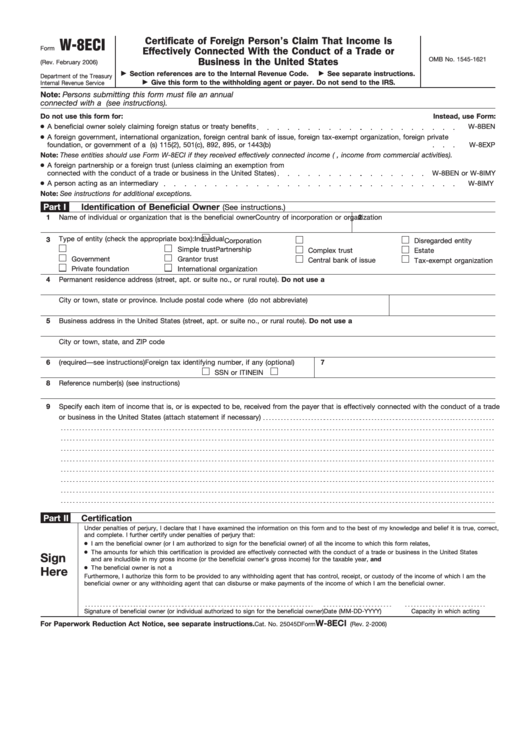

W-8Eci Form

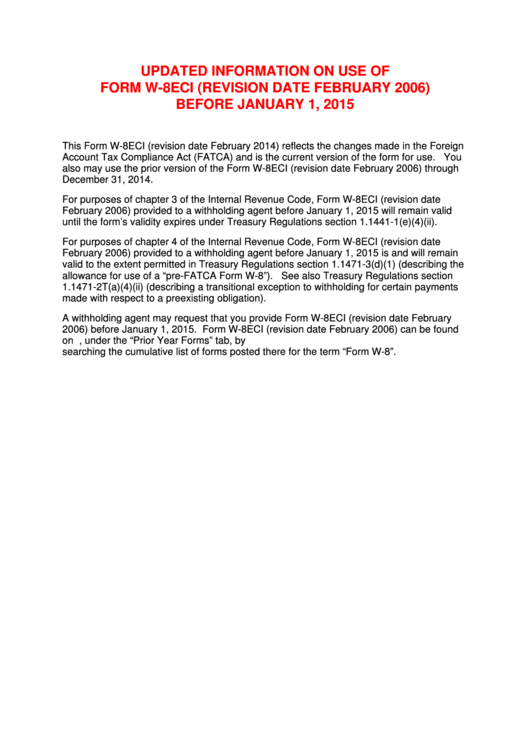

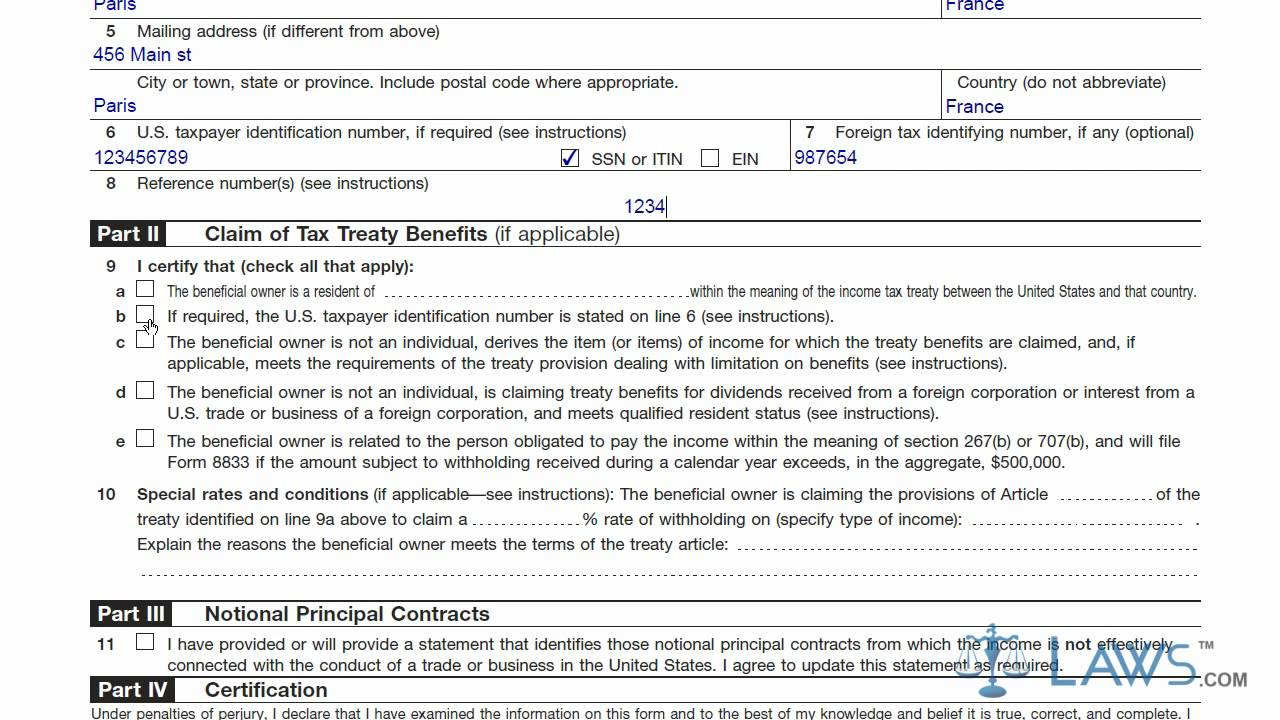

W-8Eci Form - Income tax return to report income connected. October 2021) certificate of foreign person's claim that income is effectively connected with the conduct of a trade or business in the united states department of the treasury internal revenue service section references are to the internal revenue code. Go to www.irs.gov/formw8eci for instructions and the latest information. While these forms have a revision date of october 2021, the irs states that recipients of the form can accept a prior version of the form through. The updates were necessary, in part, due to the 2017 tax law (pub. The type of income should be specified on line 11. Source income that is effectively connected with the conduct of a trade or business within the u.s.

Source income that is effectively connected with the conduct of a trade or business within the u.s. Income tax return to report income connected. Go to www.irs.gov/formw8eci for instructions and the latest information. While these forms have a revision date of october 2021, the irs states that recipients of the form can accept a prior version of the form through. October 2021) certificate of foreign person's claim that income is effectively connected with the conduct of a trade or business in the united states department of the treasury internal revenue service section references are to the internal revenue code. The updates were necessary, in part, due to the 2017 tax law (pub. The type of income should be specified on line 11.

While these forms have a revision date of october 2021, the irs states that recipients of the form can accept a prior version of the form through. Income tax return to report income connected. The type of income should be specified on line 11. October 2021) certificate of foreign person's claim that income is effectively connected with the conduct of a trade or business in the united states department of the treasury internal revenue service section references are to the internal revenue code. Source income that is effectively connected with the conduct of a trade or business within the u.s. Go to www.irs.gov/formw8eci for instructions and the latest information. The updates were necessary, in part, due to the 2017 tax law (pub.

W8 Forms Definition

Go to www.irs.gov/formw8eci for instructions and the latest information. The type of income should be specified on line 11. Income tax return to report income connected. While these forms have a revision date of october 2021, the irs states that recipients of the form can accept a prior version of the form through. The updates were necessary, in part, due.

