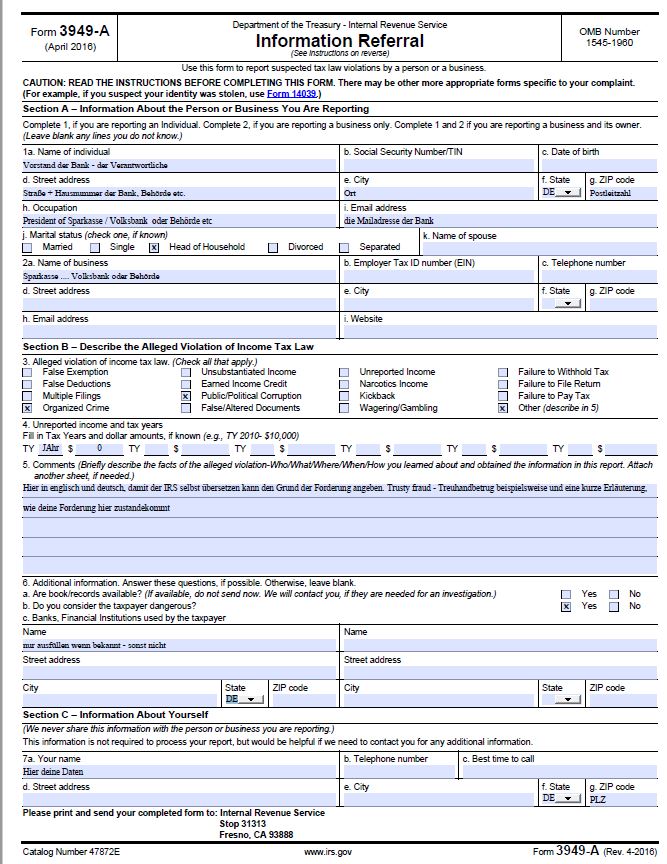

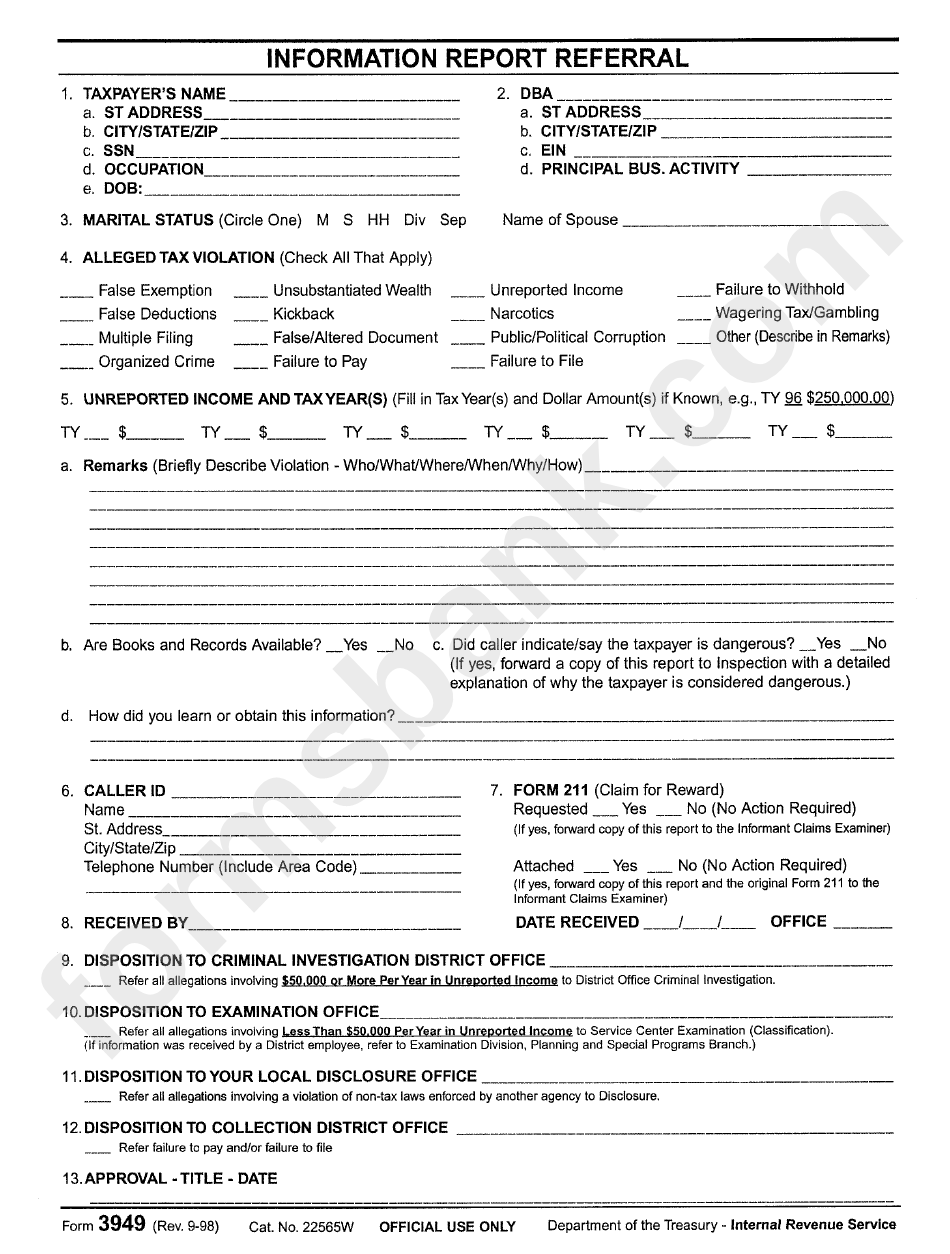

What Is Form 3949-A

What Is Form 3949-A - The irs never does anything in 30 days (unless you don't want them to do something!) you have done your duty and there is nothing more you can do with the irs. Complete, edit or print tax forms instantly. The form is known as an informational referral, and it will be used by citizens to report any instances of suspected tax fraud in the country. Information about the person or business you are reporting The form includes information such as the taxpayer's name and contact details, the nature of the offense, and whether or not law enforcement considers the taxpayer dangerous. Use this form to report suspected tax law violations by a person or a business. Select the button get form to open it and begin modifying. Fill in all necessary fields in your file with our advanced pdf editor. Ad access irs tax forms. Read the instructions before completing this form.

My child father has not filed taxes in the last 5+ years, he is also making almost $20,000 a month under the table. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. The document’s structure is straightforward. Social security number (ssn) d. Read the instructions before completing this form. Information about the person or business you are reporting So, whether a business or an individual is allegedly attempting to violate tax laws, the form is a simple way to report it. Web posted on sep 13, 2013 selected as best answer attorney cohen's response is as correct as it is hysterical! Make sure about the correctness of.

