Tax Treaty Form

Tax Treaty Form - Web what is form 8233? Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web if a tax treaty allows you to modify, reduce, or eliminate your tax liability, you’ll need to complete form 8833 to properly disclose such information on your u.s. If you have problems opening the pdf document or viewing pages,. Web you must file form 1040, u.s. The united states has entered into income tax treaties with a number of foreign countries. Treaty provisions generally are reciprocal (apply to both treaty countries), so they. Web tax treaties contain tests for determining residency for purposes of the treaty. By filing form 8233, they are looking to claim an exemption from federal. Resident during the year and who is a resident of the u.s.

The united states has entered into income tax treaties with a number of foreign countries. The treaties give foreign residents and u.s. The complete texts of the following tax treaty documents are available in adobe pdf format. Under these treaties, residents of foreign countries are taxed at a. Internal revenue service go to. If you have problems opening the. Services performed in the united states (independent personal services, business used in this section. If you have problems opening the pdf. Web what is form 8233? Web review tax treaties between the united states and foreign countries.

If you have problems opening the pdf. Web treaties | u.s. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. The united states has entered into income tax treaties with a number of foreign countries. The complete texts of the following tax treaty documents are available in adobe pdf format. Web claim tax treaty for salary payments. Web form 8833 tax treaty return position. Web you must file a u.s. Resident during the year and who is a resident of the u.s. Stanford students, postdoctoral scholars and visiting faculty who are residents of a foreign country maintaining a tax.

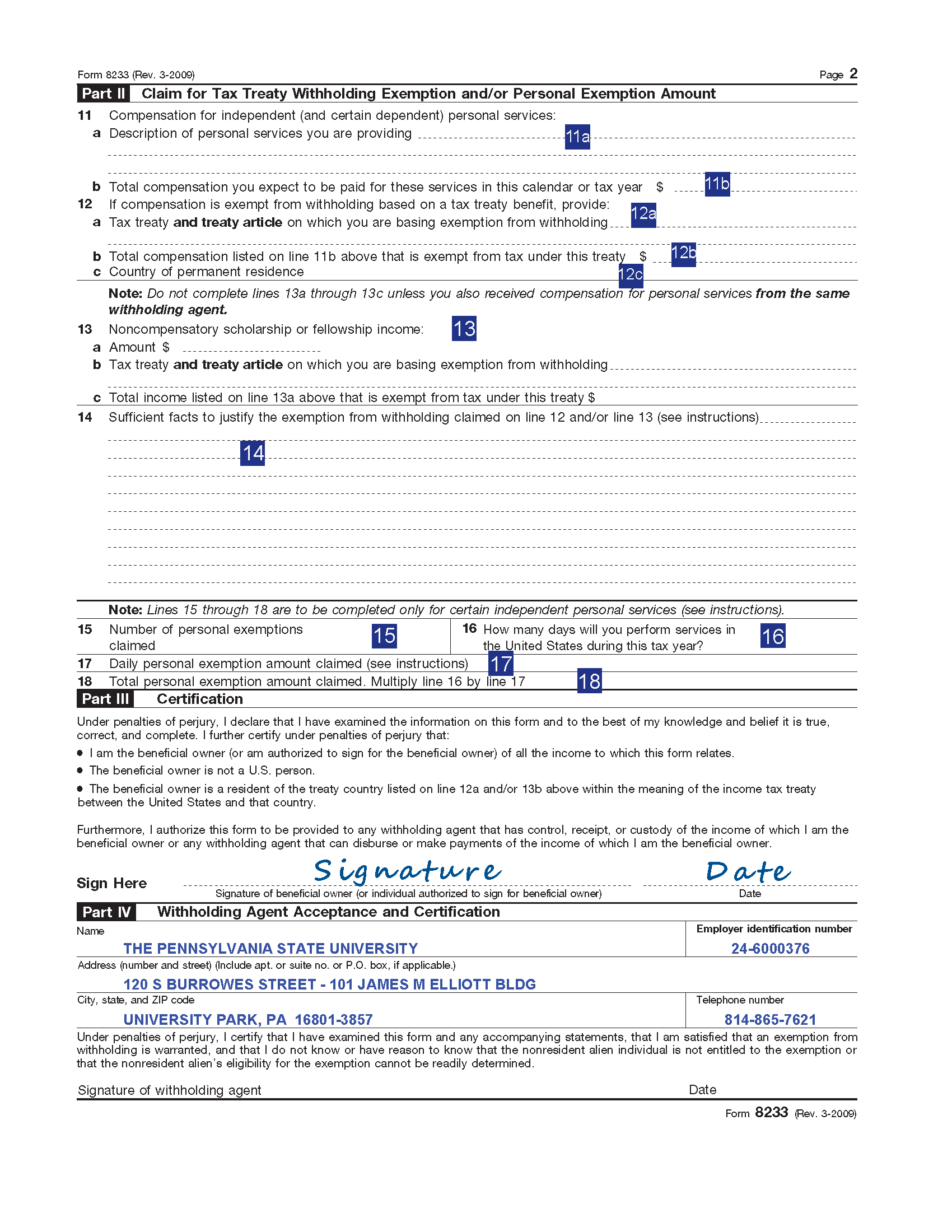

Image of Name of Exemption from Withholding IRS 8233 Form Exhibit Page 2

Stanford students, postdoctoral scholars and visiting faculty who are residents of a foreign country maintaining a tax. Taxpayer wants to rely on an international tax treaty that the united states has entered into regarding tax law,. Citizens/residents a reduced tax rate or. Internal revenue service go to. Web watch newsmax live for the latest news and analysis on today's top.

