Voluntary Dismissal Of Chapter 13 On Credit Report

Voluntary Dismissal Of Chapter 13 On Credit Report - You can avoid having your chapter 7 or chapter 13 bankruptcy case dismissed by making sure you meet all your. In this case, you filed a chapter 13 and it’s being reported. In addition, discharged debts listed on your credit report must be listed as discharged. However, to do so, you must obtain permission from the court. A discharged bankruptcy means you have satisfied the debts included in the chapter 13 bk and that creditors will not further pursue you for payment. Web in order to remove something from your credit report, it has to be inaccurate. Web if the case is dismissed, the vehicle loan will, in most cases, be considered behind because the lender was receiving less per month during the bankruptcy than what the monthly. Web for example, one route is just no longer making your payments in a chapter 13 case. This will either lower or eliminate your overall debt making you are better credit. Web the bankruptcy code explicitly says that, at the request of the person in a chapter 13 case, the bankruptcy “court shall dismiss” the case.

It was voluntarily dismissed once i had done the loan. Should you choose to stop making payments to the bankruptcy trustee, this will also result in your chapter 13 bankruptcy being dismissed. Web all you do is file a voluntary motion to dismiss chapter 13 case pursuant to 11 u.s.c. If the case is dismissed, the. You can refile another chapter 13 petition, but you'll face som refiling if your chapter 13 case is dismissed. Web for example, one route is just no longer making your payments in a chapter 13 case. Web usually, it is chapter 13 bankruptcies that are dismissed for not sticking to the repayment plan. Web the bankruptcy code explicitly says that, at the request of the person in a chapter 13 case, the bankruptcy “court shall dismiss” the case. Web if you fail to make your chapter 13 plan payments, eventually your bankruptcy case will be dismissed. Web in order to remove something from your credit report, it has to be inaccurate.

Web for example, one route is just no longer making your payments in a chapter 13 case. Web usually, it is chapter 13 bankruptcies that are dismissed for not sticking to the repayment plan. Web in order to remove something from your credit report, it has to be inaccurate. If you stop making payments to your chapter 13 plan, the trustee may file a motion to dismiss the case. Web if a dismissal is ever entered in your chapter 13 bankruptcy case, it’s crucial that you cure the deficiency that caused the dismissal and file a motion to reinstate your bankruptcy case as soon as possible. Web all you do is file a voluntary motion to dismiss chapter 13 case pursuant to 11 u.s.c. A voluntarily dismissed bankruptcy remains on your file for up to seven years from the date it was filed. Whether permission will be granted depends on the type of bankruptcy you have filed and why you are requesting the voluntary dismissal. Web a completed (discharged) or dismissed chapter 13 remains on file for up to seven years from the date filed. Before requesting a bankruptcy case be dismissed, debtors should consult with their attorney to discuss the ramifications of dismissal.

Two ways a chapter 13 ends Dismissal or discharge YouTube

Web if you complete your chapter 13 plan and receive your discharge, the credit bureaus will drop the chapter 13 off of your credit report 7 years after you filed the case. Web a completed (discharged) or dismissed chapter 13 remains on file for up to seven years from the date filed. If the case is dismissed, the. That section.

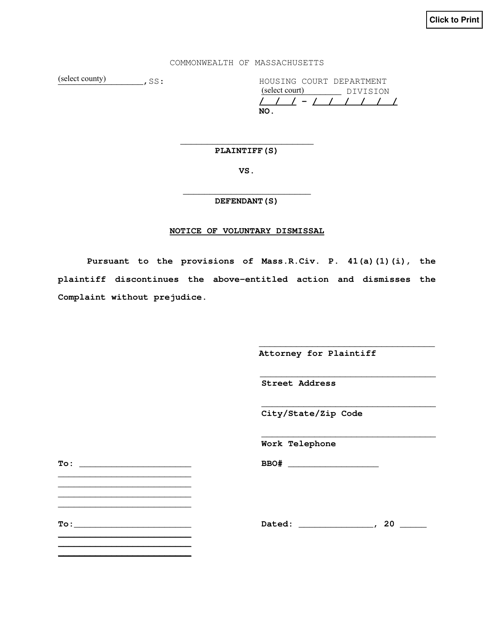

Notice of Voluntary Dismissal Filed Before Entry of Order of Dismissal

Web updated in very rare instances you may want to dismiss your own bankruptcy case. A voluntarily dismissed bankruptcy remains on your file for up to seven years from the date it was filed. It was voluntarily dismissed once i had done the loan. We cover this more below. Whether permission will be granted depends on the type of bankruptcy.

Massachusetts Notice of Voluntary Dismissal Download Fillable PDF

You can refile another chapter 13 petition, but you'll face som refiling if your chapter 13 case is dismissed. A discharged bankruptcy means you have satisfied the debts included in the chapter 13 bk and that creditors will not further pursue you for payment. Web if a dismissal is ever entered in your chapter 13 bankruptcy case, it’s crucial that.

Filed Copy Notice of Voluntary Dismissal & Agreed Order

The last three blog posts have been about amending, or “modifying,” your chapter 13 payment plan. Web usually, it is chapter 13 bankruptcies that are dismissed for not sticking to the repayment plan. Web if you fail to make your chapter 13 plan payments, eventually your bankruptcy case will be dismissed. If you stop making payments to your chapter 13.

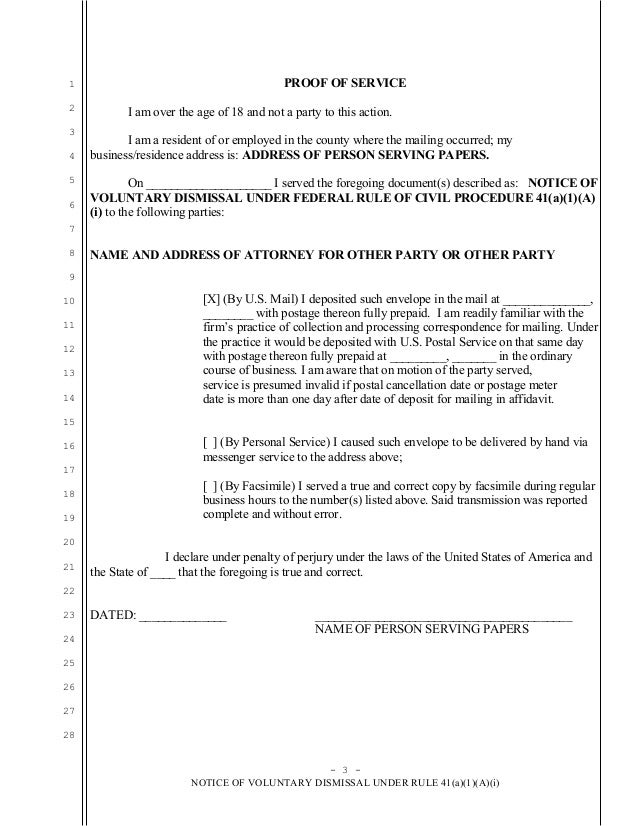

Sample notice of voluntary dismissal under Rule 41 in United States D…

Web if you fail to make your chapter 13 plan payments, eventually your bankruptcy case will be dismissed. Web voluntary dismissal of an existing chapter 13 bankruptcy case can have unexpected consequences for debtors. That section of the u.s. Web if your bankruptcy case was filed under chapter 13, you may secure a voluntary dismissal merely by filing a formal.

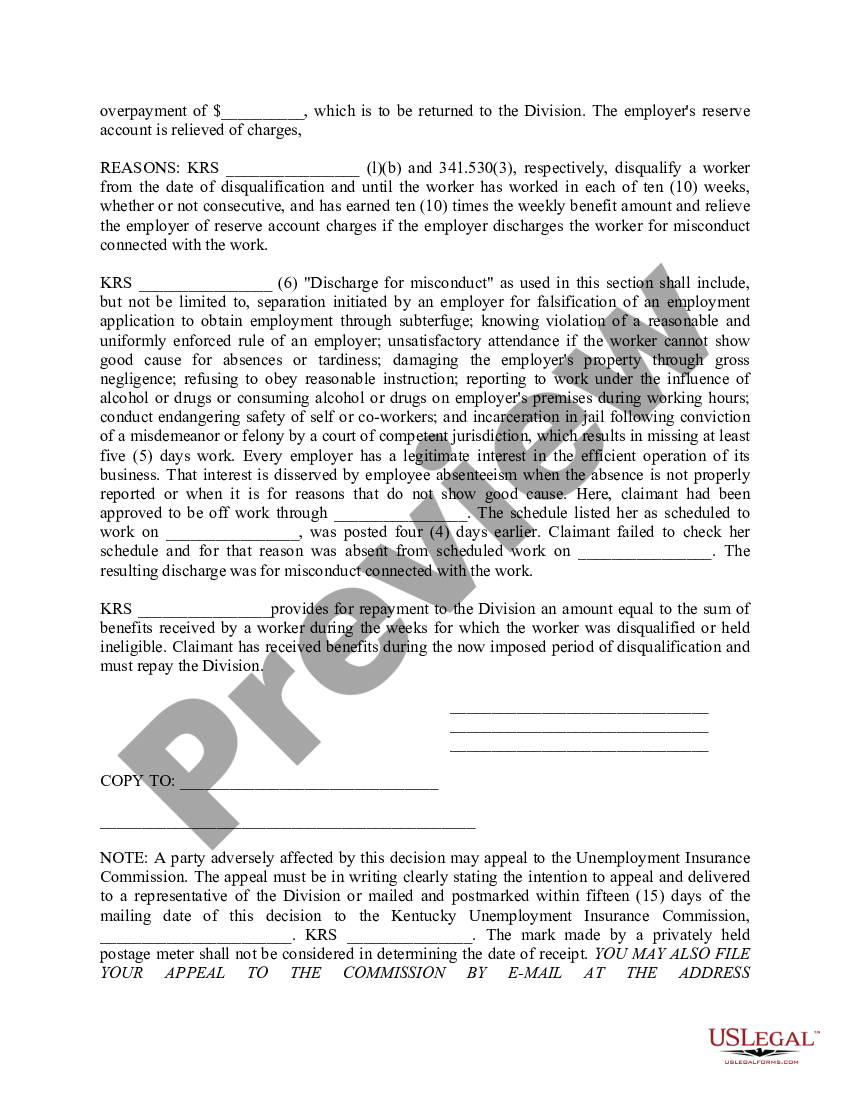

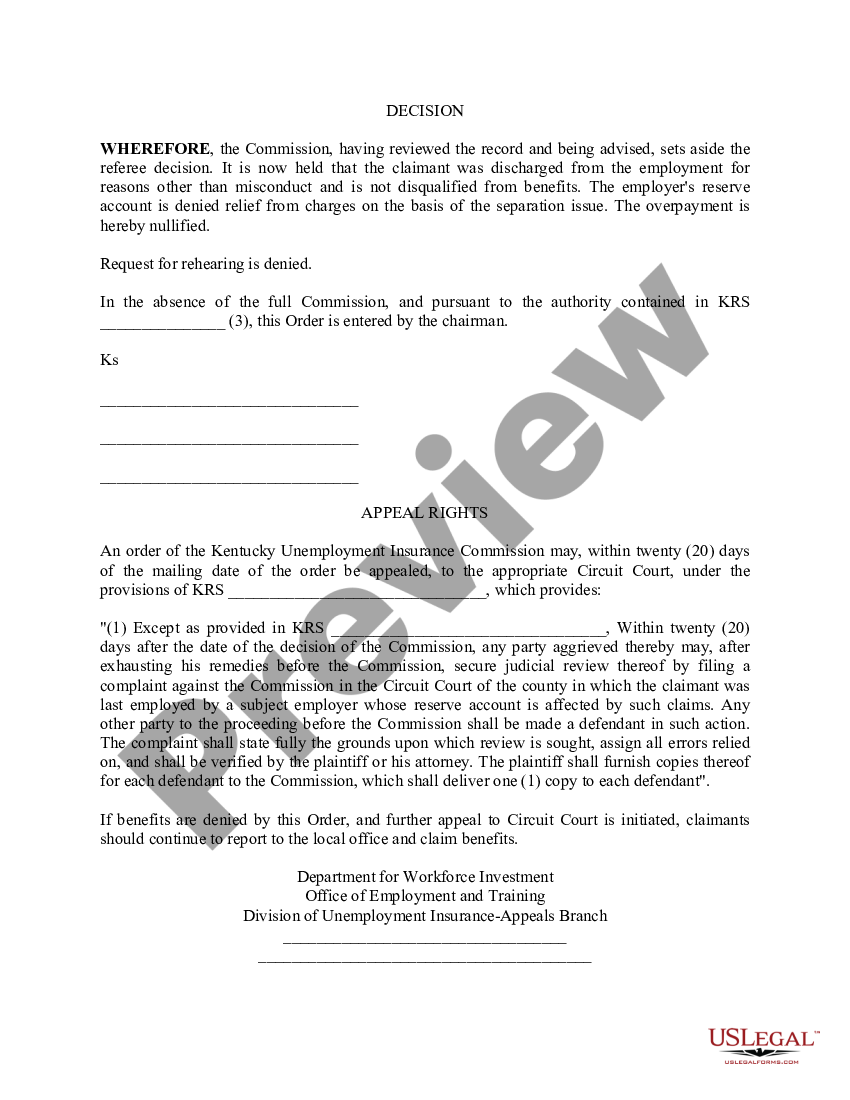

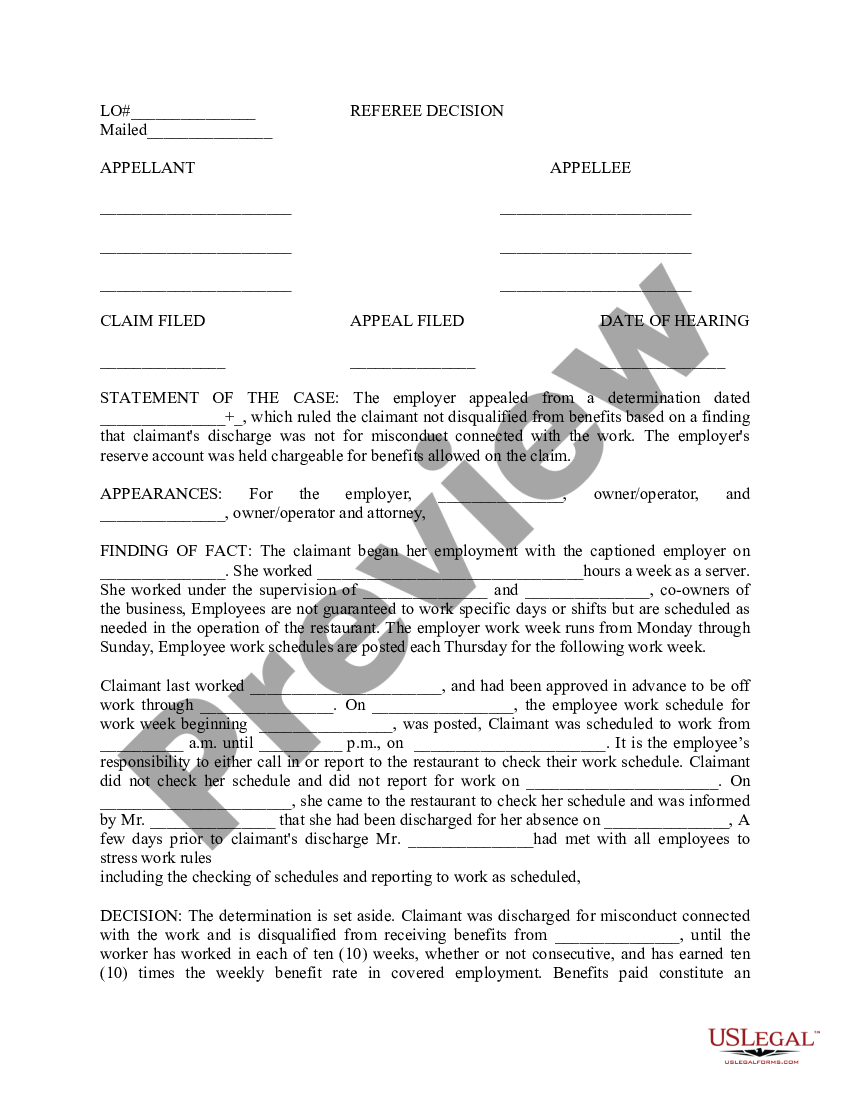

Kentucky Order Of Voluntary Dismissal US Legal Forms

In addition, discharged debts listed on your credit report must be listed as discharged. The last three blog posts have been about amending, or “modifying,” your chapter 13 payment plan. Web if you fail to make your chapter 13 plan payments, eventually your bankruptcy case will be dismissed. If you stop making payments to your chapter 13 plan, the trustee.

Kentucky Order Of Voluntary Dismissal US Legal Forms

Don’t think you will be able to get this removed. Web the bankruptcy code explicitly says that, at the request of the person in a chapter 13 case, the bankruptcy “court shall dismiss” the case. You can avoid having your chapter 7 or chapter 13 bankruptcy case dismissed by making sure you meet all your. If you stop making payments.

48+ Voluntary Dismissal Of Chapter 13 On Credit Report JameeEllaria

Web if you fail to make your chapter 13 plan payments, eventually your bankruptcy case will be dismissed. Don’t think you will be able to get this removed. It was voluntarily dismissed once i had done the loan. In this case, you filed a chapter 13 and it’s being reported. A discharged bankruptcy means you have satisfied the debts included.

Kentucky Order Of Voluntary Dismissal US Legal Forms

