Where To File Form 8832

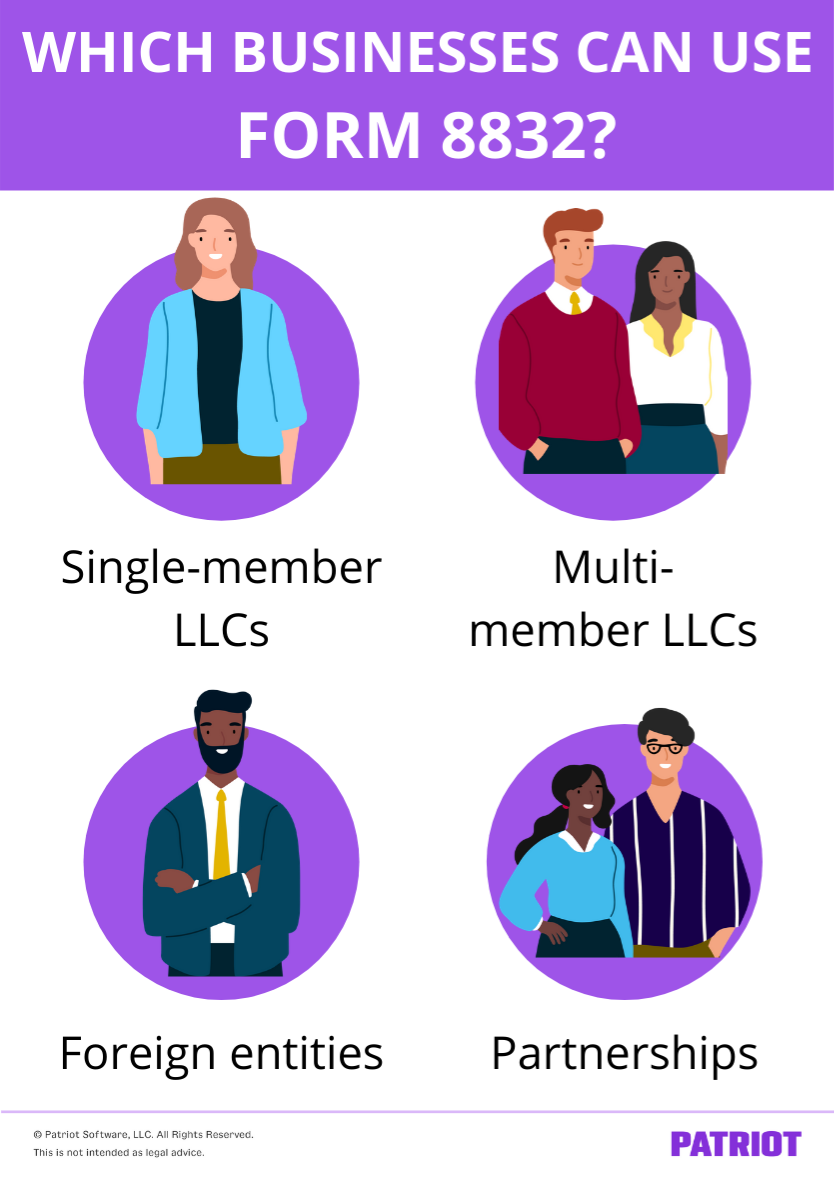

Where To File Form 8832 - If you do not yet have an ein, you cannot fill out form 8832. Web do i need to file form 8832 and 2553? This update supplements this form’s instructions. Who must file form 8832? Web where to file form 8832: Before you rush to hand in form 8832, make sure you know about form. Make sure to do the following: Web form 8832 can be filed with the irs for partnerships and limited liability companies (llcs) if they want to be taxed as different kinds of companies, like a corporation. One of the most common types of elections is for an entity to be treated as an s corporation instead of a c corporation so that the income flows through and there is only one level of tax. Web find irs mailing addresses by state to file form 8832.

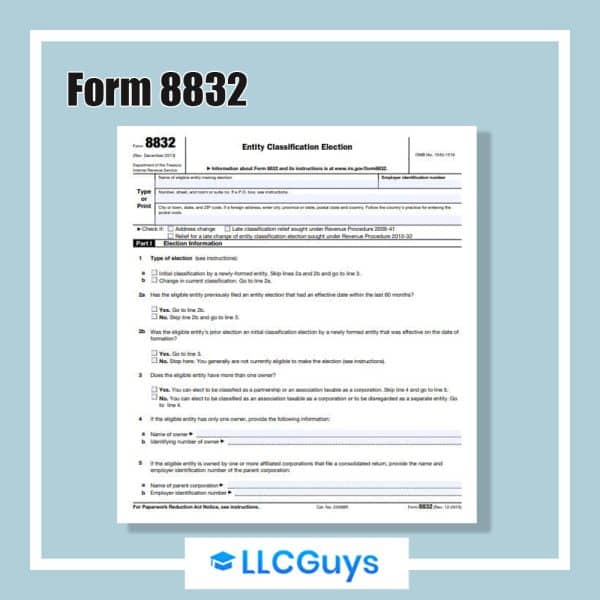

Web new mailing address the address for mailing form 8832 has changed since the form was last published. Fill out your basic information just as you would on any tax document, fill in your business’s name, address, and employer identification number (ein). Web where to file form 8832: Other tax election forms to know about. Complete part 1, election information. Pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership. If you do not yet have an ein, you cannot fill out form 8832. Web irs form 8832 instructions: Web llcs can file form 8832, entity classification election to elect their business entity classification. Who must file form 8832?

