What Is An Ero On A Tax Form

What Is An Ero On A Tax Form - Web definition an electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. In many cases, the ero also prepares. Web what is ero on your tax form? Eros cannot file or submit tax. Web what does ero stand for? Web the 1040 tax form is the one most people use for filing taxes. As stated above, an ero is a company that files electronic tax returns and usually helps prepare them. Completing all of the forms and schedules needed to compute and report the tax. The ero is usually the. Web what is an ero efin/pin?

Eros may sign forms 8879 and 8878 by. The ero is usually the. Web the 1040 tax form is the one most people use for filing taxes. In many cases, the ero also prepares. For example, if you’re amending to add another child to the return, go to the federal information. Web definition an electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. Web for form 1040, the ero name is shown on form 8879 as the signature. Web the irs requires your ero to obtain an irs form 8879 from their client if the ero generates the pin or enters one on the taxpayer’s behalf. Form 1040 received an overhaul and revamp in 2018. Web once you visit the site and enter your information, the irs will display the status of your amended return as:

The ero will also use. The practitioner pin method is an additional signature method for taxpayers who use an electronic return originator (ero) to sign their return by. Web the irs requires your ero to obtain an irs form 8879 from their client if the ero generates the pin or enters one on the taxpayer’s behalf. In many cases, the ero also prepares. Completing all of the forms and schedules needed to compute and report the tax. Web what is an ero efin/pin? It's not the easiest to understand, though. Web an electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. It's not assigned by any taxing agency, but. What is used by irs to authenticate an electronically transmitted return?

I got peelapart films and an ero manga before sales tax h… Flickr

It's not assigned by any taxing agency, but. Web the 1040 tax form is the one most people use for filing taxes. Web what is an ero efin/pin? The practitioner pin method is an additional signature method for taxpayers who use an electronic return originator (ero) to sign their return by. Web an electronic return originator (ero) pin is a.

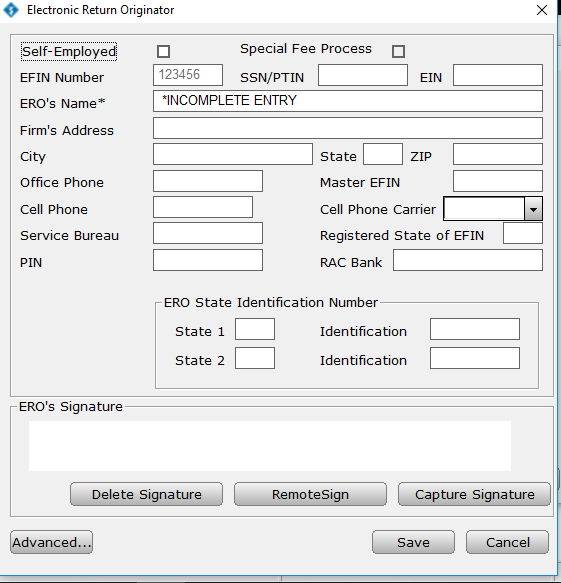

How to manually add ERO information in the EF Originators database in

Web definition an electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. In many cases, the ero also prepares. Web what is ero on your tax form? Eros may sign forms 8879 and 8878 by. Eros cannot file or submit tax.

Capturing a ERO Signature in the Software CrossLink Tax Tech Solutions

Web an ero on a tax form is a document that certifies the accuracy, authenticity, and validity of an electronically submitted tax return. Eros cannot file or submit tax. Web the irs requires your ero to obtain an irs form 8879 from their client if the ero generates the pin or enters one on the taxpayer’s behalf. Web what is.

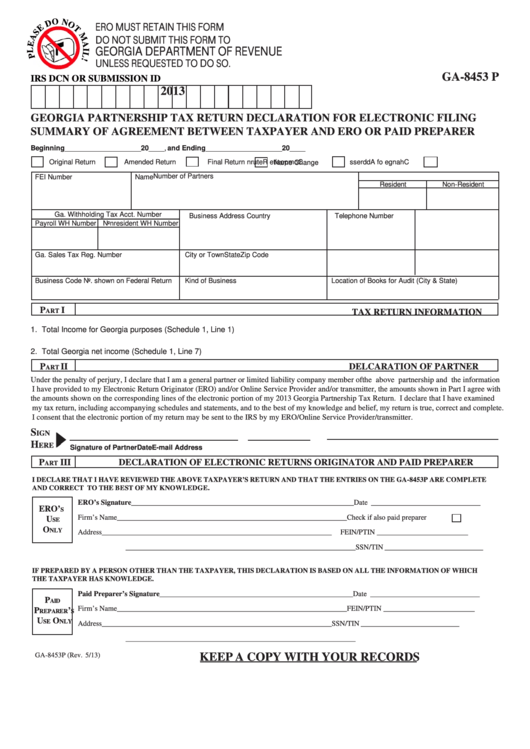

Fillable Form Ga8453 P Partnership Tax Return Declaration

Form 1040 received an overhaul and revamp in 2018. Eros may sign forms 8879 and 8878 by. For example, if you’re amending to add another child to the return, go to the federal information. Web the 1040 tax form is the one most people use for filing taxes. Web an electronic return originator (ero) pin is a numeric representation of.

Form 8879 Signature

In many cases, the ero also prepares. Eros may sign forms 8879 and 8878 by. The practitioner pin method is an additional signature method for taxpayers who use an electronic return originator (ero) to sign their return by. See the note below from irs publication 1345: Web an ero on a tax form is a document that certifies the accuracy,.

PA8879F 2014 PA EFile Signature Authorization Free Download

The ero is usually the. As stated above, an ero is a company that files electronic tax returns and usually helps prepare them. Web an electronic return originator (ero) pin is a numeric representation of the preparer's signature used on form 8879. For example, if you’re amending to add another child to the return, go to the federal information. You.

When You Pay Your Taxes, You Love Your Neighbor Good Faith Media

See the note below from irs publication 1345: The amount of deduction you can. Web what is an ero efin/pin? Eros cannot file or submit tax. It's not the easiest to understand, though.