Web in order to remove something from your credit report, it has to be inaccurate. You’ll also want to make sure that available bankruptcy exemptions protect all of your property since that’s not typically an issue in chapter 13. This will either lower or eliminate your overall debt making you are better credit. In addition, discharged debts listed on your.

Notice of Voluntary Dismissal with Prejudice Electronic Frontier

It was voluntarily dismissed once i had done the loan. Web if you complete your chapter 13 plan and receive your discharge, the credit bureaus will drop the chapter 13 off of your credit report 7 years after you filed the case. We cover this more below. Web voluntary dismissal of an existing chapter 13 bankruptcy case can have unexpected.

Before Requesting A Bankruptcy Case Be Dismissed, Debtors Should Consult With Their Attorney To Discuss The Ramifications Of Dismissal.

Web updated in very rare instances you may want to dismiss your own bankruptcy case. Web if a dismissal is ever entered in your chapter 13 bankruptcy case, it’s crucial that you cure the deficiency that caused the dismissal and file a motion to reinstate your bankruptcy case as soon as possible. A voluntarily dismissed bankruptcy remains on your file for up to seven years from the date it was filed. Web if you complete your chapter 13 plan and receive your discharge, the credit bureaus will drop the chapter 13 off of your credit report 7 years after you filed the case.

If You Stop Making Payments To Your Chapter 13 Plan, The Trustee May File A Motion To Dismiss The Case.

This is a motion for voluntary dismissal. a. In addition, discharged debts listed on your credit report must be listed as discharged. You can avoid having your chapter 7 or chapter 13 bankruptcy case dismissed by making sure you meet all your. Web all you do is file a voluntary motion to dismiss chapter 13 case pursuant to 11 u.s.c.

Should You Choose To Stop Making Payments To The Bankruptcy Trustee, This Will Also Result In Your Chapter 13 Bankruptcy Being Dismissed.

Web in order to remove something from your credit report, it has to be inaccurate. Bankruptcy code provides that the court shall dismiss the chapter 13 case at any time upon request of the debtor, unless the case was converted to a chapter 13 from a chapter. You’ll also want to make sure that available bankruptcy exemptions protect all of your property since that’s not typically an issue in chapter 13. However, in some cases, a chapter 7 bankruptcy may be dismissed by your request prior to.

However, To Do So, You Must Obtain Permission From The Court.

Web if so you can file a motion for voluntary dismissal. The last three blog posts have been about amending, or “modifying,” your chapter 13 payment plan. But what if you don’t want to be in the chapter 13. Web if the case is dismissed, the vehicle loan will, in most cases, be considered behind because the lender was receiving less per month during the bankruptcy than what the monthly.