Where Do I Mail Form 943

Where Do I Mail Form 943 - Web about form 943, employer's annual federal tax return for agricultural employees. If you are filing form 843 to request a claim for refund in form 706/709 only tax matters, then mail the form to: If the partnership's principal business, office, or agency is located in: Web where to file your taxes for form 1065. Web efile now more salient features what is 943 form? Mail your return to the address listed for your location in the table that follows. Select form 943 and enter. This form will be used by employers in the agricultural field. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Web simply follow the steps below to file your form 943:

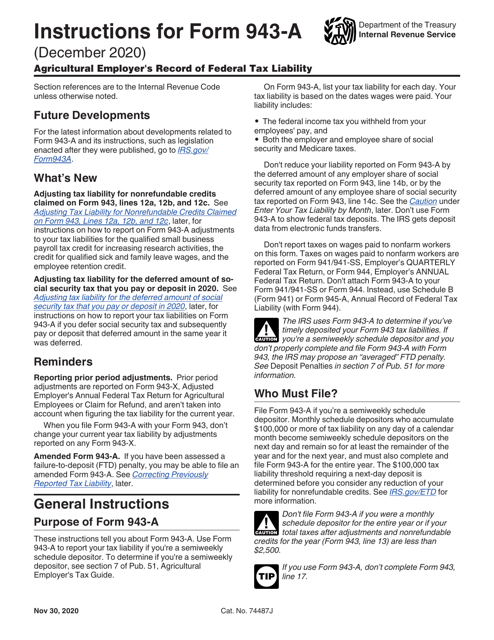

Web you have two options for filing form 943: Web where to file your taxes for form 1065. The irs mailing address for form 1040 depends on what state you live in, as they have several different addresses. Web if you made deposits on time, in full payment of the taxes for the year, you may have time to file your form 943 until february 10, 2023. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. When filing paper copies, agricultural employers must mail form 943 to the irs. Web for the latest information about developments related to form 943 and its instructions, such as legislation enacted after they were published, go to irs.gov/form943. Web form 943, is the employer’s annual federal tax return for agricultural employees. Where to mail form 943 for 2022? Select form 943 and enter.

When filing paper copies, agricultural employers must mail form 943 to the irs. The irs requires businesses with employees to. Web what is a form 943? Web what is the mailing address of the irs for form 1040? Create a free taxbandits account or login if you have one already step 2: The irs mailing address for form 1040 depends on what state you live in, as they have several different addresses. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Web efile now more salient features what is 943 form? Web where to file your taxes for form 1065. It is known as an employer’s annual federal tax return for agriculture employees.

