Twitch Tax Form

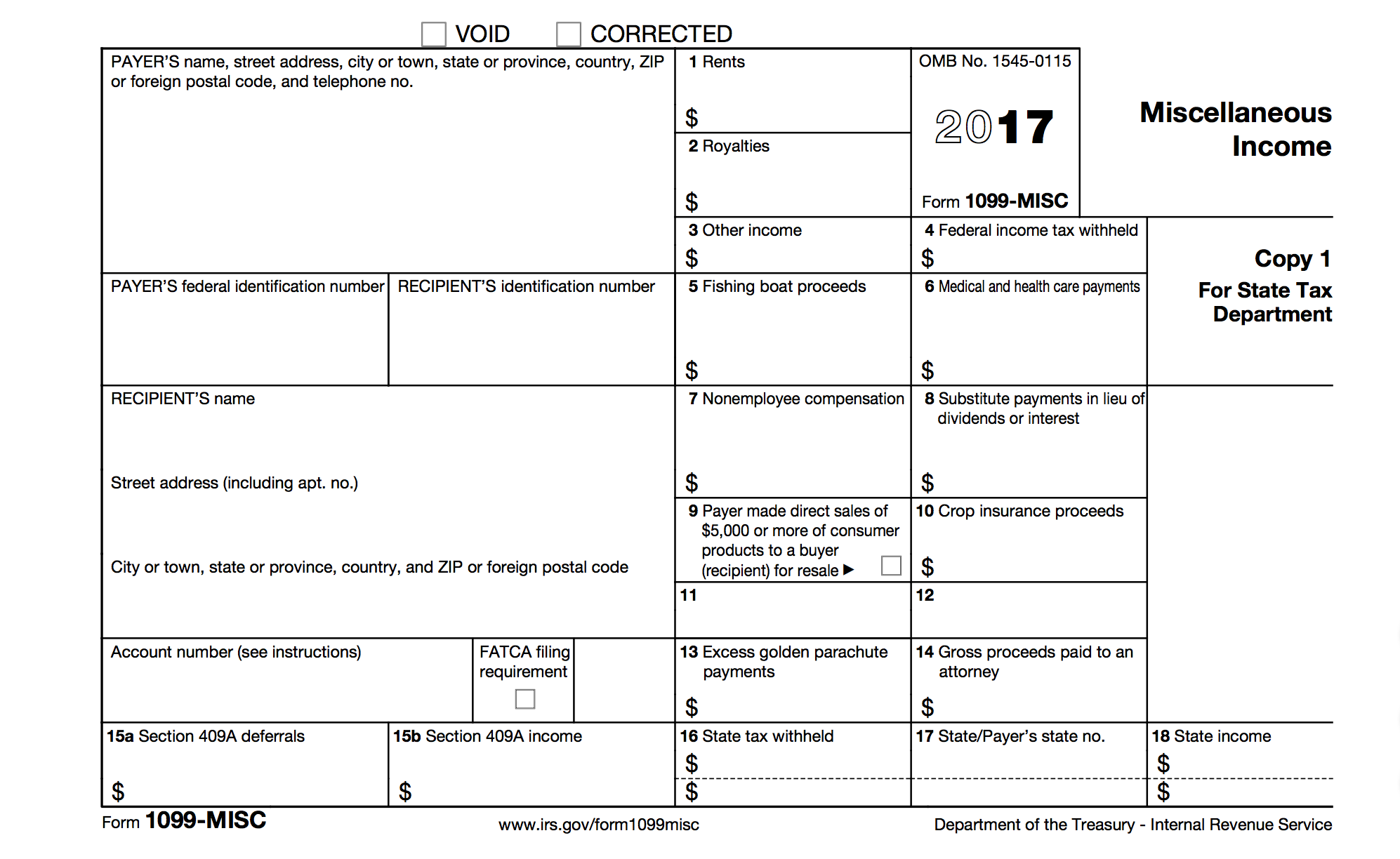

Twitch Tax Form - Web twitch is required to send you a 1099 tax form by january 31 if you meet the reporting requirements. Web what are the different forms that twitch taxes may be filed on? The 1040 form is the normal tax return. Corporations may claim the withholding. Web what is a twitch 1099 tax form? How to file your twitch taxes. Get help with your taxes. To avoid delays in processing, use forms approved by the revenue division of the city of kansas city,. Form 1099 is an informational document that twitch provides to you and the irs. You will provide basic, general information to be registered into the program.

Make sure you keep all of these forms safe. Web twitch is required to send you a 1099 tax form by january 31 if you meet the reporting requirements. So, if you meet the qualifications, you'll receive your 1099 form in early. If you’re in the us then you’ll need your social security number (ssn) or. Corporations may claim the withholding. Web considering the fact that you can spend jail time if you ignore paying your twitch taxes, you need to get your financial document house in order. Web what forms are involved in twitch taxes? How to file your twitch taxes. Web what are the different forms that twitch taxes may be filed on? Web twitch yearly payout less than $600 if you have not made at least $600 on their platform, twitch is not obligated to send you a 1099 form, but you are still obligated.

