W8 Or W9 Form

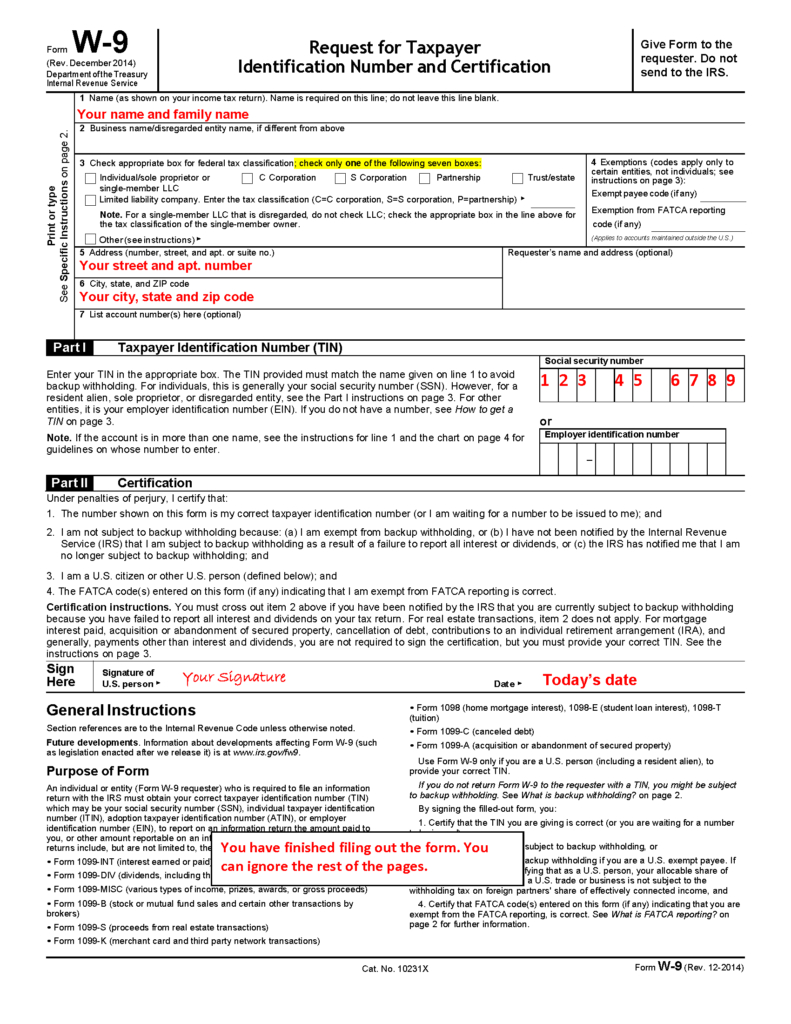

W8 Or W9 Form - Acquisition or abandonment of secured property. Web partnership trust/estate give form to the requester. See instructions on page 3): October 2021) department of the treasury internal revenue service do not use this form if: Do not send to the irs. Web the irs requires those who are not defined as u.s. Contributions you made to an ira. 4 exemptions (codes apply only to certain entities, not individuals; Form 1099 is only required to be issued once the minimum. Enter the tax classification (c=c corporation, s=s corporation, p=partnership)