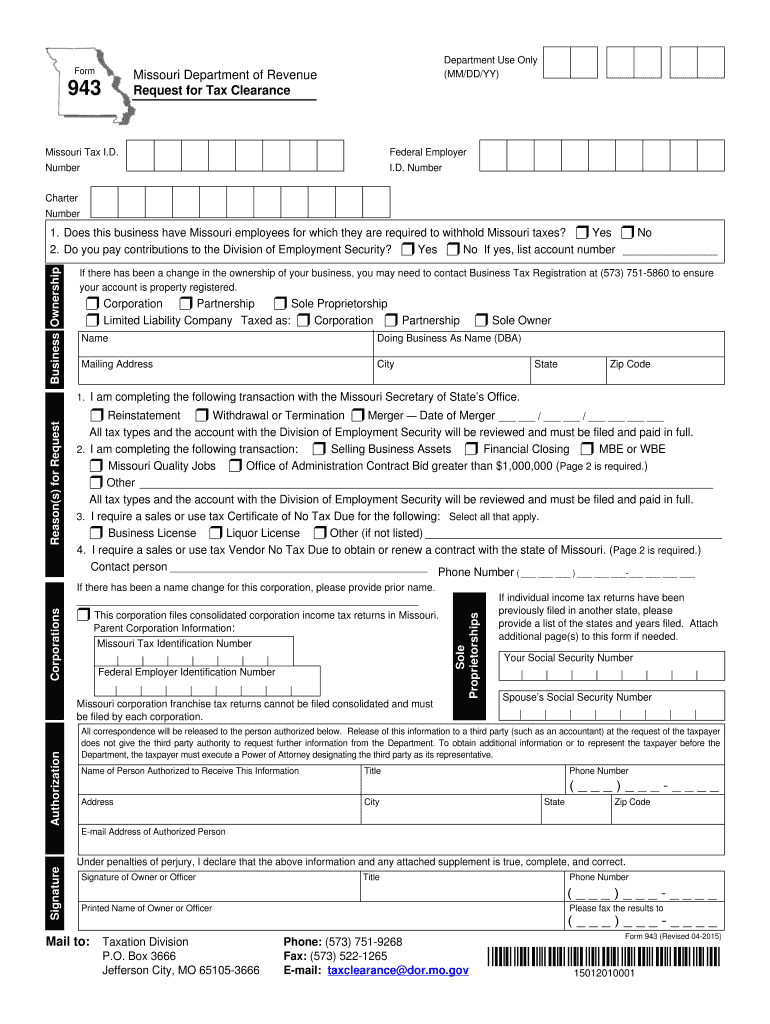

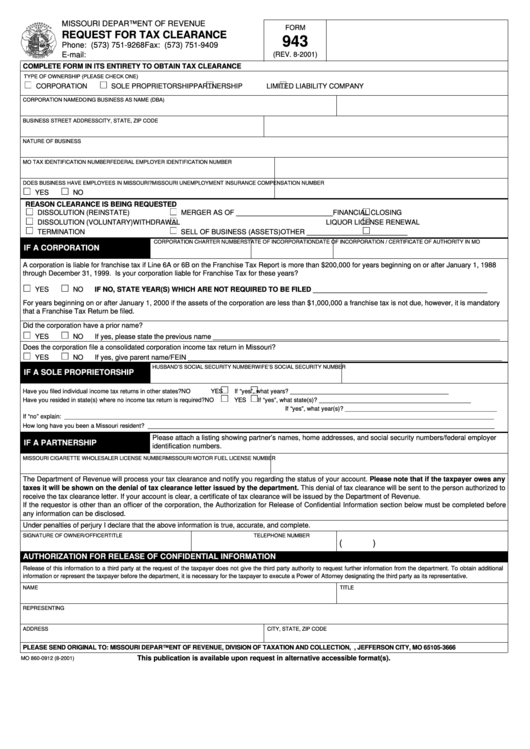

20152020 Form MO DoR 943 Fill Online, Printable, Fillable, Blank

Mail your return to the address listed for your location in the table that follows. Web simply follow the steps below to file your form 943: The irs mailing address for form 1040 depends on what state you live in, as they have several different addresses. Web where to file your taxes for form 1065. Select form 943 and enter.

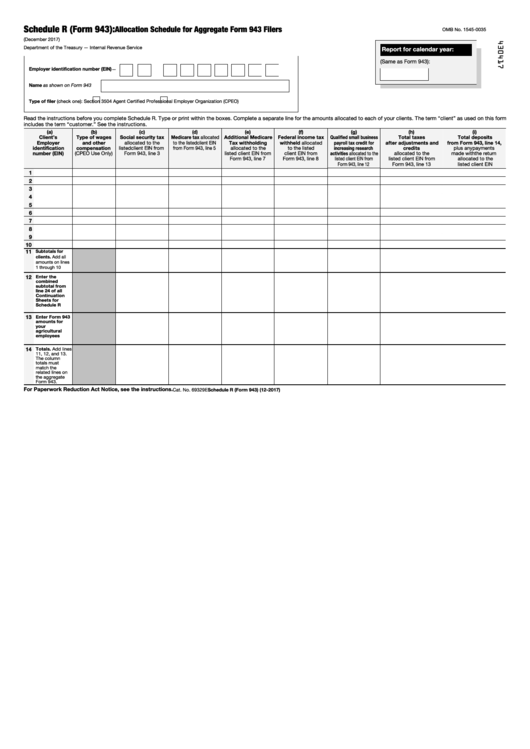

Fillable Schedule R (Form 943) Allocation Schedule For Aggregate Form

Select form 943 and enter. This form will be used by employers in the agricultural field. 1.877.683.3280 learn about the different federal payroll forms, and how our payroll products support them. It is known as an employer’s annual federal tax return for agriculture employees. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023,.

