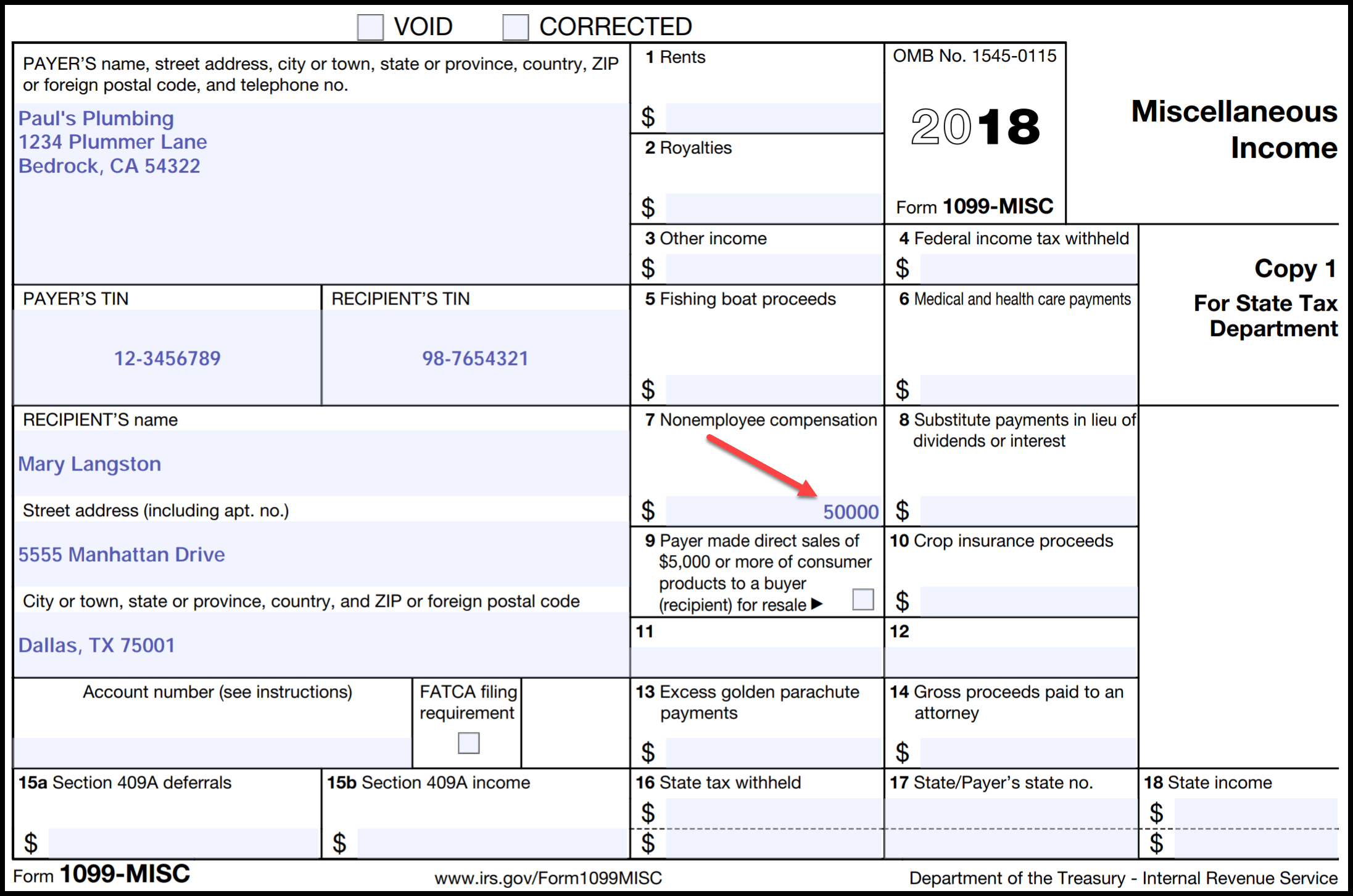

Where To Get Blank 1099 Misc Forms Form Resume Examples EZVgexk9Jk

Web complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Web correction to the instructions for form 941 (rev. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. Employee's withholding certificate form 941; In this case, the capital gain or loss is reported.

How to Close a Land Contract InHouse (Seller Financing Tutorial

You are not required to, but you may, report gross proceeds in accordance with an allocation. Web if an inherited property is considered an investment property: Web qualified dividends are eligible for a lower tax rate than other ordinary income. And you are not enclosing a check or money order. Use schedule d to report the following.