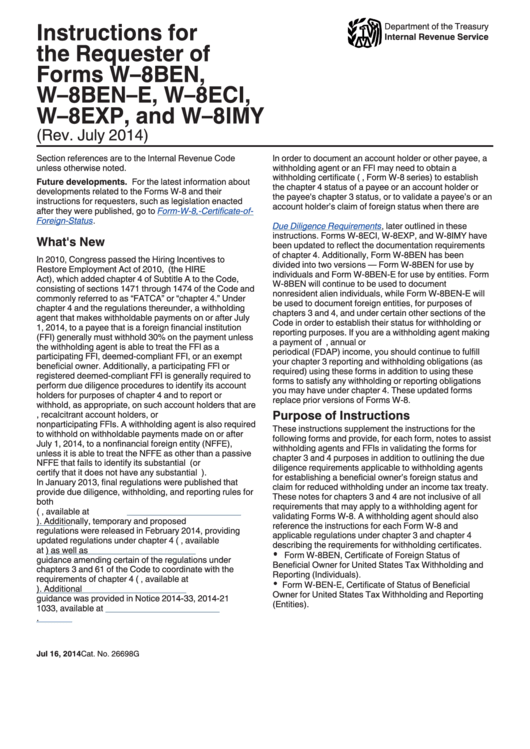

Form w 8eci instructions

Go to www.irs.gov/formw8eci for instructions and the latest information. While these forms have a revision date of october 2021, the irs states that recipients of the form can accept a prior version of the form through. The updates were necessary, in part, due to the 2017 tax law (pub. Income tax return to report income connected. The type of income.

Form W8ECI Certificate of Foreign Person's Claim That Is

Source income that is effectively connected with the conduct of a trade or business within the u.s. The type of income should be specified on line 11. While these forms have a revision date of october 2021, the irs states that recipients of the form can accept a prior version of the form through. Income tax return to report income.

Fillable Form W8eci Certificate Of Foreign Person'S Claim That

Source income that is effectively connected with the conduct of a trade or business within the u.s. The type of income should be specified on line 11. Go to www.irs.gov/formw8eci for instructions and the latest information. The updates were necessary, in part, due to the 2017 tax law (pub. October 2021) certificate of foreign person's claim that income is effectively.

Fillable Form W8eci Certificate Of Foreign Person'S Claim That

Go to www.irs.gov/formw8eci for instructions and the latest information. The updates were necessary, in part, due to the 2017 tax law (pub. Source income that is effectively connected with the conduct of a trade or business within the u.s. The type of income should be specified on line 11. October 2021) certificate of foreign person's claim that income is effectively.

Instructions For The Requester Of Forms W8ben, W8benE, W8eci, W

Source income that is effectively connected with the conduct of a trade or business within the u.s. The type of income should be specified on line 11. Go to www.irs.gov/formw8eci for instructions and the latest information. While these forms have a revision date of october 2021, the irs states that recipients of the form can accept a prior version of.

Form w 8eci instructions

Go to www.irs.gov/formw8eci for instructions and the latest information. October 2021) certificate of foreign person's claim that income is effectively connected with the conduct of a trade or business in the united states department of the treasury internal revenue service section references are to the internal revenue code. Income tax return to report income connected. While these forms have a.

Irs form 8288 b instructions

Go to www.irs.gov/formw8eci for instructions and the latest information. October 2021) certificate of foreign person's claim that income is effectively connected with the conduct of a trade or business in the united states department of the treasury internal revenue service section references are to the internal revenue code. The updates were necessary, in part, due to the 2017 tax law.

Form W8BENE Certificate of Entities Status of Beneficial Owner for

October 2021) certificate of foreign person's claim that income is effectively connected with the conduct of a trade or business in the united states department of the treasury internal revenue service section references are to the internal revenue code. The type of income should be specified on line 11. While these forms have a revision date of october 2021, the.

Irs Form W8 Printable Example Calendar Printable

October 2021) certificate of foreign person's claim that income is effectively connected with the conduct of a trade or business in the united states department of the treasury internal revenue service section references are to the internal revenue code. Income tax return to report income connected. While these forms have a revision date of october 2021, the irs states that.

Go To Www.irs.gov/Formw8Eci For Instructions And The Latest Information.

The updates were necessary, in part, due to the 2017 tax law (pub. The type of income should be specified on line 11. Source income that is effectively connected with the conduct of a trade or business within the u.s. Income tax return to report income connected.

October 2021) Certificate Of Foreign Person's Claim That Income Is Effectively Connected With The Conduct Of A Trade Or Business In The United States Department Of The Treasury Internal Revenue Service Section References Are To The Internal Revenue Code.

While these forms have a revision date of october 2021, the irs states that recipients of the form can accept a prior version of the form through.

:max_bytes(150000):strip_icc()/W-8ECI-b53cb3dfa4714356b09222d307cbdcef.png)