Partnerships and limited liability companies can file irs form 8832. Web form 8832 can be filed with the irs for partnerships and limited liability companies (llcs) if they want to be taxed as different kinds of companies, like a corporation. Filers should rely on this update for the changes described,which will be incorporated into the next revision of the form’s instructions. Fill out your basic information just as you would on any tax document, fill in your business’s name, address, and employer identification number (ein). Web new mailing address the address for mailing form 8832 has changed since the form was last published. The location you send the form depends on the state or country your business calls home. Form 8832 if you are located in. Web irs form 8832 instructions: Web where to file form 8832: One of the most common types of elections is for an entity to be treated as an s corporation instead of a c corporation so that the income flows through and there is only one level of tax.

IRS Form 8832 Instructions and FAQs for Business Owners NerdWallet

This confirms form 2553 must be filed n order to make the election: Depending on where you live, there are two mailing addresses. If you do not yet have an ein, you cannot fill out form 8832. Make sure to do the following: It has to be mailed to the agency.

Irs Form 8832 Fillable Pdf Printable Forms Free Online

Filers should rely on this update for the changes described,which will be incorporated into the next revision of the form’s instructions. Web new mailing address the address for mailing form 8832 has changed since the form was last published. Before you rush to hand in form 8832, make sure you know about form. Complete part 1, election information. Web llcs.

What is Form 8832 and How Do I File it?

One of the most common types of elections is for an entity to be treated as an s corporation instead of a c corporation so that the income flows through and there is only one level of tax. The irs form lists two addresses to mail in your form. Make sure to do the following: Web what does this mean?.

Do I Need to File IRS Form 8832 for My Business? The Handy Tax Guy

40% of small biz owners get paid by check. Before you rush to hand in form 8832, make sure you know about form. Web do i need to file form 8832 and 2553? The updated mailing addresses are shown below. Fill out your basic information just as you would on any tax document, fill in your business’s name, address, and.

What Is Form 8832 and How Do I Fill It Out? Ask Gusto

Pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership. Web what does this mean? Enter your business name and address. Fill out your basic information just as you would on any tax document, fill in your business’s name, address, and employer identification number (ein). Make sure to do the.

What Is IRS Form 8832? Definition, Deadline, & More

Filers should rely on this update for the changes described,which will be incorporated into the next revision of the form’s instructions. Web unfortunately, you cannot file form 8832 electronically with the irs. Web find irs mailing addresses by state to file form 8832. Form 8832 if you are located in. Partnerships and limited liability companies can file irs form 8832.

Form 8832 All About It and How to File It?

The irs form lists two addresses to mail in your form. Web unfortunately, you cannot file form 8832 electronically with the irs. Web find irs mailing addresses by state to file form 8832. Other tax election forms to know about. One of the most common types of elections is for an entity to be treated as an s corporation instead.

Form 8832 and Changing Your LLC Tax Status Bench Accounting

Web what does this mean? The irs form lists two addresses to mail in your form. Make sure to do the following: Web do i need to file form 8832 and 2553? You can find irs form 8832 on the irs website the first page of the form has information about where to.

Using Form 8832 to Change Your LLC’s Tax Classification

Web new mailing address the address for mailing form 8832 has changed since the form was last published. Web do i need to file form 8832 and 2553? Who must file form 8832? Form 8832 is not available for submission through efile. Complete part 2, late election relief.

Form 8832 All About It and How to File It?

This confirms form 2553 must be filed n order to make the election: Web new mailing address the address for mailing form 8832 has changed since the form was last published. The irs form lists two addresses to mail in your form. If you do not yet have an ein, you cannot fill out form 8832. Web unfortunately, you cannot.

The Location You Send The Form Depends On The State Or Country Your Business Calls Home.

Complete part 2, late election relief. Form 8832 is not available for submission through efile. One of the most common types of elections is for an entity to be treated as an s corporation instead of a c corporation so that the income flows through and there is only one level of tax. It has to be mailed to the agency.

40% Of Small Biz Owners Get Paid By Check.

Enter your business name and address. Web what does this mean? The updated mailing addresses are shown below. Web find irs mailing addresses by state to file form 8832.

Web Unfortunately, You Cannot File Form 8832 Electronically With The Irs.

Form 8832 if you are located in. Other tax election forms to know about. This update supplements this form’s instructions. Web new mailing address the address for mailing form 8832 has changed since the form was last published.

You Can Find Irs Form 8832 On The Irs Website The First Page Of The Form Has Information About Where To.

Web where to file form 8832: Web irs form 8832 instructions: Before you rush to hand in form 8832, make sure you know about form. This confirms form 2553 must be filed n order to make the election: