Utah Employee Withholding Form 2023

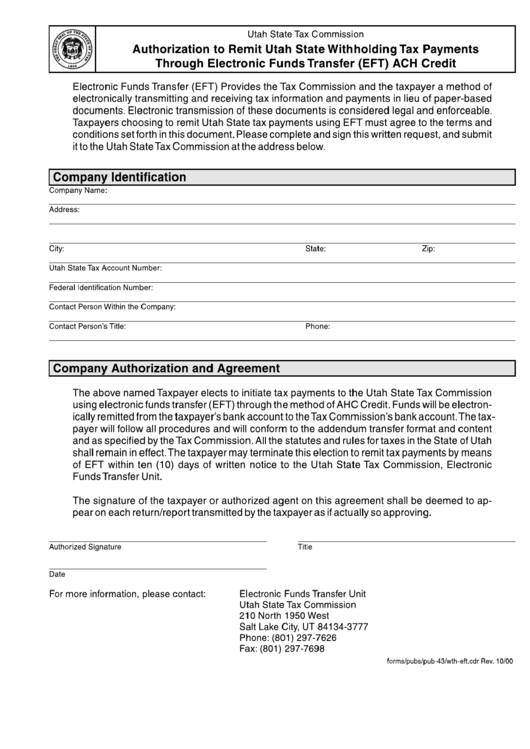

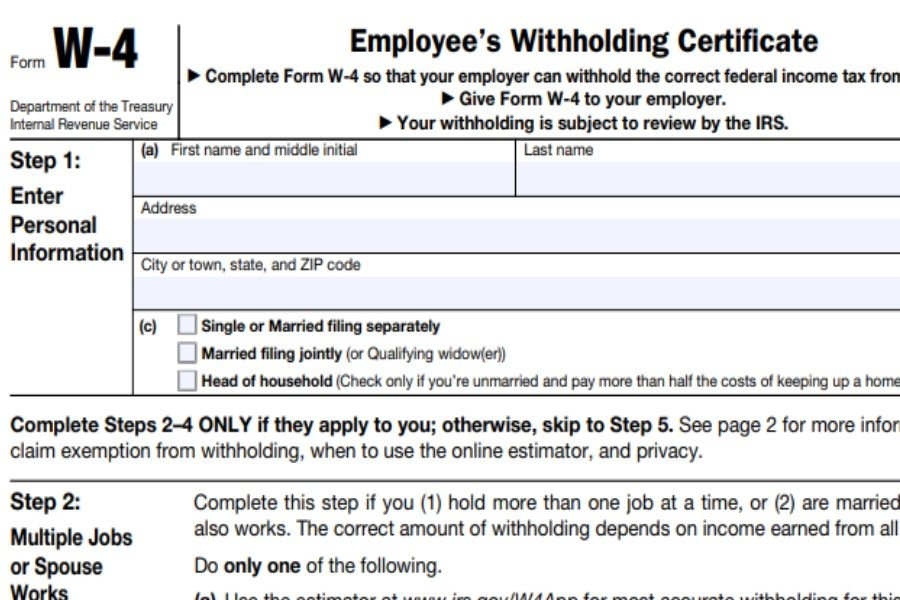

Utah Employee Withholding Form 2023 - Web employees must designate the number of withholding allowances they wish to claim on their paycheck. Web how to file you may file your withholding electronically* through: Web 51 rows utah withholding tax template: Blank time sheet for finet coding; Web utah withholding tax guide: Main menu, 2 of 9 main menu; Web payroll deductions before taxes. Web follow these steps to complete and submit your return: The utah state tax commission has updated. Including federal and state tax rates, withholding forms, and payroll tools.

The income tax withholding formula for the state of utah includes the following changes: The income tax rate has changed from 4.95 percent to 4.85 percent. The income tax rate has changed from 4.85 percent to 4.65. Web utah withholding tax guide: Web employees must designate the number of withholding allowances they wish to claim on their paycheck. Web the utah employer contribution rate is calculated annually by the unemployment insurance division. 2023 qualified political party declaration of candidacy. Download the current template and save to your computer before using. Web utah withholding tax, 1 of 9 , active utah withholding tax; The utah state tax commission has updated.

2023 employee withholding certificates thomson reuters tax & accounting january 5, 2023 · 5 minute read as we begin 2023, employers may. Deq blank time sheet (deq employees only) fi11 leave donation form; To update, increase or change the number of exemptions you have two. Main menu, 2 of 9 main menu; In 2023, more than 68 percent of utah’s employers. Web employees must designate the number of withholding allowances they wish to claim on their paycheck. The income tax rate has changed from 4.85 percent to 4.65. The utah state tax commission has updated. Web ing tax from employees’ wages, and † utah withholding tax tables for quick lookup. Web 51 rows utah withholding tax template:

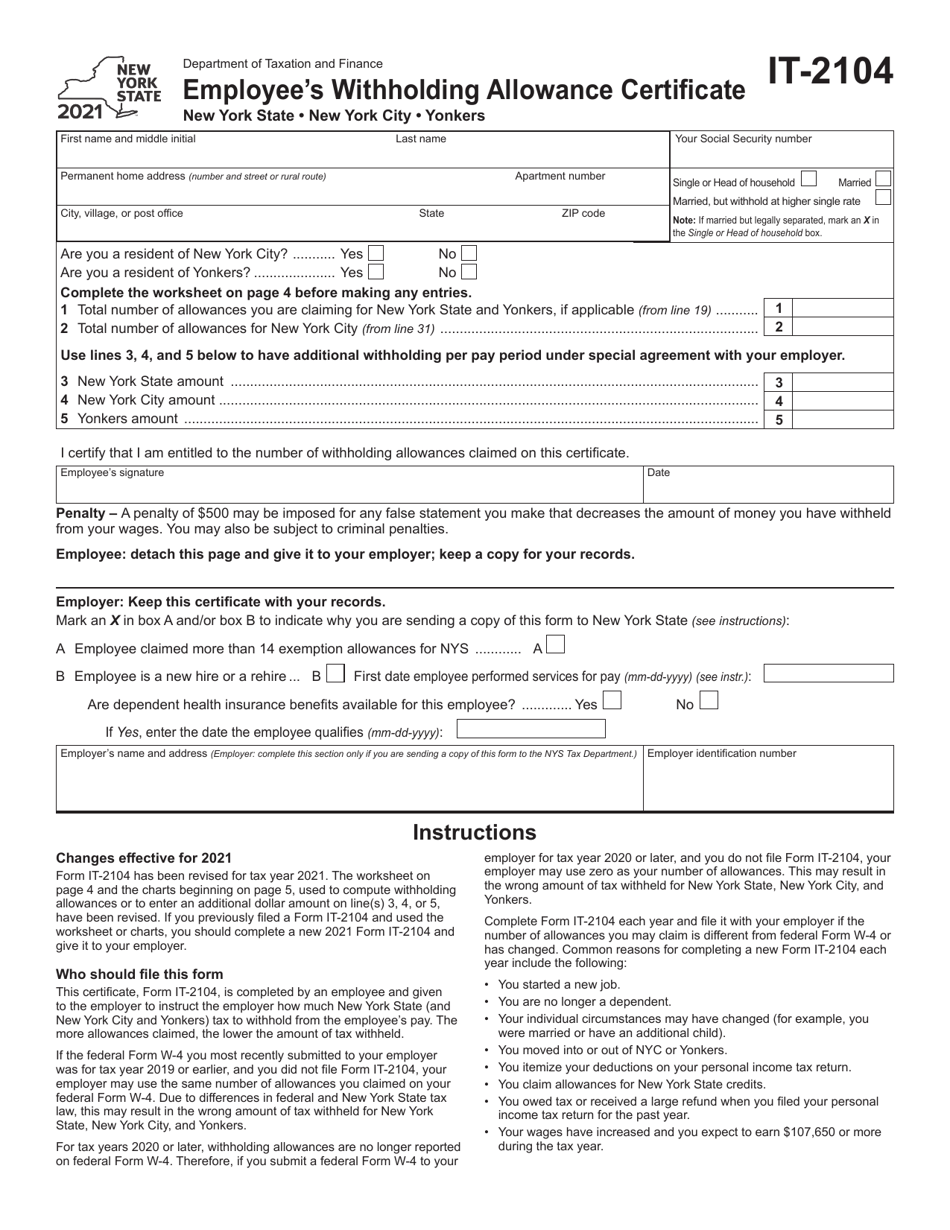

Form IT2104 Download Fillable PDF or Fill Online Employee's

26, 2022, 6:11 pm utah releases 2023 withholding guide, methods unchanged jamie rathjen editor/writer utah’s 2023 withholding guide. 2023 employee withholding certificates thomson reuters tax & accounting january 5, 2023 · 5 minute read as we begin 2023, employers may. Web the utah employer contribution rate is calculated annually by the unemployment insurance division. The income tax rate has changed.

