Va Estimated Tax Form

Va Estimated Tax Form - Web form 760es is used by individuals to make estimated income tax payments. Or (d) your expected estimated tax liability exceeds your withholding and tax credits by $150 or less. To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes,. Web estimated income tax worksheet on page 3) is less than $11,950; Web • pay the total estimated tax (line 16 of the 2023 estimated tax worksheet) by january 16, 2024. Filing is required only for individuals whose income and net tax due exceed the amounts. Web form 760es is a virginia individual income tax form. Web form 760es is used by individuals to make estimated income tax payments. Us legal forms is developed as. How do i know if i need to complete form 760c?

To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes,. Web virginia state income tax forms for tax year 2022 (jan. Tax blank filling out can turn into a significant challenge and serious headache if no correct guidance supplied. If you haven't filed or paid taxes using eforms and need more information,. Web follow the simple instructions below: How do i know if i need to complete form 760c? Web form 760es is used by individuals to make estimated income tax payments. Quickly access top tasks for frequently downloaded va forms. Web search for va forms by keyword, form name, or form number. Web • pay the total estimated tax (line 16 of the 2023 estimated tax worksheet) by january 16, 2024.

Web eforms are a fast and free way to file and pay state taxes online. Web • pay the total estimated tax (line 16 of the 2023 estimated tax worksheet) by january 16, 2024. How do i know if i need to complete form 760c? Web virginia state income tax forms for tax year 2022 (jan. Tax blank filling out can turn into a significant challenge and serious headache if no correct guidance supplied. Quickly access top tasks for frequently downloaded va forms. Web last year i sent virginia estimated tax payments as recommended by turbotax using form 760es/cg. Web follow the simple instructions below: Web form 760es is a virginia individual income tax form. If you haven't filed or paid taxes using eforms and need more information,.

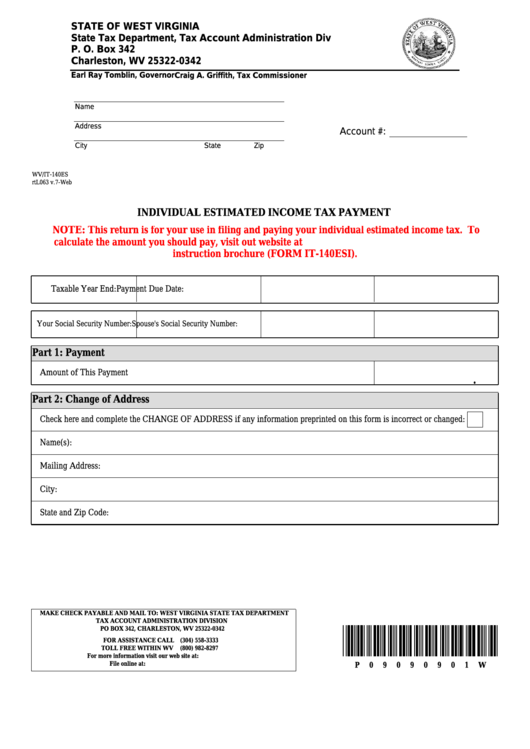

Form Wv/it140es Individual Estimated Tax Payment printable

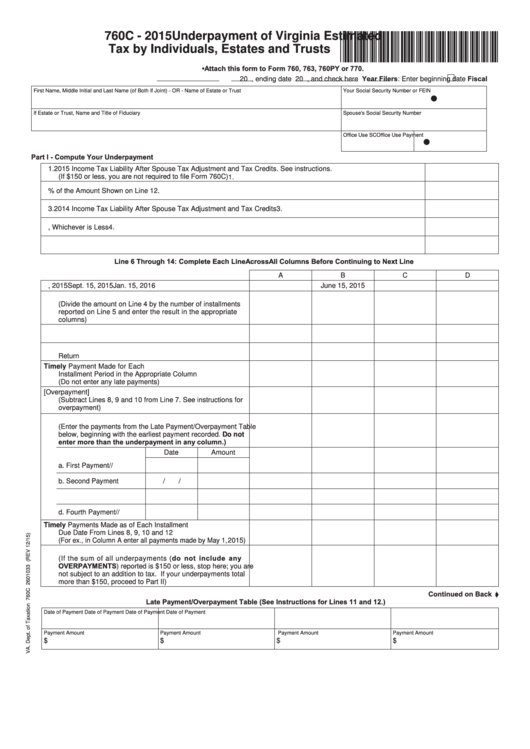

How do i know if i need to complete form 760c? Tax blank filling out can turn into a significant challenge and serious headache if no correct guidance supplied. Web this report will show the difference between the amount of tax the corporation would pay if it filed as part of a unitary combined group and the amount of tax.

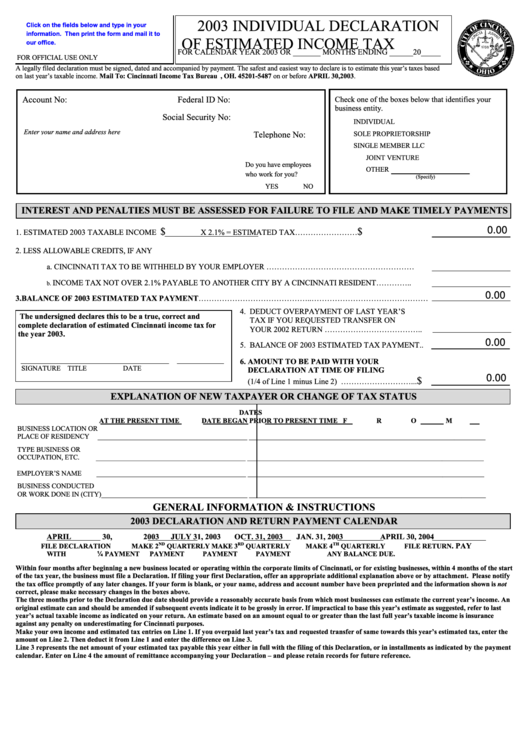

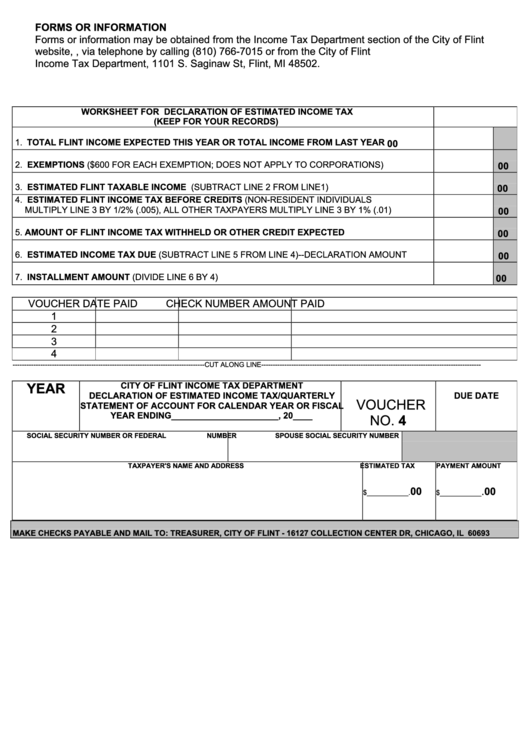

Fillable Individual Declaration Of Estimated Tax Form/form D1

Web search for va forms by keyword, form name, or form number. Tax blank filling out can turn into a significant challenge and serious headache if no correct guidance supplied. Or (d) your expected estimated tax liability exceeds your withholding and tax credits by $150 or less. How do i know if i need to complete form 760c? Web form.

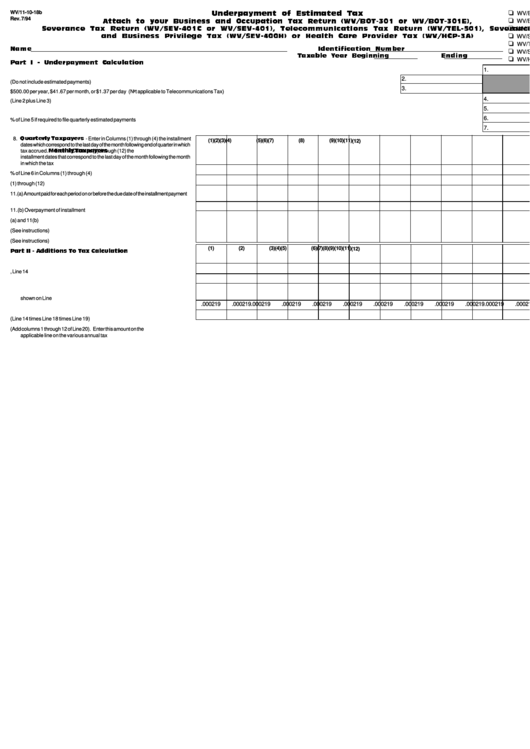

Fillable Form 760c Underpayment Of Virginia Estimated Tax By

Web estimated income tax worksheet on page 3) is less than $11,950; To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes,. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Select an eform below to start filing. Beginning in 2021, the frederick county office of.

