What Is Form 7200

What Is Form 7200 - Treasury security for a foreign person. 'cheeky' verstappen toys with rivals as title looms. Web paid preparer just follow the instructions below to complete and file your form 7200 successfully to the irs. Web file form 7200 if you can’t reduce your employment tax deposits to fully account for these credits that you expect to claim on your employment tax return for the applicable quarter. Web what is irs form 7200? Name, ein, and address 2. Who can file form 7200? Irs form 7200 allows employers to request an advanced payment of their employee retention credit. Web the purpose of this form 7200 irs is to make the process of filing taxes easier for the taxpayer. Web what is form 7200?

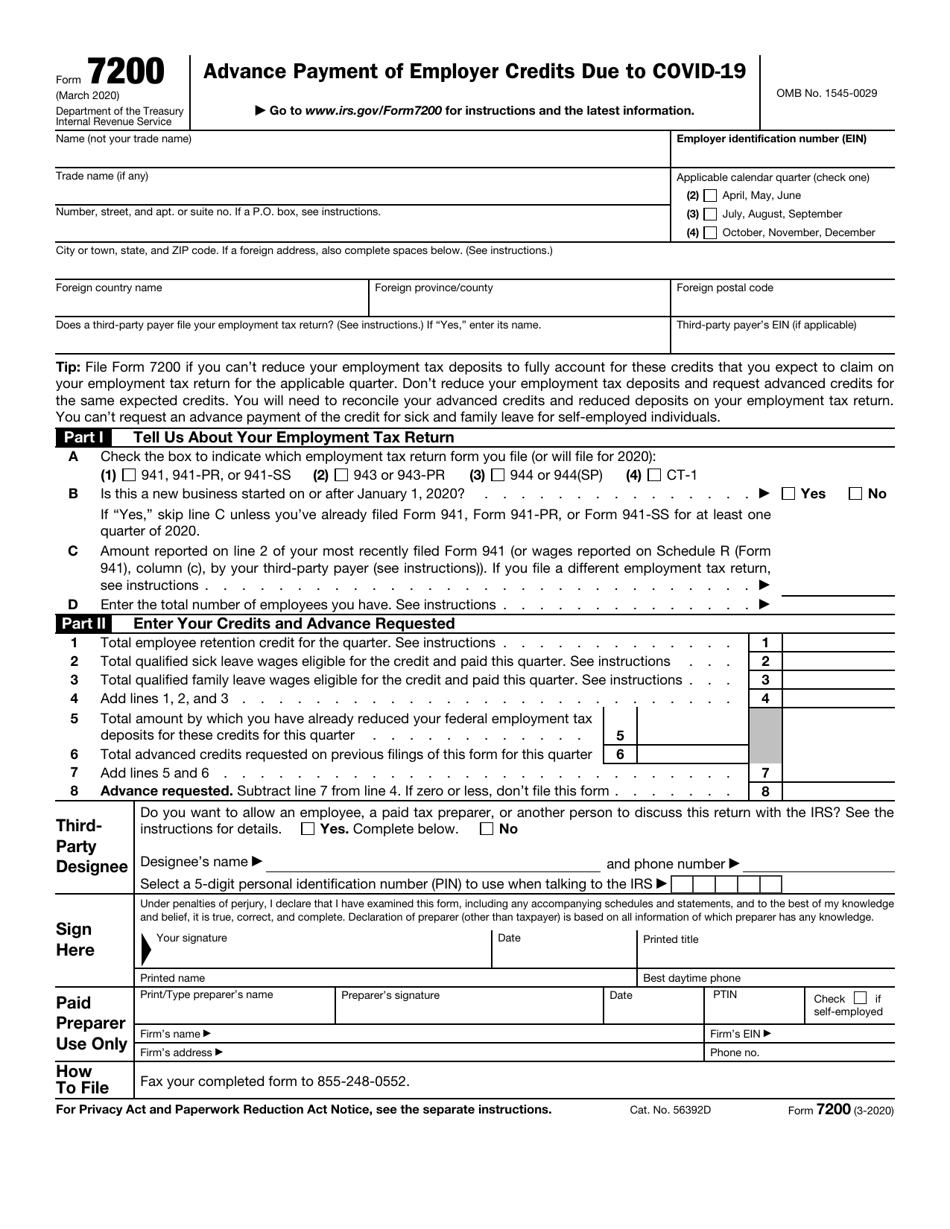

Web form 7200 is an official irs document that allows employers to request advance payment on employer credits for: Don’t reduce your employment tax deposits and request advanced credits for the same expected credits. Web paid preparer just follow the instructions below to complete and file your form 7200 successfully to the irs. Web form 7200 is used by eligible employers and small employers to request advance payment of the employee retention credit and the ffcra credits that an employer claims on employment tax returns such as form 941, employers quarterly federal tax return. 'cheeky' verstappen toys with rivals as title looms. Web what is form 7200? When employers deduct these credits from their deposits in anticipation of these credits. Form 7200 remains on irs.gov only as a historical item at www.irs.gov/allforms. Web what is irs form 7200? Add / subtract a percentage.

