What Is Form 8959

What Is Form 8959 - Form 8959 is a tax form used to calculate and report the additional medicare tax owed by certain. Ad download or email irs 8959 & more fillable forms, register and subscribe now! The 0.9 percent additional medicare tax applies to. It needs to be completed only by those whose medicare wages are over the established threshold. Use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. For more on this, please call. Web it’s calculated on form 8959 to determining how much additional medicare tax must be withheld by your employer, if any at all. You will carry the amounts to. Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. This tax became effective in 2013 and is reported on form 8959, additional medicare tax.

You will carry the amounts to. Web it’s calculated on form 8959 to determining how much additional medicare tax must be withheld by your employer, if any at all. Ad download or email irs 8959 & more fillable forms, register and subscribe now! Use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. If you had too little tax withheld, or did not pay enough estimated tax, you may owe an estimated tax penalty. Use this form to figure the amount. If filing jointly, you’ll need to add medicare wages,. Web what is the form 8959? Get ready for tax season deadlines by completing any required tax forms today. The 0.9 percent additional medicare tax applies to.

Ad download or email irs 8959 & more fillable forms, register and subscribe now! It needs to be completed only by those whose medicare wages are over the established threshold. Web information about form 8959, additional medicare tax, including recent updates, related forms and instructions on how to file. The 0.9 percent additional medicare tax applies to. Web purpose of form use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Use this form to figure the amount. Web underpayment of estimated tax. Get ready for tax season deadlines by completing any required tax forms today. Web the 8959 form is an application that is used to calculate additional medicare tax. Web what is irs form 8959?

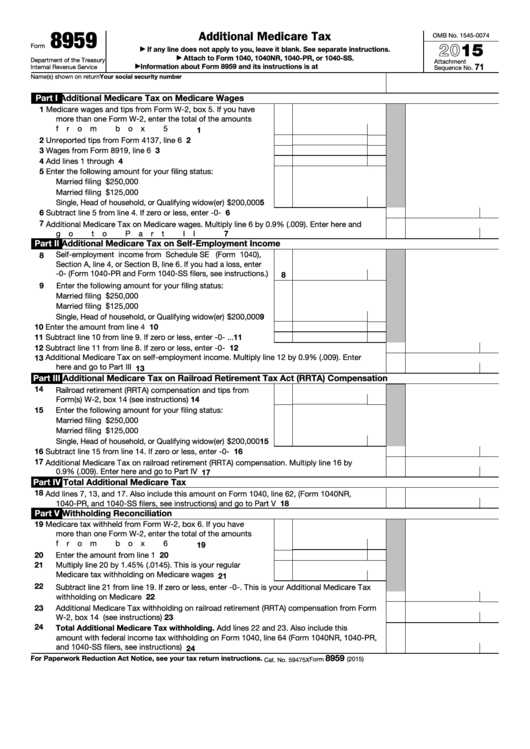

Form 8959 Additional Medicare Tax (2014) Free Download

Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Web purpose of form use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. For more on.