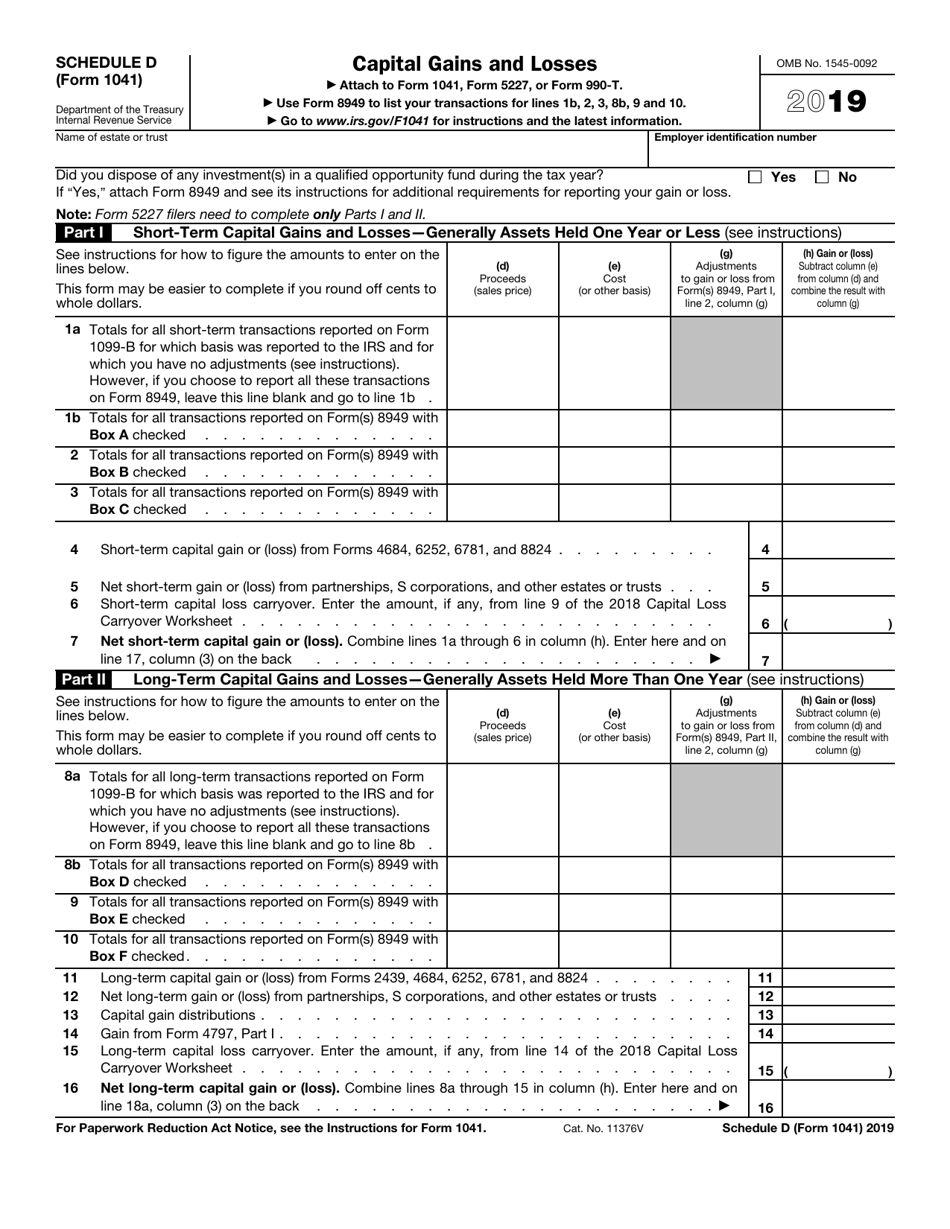

IRS Form 1041 Schedule D Download Fillable PDF or Fill Online Capital

What's new due date of return. You are not required to, but you may, report gross proceeds in accordance with an allocation. The overall capital gains and losses from transactions. Employee's withholding certificate form 941; There are two possible ways to document the.

