What Type Of Form Is Ho-4

What Type Of Form Is Ho-4 - No matter how the ho4 renters insurance is spelled, it’s still going to do the same thing by insuring a renter’s personal belongings and personal liability. Web the homeowners policy contents broad form 4 (ho 4) is part of the insurance services office, inc. Don’t let that confuse you. They are different types of home insurance policy forms. Typically with these policies, your liability and your personal property are covered up to the policy limits. Web the ho4 home insurance policy is sometimes called a tenant’s form or renters insurance. A rental policy will cover a renters personal property, personal liability, and some of them will cover loss of use. You might be wondering what these terms mean. Typically with these policies, your liability and your personal property are covered up to the policy limits. The ho 4 form insures a tenant for direct damage to unscheduled personal property on a broad named perils basis.

Additional living expenses coverage can help pay for temporary accommodation and meals when you’re displaced from your home following a covered loss. Web the ho4 home insurance policy is sometimes called a tenant’s form or renters insurance. A rental policy will cover a renters personal property, personal liability, and some of them will cover loss of use. Web policy forms for renters. The ho 4 form insures a tenant for direct damage to unscheduled personal property on a broad named perils basis. Typically with these policies, your liability and your personal property are covered up to the policy limits. You might be wondering what these terms mean. Don’t let that confuse you. No matter how the ho4 renters insurance is spelled, it’s still going to do the same thing by insuring a renter’s personal belongings and personal liability. Typically with these policies, your liability and your personal property are covered up to the policy limits.

Web policy forms for renters. They are different types of home insurance policy forms. A rental policy will cover a renters personal property, personal liability, and some of them will cover loss of use. Commonly referred to as renters insurance , this policy form covers personal property in a rented home or apartment. Additional living expenses coverage can help pay for temporary accommodation and meals when you’re displaced from your home following a covered loss. Typically with these policies, your liability and your personal property are covered up to the policy limits. The ho 4 form insures a tenant for direct damage to unscheduled personal property on a broad named perils basis. Web the homeowners policy contents broad form 4 (ho 4) is part of the insurance services office, inc. You might be wondering what these terms mean. Typically with these policies, your liability and your personal property are covered up to the policy limits.

Type 4 HoRo Kards The WWII CCG Wiki Fandom

They are different types of home insurance policy forms. Web the ho4 home insurance policy is sometimes called a tenant’s form or renters insurance. Don’t let that confuse you. No matter how the ho4 renters insurance is spelled, it’s still going to do the same thing by insuring a renter’s personal belongings and personal liability. Commonly referred to as renters.

How do I build my own reports?

You might be wondering what these terms mean. They are different types of home insurance policy forms. No matter how the ho4 renters insurance is spelled, it’s still going to do the same thing by insuring a renter’s personal belongings and personal liability. The ho 4 form insures a tenant for direct damage to unscheduled personal property on a broad.

Ww2 type 4 horo model TurboSquid 1189714

Web policy forms for renters. A rental policy will cover a renters personal property, personal liability, and some of them will cover loss of use. The ho 4 form insures a tenant for direct damage to unscheduled personal property on a broad named perils basis. Typically with these policies, your liability and your personal property are covered up to the.

Type 5 HoTo The Type 5 HoTo is a casemate tank destroyer… Flickr

They are different types of home insurance policy forms. Don’t let that confuse you. Web policy forms for renters. A rental policy will cover a renters personal property, personal liability, and some of them will cover loss of use. You might be wondering what these terms mean.