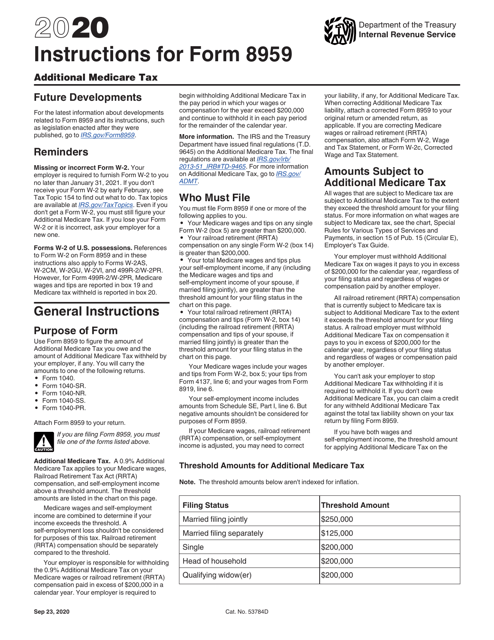

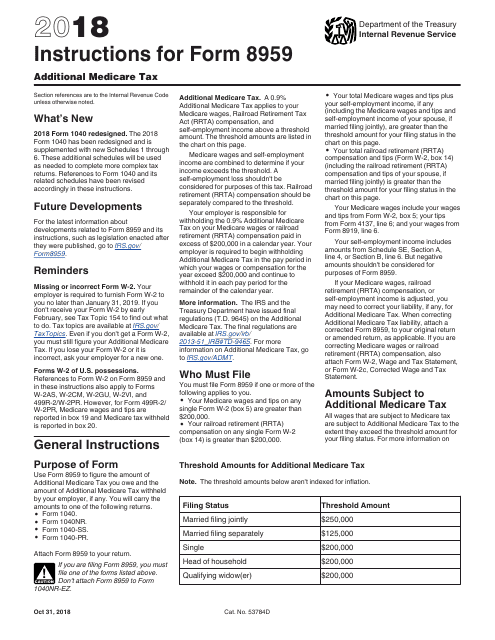

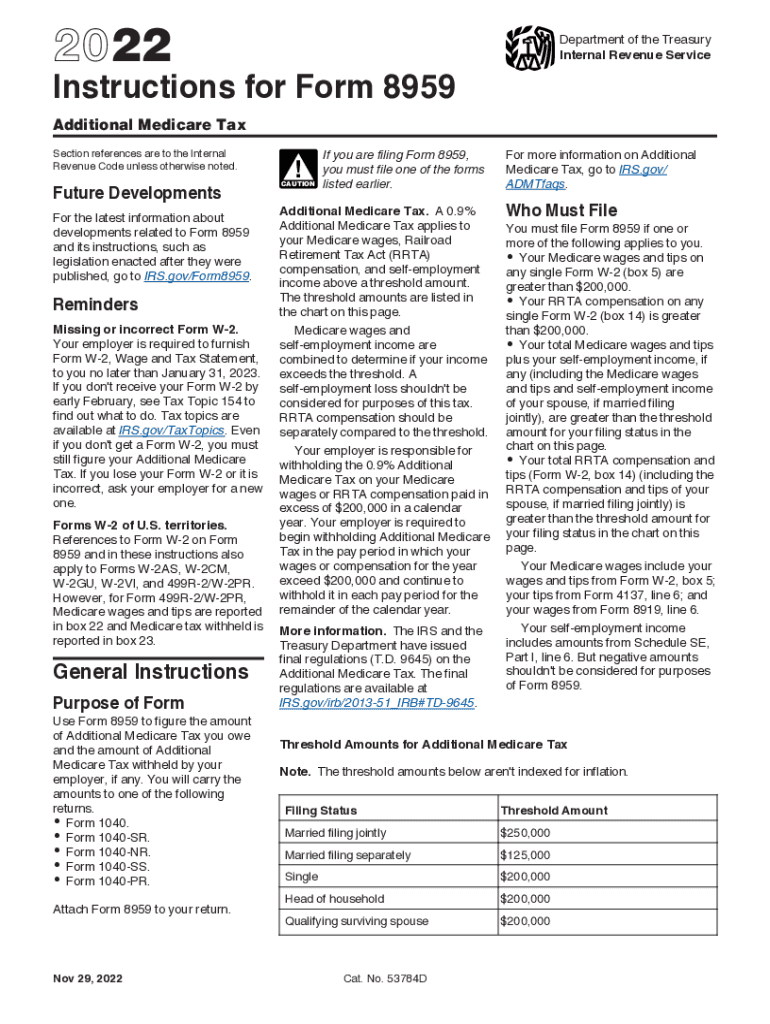

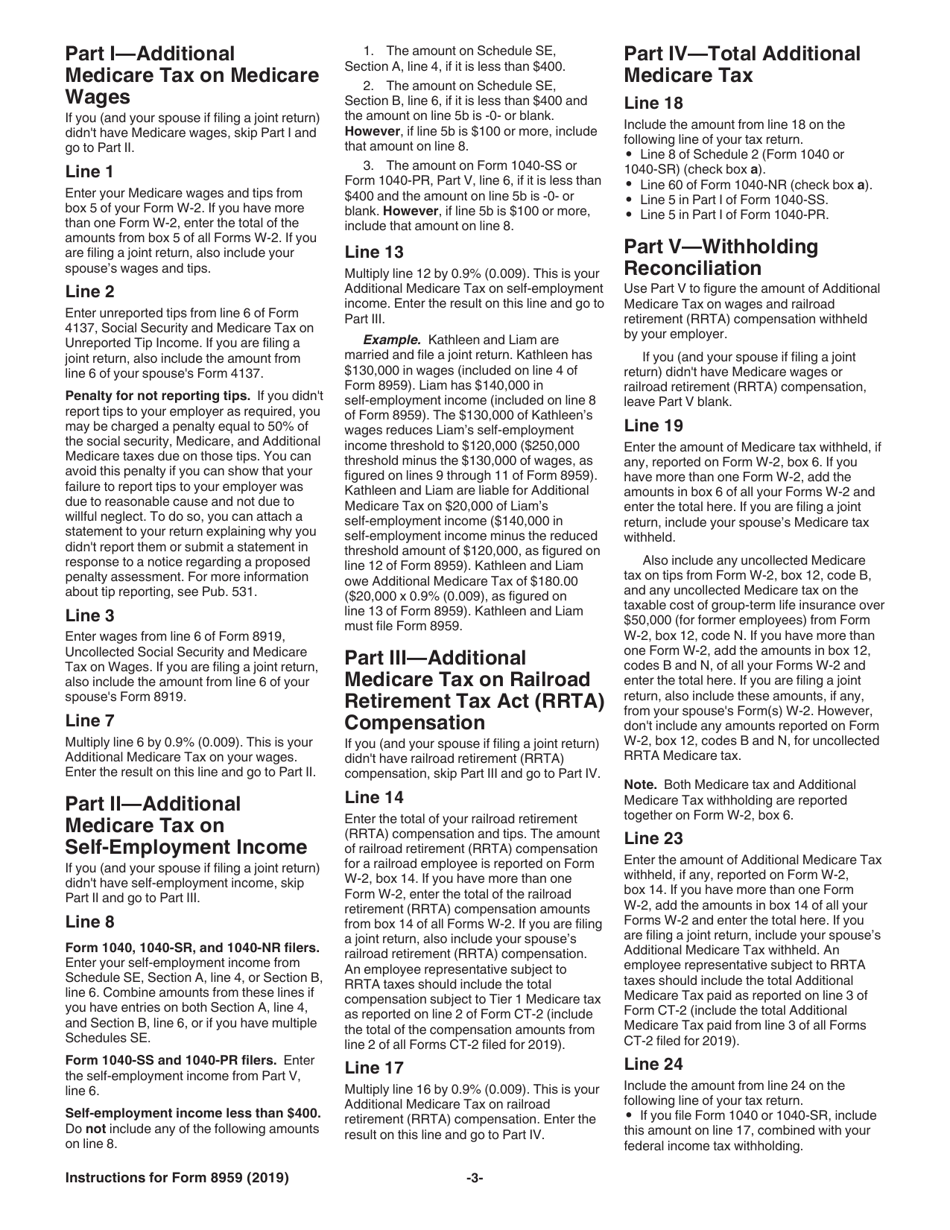

Download Instructions for IRS Form 8959 Additional Medicare Tax PDF

Get ready for tax season deadlines by completing any required tax forms today. Web form 8959 department of the treasury internal revenue service. Web what is the additional medicare tax? Web it’s calculated on form 8959 to determining how much additional medicare tax must be withheld by your employer, if any at all. Web the 8959 form is an application.

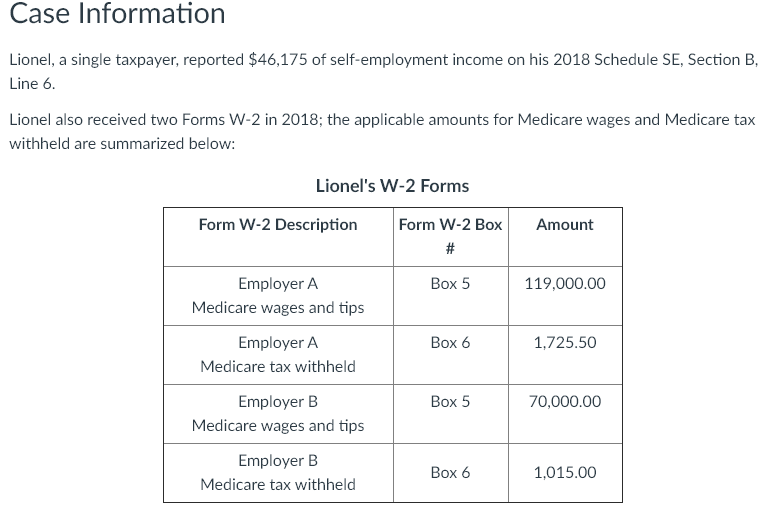

Solved Case Information Lionel, a single taxpayer, reported

Web the 8959 form is an application that is used to calculate additional medicare tax. It needs to be completed only by those whose medicare wages are over the established threshold. Web information about form 8959, additional medicare tax, including recent updates, related forms and instructions on how to file. Ad download or email irs 8959 & more fillable forms,.

Download Instructions for IRS Form 8959 Additional Medicare Tax PDF

Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. Web what is irs form.

2022 Form IRS 8959 Instructions Fill Online, Printable, Fillable

Use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. If filing jointly, you’ll need to add medicare wages,. Web form 8959 department of the treasury internal revenue service. Use this form to figure the amount. Ad download or email irs 8959 & more.

Download Instructions for IRS Form 8959 Additional Medicare Tax PDF

Upload, modify or create forms. Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. It needs to be completed only by those whose medicare wages are over the established threshold. Web form 8959 department of the treasury internal revenue service. If filing.

1099 Misc Fillable Form Free amulette

Ad download or email irs 8959 & more fillable forms, register and subscribe now! For more on this, please call. Web beginning with the 2013 tax year, you have to file form 8959 if the medicare wages or rrta reported exceed $200,000 for single filers or $250,000 for joint filers. Web purpose of form use form 8959 to figure the.