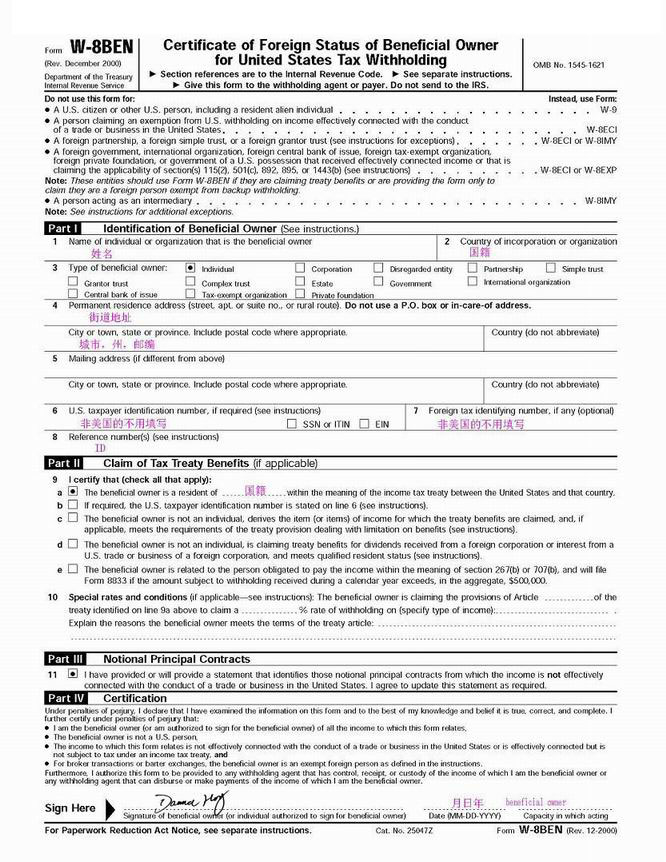

Contributions you made to an ira. See instructions on page 3): October 2021) department of the treasury internal revenue service do not use this form if: Do not send to the irs. Acquisition or abandonment of secured property. Enter the tax classification (c=c corporation, s=s corporation, p=partnership) Web partnership trust/estate give form to the requester. Certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) for use by individuals. Web the irs requires those who are not defined as u.s. 4 exemptions (codes apply only to certain entities, not individuals;

Certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) for use by individuals. 4 exemptions (codes apply only to certain entities, not individuals; Acquisition or abandonment of secured property. October 2021) department of the treasury internal revenue service do not use this form if: See instructions on page 3): Web partnership trust/estate give form to the requester. Form 1099 is only required to be issued once the minimum. Exempt payee code (if any) limited liability company. Web the irs requires those who are not defined as u.s. Enter the tax classification (c=c corporation, s=s corporation, p=partnership)

The Federal Zone Appendix L IRS Form W8

Contributions you made to an ira. Web the irs requires those who are not defined as u.s. Web partnership trust/estate give form to the requester. Certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) for use by individuals. Exempt payee code (if any) limited liability company.

美国 W8 W9 税务认证表格是什么?该如何填写?_Google AdSense实操教程_多思多金(Moidea.info)

Contributions you made to an ira. Exempt payee code (if any) limited liability company. Acquisition or abandonment of secured property. Do not send to the irs. Form 1099 is only required to be issued once the minimum.

FATCA Driven New IRS Forms W8BEN versus W8BENE versus W9 (etc

Certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) for use by individuals. Do not send to the irs. 4 exemptions (codes apply only to certain entities, not individuals; Exempt payee code (if any) limited liability company. Web the irs requires those who are not defined as u.s.

Sample Example Of W9 Form Filled Out Fill Online, Printable, Fillable

Contributions you made to an ira. Web the irs requires those who are not defined as u.s. Form 1099 is only required to be issued once the minimum. Certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) for use by individuals. Do not send to the irs.

What Is The Purpose Of A W8 Ben Form Santos Czerwinski's Template

Enter the tax classification (c=c corporation, s=s corporation, p=partnership) Form 1099 is only required to be issued once the minimum. See instructions on page 3): Certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) for use by individuals. Do not send to the irs.

Sample W 9 Form Example Calendar Printable

Web the irs requires those who are not defined as u.s. Acquisition or abandonment of secured property. October 2021) department of the treasury internal revenue service do not use this form if: 4 exemptions (codes apply only to certain entities, not individuals; See instructions on page 3):

IRS Form W8

Form 1099 is only required to be issued once the minimum. October 2021) department of the treasury internal revenue service do not use this form if: Web the irs requires those who are not defined as u.s. Certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) for use by individuals. Do not send to.

IRS Releases New IRS Form W8BEN. * U.S. citizens and LPRs beware of

Enter the tax classification (c=c corporation, s=s corporation, p=partnership) October 2021) department of the treasury internal revenue service do not use this form if: Web the irs requires those who are not defined as u.s. Acquisition or abandonment of secured property. Form 1099 is only required to be issued once the minimum.

What is a W8 Form? Why Should I Complete This Form? TradeSherpa

4 exemptions (codes apply only to certain entities, not individuals; Exempt payee code (if any) limited liability company. Acquisition or abandonment of secured property. Do not send to the irs. Contributions you made to an ira.

Downloadable W9 Tax Form How To Fill Out A W9 Form Line W within Irs

October 2021) department of the treasury internal revenue service do not use this form if: See instructions on page 3): Form 1099 is only required to be issued once the minimum. 4 exemptions (codes apply only to certain entities, not individuals; Web the irs requires those who are not defined as u.s.

October 2021) Department Of The Treasury Internal Revenue Service Do Not Use This Form If:

Acquisition or abandonment of secured property. Web the irs requires those who are not defined as u.s. Certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) for use by individuals. Enter the tax classification (c=c corporation, s=s corporation, p=partnership)

See Instructions On Page 3):

Exempt payee code (if any) limited liability company. Form 1099 is only required to be issued once the minimum. Do not send to the irs. Contributions you made to an ira.

Web Partnership Trust/Estate Give Form To The Requester.

4 exemptions (codes apply only to certain entities, not individuals;