Utah Employee Withholding Tax Form 2023

Blank time sheet for finet coding; Web utah withholding tax guide: 2023 employee withholding certificates thomson reuters tax & accounting january 5, 2023 · 5 minute read as we begin 2023, employers may. The income tax rate has changed from 4.85 percent to 4.65. Web the utah employer contribution rate is calculated annually by the unemployment insurance division.

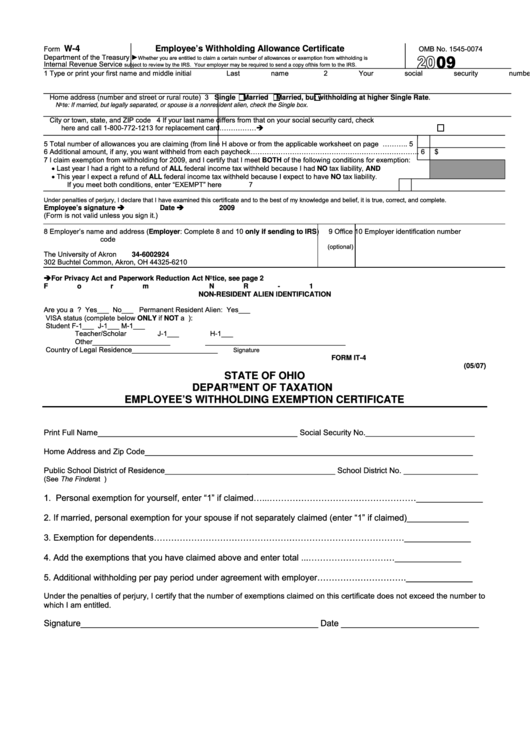

Ohio Withholding Form W 4 2022 W4 Form

Web utah withholding tax, 1 of 9 , active utah withholding tax; Web follow these steps to complete and submit your return: In 2023, more than 68 percent of utah’s employers. Web payroll deductions before taxes. The income tax rate has changed from 4.85 percent to 4.65.

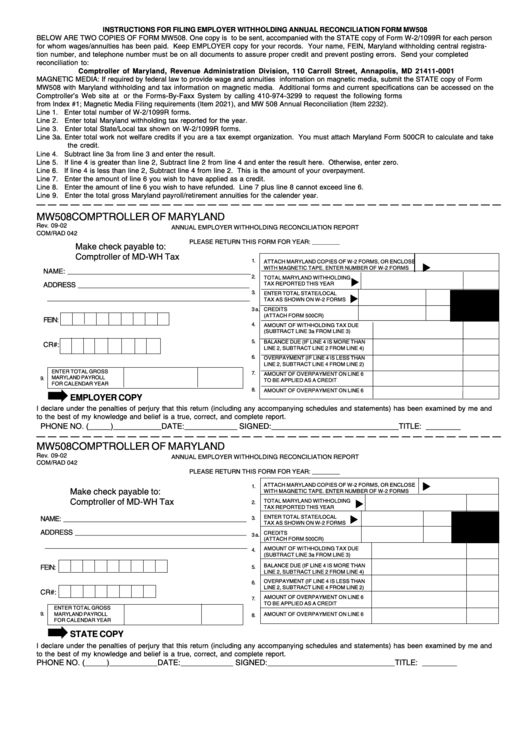

Maryland Withholding Form 2021 2022 W4 Form

To update, increase or change the number of exemptions you have two. Web utah withholding tax, 1 of 9 , active utah withholding tax; Web ing tax from employees’ wages, and † utah withholding tax tables for quick lookup. 2023 employee withholding certificates thomson reuters tax & accounting january 5, 2023 · 5 minute read as we begin 2023, employers.

Utah State Tax Withholding Form 2022

Web 51 rows utah withholding tax template: Web follow these steps to complete and submit your return: Web how to file you may file your withholding electronically* through: Utah issues revised 2023 income tax withholding guide reflecting lower personal income tax rate. The income tax withholding formula for the state of utah includes the following changes:

Arkansas Employee Tax Withholding Form 2023

2023 unaffiliated certificate of nomination. 26, 2022, 6:11 pm utah releases 2023 withholding guide, methods unchanged jamie rathjen editor/writer utah’s 2023 withholding guide. Web how to file you may file your withholding electronically* through: Web employees must designate the number of withholding allowances they wish to claim on their paycheck. 2023 qualified political party declaration of candidacy.

