Where Do I Get Form 2441

Where Do I Get Form 2441 - Report the caregiver’s costs on form 2441: Web for the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form2441. Web internal revenue service. And you are not enclosing a check or money order. Web the irs has released form 2441 (child and dependent care expenses) and its accompanying instructions for the 2021 tax year. You should get form successfully deleted. Form 941 asks for the total amount of. The reason is that box 10 (dependent care benefits) requires a. So, you must have the care provider’s: Web to enter child and dependent care information in your taxact return, click federal.

If you mail tax returns, you. Taxpayers file form 2441 with form. This temporary increase was not extended for tax year 2022 returns. Employee's withholding certificate form 941; If you're married, your spouse must also have earned income. And you are not enclosing a check or money order. Form 941 asks for the total amount of. Web where do i file form 2441? Web internal revenue service. If you are located in.

You should get form successfully deleted. If there is a number there, you won't be able to delete. And you are not enclosing a check or money order. Special filing address for exempt organizations; If you’re eligible to claim the childcare tax credit, you can claim it if the person you paid doesn’t report the income. Web in order to claim the child and dependent care credit, form 2441, you must: This temporary increase was not extended for tax year 2022 returns. Employee's withholding certificate form 941; Taxpayers file form 2441 with form. So, you must have the care provider’s:

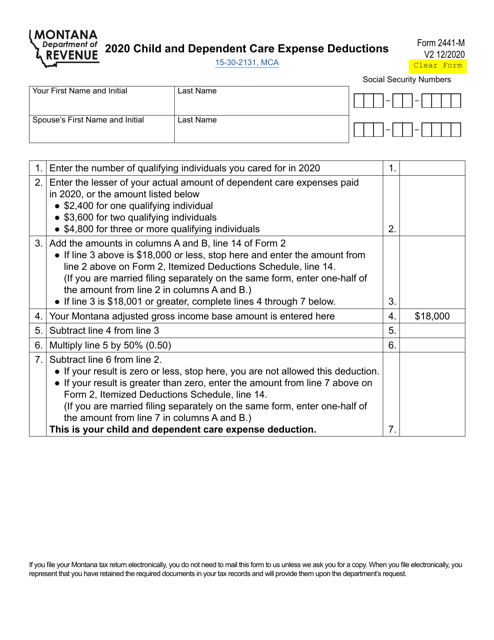

Form 2441M Download Fillable PDF or Fill Online Child and Dependent

Web for the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form2441. Web follow these steps to enter dependent care information: If you mail tax returns, you. Report the caregiver’s costs on form 2441: And you are not enclosing a check or money order.

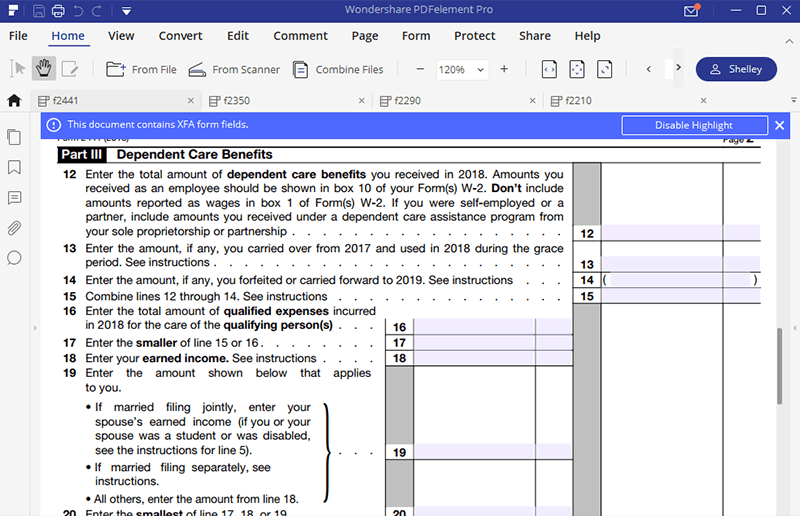

Ssurvivor Form 2441 Child And Dependent Care Expenses

Web where do i file form 2441? Gather information needed to complete form 941. So, you must have the care provider’s: This temporary increase was not extended for tax year 2022 returns. Web follow these steps to enter dependent care information:

Tax Form 2441 Filing Child and Dependent Care Expenses Top Daycare

Report the caregiver’s costs on form 2441: Web where do i file form 2441? Taxpayers file form 2441 with form. No., city, state, and zip code) (c) identifying number (ssn or ein) Employee's withholding certificate form 941;

How To Read Tax Return

If there is a number there, you won't be able to delete. Web scroll down the list of forms and select delete next to form 2441; So, you must have the care provider’s: Taxpayers file form 2441 with form. Choose delete selected form to confirm.

Breanna Form 2441 Irs Instructions

Web internal revenue service. Employee's withholding certificate form 941; And you are not enclosing a check or money order. So, you must have the care provider’s: Choose delete selected form to confirm.

Form 2441 Child/Dependent Care Expenses Miller Financial Services

You should get form successfully deleted. Web care provider is your (number, street, apt. Web internal revenue service. Web where do i file form 2441? If you mail tax returns, you.

Breanna Form 2441 Instructions Provider Amount Paid

Report the caregiver’s costs on form 2441: Employee's withholding certificate form 941; Web for the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form2441. For tax year 2021 only: Special filing address for exempt organizations;

2020 Tax Form 2441 Create A Digital Sample in PDF

Form 941 asks for the total amount of. If there is a number there, you won't be able to delete. Gather information needed to complete form 941. For tax year 2021 only: Web to enter child and dependent care information in your taxact return, click federal.

Breanna Form 2441 Instructions Provider Amount Paid

For tax year 2021 only: Employee's withholding certificate form 941; If there is a number there, you won't be able to delete. The reason is that box 10 (dependent care benefits) requires a. And you are enclosing a check or money order.

Breanna Form 2441 Tax Liability Limit

Web in order to claim the child and dependent care credit, form 2441, you must: Web scroll down the list of forms and select delete next to form 2441; Employers engaged in a trade or business who. No., city, state, and zip code) (c) identifying number (ssn or ein) The reason is that box 10 (dependent care benefits) requires a.

Choose Delete Selected Form To Confirm.

Employee's withholding certificate form 941; And you are not enclosing a check or money order. This temporary increase was not extended for tax year 2022 returns. Web internal revenue service.

So, You Must Have The Care Provider’s:

If you mail tax returns, you. Web the irs has released form 2441 (child and dependent care expenses) and its accompanying instructions for the 2021 tax year. Web follow these steps to enter dependent care information: Employers engaged in a trade or business who.

If You're Married, Your Spouse Must Also Have Earned Income.

Web scroll down the list of forms and select delete next to form 2441; If you file electronic tax returns, your tax software will automatically include form 2441 with your tax return. If you are located in. No., city, state, and zip code) (c) identifying number (ssn or ein)

For Tax Year 2021 Only:

You should get form successfully deleted. If you’re eligible to claim the childcare tax credit, you can claim it if the person you paid doesn’t report the income. Special filing address for exempt organizations; Web for the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form2441.

/ScreenShot2020-02-03at2.02.31PM-9dcbc3a8b1604721b8586a24d7c7ffb7.png)