Fillable Form 8959 Additional Medicare Tax 2015 printable pdf download

Web underpayment of estimated tax. Web what is the form 8959? Form 8959 is a tax form used to calculate and report the additional medicare tax owed by certain. Web beginning with the 2013 tax year, you have to file form 8959 if the medicare wages or rrta reported exceed $200,000 for single filers or $250,000 for joint filers. For.

수질배출시설 및 방지시설의가동개시신고 샘플, 양식 다운로드

Upload, modify or create forms. Web what is irs form 8959? Try it for free now! Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. For more on this, please call.

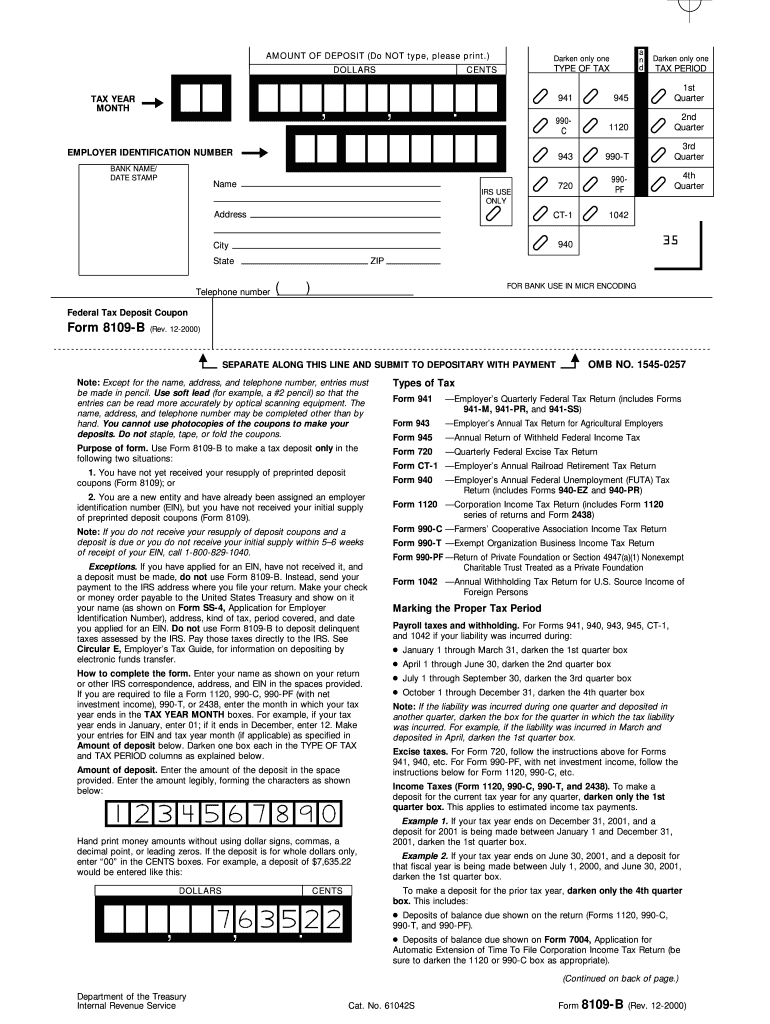

Form 8109 Fill Out and Sign Printable PDF Template signNow

Web it’s calculated on form 8959 to determining how much additional medicare tax must be withheld by your employer, if any at all. Web form 8959 department of the treasury internal revenue service. Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any..

Web Form 8959 Is Used To Calculate The Amount Of Additional Medicare Tax Owed And The Amount Of Additional Medicare Tax Withheld By A Taxpayer’s Employer, If Any.

Web what is the additional medicare tax? Get ready for tax season deadlines by completing any required tax forms today. Web underpayment of estimated tax. This tax became effective in 2013 and is reported on form 8959, additional medicare tax.

Web It’s Calculated On Form 8959 To Determining How Much Additional Medicare Tax Must Be Withheld By Your Employer, If Any At All.

If filing jointly, you’ll need to add medicare wages,. For more on this, please call. Web information about form 8959, additional medicare tax, including recent updates, related forms and instructions on how to file. Form 8959 is a tax form used to calculate and report the additional medicare tax owed by certain.

Web What Is The Form 8959?

Upload, modify or create forms. Ad download or email irs 8959 & more fillable forms, register and subscribe now! Use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Use this form to figure the amount.

The 0.9 Percent Additional Medicare Tax Applies To.

Web what is irs form 8959? Web irs form 8959, additional medicare tax, is the federal form that high earners must file with their income tax return to reconcile the following: If you had too little tax withheld, or did not pay enough estimated tax, you may owe an estimated tax penalty. Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any.