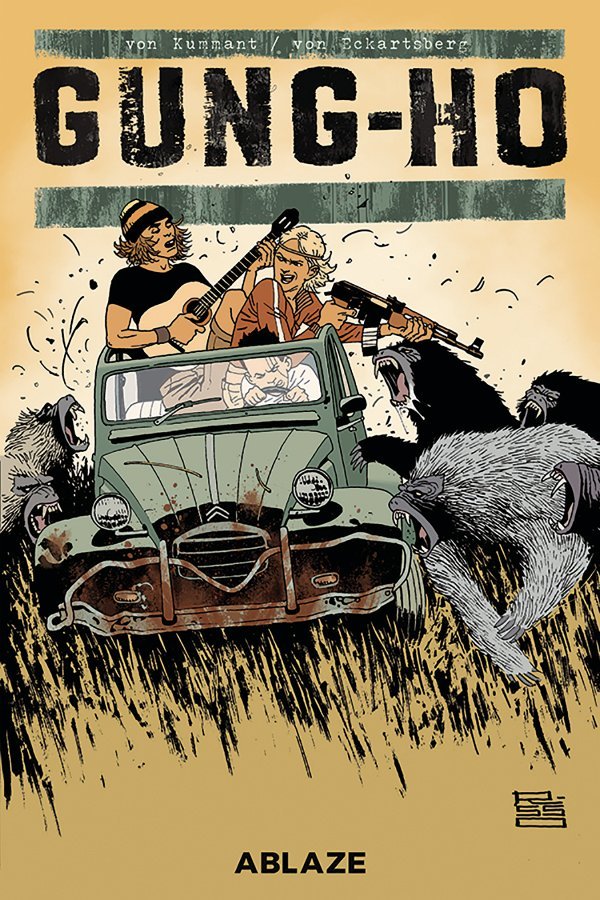

GungHo 4 Cvr A Risso CovrPrice

Don’t let that confuse you. No matter how the ho4 renters insurance is spelled, it’s still going to do the same thing by insuring a renter’s personal belongings and personal liability. Commonly referred to as renters insurance , this policy form covers personal property in a rented home or apartment. Additional living expenses coverage can help pay for temporary accommodation.

Fighting compartment of the only Type 4 HoRo in the world TankPorn

Web policy forms for renters. Additional living expenses coverage can help pay for temporary accommodation and meals when you’re displaced from your home following a covered loss. You might be wondering what these terms mean. Web the homeowners policy contents broad form 4 (ho 4) is part of the insurance services office, inc. Typically with these policies, your liability and.

What Is the Difference Between HO2 and HO3 Homeowners Policies?

You might be wondering what these terms mean. Web policy forms for renters. The ho 4 form insures a tenant for direct damage to unscheduled personal property on a broad named perils basis. Typically with these policies, your liability and your personal property are covered up to the policy limits. No matter how the ho4 renters insurance is spelled, it’s.

Gulumik Military Models Type5 HoTo 1/72

Web the ho4 home insurance policy is sometimes called a tenant’s form or renters insurance. Additional living expenses coverage can help pay for temporary accommodation and meals when you’re displaced from your home following a covered loss. Typically with these policies, your liability and your personal property are covered up to the policy limits. You might be wondering what these.

HO Layout Plan 11 by 12 Double Track Main Line Upper Level Model

Commonly referred to as renters insurance , this policy form covers personal property in a rented home or apartment. Typically with these policies, your liability and your personal property are covered up to the policy limits. Web policy forms for renters. Additional living expenses coverage can help pay for temporary accommodation and meals when you’re displaced from your home following.

Shiny HoOh Pokémon Know Your Meme

Typically with these policies, your liability and your personal property are covered up to the policy limits. You might be wondering what these terms mean. Web the ho4 home insurance policy is sometimes called a tenant’s form or renters insurance. Additional living expenses coverage can help pay for temporary accommodation and meals when you’re displaced from your home following a.

They Are Different Types Of Home Insurance Policy Forms.

The ho 4 form insures a tenant for direct damage to unscheduled personal property on a broad named perils basis. A rental policy will cover a renters personal property, personal liability, and some of them will cover loss of use. Web policy forms for renters. You might be wondering what these terms mean.

Commonly Referred To As Renters Insurance , This Policy Form Covers Personal Property In A Rented Home Or Apartment.

Web the homeowners policy contents broad form 4 (ho 4) is part of the insurance services office, inc. Web the ho4 home insurance policy is sometimes called a tenant’s form or renters insurance. No matter how the ho4 renters insurance is spelled, it’s still going to do the same thing by insuring a renter’s personal belongings and personal liability. Typically with these policies, your liability and your personal property are covered up to the policy limits.

Additional Living Expenses Coverage Can Help Pay For Temporary Accommodation And Meals When You’re Displaced From Your Home Following A Covered Loss.

Don’t let that confuse you. Typically with these policies, your liability and your personal property are covered up to the policy limits.