Texas Form 503

Texas Form 503 - Texas form 503 pdf details. The document has moved here. Certificate of withdrawal of registration; Web tax certificate request form: The secretary of state is aware that many transactions in the business and financial world are time sensitive. Withdrawal of registration for limited liability partnership; Any corporation, limited partnership, limited liability partnership, or limited liability company that regularly conducts business or renders professional services under an assumed name is required to file an assumed. Web under section 5.053 of the boc, the name of a filing entity or a registered series of a texas llc or the name under which a foreign filing entity registers to transact business in this state must be distinguishable in the records of the secretary of state from the name of any existing filing entity, the name of a foreign filing entity that is re. Assumed name certificate for filing with the secretary of state; Web business filing tracker (submitted last 6 months) turnaround times documents will appear on the filing status list once they have been entered into the system.

503 (revised 08/19) return in duplicate to: Under penalty of perjury, i attest that i am authorized to sign this letter of authorization. The texas form 503 is a form that's used to report the purchase of taxable goods or services in texas. Web about form 503 for a period of at least thirty (30) days of each calendar month, you must submit a form 503, “receipt of receipts,” before any military financial institutions will credit your account. Certificate of termination of a domestic filing entity pursuant to the texas business organizations code (excluding nonprofit corporations) Texas comptroller of public accounts property tax assistance division p.o. Web find and fill out the correct state of texas form 503. Web if each or any series of the llc transacting business in texas transacts business under a name other than the name of the llc, the llc must file an assumed name certificate in compliance with chapter 71 of the texas business &. Texas comptroller of public accounts. Web instructions for filing articles of dissolution for a nonprofit corporation (form 603) commentary:

Application for property tax refund: Web about form 503 for a period of at least thirty (30) days of each calendar month, you must submit a form 503, “receipt of receipts,” before any military financial institutions will credit your account. Certificate of withdrawal of registration; Web instructions for filing articles of dissolution for a nonprofit corporation (form 603) commentary: Web tax certificate request form: You do not need to provide a copy of a military identification card. Conversion domestic limited liability partnerships; Withdrawal of registration for limited liability partnership; Appointment of an agent by financial institutions and unincorporated associations reinstatement; Any corporation, limited partnership, limited liability partnership, or limited liability company that regularly conducts business or renders professional services under an assumed name is required to file an assumed.

LOGO

Web if each or any series of the llc transacting business in texas transacts business under a name other than the name of the llc, the llc must file an assumed name certificate in compliance with chapter 71 of the texas business &. Web make checks payable to: Choose the correct version of the editable pdf form from the list.

Form 503 Fill Online, Printable, Fillable, Blank pdfFiller

Web termination of a domestic entity; Click on the button below to start modifying your this form document. Choose the correct version of the editable pdf form from the list and get started filling it out. The document has moved here. Web a texas entity that is not required to have or that does not maintain a registered office address.

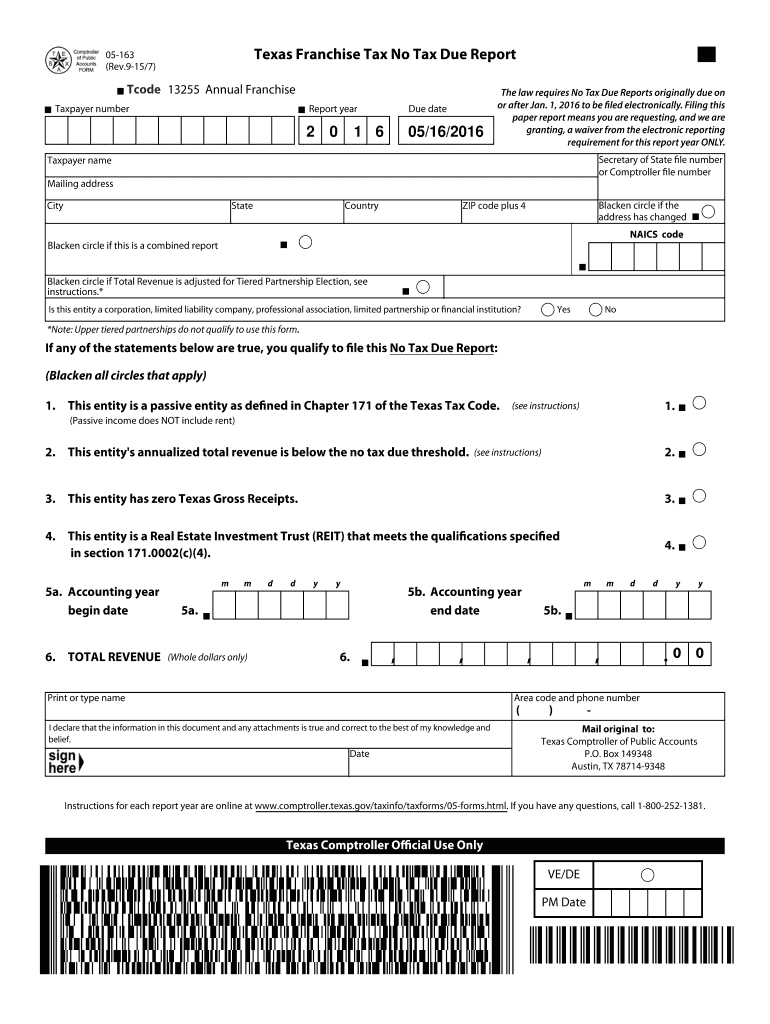

2015 Form TX Comptroller 05163 Fill Online, Printable, Fillable, Blank

Get everything done in minutes. Choose the correct version of the editable pdf form from the list and get started filling it out. Certificate of termination of a domestic filing entity pursuant to the texas business organizations code (excluding nonprofit corporations) Web a texas entity that is not required to have or that does not maintain a registered office address.

LOGO

Web termination of a domestic entity; Send the completed order form and check to: Get everything done in minutes. Request to remove personal information from the harris county tax office website: Web make checks payable to:

ARMA Houston 2014 eRecords Inventory The Texas Record

Web about form 503 for a period of at least thirty (30) days of each calendar month, you must submit a form 503, “receipt of receipts,” before any military financial institutions will credit your account. Save or instantly send your ready documents. Send the completed order form and check to: Editing can be carried out with your phone, laptop, or.

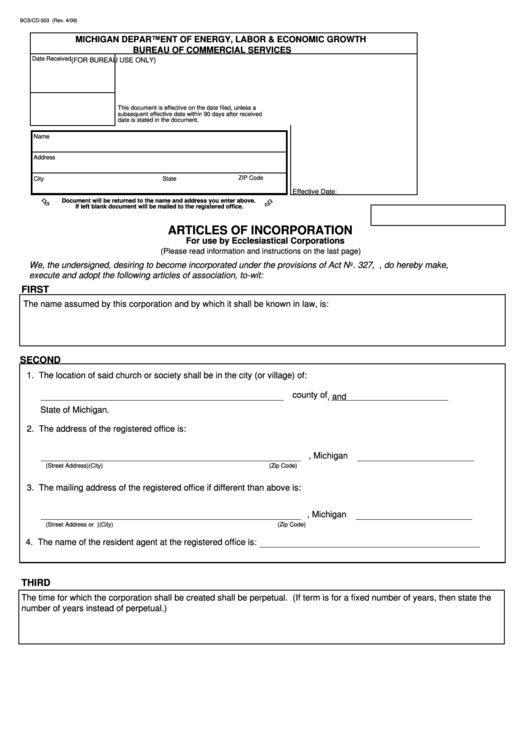

Fillable Form Bcs/cd503 Articles Of Incorporation For Use By

The secretary of state is aware that many transactions in the business and financial world are time sensitive. Assumed name certificate for filing with the secretary of state; You do not need to provide a copy of a military identification card. Application for property tax refund: Texas form 503 pdf details.

LOGO

The texas form 503 is a form that's used to report the purchase of taxable goods or services in texas. Web form 503 is a tax form used by businesses to report the sale of certain goods and services. Under penalty of perjury, i attest that i am authorized to sign this letter of authorization. Editing can be carried out.

Form Ps 503 Fill Online, Printable, Fillable, Blank pdfFiller

Certificate of withdrawal of registration; Editing can be carried out with your phone, laptop, or tablet. Save or instantly send your ready documents. You do not need to provide a copy of a military identification card. Assumed name certificate for filing with the secretary of state;

Exhibit 3.5

Texas form 503 pdf details. Web if each or any series of the llc transacting business in texas transacts business under a name other than the name of the llc, the llc must file an assumed name certificate in compliance with chapter 71 of the texas business &. The assumed name under which the business or professional service is, or.

Fill Free fillable Texas Secretary of State PDF forms

Get form now download pdf form 503 pdf details Send the completed order form and check to: Editing can be carried out with your phone, laptop, or tablet. The office strongly encourages electronic filing through sosdirect or sosupload to ensure swift processing times.to better serve the public, this office provides forms for downloading, filings by fax, expedited and preclearance. Web.

Any Corporation, Limited Partnership, Limited Liability Partnership, Or Limited Liability Company That Regularly Conducts Business Or Renders Professional Services Under An Assumed Name Is Required To File An Assumed.

Web business filing tracker (submitted last 6 months) turnaround times documents will appear on the filing status list once they have been entered into the system. Web under section 5.053 of the boc, the name of a filing entity or a registered series of a texas llc or the name under which a foreign filing entity registers to transact business in this state must be distinguishable in the records of the secretary of state from the name of any existing filing entity, the name of a foreign filing entity that is re. The assumed name under which the business or professional service is, or is to be, conducted or rendered is: Choose the correct version of the editable pdf form from the list and get started filling it out.

Web Make Checks Payable To:

Request to remove personal information from the harris county tax office website: Texas comptroller of public accounts property tax assistance division p.o. Certificate of withdrawal of registration; Web a texas entity that is not required to have or that does not maintain a registered office address in texas, such as a texas limited liability partnership or bank, would file its assumed name certificate in the county in which the entity’s principal office is located.

Web Find And Fill Out The Correct State Of Texas Form 503.

Web instructions for filing articles of dissolution for a nonprofit corporation (form 603) commentary: Send the completed order form and check to: Conversion domestic limited liability partnerships; Military property owner's request for waiver of delinquent penalty and interest:

Application For Property Tax Refund:

Request for replacement refund check: Editing can be carried out with your phone, laptop, or tablet. The secretary of state is aware that many transactions in the business and financial world are time sensitive. Withdrawal of registration for limited liability partnership;