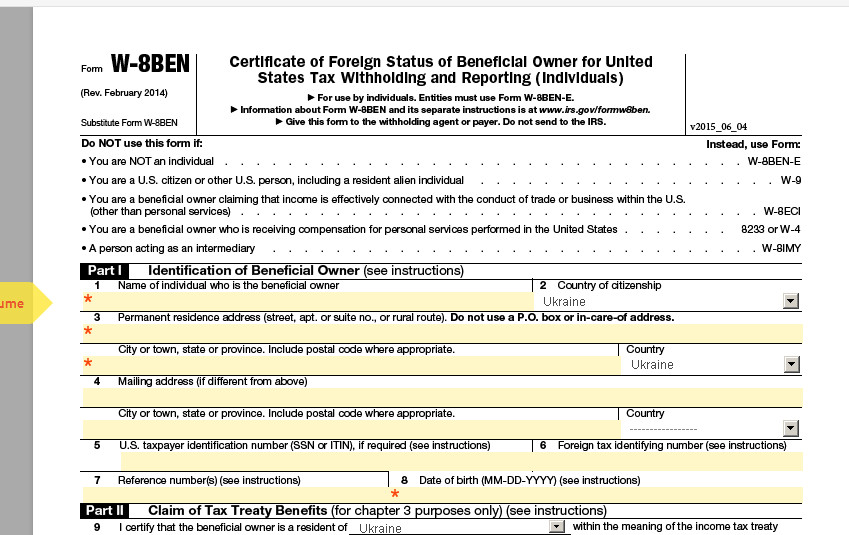

Tax Treaty Forms 0901 Series Withholding Tax Stocks

Tax return and form 8833 if you claim the following treaty benefits. Treaty provisions generally are reciprocal (apply to both treaty countries), so they. If you have problems opening the pdf document or viewing pages,. Web what is form 8233? Department of the treasury home policy issues tax policy treaties treaties in the table below you can access the text.

Form 8833 TreatyBased Return Position Disclosure under Section 6114

Web form 8833 under section 6114 or 7701(b) (rev. Taxpayer wants to rely on an international tax treaty that the united states has entered into regarding tax law,. Tax return and form 8833 if you claim the following treaty benefits. Resident during the year and who is a resident of the u.s. Web tax treaties contain tests for determining residency.

How to Fix Youtube Adsense Tax Treaty Info Form Non US Youtube Creators

If you have problems opening the. Web form 8833 tax treaty return position. Web the complete texts of the following tax treaty documents are available in adobe pdf format. Tax return and form 8833 if you claim the following treaty benefits. Web what is form 8233?

Claiming Tax Treaty Benefits India Dictionary

The complete texts of the following tax treaty documents are available in adobe pdf format. Internal revenue service go to. Web the complete texts of the following tax treaty documents are available in adobe pdf format. Web form 8833 under section 6114 or 7701(b) (rev. Web a tax treaty withholding exemption definitions of terms.

turbotax tax treaty Fill Online, Printable, Fillable Blank form

Web claim tax treaty for salary payments. Web treaties | u.s. Taxpayer wants to rely on an international tax treaty that the united states has entered into regarding tax law,. Department of the treasury home policy issues tax policy treaties treaties in the table below you can access the text of many us income tax. Under these treaties, residents of.

Interpretation of Tax Treaty CA Final International Taxation

If you have problems opening the pdf document or viewing pages,. Web you must file a u.s. Web review tax treaties between the united states and foreign countries. Web treaties | u.s. Web the complete texts of the following tax treaty documents are available in adobe pdf format.

Form 8233 Exemption from Withholding on Compensation for Independent

Web the complete texts of the following tax treaty documents are available in adobe pdf format. Stanford students, postdoctoral scholars and visiting faculty who are residents of a foreign country maintaining a tax. Web you must file form 1040, u.s. You claim a reduction or modification in the taxation of gain or loss from the disposition of a. Citizens/residents a.

Claiming Tax Treaty Benefits India Dictionary

Under these treaties, residents of foreign countries are taxed at a. You claim a reduction or modification in the taxation of gain or loss from the disposition of a. The united states has entered into income tax treaties with a number of foreign countries. By filing form 8233, they are looking to claim an exemption from federal. Web watch newsmax.

