Where To File Form 1310

Where To File Form 1310 - Web follow these steps to generate form 1310: Web if the personal representative is filing a claim for refund on form 1040x, amended u.s. Attach to the tax return certified copies of the: Green died on january 4 before filing his tax return. Ad get ready for tax season deadlines by completing any required tax forms today. Web where do i file irs 1310? Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due a. Web where to file your taxes for form 1065. Go to screen 63, deceased taxpayer (1310). Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund.

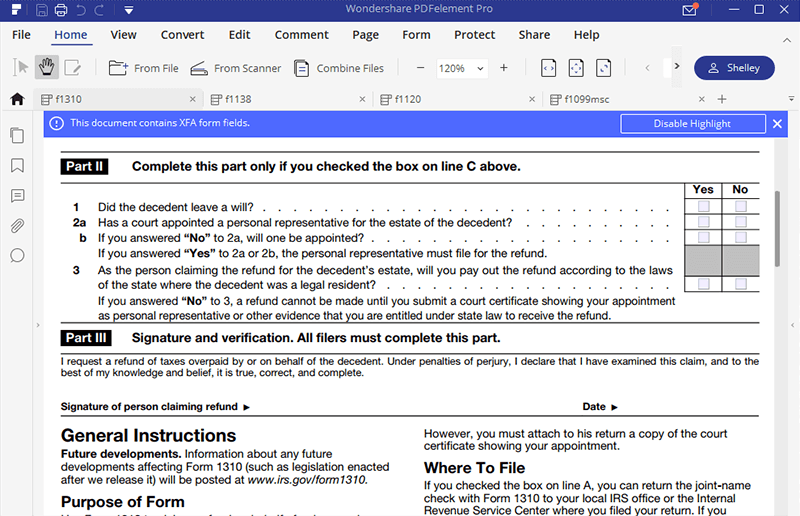

If data entry on the 1310 screen does not meet the irs guidelines, there will be elf critical diagnostics. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Web statement of person claiming refund due a deceased taxpayer (irs form 1310) legal representatives. Enter a 1, 2, or 3 in 1=surviving spouse (married filing joint),. Web line a check the box on line a if you received a refund check in your name and your deceased spouse's name. On april 3 of the same year, you. Web if you’re a surviving spouse, you’ll mail form 1310 to the same internal revenue service center where you filed your return. Web 9 rows the irs has set specific electronic filing guidelines for form 1310. Web if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Complete, edit or print tax forms instantly.

Web line a check the box on line a if you received a refund check in your name and your deceased spouse's name. Go to screen 63, deceased taxpayer (1310). Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Send form 1310 to the irs office responsible for processing the decedent's federal tax return. Web if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due a. You are a surviving spouse filing an original or. Web taxpayer, you must file form 1310 unless either of the following applies: Complete, edit or print tax forms instantly. On april 3 of the same year, you.

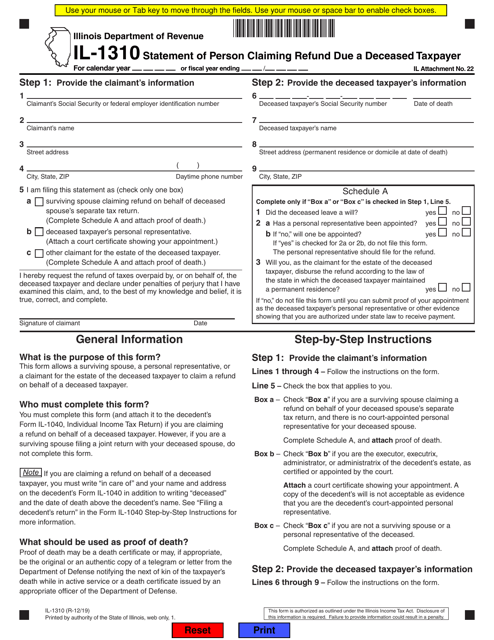

Form IL1310 Download Fillable PDF or Fill Online Statement of Person

Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Go to screen 63, deceased taxpayer (1310). Attach to the tax return certified copies of the: If you aren’t the surviving spouse, then you’ll mail the. Enter a 1, 2,.