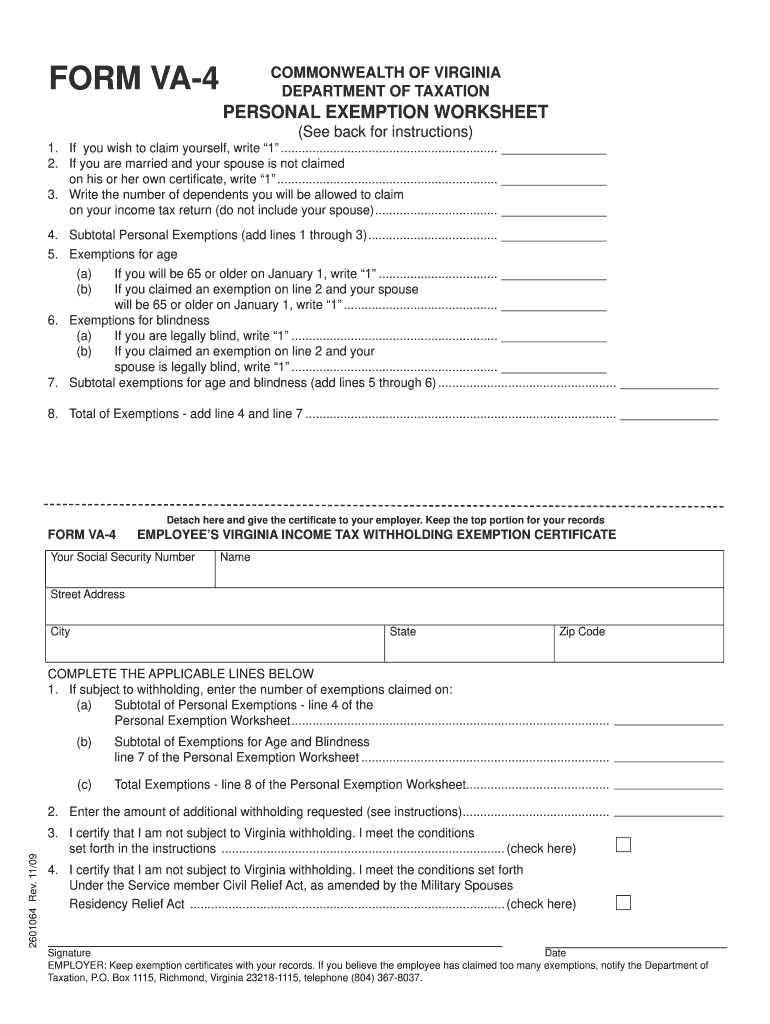

Va 4 State Tax Form Fillable Fill Out and Sign Printable PDF Template

Web last year i sent virginia estimated tax payments as recommended by turbotax using form 760es/cg. How do i know if i need to complete form 760c? Web this report will show the difference between the amount of tax the corporation would pay if it filed as part of a unitary combined group and the amount of tax based on.

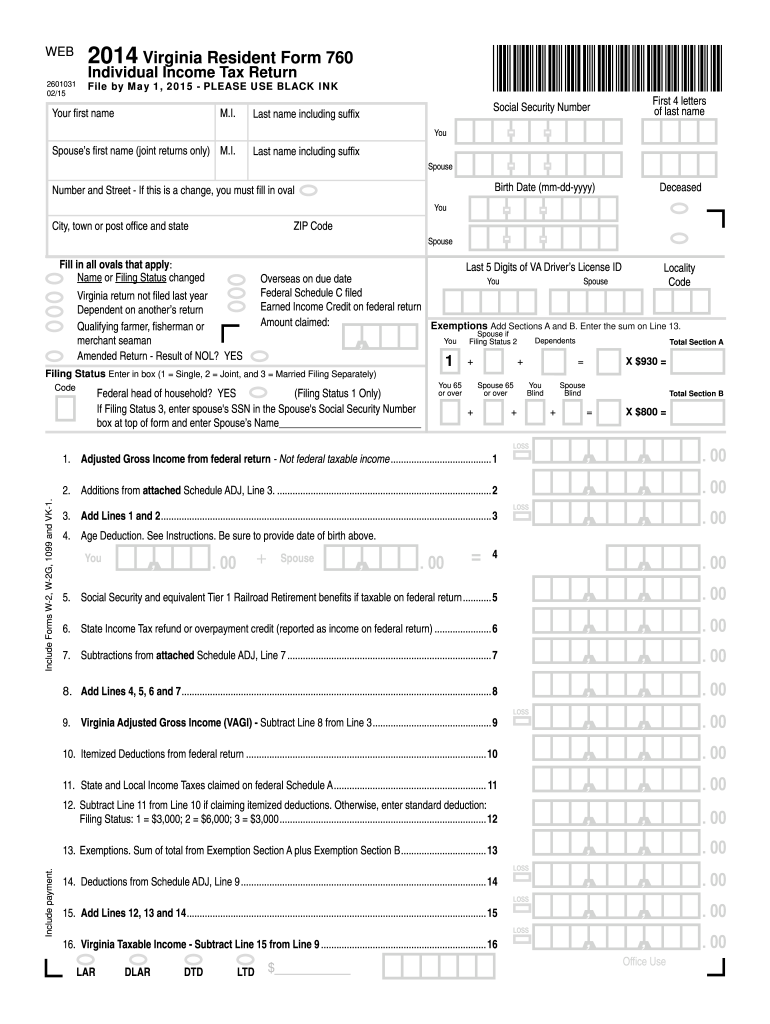

2014 Form VA DoT 760 Fill Online, Printable, Fillable, Blank PDFfiller

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Web form 760es is a virginia individual income tax form. Details on how to only prepare and print a. If you haven't filed or paid taxes using eforms and need more information,. Web last year i sent virginia estimated tax payments as recommended.