Related tax forms what do you think? Web the form represents an easy way to report if someone (whether an entity or a person) is allegedly trying to breach the tax legislation. However, if money was stolen, why not call the local authorities? And many are also using the form for something other than. Select the button get form to open it and begin modifying. My child father has not filed taxes in the last 5+ years, he is also making almost $20,000 a month under the table. If you suspect anyone of tax fraud, you will need to report the following: Provide as much information as you know about the person or business you are reporting. The form includes information such as the taxpayer's name and contact details, the nature of the offense, and whether or not law enforcement considers the taxpayer dangerous. Web how it works open the 3949a and follow the instructions easily sign the form 3949 a with your finger send filled & signed 3949 a form or save rate the form 3949a 4.7 satisfied 151 votes handy tips for filling out 3949a form online printing and scanning is no longer the best way to manage documents.

Printable Irs Form 3949 A Master of Documents

Web the form represents an easy way to report if someone (whether an entity or a person) is allegedly trying to breach the tax legislation. The document’s structure is straightforward. The irs never does anything in 30 days (unless you don't want them to do something!) you have done your duty and there is nothing more you can do with.

IRS Form 3949A Wiensworld

Information about the person or business you are reporting Ad access irs tax forms. Make sure about the correctness of. Web the form represents an easy way to report if someone (whether an entity or a person) is allegedly trying to breach the tax legislation. Read the instructions before completing this form.