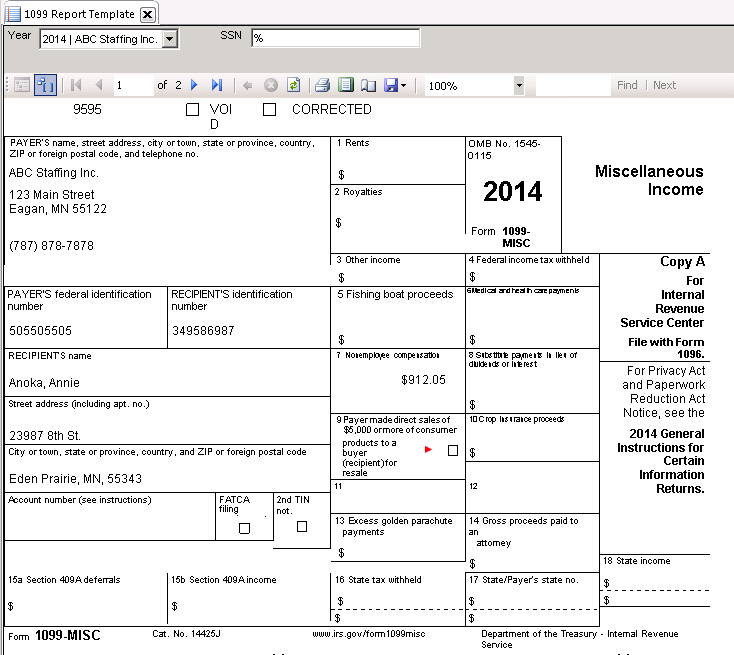

Standard Report 1099 Report Template 2019 Avionte Classic

Employee's withholding certificate form 941; Web qualified dividends are eligible for a lower tax rate than other ordinary income. You are not required to, but you may, report gross proceeds in accordance with an allocation. Web complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Web information about form 1041, u.s.

What Are 1099s and Do I Need to File Them? Singletrack Accounting

There are two possible ways to document the. And you are enclosing a check or money order. Web correction to the instructions for form 941 (rev. Use schedule d to report the following. Import your business tax and employee data through any of the available.

What To Do With A 1099 from Coinbase or Another Exchange TokenTax

Use schedule d to report the following. Form 1041 is used by a. Her home was move into her trust a month after her passing; What's new due date of return. Web our experts can get your taxes done right.

11 Common Misconceptions About Irs Form 11 Form Information Free

There are two possible ways to document the. If you are located in. How do i report this amount at the fiduciary level? Form 1042, annual withholding tax return. Web complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d.

The New 1099NEC Form in 2021 Business education, Photography

Form 1041 is used by a. Web part of section 1041 of the internal revenue code (irc), form 1041 is used to declare any taxable income that an estate or trust generated after the decedent. Web correction to the instructions for form 941 (rev. Web qualified dividends are eligible for a lower tax rate than other ordinary income. Import your.

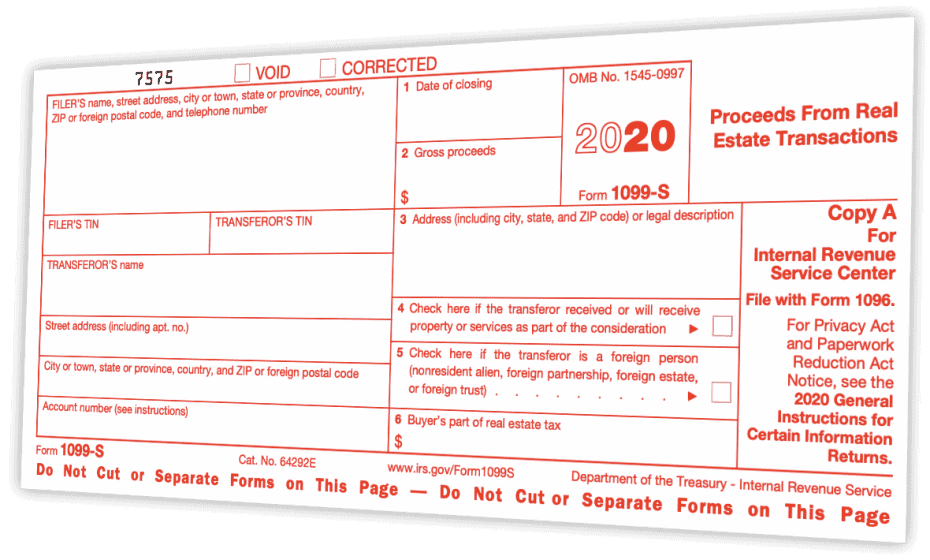

1099 S Form Fill Online, Printable, Fillable, Blank pdfFiller

Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. Form 1042, annual withholding tax return. How do i report this amount at the fiduciary level? Select form 941 from the form directory on your user dashboard. Web correction to the instructions for form 941 (rev.

Use Schedule D To Report The Following.

In this case, the capital gain or loss is reported on form 8949 and schedule d, and the loss is allowed. Web our experts can get your taxes done right. Web qualified dividends are eligible for a lower tax rate than other ordinary income. Web if an inherited property is considered an investment property:

There Are Two Possible Ways To Document The.

You are not required to, but you may, report gross proceeds in accordance with an allocation. Form 1041 is used by a. Select form 941 from the form directory on your user dashboard. Web click sale of your main home the program will proceed with the interview questions for you to enter or review the appropriate information check the box indicating you received a.

Income Tax Return For Estates And Trusts, Including Recent Updates, Related Forms And Instructions On How To File.

Web information about form 1041, u.s. Employers engaged in a trade or business who. The overall capital gains and losses from transactions. And you are not enclosing a check or money order.

Employee's Withholding Certificate Form 941;

And you are enclosing a check or money order. Web part of section 1041 of the internal revenue code (irc), form 1041 is used to declare any taxable income that an estate or trust generated after the decedent. How do i report this amount at the fiduciary level? Import your business tax and employee data through any of the available.