Web how to write 7200 in standard form. Don’t reduce your employment tax deposits and request advanced credits for the same expected credits. Form 7200 covers claims on different employment tax returns, including quarterly employment tax, form 941, and employer relief credits on qualified sick and family leave. Web paid preparer just follow the instructions below to complete and file your form 7200 successfully to the irs. Web the purpose of this form 7200 irs is to make the process of filing taxes easier for the taxpayer. Percentage (% of) percentage change. (form 7200, instructions) delay in processing advance payments. For instructions and the latest information. Max verstappen is toying with. There are two reasons why taxpayers would need to complete this 7200 form.

File Form 7200 (Advance Payment of Employer Credits Due to COVID19

Add / subtract a percentage. Who can file form 7200? Percentage (% of) percentage change. Don’t reduce your employment tax deposits and request advanced credits for the same expected credits. Web the purpose of this form 7200 irs is to make the process of filing taxes easier for the taxpayer.

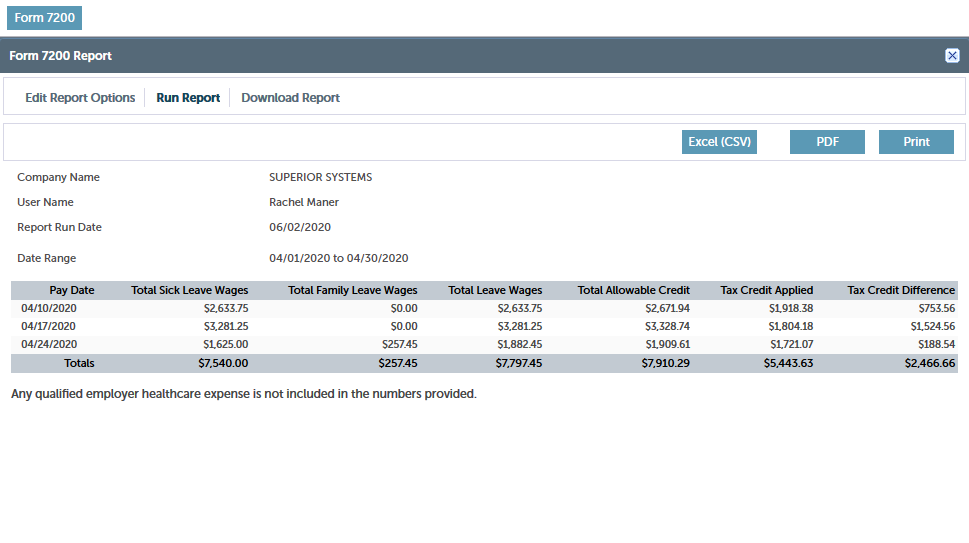

APS Releases Form 7200 Report, COVID19 Credits APS Payroll

Web after he led luton back to the top flight, bbc sport talks to those who have played under manager rob edwards. Form 7200 remains on irs.gov only as a historical item at www.irs.gov/allforms. Qualified sick and family leave wages. (form 7200, instructions) delay in processing advance payments. Web how to write 7200 in standard form.

