What Is Form 8804

What Is Form 8804 - Web form 8804, annual return for partnership withholding tax (section 1446) specifically is used to report the total liability under section 1446 for the. Web use this section to force the effectively connected taxable income allocable to foreign partners and to enter reductions to effectively connected taxable income for form 8804,. Form 8804, annual return for partnership withholding tax (section 1446), form 8805, foreign partner’s information statement of. Web use form 8804 to report the total liability under section 1446 for the partnership's tax year. Web form 8804 is also a transmittal form for forms 8805. This form is also a transmittal one for form 8805. Web form 8804 is filed separately from the form 1065, u.s. Web forms 8804, 8805, and 8813: Web form 8804 summarizes any form 8805 you sent to your foreign partners, even if you didn’t withhold taxes. Web the 8804 form is also known as annual return for partnership withholding tax.

Web 8804 annual return for partnership withholding tax form 8804 department of the treasury internal revenue service annual return for partnership withholding tax (section 1446). Web form 8804 summarizes any form 8805 you sent to your foreign partners, even if you didn’t withhold taxes. This form is also a transmittal one for form 8805. Web form 7204, consent to extend the time to assess tax related to contested foreign income taxes—provisional foreign tax credit agreement. Web the 8804 form is also known as annual return for partnership withholding tax. Web form 4868, also known as an “application for automatic extension of time to file u.s. It is covered by section 1446 internal revenue code, created by the department of the treasury. Form 8804 is also a transmittal form for form(s) 8805. Web forms 8804, 8805, and 8813: Web form 8804 is filed separately from the form 1065, u.s.

Web form 8804, annual return for partnership withholding tax (section 1446) (online) title form 8804, annual return for partnership withholding tax (section 1446) [electronic resource]. Use form 8805 to show the. Individual income tax return,” is a form that taxpayers can file with the irs if. This form is also a transmittal one for form 8805. Web form 7204, consent to extend the time to assess tax related to contested foreign income taxes—provisional foreign tax credit agreement. Web form 8804 is filed separately from the form 1065, u.s. Web forms 8804, 8805, and 8813: Any additional withholding tax owed for the partnership's tax year is paid (in u. Web use form 8804 to report the total liability under section 1446 for the partnership's tax year. Web form 8804 summarizes any form 8805 you sent to your foreign partners, even if you didn’t withhold taxes.

2019 8804 2019 Blank Sample to Fill out Online in PDF

Individual income tax return,” is a form that taxpayers can file with the irs if. It is covered by section 1446 internal revenue code, created by the department of the treasury. This form is also a transmittal one for form 8805. Web form 4868, also known as an “application for automatic extension of time to file u.s. Any additional withholding.

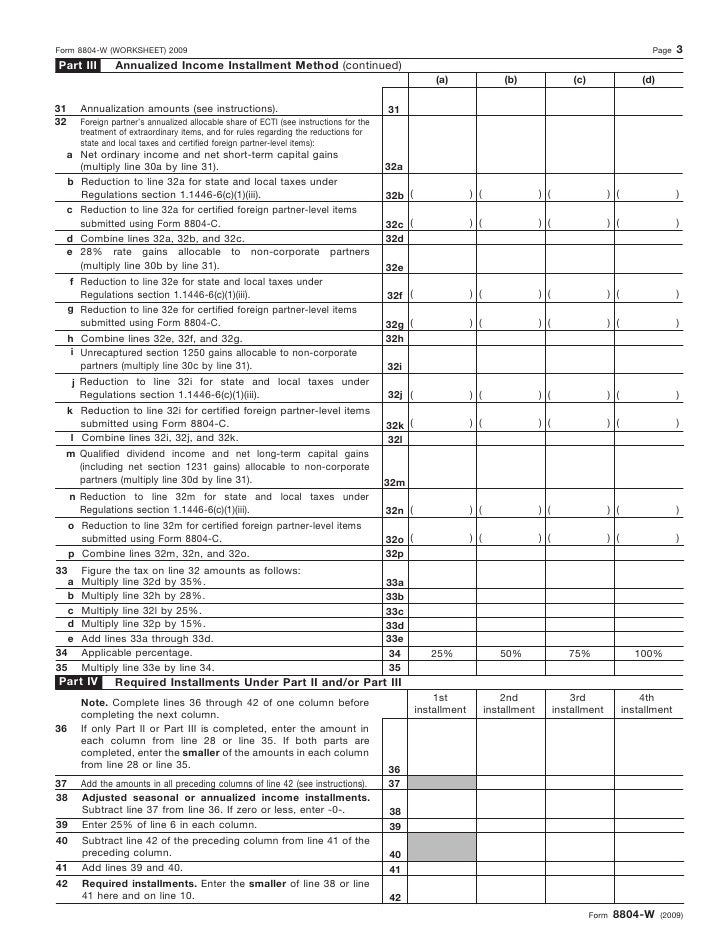

Form 8804W Installment Payments of Section 1446 Tax for Partnership…

It is covered by section 1446 internal revenue code, created by the department of the treasury. Web form 7204, consent to extend the time to assess tax related to contested foreign income taxes—provisional foreign tax credit agreement. Form 8804, annual return for partnership withholding tax (section 1446), form 8805, foreign partner’s information statement of. Web form 4868, also known as.