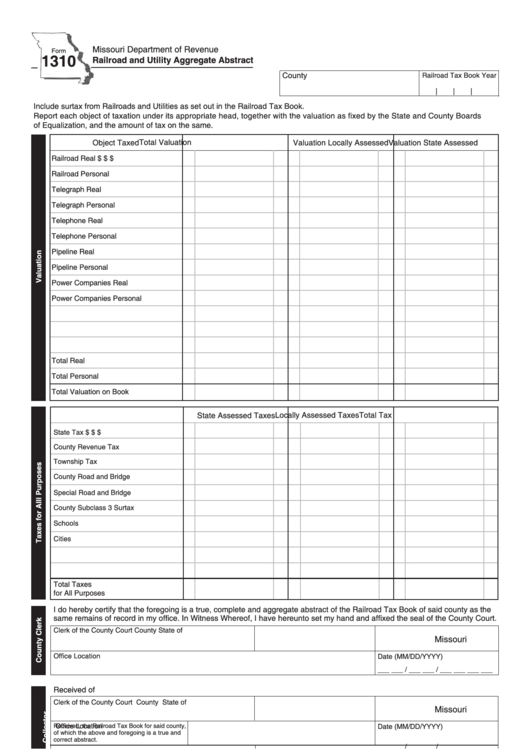

Fillable Form 1310 Railroad And Utility Aggregate Abstract printable

You are a surviving spouse filing an original or. Web 9 rows the irs has set specific electronic filing guidelines for form 1310. Click miscellaneous topics in the federal quick q&a topics menu to expand, then click claim. If you aren’t the surviving spouse, then you’ll mail the. Go to screen 63, deceased taxpayer (1310).

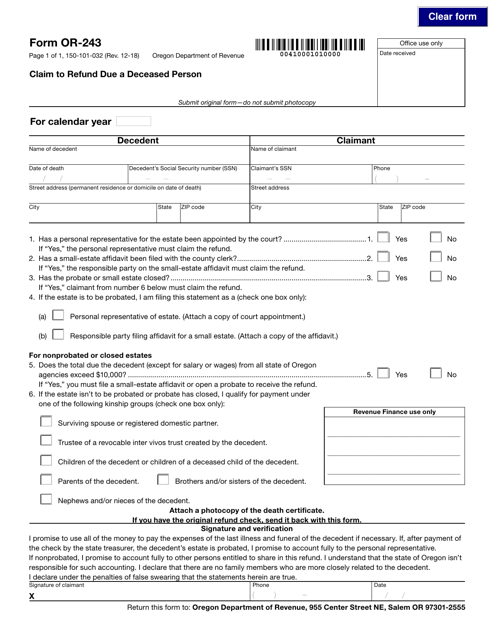

Irs Form 1310 Printable Master of Documents

Web line a check the box on line a if you received a refund check in your name and your deceased spouse's name. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. If you aren’t the surviving spouse, then.

Modelo 1310 Traders Studio

Then you have to provide all other required information in the. Web 9 rows the irs has set specific electronic filing guidelines for form 1310. Ad fill, sign, email irs 1310 & more fillable forms, register and subscribe now! If you aren’t the surviving spouse, then you’ll mail the. These addresses are listed in the.

Form 1310 Major Errors Intuit Accountants Community

Web where to file your taxes for form 1065. Web follow these steps to generate form 1310: Individual income tax return, or form 843, claim for refund and. Then you have to provide all other required information in the. Web this information includes name, address, and the social security number of the person who is filing the tax return.