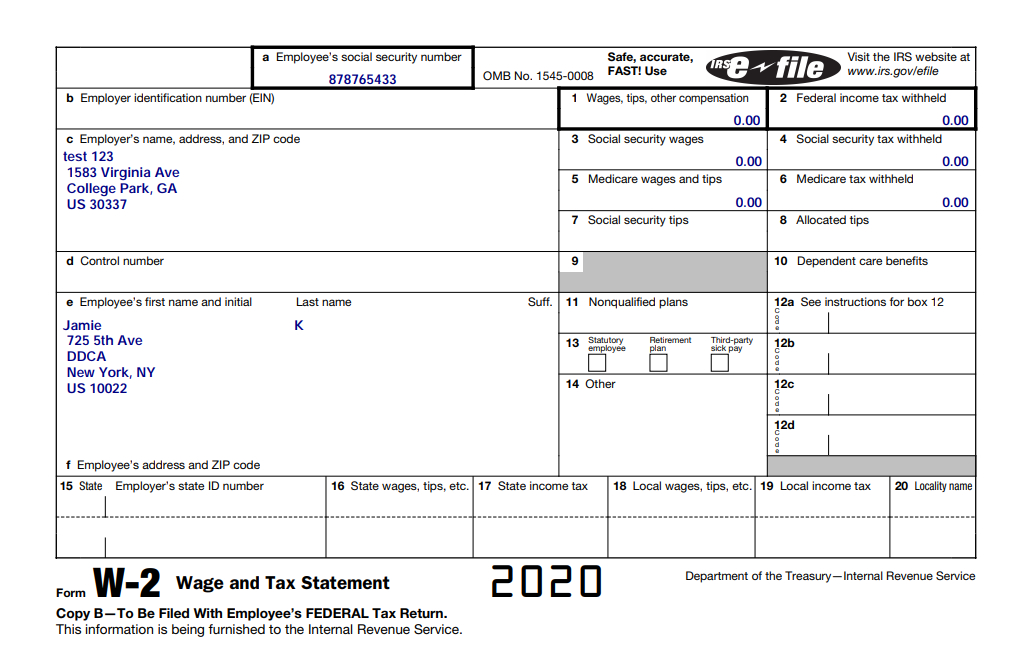

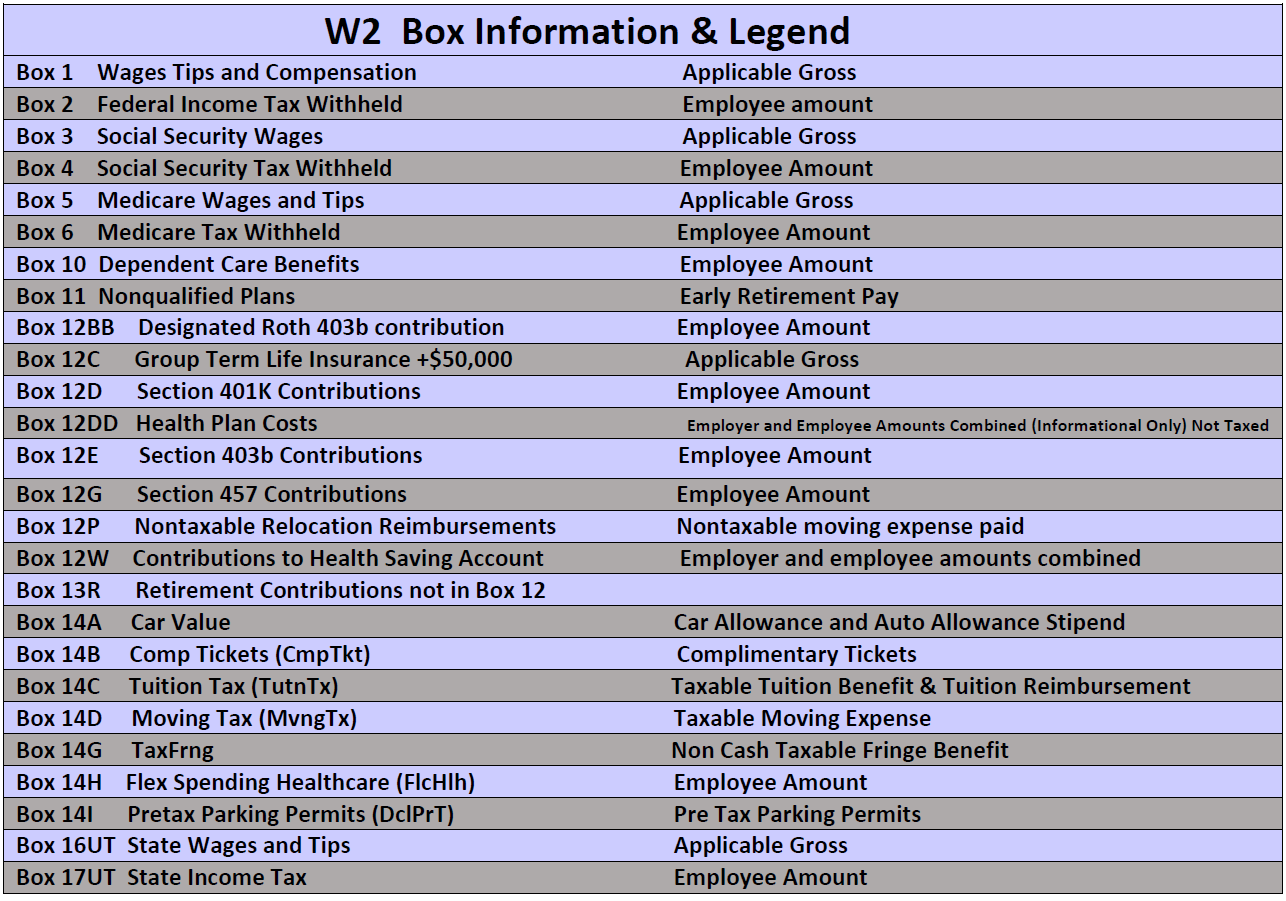

How to Download employee W2 withholding form using Deskera People?

Web payroll deductions before taxes. Web the utah employer contribution rate is calculated annually by the unemployment insurance division. Web the income tax withholding formula for the state of utah includes the following changes: The income tax rate has changed from 4.85 percent to 4.65. The income tax rate has changed from 4.95 percent to 4.85 percent.

Employee Withholding Form 2021 W4 Form 2021

Utah issues revised 2023 income tax withholding guide reflecting lower personal income tax rate. To update, increase or change the number of exemptions you have two. The utah state tax commission has updated. Web your free and reliable utah payroll and tax resource. Deq blank time sheet (deq employees only) fi11 leave donation form;

8 Form Utah Ten Reasons Why You Shouldn’t Go To 8 Form Utah On Your Own

2023 qualified political party declaration of candidacy. Web employees must designate the number of withholding allowances they wish to claim on their paycheck. The income tax withholding formula for the state of utah includes the following changes: In 2023, more than 68 percent of utah’s employers. Web 51 rows utah withholding tax template:

Utah State Withholding Form 2022

Download the current template and save to your computer before using. Web 51 rows utah withholding tax template: Web the utah employer contribution rate is calculated annually by the unemployment insurance division. The income tax rate has changed from 4.85 percent to 4.65. 2023 unaffiliated certificate of nomination.

