Travis County Property Tax Protest Form

Travis County Property Tax Protest Form - Web a property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code section 41.41. Web filing a protest. In travis, williamson and hays counties, may 15 is the deadline for most property owners to file a notice of protest of your appraised value. February 23, 2023 in texas, the 10% homestead cap is a limit on the amount that taxable value can increase for a primary residence in any one year. Web value protests learn about property tax appraised value protests. Completing these forms online gives property owners numerous benefits. Web get in line now (residential & bpp) residential properties bpp need help? Contact us or check out the videos below to learn more about navigating the protest process through our online portal. Residence homestead exemption application travis central appraisal district name and/or address correction form You may follow these appeal procedures if you have a concern about:

There are two ways to protest your property tax values. • the appraised (market) value of your property; You can also file online to protest your travis county property tax. Web get in line now (residential & bpp) residential properties bpp need help? Web the tax office collects fees for a variety of state and local government agencies and proudly registers voters in travis county! Web filing a protest. Web how do i protest my property taxes? Web the travis central appraisal district (tcad) is responsible for listing property and ownership information, estimating values, providing plat maps, and assisting taxpayers with the protest process. Application for a homestead exemption. Web a property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code section 41.41.

Web statement of inability to pay court costs. A property owner or an owner’s designated agent can use. February 23, 2023 in texas, the 10% homestead cap is a limit on the amount that taxable value can increase for a primary residence in any one year. Web a property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code section 41.41. Web though you could learn how to appeal property taxes yourself—filing forms, faxing in appraisals, submitting evidence, and attending appraisal review board hearings and judicial appeals—there’s a much easier way to protest your travis county property tax. Web how do i protest my property taxes? Get comps & evidence packet now! Web visit the travis central appraisal district forms database for other property tax forms including: Web property owners have the right to protest actions concerning their property tax appraisals. Web filing a protest.

Travis County Property Tax Protest Discount Property Taxes

Web travis county tax office property tax, appraised value protests the travis central appraisal district (tcad) is responsible for listing property and ownership information, estimating value, providing plat maps, and assisting taxpayers with the protest process. Web get in line now (residential & bpp) residential properties bpp need help? If you need assistance with setting up an account or logging.

Travis County Property Tax Deferral PROFRTY

How do i change the address or ownership records for a property? You can also file online to protest your travis county property tax. There are two ways to protest your property tax values. Get comps & evidence packet now! Completing these forms online gives property owners numerous benefits.

Everything You Need to Know About Travis County Property Tax

A tax lien automatically attaches to your property to secure tax payments, late penalties and interest. Web visit the travis central appraisal district forms database for other property tax forms including: The travis central appraisal district offers property owners the opportunity to complete several forms online, including: Web though you could learn how to appeal property taxes yourself—filing forms, faxing.

Fill Free fillable forms Travis County Information Technology Services

Web state law requires your appraisal district to determine the market value of your home on jan. Web for travis county homeowners: Web property tax protest will protest your travis central appraisal district's proposed 2022 market value to the travis appraisal review board. If you know what service you need, use the main menu on the left. There are two.

Travis County Property Tax Protest Discount Property Taxes

Learn more calendar_today make an appointment no_sim go paperless assignment take our satisfication survey these options are only available for some services question_answer. The travis central appraisal district offers property owners the opportunity to complete several forms online, including: If you need assistance with setting up an account or logging in, please contact our customer service department for assistance. Web.

Travis County Property Tax Protest Discount Property Taxes

Contact us or check out the videos below to learn more about navigating the protest process through our online portal. This form is for use by a property owner to offer and submit evidence and/or argument for an appraisal review board (arb) protest hearing by telephone conference call, videoconference or written affidavit pursuant to tax code. Web property owners have.