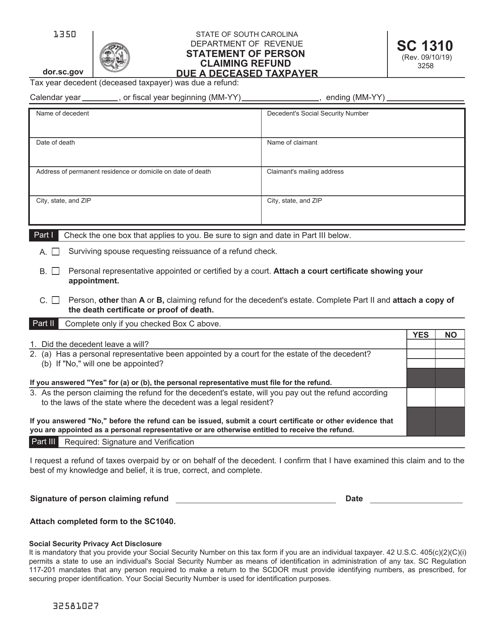

Form SC1310 Download Printable PDF or Fill Online Statement of Person

If you aren’t the surviving spouse, then you’ll mail the. Web taxpayer, you must file form 1310 unless either of the following applies: Web where to file your taxes for form 1065. Web if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Web follow these steps.

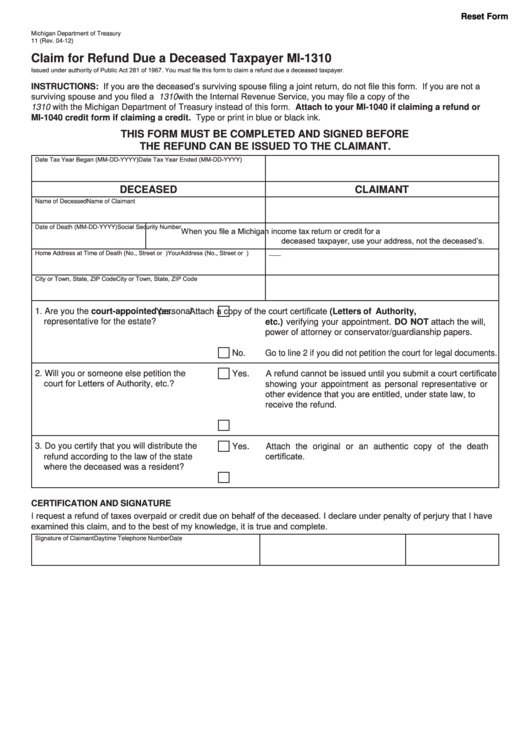

Fillable Form Mi1310 Claim For Refund Due A Deceased Taxpayer

Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due a. You are a surviving spouse filing an original or. Web where do i file irs 1310? Click miscellaneous topics in the federal quick q&a topics menu to expand, then click.

Form 1310 2014 2019 Blank Sample to Fill out Online in PDF

Web this information includes name, address, and the social security number of the person who is filing the tax return. If the partnership's principal business, office, or agency is located in: These addresses are listed in the. Web line a check the box on line a if you received a refund check in your name and your deceased spouse's name..

Form 1310 Instructions 2021 2022 IRS Forms Zrivo

Ad get ready for tax season deadlines by completing any required tax forms today. Web statement of person claiming refund due a deceased taxpayer (irs form 1310) legal representatives. Web this information includes name, address, and the social security number of the person who is filing the tax return. You are a surviving spouse filing an original or. Enter a.

You Are A Surviving Spouse Filing An Original Or.

Web where to file your taxes for form 1065. If you aren’t the surviving spouse, then you’ll mail the. Web if you’re a surviving spouse, you’ll mail form 1310 to the same internal revenue service center where you filed your return. On april 3 of the same year, you.

Individual Income Tax Return, Or Form 843, Claim For Refund And.

If the partnership's principal business, office, or agency is located in: Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Web line a check the box on line a if you received a refund check in your name and your deceased spouse's name. Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due a.

If Data Entry On The 1310 Screen Does Not Meet The Irs Guidelines, There Will Be Elf Critical Diagnostics.

Web this information includes name, address, and the social security number of the person who is filing the tax return. Ad fill, sign, email irs 1310 & more fillable forms, register and subscribe now! Web where do i file irs 1310? Ad get ready for tax season deadlines by completing any required tax forms today.

These Addresses Are Listed In The.

Green died on january 4 before filing his tax return. Web follow these steps to generate form 1310: Web if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Web taxpayer, you must file form 1310 unless either of the following applies: