What Is 2441 Form

What Is 2441 Form - Web the child and dependent care credit allows you to reduce the income tax you owe based on some of the expenses you incur for paying someone to provide care to. Enter the total amount of : New checkbox on line 2,. The disabled person filed a joint return, or c. Web form 2441 (2017) page. Ad access irs tax forms. Web irs form 2441: Web the maximum amount of qualified child and dependent care expenses that can be claimed on form 2441 is $3,000 for one qualifying person, $6,000 for two or more qualifying. Complete, edit or print tax forms instantly. You may be able to claim the child and dependent care credit if you pay for the care of a qualifying individual so you can work or.

Enter the total amount of : Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules. Web the maximum amount of qualified child and dependent care expenses that can be claimed on form 2441 is $3,000 for one qualifying person, $6,000 for two or more qualifying. You (or your spouse if filing jointly) could be claimed as a dependent on another taxpayer's 2020 return. Entering child or dependent care expenses for form. New checkbox on line 2,. Amounts you received as an employee. Complete, edit or print tax forms instantly. Ad access irs tax forms. Web the child and dependent care credit allows you to reduce the income tax you owe based on some of the expenses you incur for paying someone to provide care to.

Web irs form 2441 is designed to provide proof to the irs that you are eligible for the child and dependent care tax credit, disclose the eligible costs you incurred for. New checkbox on line 2,. Web irs form 2441: Web form 2441 (2017) page. Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules. Entering child or dependent care expenses for form. Web the child and dependent care credit allows you to reduce the income tax you owe based on some of the expenses you incur for paying someone to provide care to. You (or your spouse if filing jointly) could be claimed as a dependent on another taxpayer's 2020 return. Amounts you received as an employee. Complete, edit or print tax forms instantly.

IRS Form 2441 What It Is, Who Can File, and How To Fill it Out (2023)

Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules. Web the following articles are the top questions referring to child and dependent care qualified expenses (2441): Web the child and dependent care credit allows you to.

Filing the form 2441 YouTube

Web the child and dependent care credit allows you to reduce the income tax you owe based on some of the expenses you incur for paying someone to provide care to. Complete, edit or print tax forms instantly. Web the child and dependent care credit is a tax credit that may help you pay for the care of eligible children.

Ssurvivor Form 2441 Irs

Web the maximum amount of qualified child and dependent care expenses that can be claimed on form 2441 is $3,000 for one qualifying person, $6,000 for two or more qualifying. Complete, edit or print tax forms instantly. Web irs form 2441 is designed to provide proof to the irs that you are eligible for the child and dependent care tax.

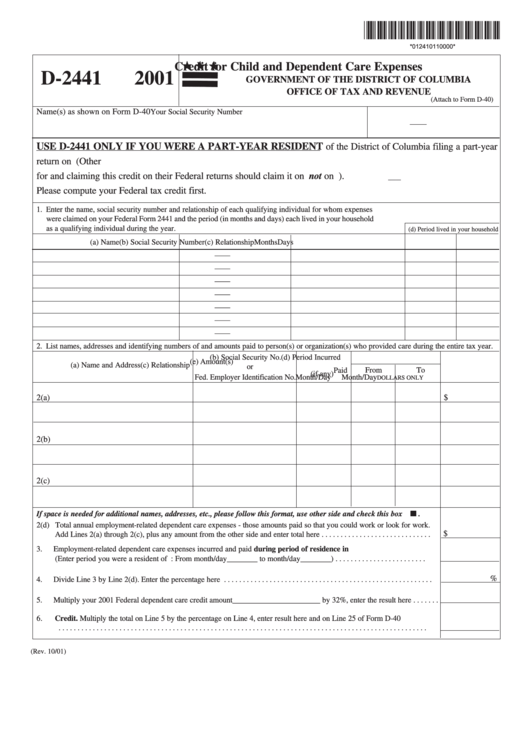

Form D2441 Credit For Child And Dependent Care Expenses 2001

Enter the total amount of : Web irs form 2441 is designed to provide proof to the irs that you are eligible for the child and dependent care tax credit, disclose the eligible costs you incurred for. Entering child or dependent care expenses for form. Amounts you received as an employee. Web form 2441 (2017) page.

Breanna Form 2441 Instructions Provider Amount Paid

Complete, edit or print tax forms instantly. You (or your spouse if filing jointly) could be claimed as a dependent on another taxpayer's 2020 return. Web the child and dependent care credit allows you to reduce the income tax you owe based on some of the expenses you incur for paying someone to provide care to. Web if you or.

Claim tax credit for your child or dependent by filing IRS Form 2441

Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules. You (or your spouse if filing jointly) could be claimed as a dependent on another taxpayer's 2020 return. Web taxpayers file form 2441 with form 1040 to.

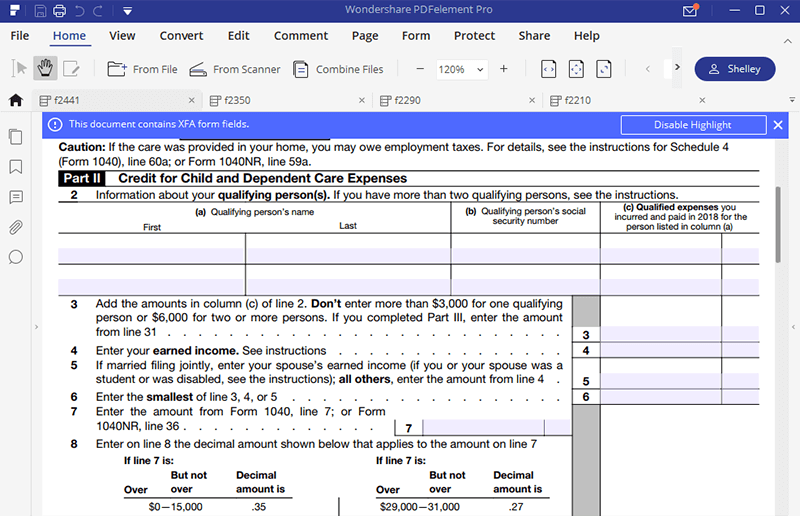

Instructions for How to Fill in IRS Form 2441

Web the following articles are the top questions referring to child and dependent care qualified expenses (2441): Web future developments for the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go to irs.gov/. You may be able to claim the child and dependent care credit if you pay for.

2016 Form 2441 Edit, Fill, Sign Online Handypdf

Web irs form 2441: You may be able to claim the child and dependent care credit if you pay for the care of a qualifying individual so you can work or. Enter the total amount of : Web or $500 a month on form 2441 based on the income rules listed later in the instructions under if you or your.

2020 Tax Form 2441 Create A Digital Sample in PDF

Web irs form 2441 is designed to provide proof to the irs that you are eligible for the child and dependent care tax credit, disclose the eligible costs you incurred for. Web the following articles are the top questions referring to child and dependent care qualified expenses (2441): Amounts you received as an employee. Entering child or dependent care expenses.

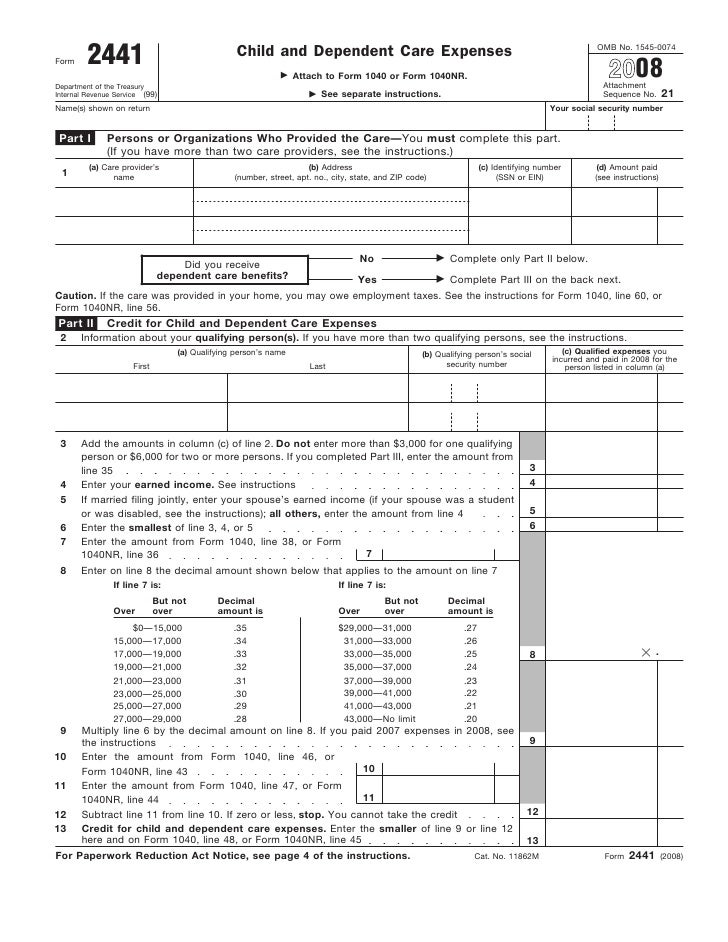

Form 2441Child and Dependent Care Expenses

Web the child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents (qualifying persons). Web irs form 2441: Web taxpayers file form 2441 with form 1040 to determine the amount of their available dependent care tax credit (dctc), and dcap participants must file it with. New checkbox.

Web The Child And Dependent Care Credit Is A Tax Credit That May Help You Pay For The Care Of Eligible Children And Other Dependents (Qualifying Persons).

Web the following articles are the top questions referring to child and dependent care qualified expenses (2441): Entering child or dependent care expenses for form. Web irs form 2441: Web future developments for the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go to irs.gov/.

New Checkbox On Line 2,.

Web taxpayers file form 2441 with form 1040 to determine the amount of their available dependent care tax credit (dctc), and dcap participants must file it with. Web the child and dependent care credit allows you to reduce the income tax you owe based on some of the expenses you incur for paying someone to provide care to. Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules. You may be able to claim the child and dependent care credit if you pay for the care of a qualifying individual so you can work or.

Web Irs Form 2441 Is Designed To Provide Proof To The Irs That You Are Eligible For The Child And Dependent Care Tax Credit, Disclose The Eligible Costs You Incurred For.

Web or $500 a month on form 2441 based on the income rules listed later in the instructions under if you or your spouse was a student or disabled. Enter the total amount of : You (or your spouse if filing jointly) could be claimed as a dependent on another taxpayer's 2020 return. Complete, edit or print tax forms instantly.

The Disabled Person Filed A Joint Return, Or C.

Amounts you received as an employee. Ad access irs tax forms. Web the maximum amount of qualified child and dependent care expenses that can be claimed on form 2441 is $3,000 for one qualifying person, $6,000 for two or more qualifying. Web form 2441 (2017) page.

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)