Turbotax Form 3921

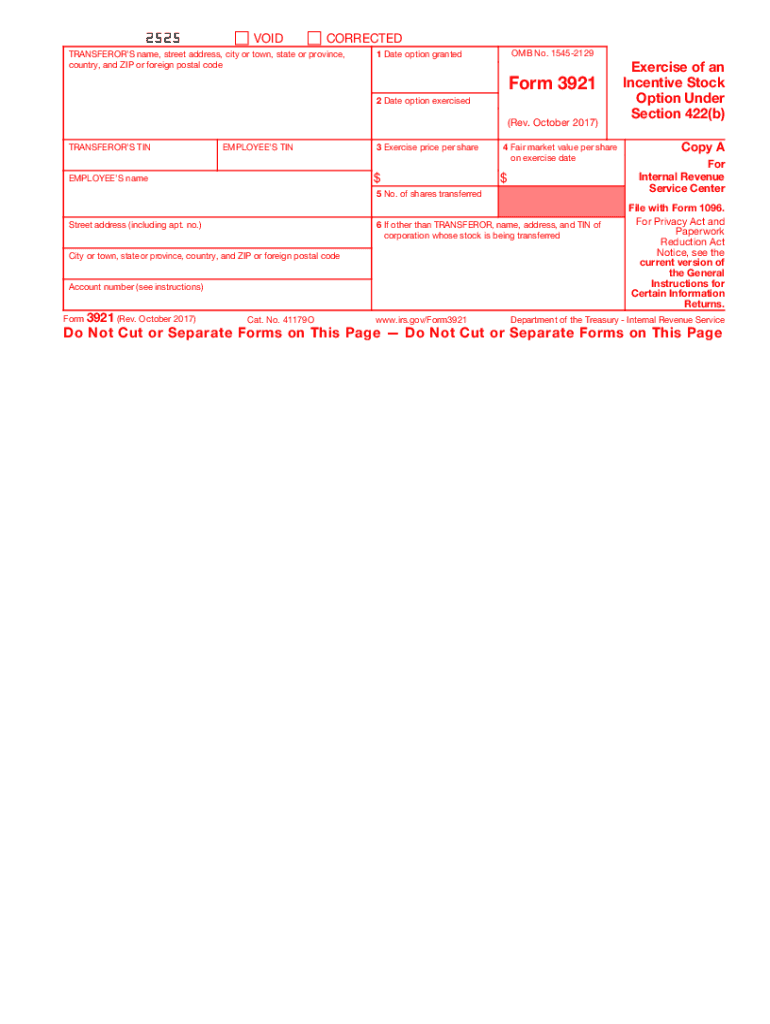

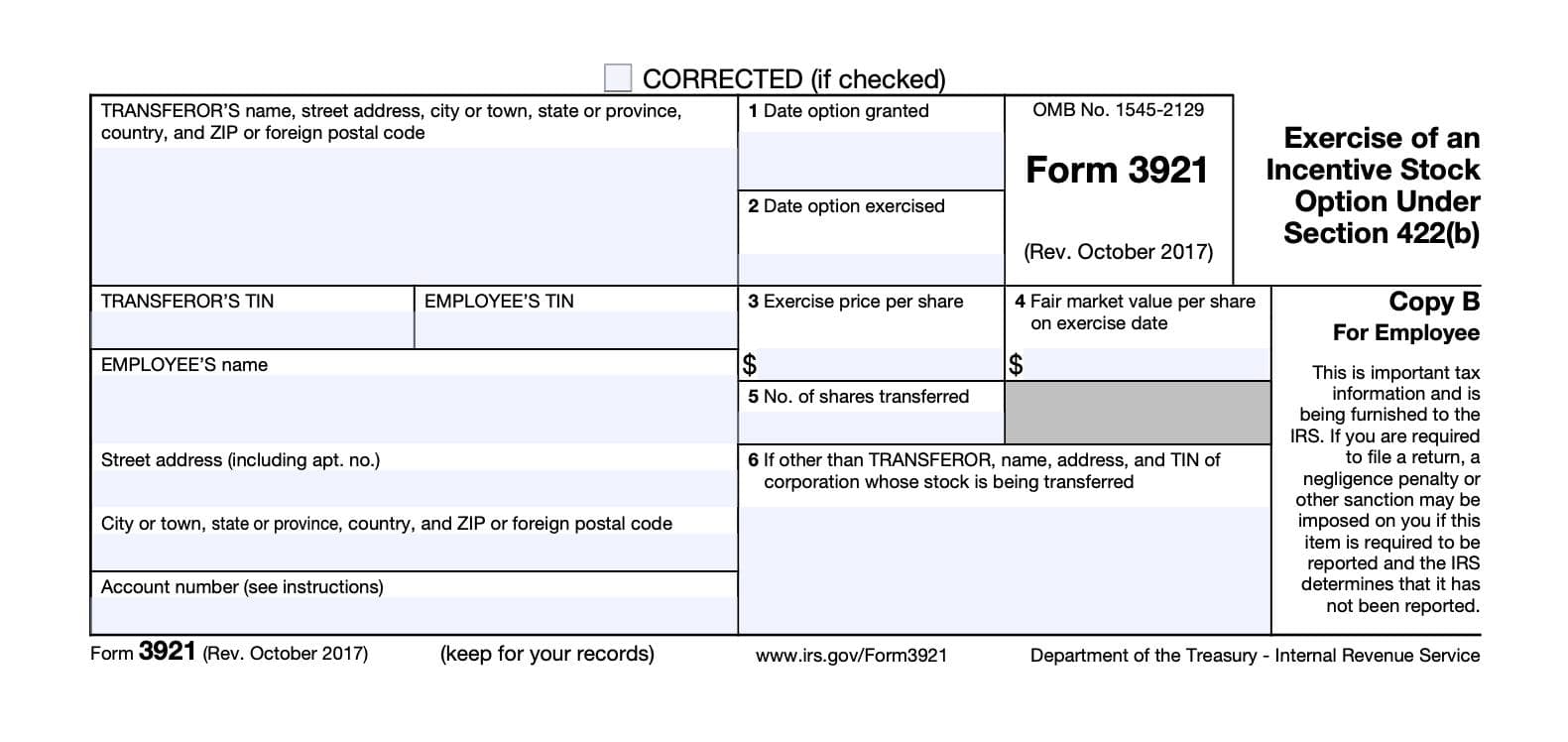

Turbotax Form 3921 - Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock option (iso). Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Web form 3921, exercise of an incentive stock option under section 422 (b), is a form provided to a taxpayer when they exercise an incentive stock option (iso). Edit, sign and print tax forms on any device with uslegalforms. Form 3921 is a form that companies have to file with the irs when a shareholder exercises their incentive stock option (iso). Web 3921 is an informational form only. According to irs publication 525 you must report it for amt purposes once it becomes transferable by you without. A preparer must determine if an entry is needed based on the facts of the transfer. Web form 3921 walkthrough. Web find out about form 3921 and how employee granted iso is taxed by william perez updated on december 24, 2022 reviewed by lea d.

Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock option (iso). This makes it easier for the irs to hold. Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option. Web entering amounts from form 3921 in the individual module of lacerte. A startup is required to file one. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Web specific instructions for form 3921 who must file every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an. Web form 3921 is an informational report, similar to 1099s, that lets the irs know that certain individuals/entities received compensation. Form 3921 is an irs form that is filed when an employee has exercised shares including incentive stock options (isos) in. Web 3921 is an informational form only.

Web up to $40 cash back easily complete a printable irs 3921 form 2017 online. Web february 26, 2022 3:49 pm 0 reply bookmark icon cfchase returning member this does apply to me, i have a 1099b but no form 3921. Web what is form 3921? Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock option (iso). The form has to be. Web entering amounts from form 3921 in the individual module of lacerte. Web find out about form 3921 and how employee granted iso is taxed by william perez updated on december 24, 2022 reviewed by lea d. A preparer must determine if an entry is needed based on the facts of the transfer. Form 3921 is an irs form that is filed when an employee has exercised shares including incentive stock options (isos) in. Web form 3921 walkthrough.

