Where Do I Find Form 941 In Quickbooks

Where Do I Find Form 941 In Quickbooks - Click taxes on the left navigation menu and choose payroll tax. Web once you click on it, a new page will load. Your previous tax forms are available in the payroll tax center. Track sales & sales tax. If you would like to print this form, all you need to do is click on the print icon located on the top left of. Web best answers monicam3 moderator january 10, 2022 02:29 pm yes, @payroll941. In the forms section, tap the view and. Click on the employees from the top menu bar. It must be filed at least quarterly and sometimes. On the left panel, choose the taxes menu to select payroll tax.

Click on the employees from the top menu bar. Track sales & sales tax. If you would like to print this form, all you need to do is click on the print icon located on the top left of. The program defaults to monthly. Web how do i get my form 941 from quickbooks? In the forms section, tap the view and. Chose quarterly form 941/schedule b or annual. On the left panel, choose the taxes menu to select payroll tax. Web best answers garlyngay moderator february 18, 2019 06:35 am hello mike16, let me show you how to print the filed 941 form so you can mail it to the irs. Click the taxes tab on the left panel.

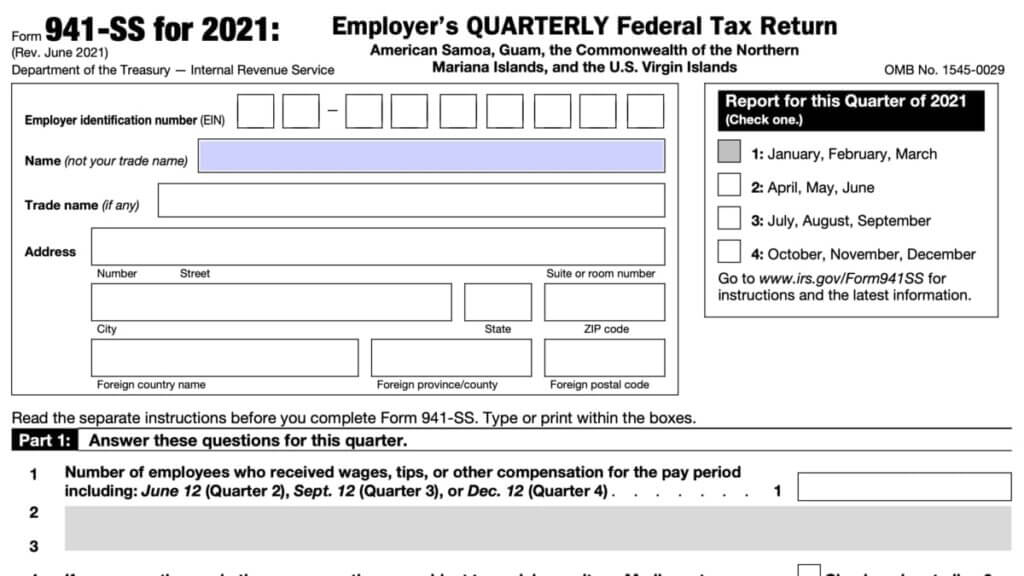

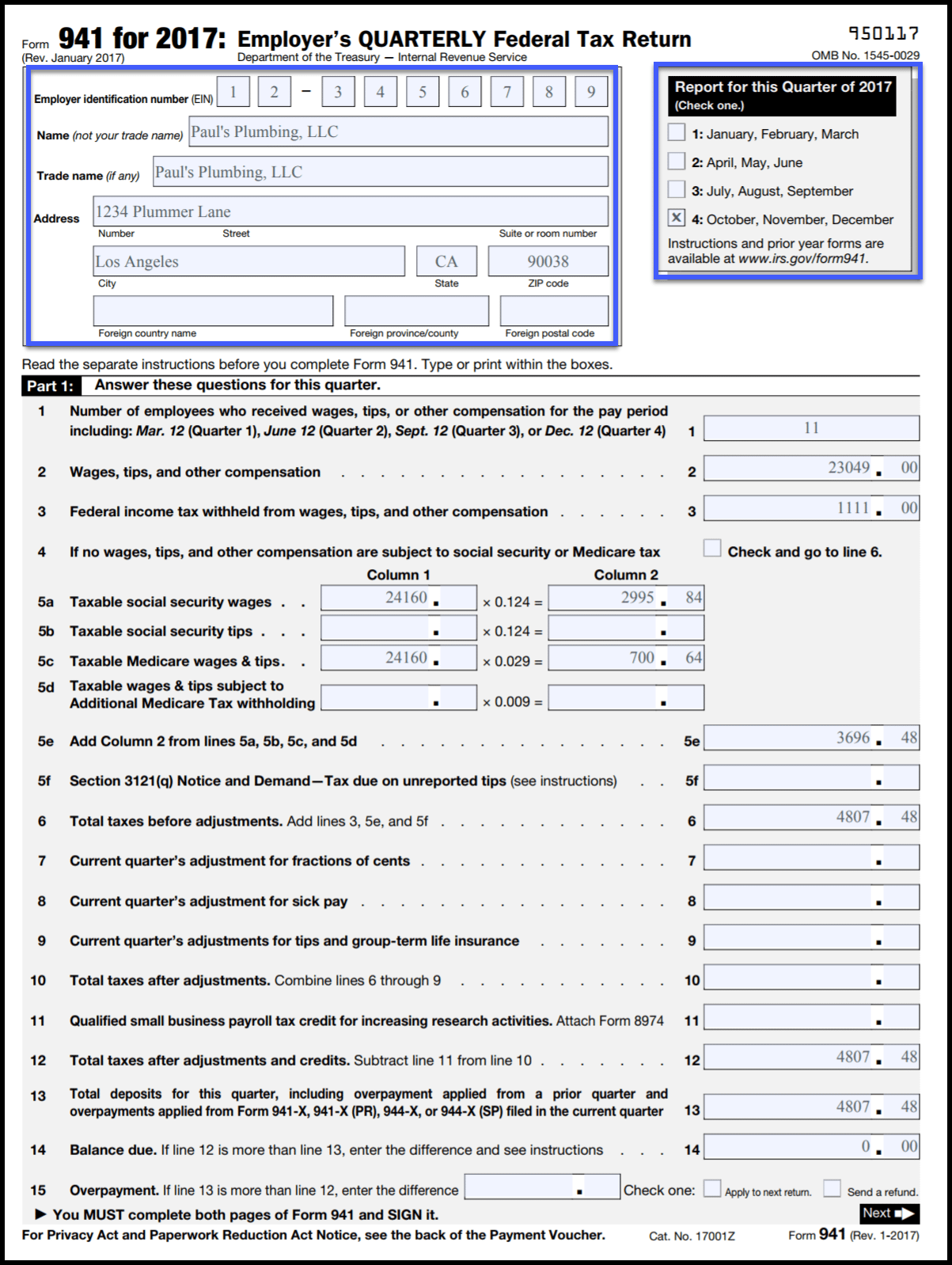

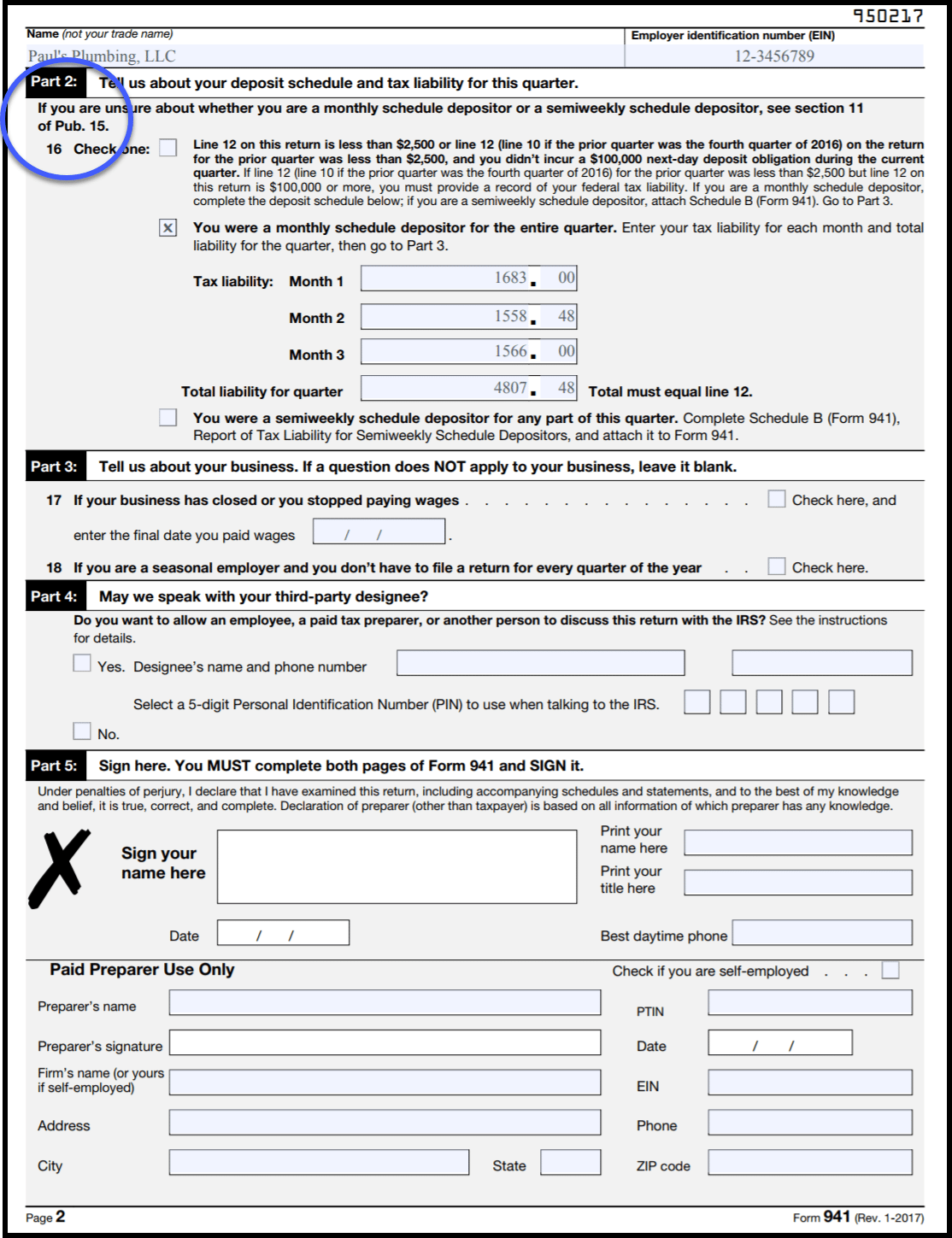

In the forms section, tap the view and. On the left panel, choose the taxes menu to select payroll tax. Web form 941 for 2023: Web where to find 1st quarter 2021 941? I'd be happy to walk you through locating previous year's tax forms. Web how do i get my form 941 from quickbooks? Web to get your 941 form from quickbooks, follow these steps: Web form 941 is only filed if you are a business paying employees and withholding taxes from their paychecks. The program defaults to monthly. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122.

941 Form Mailing Address 2023 941 Forms Zrivo

Indicate the appropriate tax quarter and year in the quarter and year fields. Click on the employees from the top menu bar. Choose quarterly tax forms and 941 as your filter. Web once you click on it, a new page will load. Web you'll need to file form 941 outside of quickbooks in order to include amounts on line 13c.