IRS Form 7200 Download Fillable PDF or Fill Online Advance Payment of

'cheeky' verstappen toys with rivals as title looms. There are two reasons why taxpayers would need to complete this 7200 form. Percentage (% of) percentage change. Web file form 7200 if you can’t reduce your employment tax deposits to fully account for these credits that you expect to claim on your employment tax return for the applicable quarter. When employers.

IRS Form 7200 Advance of Employer Credits Due to COVID19

Add / subtract a percentage. Max verstappen is toying with. Web what is form 7200? For instructions and the latest information. Form 7200 covers claims on different employment tax returns, including quarterly employment tax, form 941, and employer relief credits on qualified sick and family leave.

Avoid These Common Mistakes When Filing Your IRS Form 7200 Blog

Max verstappen is toying with. Name, ein, and address 2. Web how to write 7200 in standard form. Add / subtract a percentage. For instructions and the latest information.

StepbyStep Guide Form 7200 Advance Employment Credits BerniePortal

For instructions and the latest information. Irs form 7200 allows employers to request an advanced payment of their employee retention credit. Web what is irs form 7200? 'cheeky' verstappen toys with rivals as title looms. Web form 7200 is used by eligible employers and small employers to request advance payment of the employee retention credit and the ffcra credits that.

Why File Form 7200? How Does This Form Work? Blog TaxBandits

Web how to write 7200 in standard form. Form 7200 covers claims on different employment tax returns, including quarterly employment tax, form 941, and employer relief credits on qualified sick and family leave. Web after he led luton back to the top flight, bbc sport talks to those who have played under manager rob edwards. Name, ein, and address 2..

IRS Form 7200 2022 IRS Forms

Credits and advance request details click here to learn more about form 7200 line by line instructions get started now! Web after he led luton back to the top flight, bbc sport talks to those who have played under manager rob edwards. Web what is irs form 7200? Treasury security for a foreign person. For instructions and the latest information.

How to file Form 7200? YouTube

Irs form 7200 allows employers to request an advanced payment of their employee retention credit. Web the purpose of this form 7200 irs is to make the process of filing taxes easier for the taxpayer. Add / subtract a percentage. 'cheeky' verstappen toys with rivals as title looms. Web form 7200 is used by eligible employers and small employers to.

What Is The Form 7200, How Do I File It? Blog TaxBandits

Department of the treasury internal revenue service. Max verstappen is toying with. Credits and advance request details click here to learn more about form 7200 line by line instructions get started now! Web what is irs form 7200? Qualified sick and family leave wages.

Web The Purpose Of This Form 7200 Irs Is To Make The Process Of Filing Taxes Easier For The Taxpayer.

(form 7200, instructions) delay in processing advance payments. Qualified sick and family leave wages. Web what is form 7200? Department of the treasury internal revenue service.

Web How To Write 7200 In Standard Form.

Form 7200 covers claims on different employment tax returns, including quarterly employment tax, form 941, and employer relief credits on qualified sick and family leave. Form 7200 remains on irs.gov only as a historical item at www.irs.gov/allforms. Don’t reduce your employment tax deposits and request advanced credits for the same expected credits. Web what is form 7200?

Web What Is Irs Form 7200?

Web after he led luton back to the top flight, bbc sport talks to those who have played under manager rob edwards. The first is if the ratepayer bought a u.s. Max verstappen is toying with. Web form 7200 is used by eligible employers and small employers to request advance payment of the employee retention credit and the ffcra credits that an employer claims on employment tax returns such as form 941, employers quarterly federal tax return.

'Cheeky' Verstappen Toys With Rivals As Title Looms.

Add / subtract a percentage. Percentage (% of) percentage change. There are two reasons why taxpayers would need to complete this 7200 form. Treasury security for a foreign person.