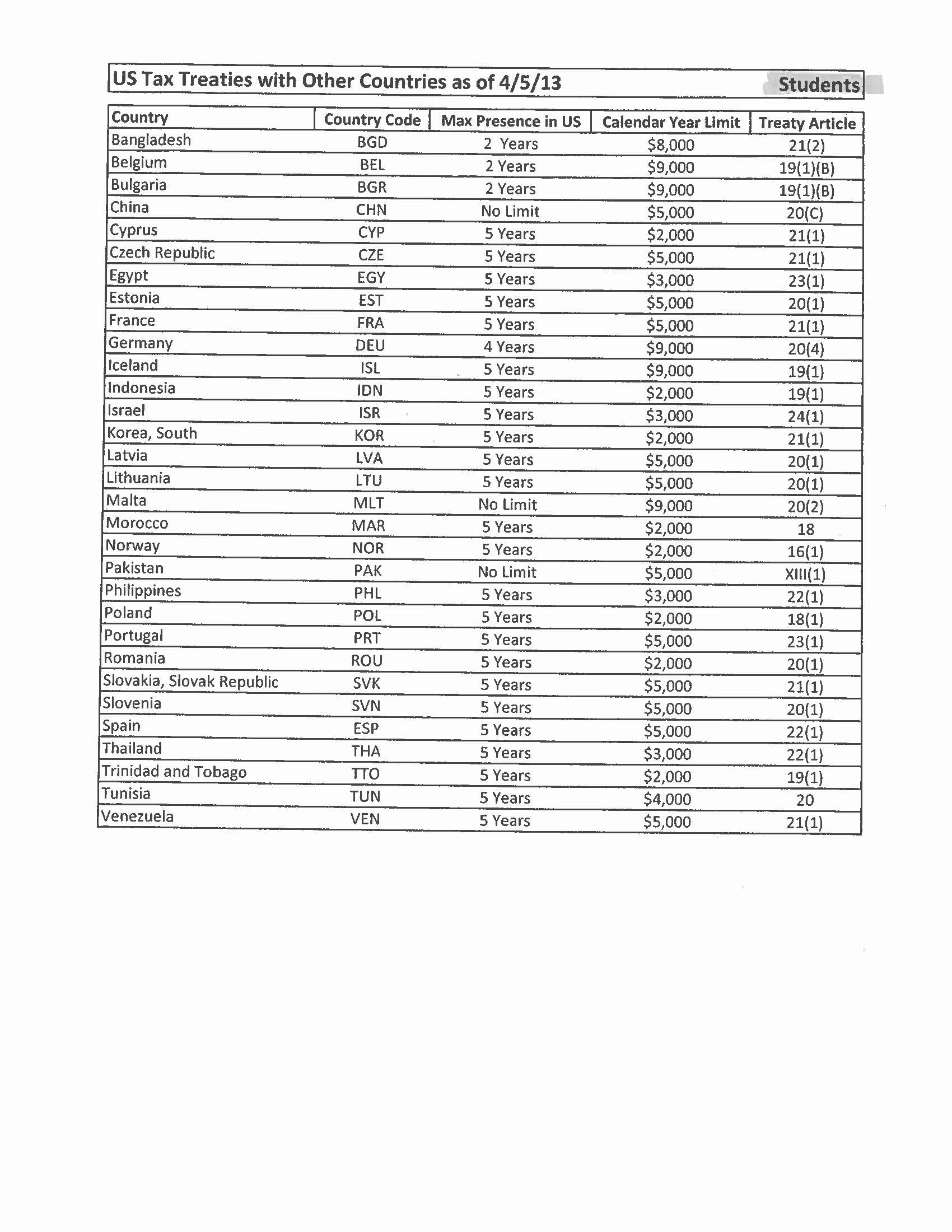

International Students

Department of the treasury home policy issues tax policy treaties treaties in the table below you can access the text of many us income tax. Services performed in the united states (independent personal services, business used in this section. Stanford students, postdoctoral scholars and visiting faculty who are residents of a foreign country maintaining a tax. Web if a tax.

If You Have Problems Opening The.

Web you must file form 1040, u.s. Web review tax treaties between the united states and foreign countries. Web if a tax treaty allows you to modify, reduce, or eliminate your tax liability, you’ll need to complete form 8833 to properly disclose such information on your u.s. Services performed in the united states (independent personal services, business used in this section.

Web Tax Treaties Contain Tests For Determining Residency For Purposes Of The Treaty.

Stanford students, postdoctoral scholars and visiting faculty who are residents of a foreign country maintaining a tax. By filing form 8233, they are looking to claim an exemption from federal. Web form 8833 tax treaty return position. The treaties give foreign residents and u.s.

Web What Is Form 8233?

You claim a reduction or modification in the taxation of gain or loss from the disposition of a. Citizens/residents a reduced tax rate or. Web the complete texts of the following tax treaty documents are available in adobe pdf format. If you have problems opening the pdf document or viewing pages,.

The Complete Texts Of The Following Tax Treaty Documents Are Available In Adobe Pdf Format.

Tax return and form 8833 if you claim the following treaty benefits. Taxpayer wants to rely on an international tax treaty that the united states has entered into regarding tax law,. If you have problems opening the pdf. Web treaties | u.s.