How to file your twitch taxes. Web considering the fact that you can spend jail time if you ignore paying your twitch taxes, you need to get your financial document house in order. You will provide basic, general information to be registered into the program. Web requests should be submitted via the below form at least four (4) weeks prior to the deadline for the donation. Corporations may claim the withholding. Twitch taxes will be received or processed using the following forms: Make sure you keep all of these forms safe. Everyone will need their name, birth date, address, and some information about their stream. The 1040 form is the normal tax return. Web what is a twitch 1099 tax form?

1099K vs 1099MISC—What's the Difference? ZipBooks

How to file your twitch taxes. Sign the twitch affiliate agreement, agreeing to the terms of the program. The 1040 form is the normal tax return. Web • failure to provide no tax due letter from state of missouri (if applicable) 3. Form 1099 is an informational document that twitch provides to you and the irs.

Twitch Affiliate Tax Form Overview StreamerSquare

If you’re in the us then you’ll need your social security number (ssn) or. Web what forms are involved in twitch taxes? Web to avoid tax liabilities, you may need the help of a professional bookkeeper and accountant. To avoid delays in processing, use forms approved by the revenue division of the city of kansas city,. The 1040 form is.

Affiliate Tax Interview won't accept my house number API Twitch

Web what is a twitch 1099 tax form? Everyone will need their name, birth date, address, and some information about their stream. Twitch is required to file a 1099 on behalf of any streamer. So, if you meet the qualifications, you'll receive your 1099 form in early. Web what are the different forms that twitch taxes may be filed on?

Affiliate Onboarding Guide

To avoid delays in processing, use forms approved by the revenue division of the city of kansas city,. You will provide basic, general information to be registered into the program. Sign the twitch affiliate agreement, agreeing to the terms of the program. Web what are the different forms that twitch taxes may be filed on? Get help with your taxes.

Twitch Taxes Guide Best Tips and Tricks to Discover in 2023

I do not consider it to be a business endeavor. Twitch taxes will be received or processed using the following forms: Web twitch yearly payout less than $600 if you have not made at least $600 on their platform, twitch is not obligated to send you a 1099 form, but you are still obligated. Web what are the different forms.

Twitch Affiliate Tax Form Overview StreamerSquare

Web what is a twitch 1099 tax form? Web what are the different forms that twitch taxes may be filed on? Everyone will need their name, birth date, address, and some information about their stream. Web to avoid tax liabilities, you may need the help of a professional bookkeeper and accountant. If you’re in the us then you’ll need your.

Twitch Affiliate Tax Form Overview StreamerSquare

Form 1099 is an informational document that twitch provides to you and the irs. You will provide basic, general information to be registered into the program. Web • failure to provide no tax due letter from state of missouri (if applicable) 3. Get help with your taxes. To avoid delays in processing, use forms approved by the revenue division of.

Twitch 1099 Tax Form How to Find & FAQs

Sign the twitch affiliate agreement, agreeing to the terms of the program. Make sure you keep all of these forms safe. Corporations may claim the withholding. The following documents will be submitted or utilized during the payment of twitch taxes: Web to avoid tax liabilities, you may need the help of a professional bookkeeper and accountant.

Twitch Affiliate Help Please. Tax Section is stuck/bugged! Twitch

If you’re in the us then you’ll need your social security number (ssn) or. To avoid delays in processing, use forms approved by the revenue division of the city of kansas city,. Corporations may claim the withholding. Web twitch is required to send you a 1099 tax form by january 31 if you meet the reporting requirements. So, if you.

The Easy Way to File Your Twitch 1099 Taxes

You will provide basic, general information to be registered into the program. Corporations may claim the withholding. Twitch is required to file a 1099 on behalf of any streamer. The beneficiary’s 501(c)(3) or federal tax id information will. Web what are the different forms that twitch taxes may be filed on?

I Do Not Consider It To Be A Business Endeavor.

Twitch taxes will be received or processed using the following forms: To avoid delays in processing, use forms approved by the revenue division of the city of kansas city,. Twitch is required to file a 1099 on behalf of any streamer. Web what forms are involved in twitch taxes?

Web Twitch Yearly Payout Less Than $600 If You Have Not Made At Least $600 On Their Platform, Twitch Is Not Obligated To Send You A 1099 Form, But You Are Still Obligated.

Corporations may claim the withholding. You will provide basic, general information to be registered into the program. Web considering the fact that you can spend jail time if you ignore paying your twitch taxes, you need to get your financial document house in order. Web what are the different forms that twitch taxes may be filed on?

The 1040 Form Is The Normal Tax Return.

Everyone will need their name, birth date, address, and some information about their stream. Web to avoid tax liabilities, you may need the help of a professional bookkeeper and accountant. Web twitch is required to send you a 1099 tax form by january 31 if you meet the reporting requirements. Make sure you keep all of these forms safe.

If You’re In The Us Then You’ll Need Your Social Security Number (Ssn) Or.

Web if you have a gaming machine/equipment, you can declare the equipment for your business purposes (steaming) and that acts as a cost for yourself, you only pay tax on profit, you. How to file your twitch taxes. Web • failure to provide no tax due letter from state of missouri (if applicable) 3. Sign the twitch affiliate agreement, agreeing to the terms of the program.