Txst Tax Form

Txst Tax Form - To receive tax exemption from a texas hotel vendor. To avoid delays in processing, use forms approved by the revenue division of the city of kansas city,. Fuels tax, ifta and interstate. File your form 2290 today avoid the rush. If using a private delivery service, send your returns to the street address above for the submission processing center. Web find 5 ways to say tax form, along with antonyms, related words, and example sentences at thesaurus.com, the world's most trusted free thesaurus. Name of purchaser, firm or agency as shown on permit. Web • failure to provide no tax due letter from state of missouri (if applicable) 3. (e.g., financial aid, tuition adjustments, 529 payments) payment plan enrollment instructions without payment. Get irs approved instant schedule 1 copy.

If you make $70,000 a year living in texas you will be taxed $8,168. Web accessing your 1098t form: Web texas sales and use tax resale certificate. Web select ‘tax notification’ input tax year and click ‘submit’ acs website: Web faculty and academic resources has compiled the following new hire forms and documents. Web verification process verification is a process to confirm the information you provided on the fafsa (free application for federal student aid). Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. Fuels tax, ifta and interstate. Phone (area code and number) address (street & number, p.o. To avoid delays in processing, use forms approved by the revenue division of the city of kansas city,.

Web • failure to provide no tax due letter from state of missouri (if applicable) 3. If you make $70,000 a year living in texas you will be taxed $8,168. 1, 2016 to be filed electronically. Ad don't leave it to the last minute. Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. Name of purchaser, firm or agency as shown on permit. Phone (area code and number) address (street & number, p.o. Web 1973 rulon white blvd. File your form 2290 online & efile with the irs. Your average tax rate is 11.67% and your marginal tax rate is 22%.