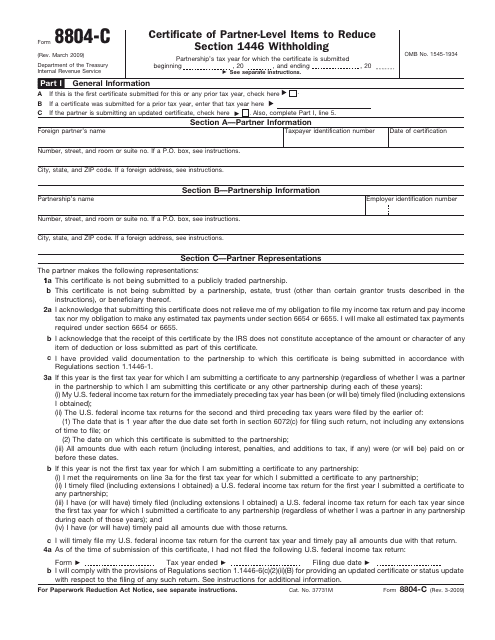

IRS Form 8804C Download Fillable PDF or Fill Online Certificate of

Web 8804 annual return for partnership withholding tax form 8804 department of the treasury internal revenue service annual return for partnership withholding tax (section 1446). Web forms 8804, 8805, and 8813: Use form 8805 to show the. Web use this section to force the effectively connected taxable income allocable to foreign partners and to enter reductions to effectively connected taxable.

Form 8804C Certificate of PartnerLevel Items to Reduce Section 1446

Any additional withholding tax owed for the partnership's tax year is paid (in u. Web form 7204, consent to extend the time to assess tax related to contested foreign income taxes—provisional foreign tax credit agreement. Web 8804 annual return for partnership withholding tax form 8804 department of the treasury internal revenue service annual return for partnership withholding tax (section 1446)..

Form 8804 Annual Return for Partnership Withholding Tax

Web form 8804, annual return for partnership withholding tax (section 1446) specifically is used to report the total liability under section 1446 for the. This form is also a transmittal one for form 8805. Web forms 8804, 8805, and 8813: Any additional withholding tax owed for the partnership's tax year is paid (in u. Use form 8805 to show the.

3.21.15 Withholding on Foreign Partners Internal Revenue Service

Web 8804 annual return for partnership withholding tax form 8804 department of the treasury internal revenue service annual return for partnership withholding tax (section 1446). Web form 8804 is utilized to report the partnership’s total liability for the tax year as stipulated in section 1446. Web form 8804, annual return for partnership withholding tax (section 1446) specifically is used to.

Form 8804 (Schedule A) Penalty for Underpayment of Estimated Section…

Web 8804 annual return for partnership withholding tax form 8804 department of the treasury internal revenue service annual return for partnership withholding tax (section 1446). Form 8804 is also a transmittal form for form(s) 8805. Web use this section to force the effectively connected taxable income allocable to foreign partners and to enter reductions to effectively connected taxable income for.

Form 8804 (Schedule A) Penalty for Underpayment of Estimated Section…

Form 8804 is also a transmittal form for form(s) 8805. Web use form 8804 to report the total liability under section 1446 for the partnership's tax year. Web form 8804 summarizes any form 8805 you sent to your foreign partners, even if you didn’t withhold taxes. Web form 8804 is also a transmittal form for forms 8805. Individual income tax.

Form 8804 (Schedule A) Penalty for Underpayment of Estimated Section…

Web form 7204, consent to extend the time to assess tax related to contested foreign income taxes—provisional foreign tax credit agreement. Web form 8804 is a tax form used by partnerships with foreign partners to report and pay their share of effectively connected taxable income (ecti). Partnership or the foreign partners of a foreign partnership with. Any additional withholding tax.

Form 8804C Certificate of PartnerLevel Items to Reduce Section 1446

Partnership or the foreign partners of a foreign partnership with. Web form 8804 is an annual summary statement of the various forms 8805 that are sent to the foreign partners of a u.s. Individual income tax return,” is a form that taxpayers can file with the irs if. Web form 7204, consent to extend the time to assess tax related.

Form 8804 Is Also A Transmittal Form For Form(S) 8805.

Withholding tax must be paid on foreign partners’ share. Form 8804, annual return for partnership withholding tax (section 1446), form 8805, foreign partner’s information statement of. Any additional withholding tax owed for the partnership's tax year is paid (in u. Web form 8804 is filed separately from the form 1065, u.s.

Use Form 8805 To Show The.

Web the 8804 form is also known as annual return for partnership withholding tax. Individual income tax return,” is a form that taxpayers can file with the irs if. Web form 8804, annual return for partnership withholding tax (section 1446) specifically is used to report the total liability under section 1446 for the. Web 8804 annual return for partnership withholding tax form 8804 department of the treasury internal revenue service annual return for partnership withholding tax (section 1446).

Web Use Form 8804 To Report The Total Liability Under Section 1446 For The Partnership's Tax Year.

Web form 8804 is also a transmittal form for forms 8805. Web forms 8804, 8805, and 8813: It is covered by section 1446 internal revenue code, created by the department of the treasury. Partnership or the foreign partners of a foreign partnership with.

Web Form 8804 Is A Tax Form Used By Partnerships With Foreign Partners To Report And Pay Their Share Of Effectively Connected Taxable Income (Ecti).

Web form 8804 is utilized to report the partnership’s total liability for the tax year as stipulated in section 1446. Web form 8804 summarizes any form 8805 you sent to your foreign partners, even if you didn’t withhold taxes. Web form 4868, also known as an “application for automatic extension of time to file u.s. This form is also a transmittal one for form 8805.