Web The Utah Employer Contribution Rate Is Calculated Annually By The Unemployment Insurance Division.

Web the income tax withholding formula for the state of utah includes the following changes: Web ing tax from employees’ wages, and † utah withholding tax tables for quick lookup. Silver lake, big cottonwood canyon, by colton matheson forms &. 2023 unaffiliated certificate of nomination.

26, 2022, 6:11 Pm Utah Releases 2023 Withholding Guide, Methods Unchanged Jamie Rathjen Editor/Writer Utah’s 2023 Withholding Guide.

Web how to file you may file your withholding electronically* through: Web 51 rows utah withholding tax template: Web payroll deductions before taxes. Deq blank time sheet (deq employees only) fi11 leave donation form;

Web Your Free And Reliable Utah Payroll And Tax Resource.

Download the current template and save to your computer before using. To update, increase or change the number of exemptions you have two. The income tax rate has changed from 4.95 percent to 4.85 percent. The income tax rate has changed from 4.85 percent to 4.65.

Web Employees Must Designate The Number Of Withholding Allowances They Wish To Claim On Their Paycheck.

Web utah withholding tax guide: Utah issues revised 2023 income tax withholding guide reflecting lower personal income tax rate. Main menu, 2 of 9 main menu; Web utah withholding tax, 1 of 9 , active utah withholding tax;