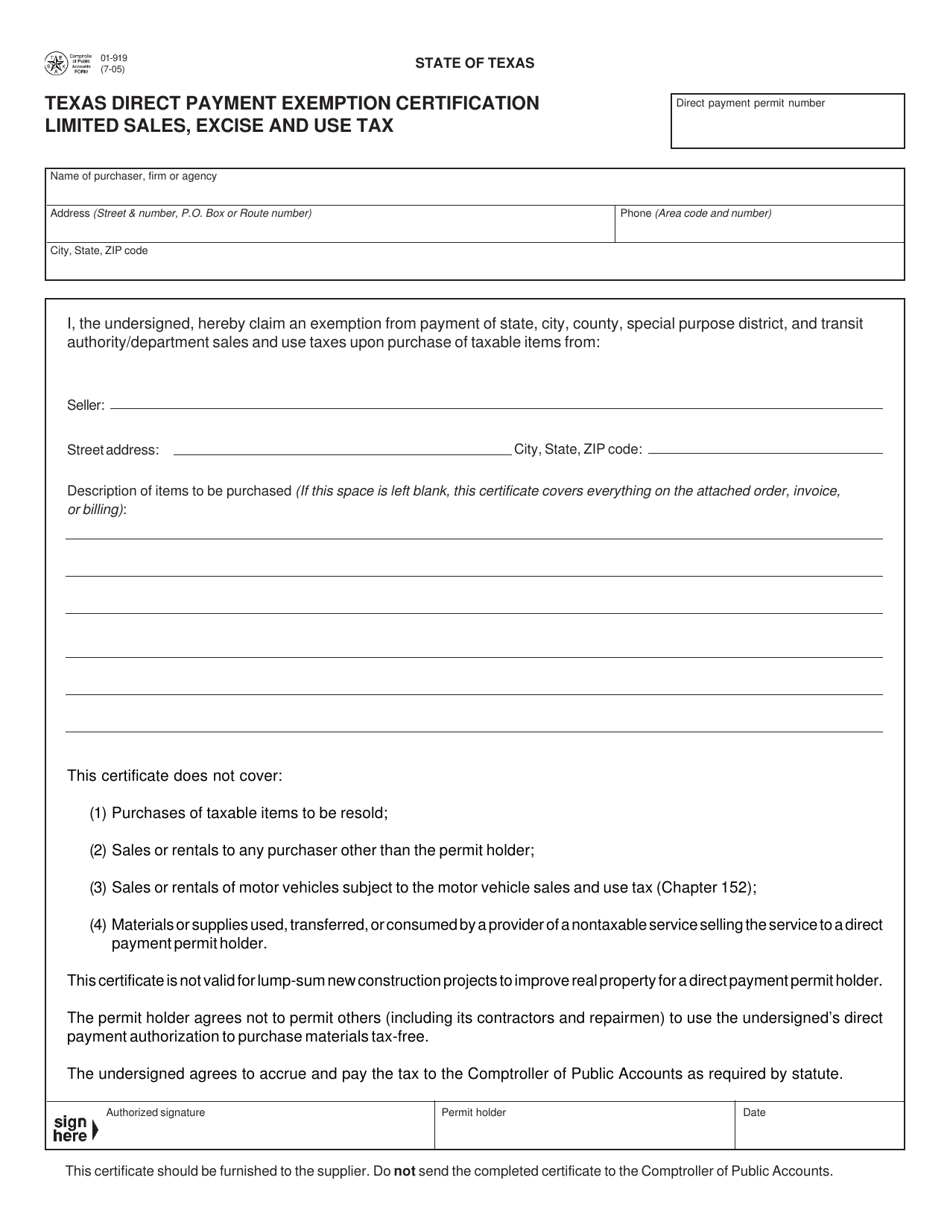

Form 01919 Download Fillable PDF or Fill Online Texas Direct Payment

File your form 2290 online & efile with the irs. Your average tax rate is 11.67% and your marginal tax rate is 22%. Submit a completed legal information update form along with the supporting legal documentation to the office of the university registrar. Web select ‘tax notification’ input tax year and click ‘submit’ acs website: File your form 2290 today.

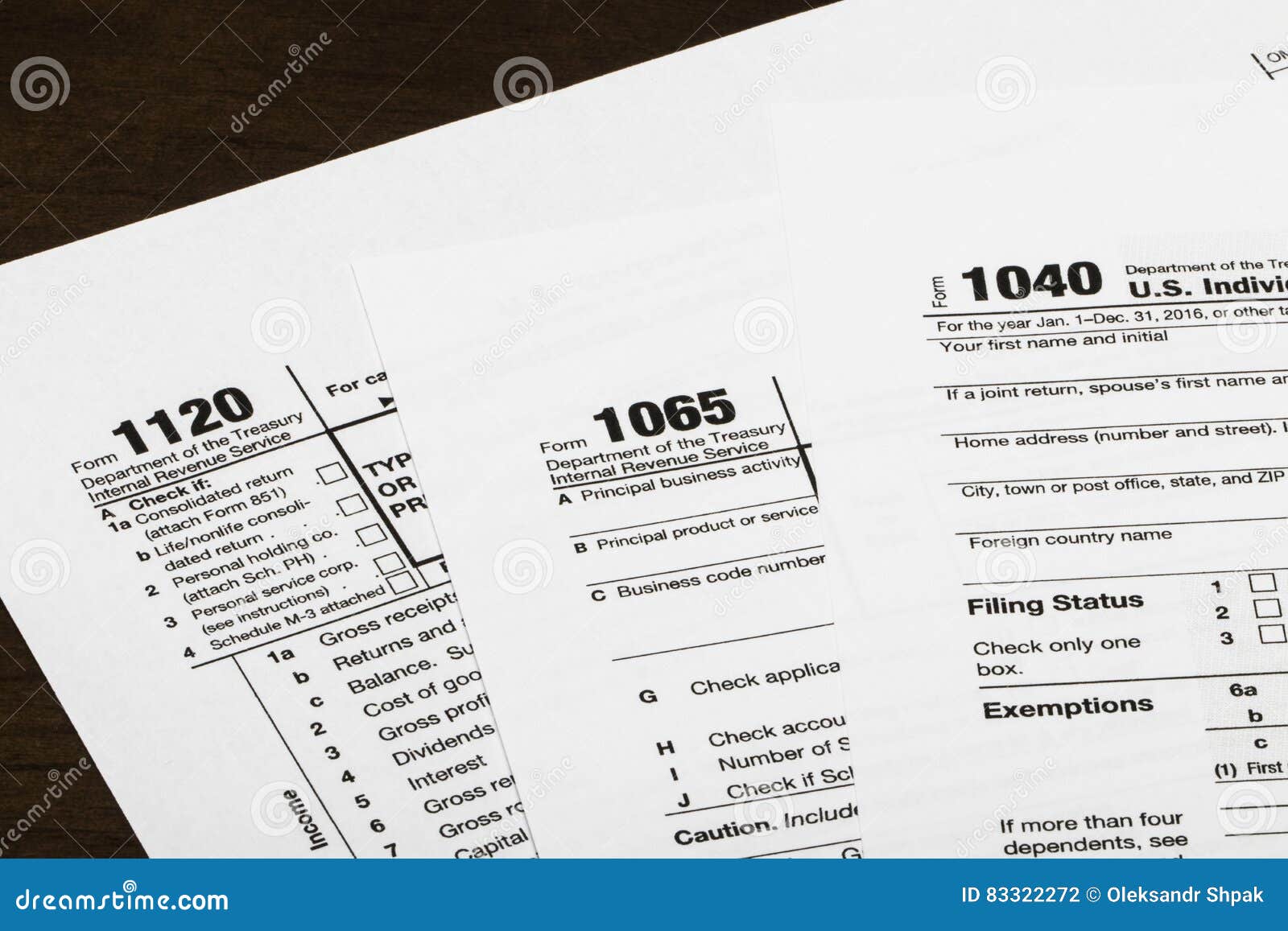

1040,1120,1065 US Tax Form / Taxation Concept Editorial Photography

Web complete the employee vs. If you need additional assistance locating the appropriate form, please. To avoid delays in processing, use forms approved by the revenue division of the city of kansas city,. Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. Web most frequently used tax forms sales and.

Tax Season Is Upon Us Things to Remember When Filing Your Tax Returns

Your average tax rate is 11.67% and your marginal tax rate is 22%. Web texas sales and use tax resale certificate. Get irs approved instant schedule 1 copy. Each contract or po that contains a request to pay an. Web select ‘tax notification’ input tax year and click ‘submit’ acs website:

how to file form 10ba of tax Archives BIS & Company

Phone (area code and number) address (street & number, p.o. If you make $70,000 a year living in texas you will be taxed $8,168. Ad don't leave it to the last minute. Web • failure to provide no tax due letter from state of missouri (if applicable) 3. Submit a completed legal information update form along with the supporting legal.

Don't make checks out to 'IRS' for federal taxes, or your payment could

Agricultural and timber exemption forms; (e.g., financial aid, tuition adjustments, 529 payments) payment plan enrollment instructions without payment. Your average tax rate is 11.67% and your marginal tax rate is 22%. File your form 2290 today avoid the rush. If using a private delivery service, send your returns to the street address above for the submission processing center.

TxSt among ‘Best Employers for Women’ San Marcos Record

Web select ‘tax notification’ input tax year and click ‘submit’ acs website: Web find 5 ways to say tax form, along with antonyms, related words, and example sentences at thesaurus.com, the world's most trusted free thesaurus. Ad don't leave it to the last minute. To receive tax exemption from a texas hotel vendor. Web complete the employee vs.