Where Is Form 941 In Quickbooks?

Web select either form 941 or 944 in the tax reports section of print reports. Web to get your 941 form from quickbooks, follow these steps: Web how to file federal payroll form 941 in quickbooks online? Click on the employees from the top menu bar. In the forms section, tap the view and print archived forms link under quarterly.

Form 941 Instructions & FICA Tax Rate 2018 (+ Mailing Address)

Web to get your 941 form from quickbooks, follow these steps: The steps may vary a little depending on which payroll service you have. But how do you file it online? Web april 05, 2022 04:23 pm. On the left panel, choose the taxes menu to select payroll tax.

Form 941 Instructions & FICA Tax Rate 2018 (+ Mailing Address)

Web track income & expenses. The current version of the form. Web how to file federal payroll form 941 in quickbooks online? Quickbooks desktop payroll enhanced amounts are taken from payroll items that have. Search for “payroll tax liability” and select the report for the quarter you want to file.

Form 941 PDF is Watermarked "Do Not File"

Web select either form 941 or 944 in the tax reports section of print reports. Web april 05, 2022 04:23 pm. Search for “payroll tax liability” and select the report for the quarter you want to file. But how do you file it online? Web how do i get my form 941 from quickbooks?

How to fill out IRS Form 941 2019 PDF Expert

Web best answers garlyngay moderator february 18, 2019 06:35 am hello mike16, let me show you how to print the filed 941 form so you can mail it to the irs. In the forms section, tap the view and print archived forms link under quarterly. The current version of the form. But how do you file it online? In general,.

QuickBooks 941 Feature Creates Tax Form 941 Fast Video YouTube

Web you'll need to file form 941 outside of quickbooks in order to include amounts on line 13c. Choose quarterly tax forms and 941 as your filter. Click the taxes tab on the left panel. Now in your file form section select the. Web how to file federal payroll form 941 in quickbooks online?

2020 QB Desktop Payroll Reports (Form 941) Populat... QuickBooks

I'd be happy to walk you through locating previous year's tax forms. In the forms section, tap the view and. Web form 941 for 2023: Choose quarterly tax forms and 941 as your filter. Web track income & expenses.

941 2020

Web you'll need to file form 941 outside of quickbooks in order to include amounts on line 13c. I'd be happy to walk you through locating previous year's tax forms. I can help you locate your 2021 form 941, posaccountant. Web once you click on it, a new page will load. Chose quarterly form 941/schedule b or annual.

QuickBooks TipHow To Add a Logo and Customize Your Forms QuickBooks

In general, employers who withhold federal income tax, social security or. Web best answers monicam3 moderator january 10, 2022 02:29 pm yes, @payroll941. Quickbooks desktop payroll enhanced amounts are taken from payroll items that have. The current version of the form. Chose quarterly form 941/schedule b or annual.

It Must Be Filed At Least Quarterly And Sometimes.

Chose quarterly form 941/schedule b or annual. The steps may vary a little depending on which payroll service you have. In general, employers who withhold federal income tax, social security or. On the left panel, choose the taxes menu to select payroll tax.

Web You'll Need To File Form 941 Outside Of Quickbooks In Order To Include Amounts On Line 13C.

The program defaults to monthly. Now in your file form section select the. I'd be happy to walk you through locating previous year's tax forms. Click taxes on the left navigation menu and choose payroll tax.

Web Best Answers Monicam3 Moderator January 10, 2022 02:29 Pm Yes, @Payroll941.

Search for “payroll tax liability” and select the report for the quarter you want to file. In the forms section, tap the view and print archived forms link under quarterly. Track sales & sales tax. But how do you file it online?

Web April 05, 2022 04:23 Pm.

Web track income & expenses. Indicate the appropriate tax quarter and year in the quarter and year fields. Web form 941 is only filed if you are a business paying employees and withholding taxes from their paychecks. Your previous tax forms are available in the payroll tax center.