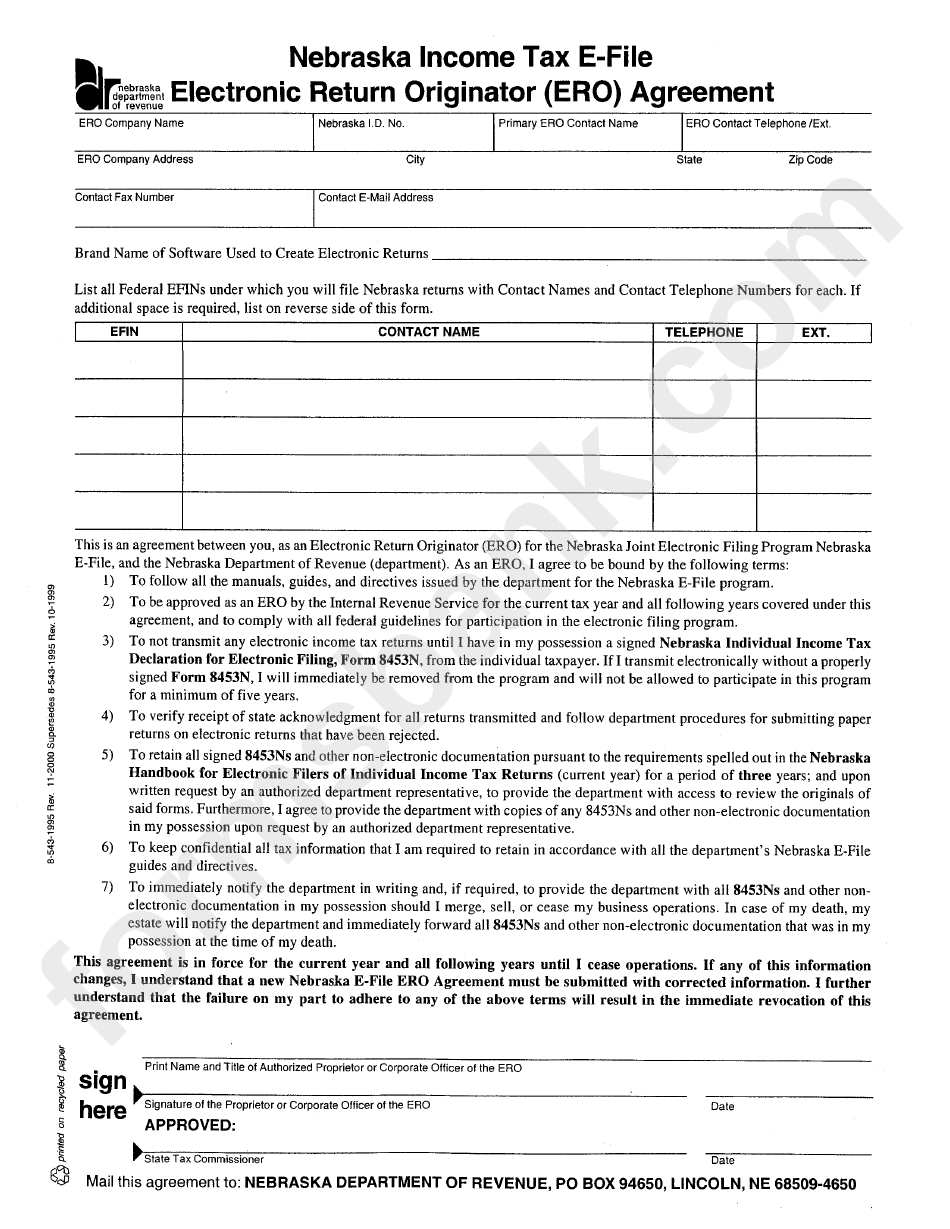

Nebraska Tax EFile Electronic Return Originator (Ero) Agreement

The practitioner pin method is an additional signature method for taxpayers who use an electronic return originator (ero) to sign their return by. In many cases, the ero also prepares. Form 1040 received an overhaul and revamp in 2018. As stated above, an ero is a company that files electronic tax returns and usually helps prepare them. Completing all of.

Incime OMB No 15450074 DO NOT MAIL THIS FORM TO THE FTB 8879 IRS E

Eros may sign forms 8879 and 8878 by. Web what does ero stand for? It's not assigned by any taxing agency, but. You will have to file your returns by. Web an ero on a tax form is a document that certifies the accuracy, authenticity, and validity of an electronically submitted tax return.

Form 8879 IRS efile Signature Authorization (2014) Free Download

The ero will also use. Web an electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. The ero is usually the. Web definition an electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. See the note below from irs publication.

Web Once You Visit The Site And Enter Your Information, The Irs Will Display The Status Of Your Amended Return As:

The ero will also use. Web definition an electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. For example, if you’re amending to add another child to the return, go to the federal information. Completing all of the forms and schedules needed to compute and report the tax.

In Many Cases, The Ero Also Prepares.

Web make the amended changes on the original form or worksheet. Web for form 1040, the ero name is shown on form 8879 as the signature. It's not assigned by any taxing agency, but. Web what does ero stand for?

Web An Ero On A Tax Form Is A Document That Certifies The Accuracy, Authenticity, And Validity Of An Electronically Submitted Tax Return.

The amount of deduction you can. Eros may sign forms 8879 and 8878 by. Web an electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. Web the irs requires your ero to obtain an irs form 8879 from their client if the ero generates the pin or enters one on the taxpayer’s behalf.

Web The 1040 Tax Form Is The One Most People Use For Filing Taxes.

You will have to file your returns by. The practitioner pin method is an additional signature method for taxpayers who use an electronic return originator (ero) to sign their return by. As stated above, an ero is a company that files electronic tax returns and usually helps prepare them. Web what is ero on your tax form?