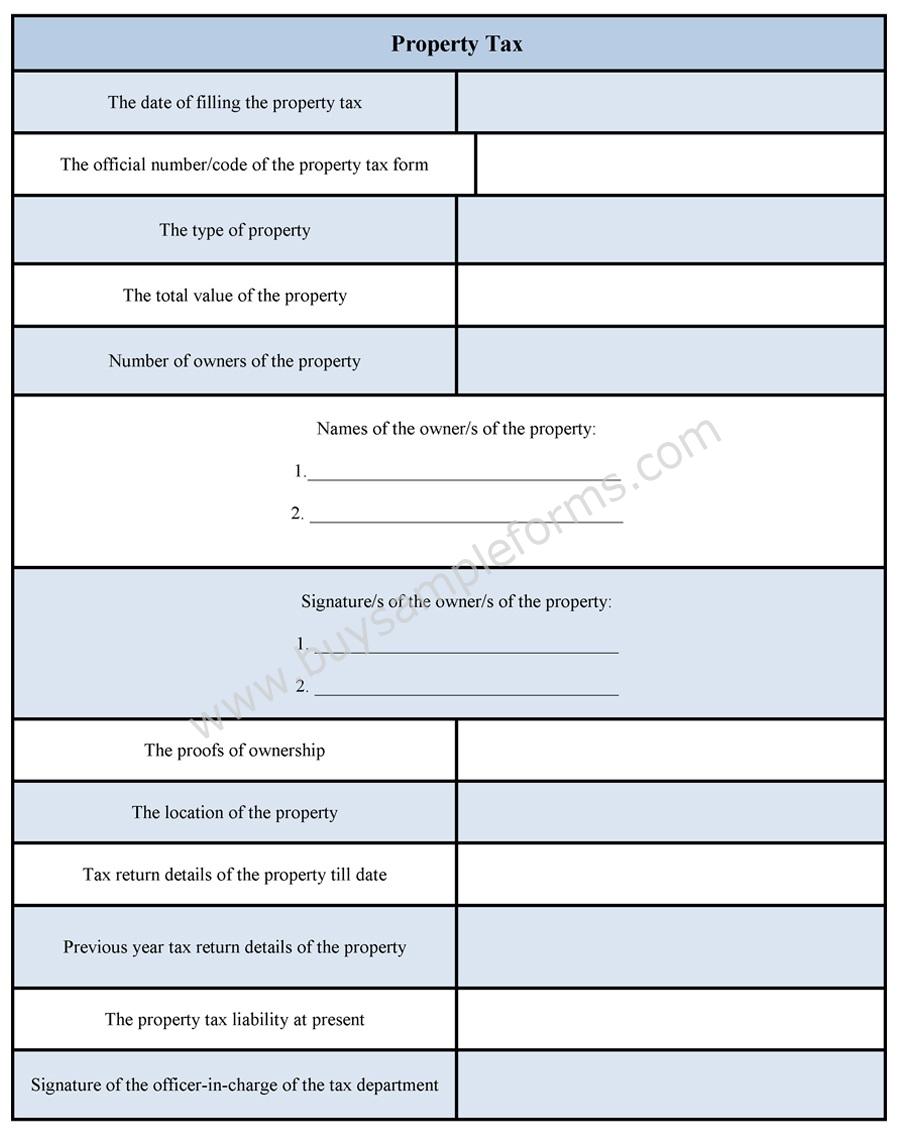

Property Tax Form Sample Forms

If you need additional assistance locating the appropriate form, please. (e.g., financial aid, tuition adjustments, 529 payments) payment plan enrollment instructions without payment. Web 1973 rulon white blvd. The law requires all no tax due reports originally due after jan. Web • failure to provide no tax due letter from state of missouri (if applicable) 3.

Texas State Capitol House of Representatives (in Session … Flickr

Web most frequently used tax forms sales and use tax; Web • failure to provide no tax due letter from state of missouri (if applicable) 3. If using a private delivery service, send your returns to the street address above for the submission processing center. To receive tax exemption from a texas hotel vendor. (e.g., financial aid, tuition adjustments, 529.

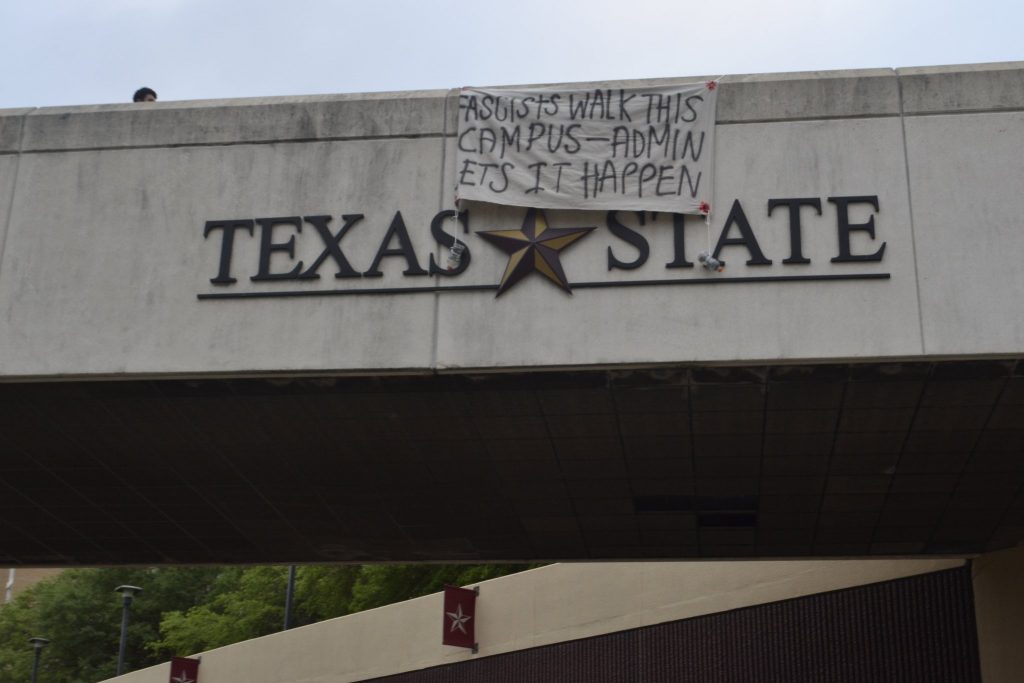

Texas State Students Confront Fascism, Arrested, & Launch SitIn

Submit a completed legal information update form along with the supporting legal documentation to the office of the university registrar. If you need additional assistance locating the appropriate form, please. Each contract or po that contains a request to pay an. Get irs approved instant schedule 1 copy. Web select ‘tax notification’ input tax year and click ‘submit’ acs website:

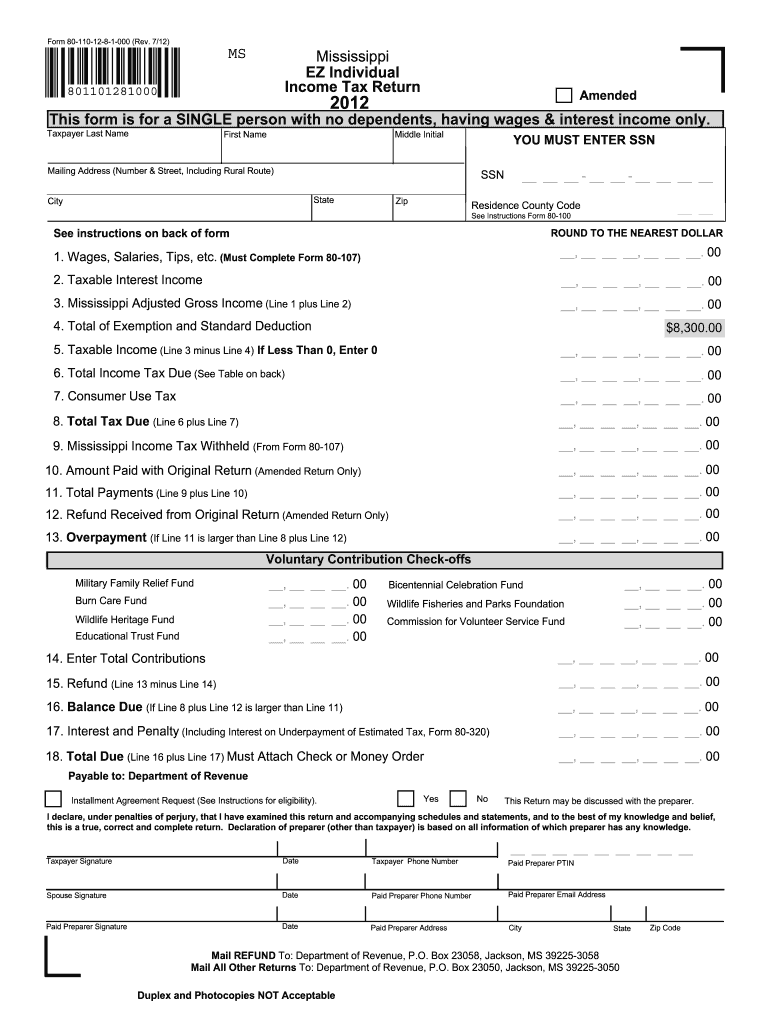

State Tax Forms Fill Out and Sign Printable PDF Template signNow

Ad don't leave it to the last minute. Web 1973 rulon white blvd. Web payment plan enrollment instructions with payment credits. Web • failure to provide no tax due letter from state of missouri (if applicable) 3. Agricultural and timber exemption forms;

1, 2016 To Be Filed Electronically.

Web 2022 texas franchise tax report information and instructions (pdf) no tax due. Submit a completed legal information update form along with the supporting legal documentation to the office of the university registrar. File your form 2290 online & efile with the irs. Name of purchaser, firm or agency as shown on permit.

If You Need Additional Assistance Locating The Appropriate Form, Please.

Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. Web how to update your record at txst. Web most frequently used tax forms sales and use tax; Web faculty and academic resources has compiled the following new hire forms and documents.

Web Find 5 Ways To Say Tax Form, Along With Antonyms, Related Words, And Example Sentences At Thesaurus.com, The World's Most Trusted Free Thesaurus.

Web complete the employee vs. The law requires all no tax due reports originally due after jan. Each contract or po that contains a request to pay an. Fuels tax, ifta and interstate.

Web Verification Process Verification Is A Process To Confirm The Information You Provided On The Fafsa (Free Application For Federal Student Aid).

Web accessing your 1098t form: Ad don't leave it to the last minute. Your average tax rate is 11.67% and your marginal tax rate is 22%. Agricultural and timber exemption forms;