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

Web the form will include: It is generally not entered on your tax return unless you then sold the stock, or if you could be subject to alternative minimum. Web who must file. A preparer must determine if an entry is needed based on the facts of the transfer. Web what is form 3921?

IRS 3921 20172021 Fill out Tax Template Online US Legal Forms

Web the form will include: Web form 3921 walkthrough. Web who must file. Get ready for this year's tax season quickly and safely with pdffiller! The form has to be.

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

Get ready for this year's tax season quickly and safely with pdffiller! Web specific instructions for form 3921 who must file every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an. It is generally not entered on your tax return unless you then sold the stock, or if.

Form 3921 How to Report Transfer of Incentive Stock Options in 2016

Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock option (iso). I went online to my. Web the form will include: Web corporations file this form for each transfer of stock to any person pursuant to that person's exercise of an incentive stock.

form 2106 turbotax Fill Online, Printable, Fillable Blank

Web entering amounts from form 3921 in the individual module of lacerte. Web find out about form 3921 and how employee granted iso is taxed by william perez updated on december 24, 2022 reviewed by lea d. Web up to $40 cash back easily complete a printable irs 3921 form 2017 online. Web you have received form 3291 because your.

Form 3921 Everything you need to know

Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option. The form has to be. Web what is form 3921? Create a blank & editable 3921 form,. Web specific instructions for form 3921 who must file every corporation which in any calendar year transfers to.

Where do i enter form 3921 information? (Turbotax 2019)

Web the form will include: Edit, sign and print tax forms on any device with uslegalforms. Get ready for this year's tax season quickly and safely with pdffiller! Form 3921 is an irs form that is filed when an employee has exercised shares including incentive stock options (isos) in. Web form 3921, exercise of an incentive stock option under section.

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

Get ready for this year's tax season quickly and safely with pdffiller! Web entering amounts from form 3921 in the individual module of lacerte. Although this information is not taxable unless. Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock option (iso). Web.

TurboTax Deluxe 2014 Fed + State + Fed Efile Tax Software

Web who must file. Web 3921 is an informational form only. Web form 3921 walkthrough. Web in drake tax, there is no specific data entry screen for form 3921. Edit, sign and print tax forms on any device with uslegalforms.

TurboTax makes filing (almost) fun Inside Design Blog Turbotax

Web specific instructions for form 3921 who must file every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an. Web in drake tax, there is no specific data entry screen for form 3921. Web february 26, 2022 3:49 pm 0 reply bookmark icon cfchase returning member this does.

Create A Blank & Editable 3921 Form,.

Web who must file. Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock option (iso). Web do i need to file form 3921 even if i didn't sell? A startup is required to file one.

Web The Form Will Include:

Solved • by intuit • 283 • updated july 19, 2022. Web form 3921 is an informational report, similar to 1099s, that lets the irs know that certain individuals/entities received compensation. Web corporations file this form for each transfer of stock to any person pursuant to that person's exercise of an incentive stock option described in section 422(b). This article will help you enter.

Web Find Out About Form 3921 And How Employee Granted Iso Is Taxed By William Perez Updated On December 24, 2022 Reviewed By Lea D.

Edit, sign and print tax forms on any device with uslegalforms. Form 3921 is a tax form that helps the irs keep track of when and how employees exercise their incentive stock options (isos). A preparer must determine if an entry is needed based on the facts of the transfer. The form has to be.

Web Form 3921, Exercise Of An Incentive Stock Option Under Section 422 (B), Is A Form Provided To A Taxpayer When They Exercise An Incentive Stock Option (Iso).

According to irs publication 525 you must report it for amt purposes once it becomes transferable by you without. Web 3921 is an informational form only. Get ready for this year's tax season quickly and safely with pdffiller! Although this information is not taxable unless.