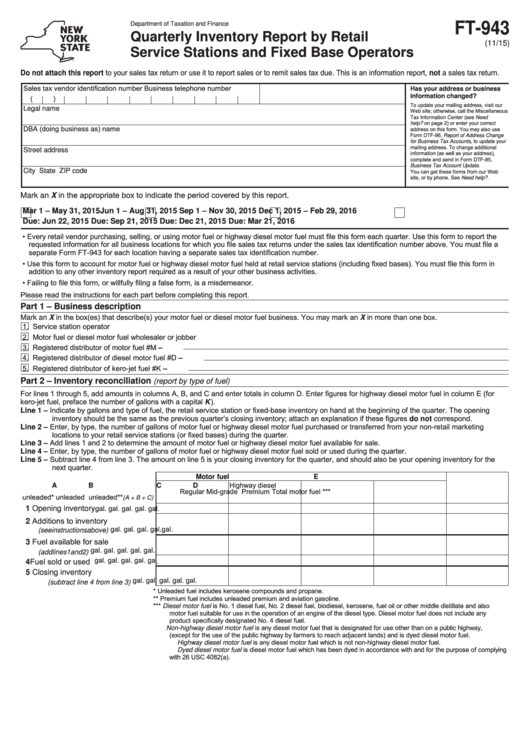

Form Ft943 Quarterly Inventory Report By Retail Service Stations And

Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. The irs mailing address for form 1040 depends on what state you live in, as they have several different addresses. Web the address is shown in the notice. Web.

Fill Free fillable F943apr Form 943 APR (Rev. October 2017) PDF form

The irs mailing address for form 1040 depends on what state you live in, as they have several different addresses. 1.877.683.3280 learn about the different federal payroll forms, and how our payroll products support them. When to file form 943 943 important dates 943 efile info 943 online service pricing 943 fee calculator Web if you file a paper return,.

Form 943 What You Need to Know About Agricultural Withholding

When filing paper copies, agricultural employers must mail form 943 to the irs. Web about form 943, employer's annual federal tax return for agricultural employees. Web if you made deposits on time, in full payment of the taxes for the year, you may have time to file your form 943 until february 10, 2023. This form will be used by.

IRS Form 943 Complete PDF Tenplate Online in PDF

And the total assets at the end of the tax year. The irs requires businesses with employees to. Select form 943 and enter. Web efile now more salient features what is 943 form? Web simply follow the steps below to file your form 943:

Download Instructions for IRS Form 943A Agricultural Employer's Record

And the total assets at the end of the tax year. Form 9143 is a request for you to provide information that was missing from your tax return (it's most commonly used when a taxpayer fails to sign the return). If you want to file online, you can either search for a tax professional to guide you through the. Select.

IRS Form 943 Online Efile 943 for 4.95 Form 943 for 2020

Web efile now more salient features what is 943 form? It is known as an employer’s annual federal tax return for agriculture employees. If the partnership's principal business, office, or agency is located in: The irs requires businesses with employees to. The irs mailing address for form 1040 depends on what state you live in, as they have several different.

Form 943 Request For Tax Clearance printable pdf download

Web if you file a paper return, where you file depends on whether you include a payment with form 943. If the partnership's principal business, office, or agency is located in: Where to mail form 943 for 2022? Web efile now more salient features what is 943 form? 1.877.683.3280 learn about the different federal payroll forms, and how our payroll.

Form 943 Employer's Annual Federal Tax Return for Agricultural

Web for the latest information about developments related to form 943 and its instructions, such as legislation enacted after they were published, go to irs.gov/form943. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. When to file form.

Create A Free Taxbandits Account Or Login If You Have One Already Step 2:

Web you have two options for filing form 943: Web if you file a paper return, where you file depends on whether you include a payment with form 943. If the partnership's principal business, office, or agency is located in: The irs requires businesses with employees to.

When Filing Paper Copies, Agricultural Employers Must Mail Form 943 To The Irs.

Web the address is shown in the notice. 1.877.683.3280 learn about the different federal payroll forms, and how our payroll products support them. Web for the latest information about developments related to form 943 and its instructions, such as legislation enacted after they were published, go to irs.gov/form943. Web form 943, is the employer’s annual federal tax return for agricultural employees.

Web About Form 943, Employer's Annual Federal Tax Return For Agricultural Employees.

The irs mailing address for form 1040 depends on what state you live in, as they have several different addresses. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Web where to file your taxes for form 1065. Web efile now more salient features what is 943 form?

Where You File Depends On Whether The.

Web simply follow the steps below to file your form 943: In other words, it is a tax form used to report federal income tax, social. It is known as an employer’s annual federal tax return for agriculture employees. If you want to file online, you can either search for a tax professional to guide you through the.