Print Form 3949 A Fill Online, Printable, Fillable, Blank pdfFiller

Web how it works open the 3949a and follow the instructions easily sign the form 3949 a with your finger send filled & signed 3949 a form or save rate the form 3949a 4.7 satisfied 151 votes handy tips for filling out 3949a form online printing and scanning is no longer the best way to manage documents. Download past year.

Form 8849 Edit, Fill, Sign Online Handypdf

The form includes information such as the taxpayer's name and contact details, the nature of the offense, and whether or not law enforcement considers the taxpayer dangerous. Ad access irs tax forms. Read the instructions before completing this form. Social security number (ssn) d. Provide as much information as you know about the person or business you are reporting.

irs form 3949a 2022 Fill Online, Printable, Fillable Blank form

My child father has not filed taxes in the last 5+ years, he is also making almost $20,000 a month under the table. Child father getting paid under the table. Related tax forms what do you think? Use this form to report suspected tax law violations by a person or a business. If you wish to report tax violations that.

2013 Form IRS 3949A Fill Online, Printable, Fillable, Blank pdfFiller

My child father has not filed taxes in the last 5+ years, he is also making almost $20,000 a month under the table. My question is, if i file a 3949a. Complete, edit or print tax forms instantly. Read the instructions before completing this form. Make sure about the correctness of.

Form 3949 Information Report Referral Department Of The Tressury

Complete, edit or print tax forms instantly. So, whether a business or an individual is allegedly attempting to violate tax laws, the form is a simple way to report it. Select the button get form to open it and begin modifying. Read the instructions before completing this form. Related tax forms what do you think?

Form 3949A Information Referral (2014) Free Download

Web how it works open the 3949a and follow the instructions easily sign the form 3949 a with your finger send filled & signed 3949 a form or save rate the form 3949a 4.7 satisfied 151 votes handy tips for filling out 3949a form online printing and scanning is no longer the best way to manage documents. Get ready for.

Form 3949A Information Referral (2014) Free Download

The form includes information such as the taxpayer's name and contact details, the nature of the offense, and whether or not law enforcement considers the taxpayer dangerous. Complete if you are reporting an individual. Provide as much information as you know about the person or business you are reporting. The document’s structure is straightforward. Web the form represents an easy.

Form 3949A Information Referral (2014) Free Download

We don't take tax law violation referrals over the phone. Read the instructions before completing this form. If you suspect anyone of tax fraud, you will need to report the following: Web the form represents an easy way to report if someone (whether an entity or a person) is allegedly trying to breach the tax legislation. Social security number (ssn).

Download Past Year Versions Of This Tax Form As Pdfs Here:

Social security number (ssn) d. The form is known as an informational referral, and it will be used by citizens to report any instances of suspected tax fraud in the country. Related tax forms what do you think? Web posted on sep 13, 2013 selected as best answer attorney cohen's response is as correct as it is hysterical!

Complete, Edit Or Print Tax Forms Instantly.

However, if money was stolen, why not call the local authorities? Complete if you are reporting an individual. The document’s structure is straightforward. Make sure about the correctness of.

Web How It Works Open The 3949A And Follow The Instructions Easily Sign The Form 3949 A With Your Finger Send Filled & Signed 3949 A Form Or Save Rate The Form 3949A 4.7 Satisfied 151 Votes Handy Tips For Filling Out 3949A Form Online Printing And Scanning Is No Longer The Best Way To Manage Documents.

If you suspect anyone of tax fraud, you will need to report the following: So, whether a business or an individual is allegedly attempting to violate tax laws, the form is a simple way to report it. Information about the person or business you are reporting The form includes information such as the taxpayer's name and contact details, the nature of the offense, and whether or not law enforcement considers the taxpayer dangerous.

The Form Has Been Previously Available For Use To Anonymously Report Fraud And Has Now Been Earmarked To.

Read the instructions before completing this form. Provide as much information as you know about the person or business you are reporting. A form that a law enforcement official may file with the irs to receive information on someone alleged to have violated tax laws. The irs never does anything in 30 days (unless you don't want them to do something!) you have done your duty and there is nothing more you can do with the irs.