Declaration Of Estimated Tax Form printable pdf download

Web form 760es is used by individuals to make estimated income tax payments. Web eforms are a fast and free way to file and pay state taxes online. Tax blank filling out can turn into a significant challenge and serious headache if no correct guidance supplied. • file form 1041 for 2023 by march 1, 2024, and pay the total.

Underpayment Of Estimated Tax Form West Virginia printable pdf download

To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes,. Select an eform below to start filing. I did not receive any form from the state showing that i paid. Tax blank filling out can turn into a significant challenge and serious headache if no correct guidance supplied. Web search for va forms by.

FREE 7+ Sample Federal Tax Forms in PDF

Web last year i sent virginia estimated tax payments as recommended by turbotax using form 760es/cg. Web eforms are a fast and free way to file and pay state taxes online. Web follow the simple instructions below: While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. I did not receive any form.

What to Know About Making Estimated Tax Payments

If you haven't filed or paid taxes using eforms and need more information,. Web follow the simple instructions below: Web estimated income tax worksheet on page 3) is less than $11,950; Web form 760es is used by individuals to make estimated income tax payments. Web last year i sent virginia estimated tax payments as recommended by turbotax using form 760es/cg.

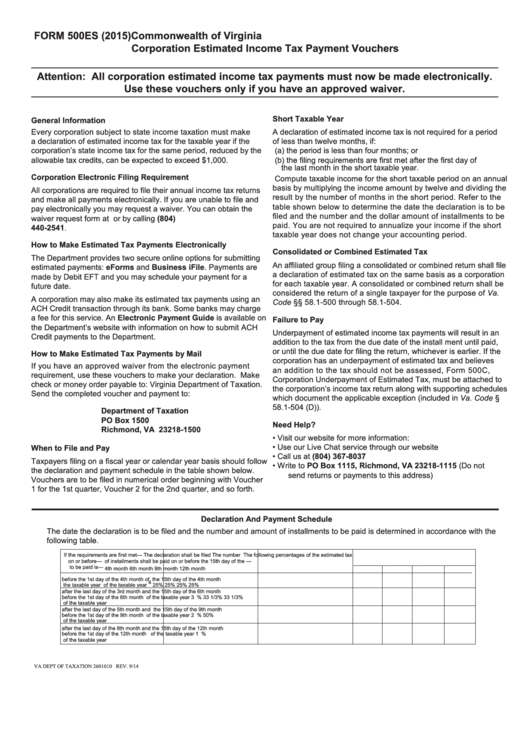

Fillable Form 500es Virginia Estimated Tax Declaration For

Web estimated income tax worksheet on page 3) is less than $11,950; Web if you owe more than $150 to the state of virginia at the end of the tax year, you may be subject to pay underestimated tax. How do i know if i need to complete form 760c? Web follow the simple instructions below: Tax blank filling out.

Web Watch Newsmax Live For The Latest News And Analysis On Today's Top Stories, Right Here On Facebook.

How do i know if i need to complete form 760c? Web eforms are a fast and free way to file and pay state taxes online. Filing is required only for individuals whose income and net tax due exceed the amounts. Web follow the simple instructions below:

Web If You Owe More Than $150 To The State Of Virginia At The End Of The Tax Year, You May Be Subject To Pay Underestimated Tax.

Web search for va forms by keyword, form name, or form number. Filing is required only for individuals whose income and net tax due exceed the amounts. Web estimated income tax worksheet on page 3) is less than $11,950; Web form 760es is a virginia individual income tax form.

Web This Report Will Show The Difference Between The Amount Of Tax The Corporation Would Pay If It Filed As Part Of A Unitary Combined Group And The Amount Of Tax Based On How They.

Web form 760es is used by individuals to make estimated income tax payments. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Beginning in 2021, the frederick county office of the commissioner of the revenue and the treasurer’s office will no longer be accepting and. If you haven't filed or paid taxes using eforms and need more information,.

Web Virginia State Income Tax Forms For Tax Year 2022 (Jan.

Or (d) your expected estimated tax liability exceeds your withholding and tax credits by $150 or less. To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes,. Us legal forms is developed as. I did not receive any form from the state showing that i paid.

/GettyImages-154920329-577423dd3df78cb62c196616.jpg)