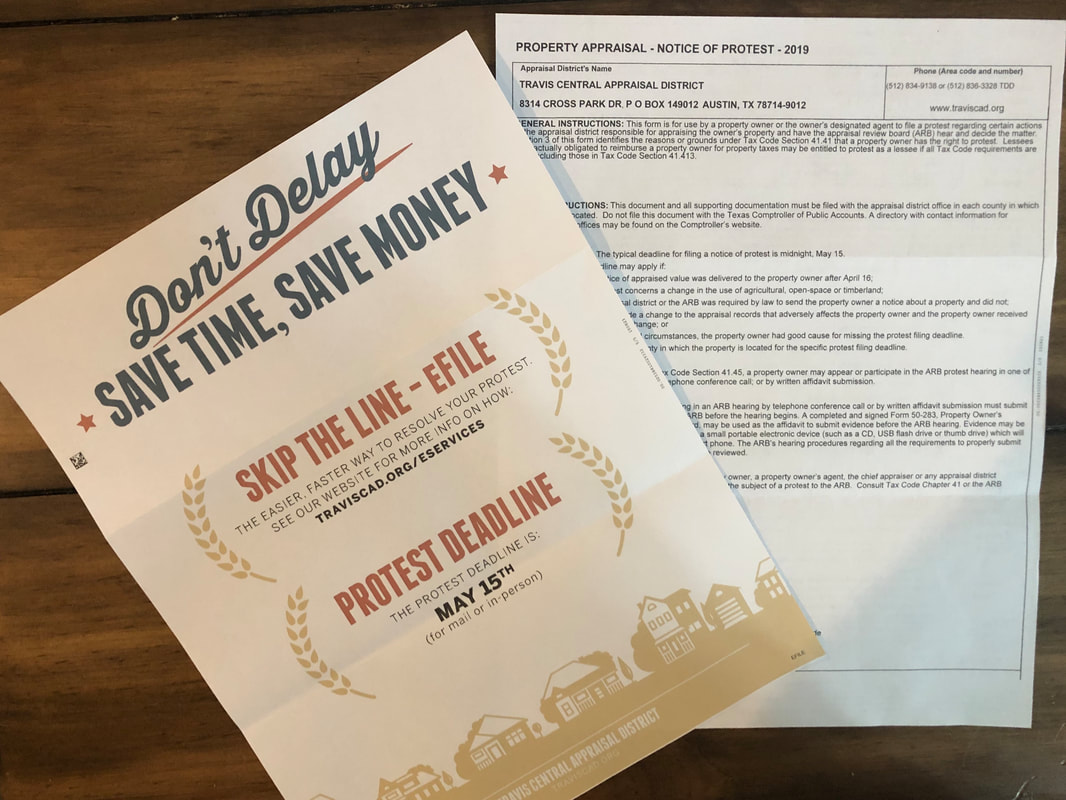

What a Mess! 2019 Travis County Property Tax Protest YouTube

Web for travis county homeowners: You may follow these appeal procedures if you have a concern about: How do i change the address or ownership records for a property? Online protest forms can be filed at www.traviscad.org/efile. Web though you could learn how to appeal property taxes yourself—filing forms, faxing in appraisals, submitting evidence, and attending appraisal review board hearings.

Protesting Your Property Taxes in Travis County

How do i change the address or ownership records for a property? Application for a homestead exemption. Sign up here to reduce your taxes and put money back in your pocket. This form is for use by a property owner to offer and submit evidence and/or argument for an appraisal review board (arb) protest hearing by telephone conference call, videoconference.

Travis County Property Tax Liens PRORFETY

If you know what service you need, use the main menu on the left. Web the tax office collects fees for a variety of state and local government agencies and proudly registers voters in travis county! Web property owners have the right to protest actions concerning their property tax appraisals. Web protest property taxes in travis county in 10 minutes.

Travis County Property Tax Protest Discount Property Taxes

There are two ways to protest your property tax values. Web filing a protest. Web travis county tax office property tax, appraised value protests the travis central appraisal district (tcad) is responsible for listing property and ownership information, estimating value, providing plat maps, and assisting taxpayers with the protest process. Web though you could learn how to appeal property taxes.

This Form Is For Use By A Property Owner To Offer And Submit Evidence And/Or Argument For An Appraisal Review Board (Arb) Protest Hearing By Telephone Conference Call, Videoconference Or Written Affidavit Pursuant To Tax Code.

By mail download this form, fill it out, and mail it to the address below. Residence homestead exemption application travis central appraisal district name and/or address correction form Web statement of inability to pay court costs. Web a property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code section 41.41.

Contact Us Or Check Out The Videos Below To Learn More About Navigating The Protest Process Through Our Online Portal.

Web travis county tax office property tax, appraised value protests the travis central appraisal district (tcad) is responsible for listing property and ownership information, estimating value, providing plat maps, and assisting taxpayers with the protest process. Make sure you list facts and data as to why you believe the assessed value is incorrect. You may follow these appeal procedures if you have a concern about: Lessees contractually obligated to reimburse a property owner for property taxes may be entitled to protest as.

Web Get In Line Now (Residential & Bpp) Residential Properties Bpp Need Help?

Web value protests learn about property tax appraised value protests. Web 2022 2021 2020 2019 how does the 10% homestead cap value work in texas? Web though you could learn how to appeal property taxes yourself—filing forms, faxing in appraisals, submitting evidence, and attending appraisal review board hearings and judicial appeals—there’s a much easier way to protest your travis county property tax. You can also file online to protest your travis county property tax.

After You Have Filed, It Can Take Several Months For The.

Completing these forms online gives property owners numerous benefits. A tax lien automatically attaches to your property to secure tax payments, late penalties and interest. However, the tcad website is down as of april 15 due to too many people accessing the website after. Web property owners have the right to protest actions concerning their property tax appraisals.