Tax Form M1Pr

Tax Form M1Pr - Web taxpayers who already filed a 2022 form m1pr may see a larger refund than originally claimed. Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Renter homeowner nursing home or adult. You will not receive a refund if your return. Web you will need the crp to determine your refund, if any, and you must include what is called a form m1pr with the crp when it is filed. Web file by august 15, 2022 your 2021 form m1pr should be mailed, delivered, or electronically filed with the department by august 15, 2022. Web 2022 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund: You will not receive a refund if your return. Enter the full amount from line 1 of your 2021 statement of. What do i need to do?

Web for details, see the instructions for form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. Web taxpayers who already filed a 2022 form m1pr may see a larger refund than originally claimed. What do i need to. Web 5 rows minnesota usually releases forms for the current tax year between january and april. Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. These forms have to be. Web only the spouse who owned and lived in the home on january 2, 2021, can apply as the homeowner for the home. You will not receive a refund if your return. Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund: From the table in the form m1 instructions.

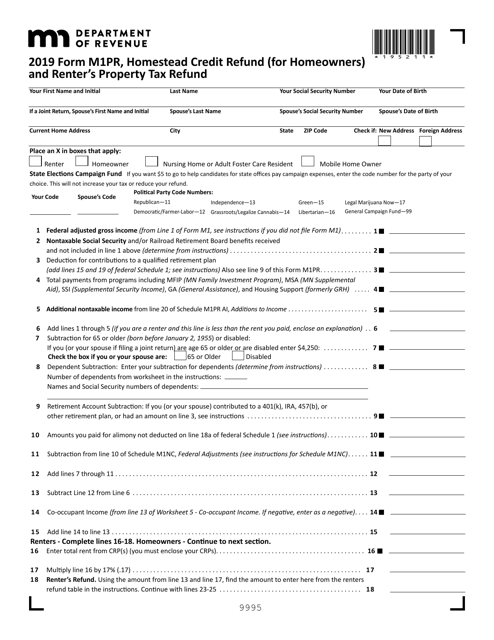

If you filed 2022 form m1pr before june 14, 2023 if you. Renter homeowner nursing home or adult. Web form m1pr is used by both homeowners and renters to claim a refund on property taxes that have either been paid directly to one's county (for homeowners) or indirectly via rent. Web 2019 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund place an x in boxes that apply: Enter the full amount from line 1 of your 2021 statement of. Web you will need the crp to determine your refund, if any, and you must include what is called a form m1pr with the crp when it is filed. Ira, pensions, and annuities c. Web 5 rows minnesota usually releases forms for the current tax year between january and april. Web taxpayers who already filed a 2022 form m1pr may see a larger refund than originally claimed. Web 2023 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund 9995 *235211* your code spouse’s code state elections campaign fund:

Form M1 Individual Tax YouTube

Web 2022 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund: From the table in the form m1 instructions. Web file by august 15, 2019 your 2018 form m1pr should be mailed, delivered, or electronically filed with the department by august 15, 2019. Web form m1pr is used.

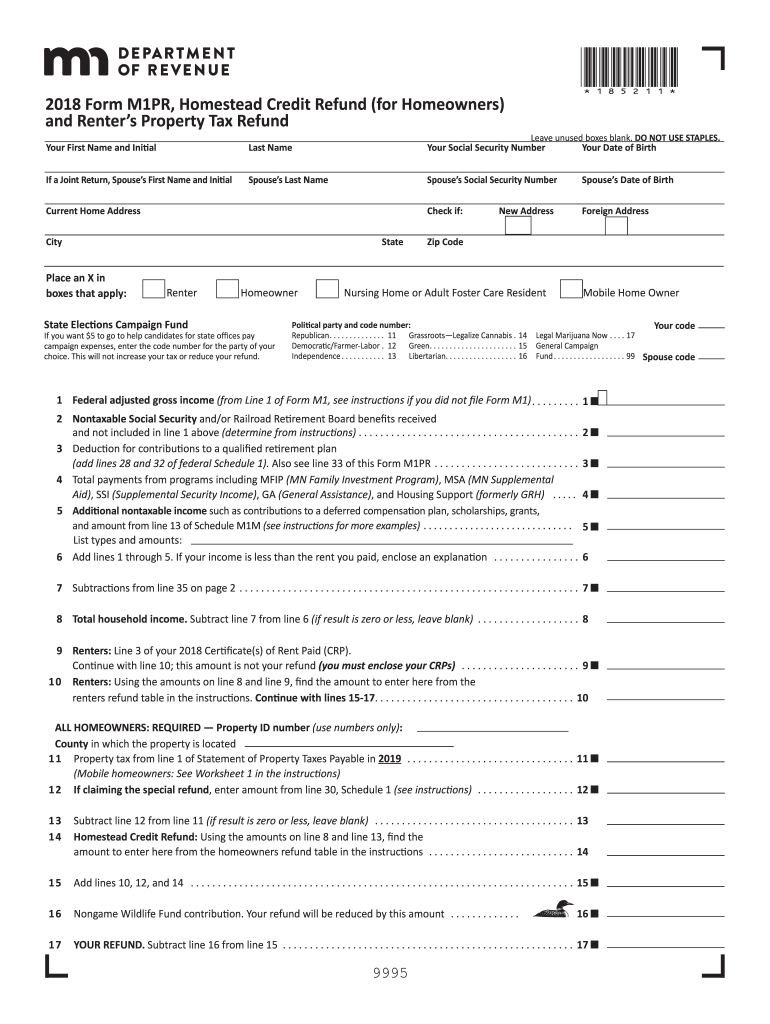

2018 An Even Better Tax Refund Forms and Instructions > Form M1PR

From the table in the form m1 instructions. When is the last day i can file my. Web 5 rows minnesota usually releases forms for the current tax year between january and april. Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) city state zip code check all that apply:..

Minnesota Property Tax Refund Fill Out and Sign Printable PDF

Alabama individual income tax return. We'll make sure you qualify, calculate your. Enter the full amount from line 1 of your 2021 statement of. Web can i amend the m1pr form? Web file by august 15, 2022 your 2021 form m1pr should be mailed, delivered, or electronically filed with the department by august 15, 2022.

Mn Dept Of Revenue Form M1pr Instructions essentially.cyou 2022

See our knowledgebase article for more information. We'll make sure you qualify, calculate your. Web only the spouse who owned and lived in the home on january 2, 2021, can apply as the homeowner for the home. What do i need to. Web file by august 15, 2022 your 2021 form m1pr should be mailed, delivered, or electronically filed with.

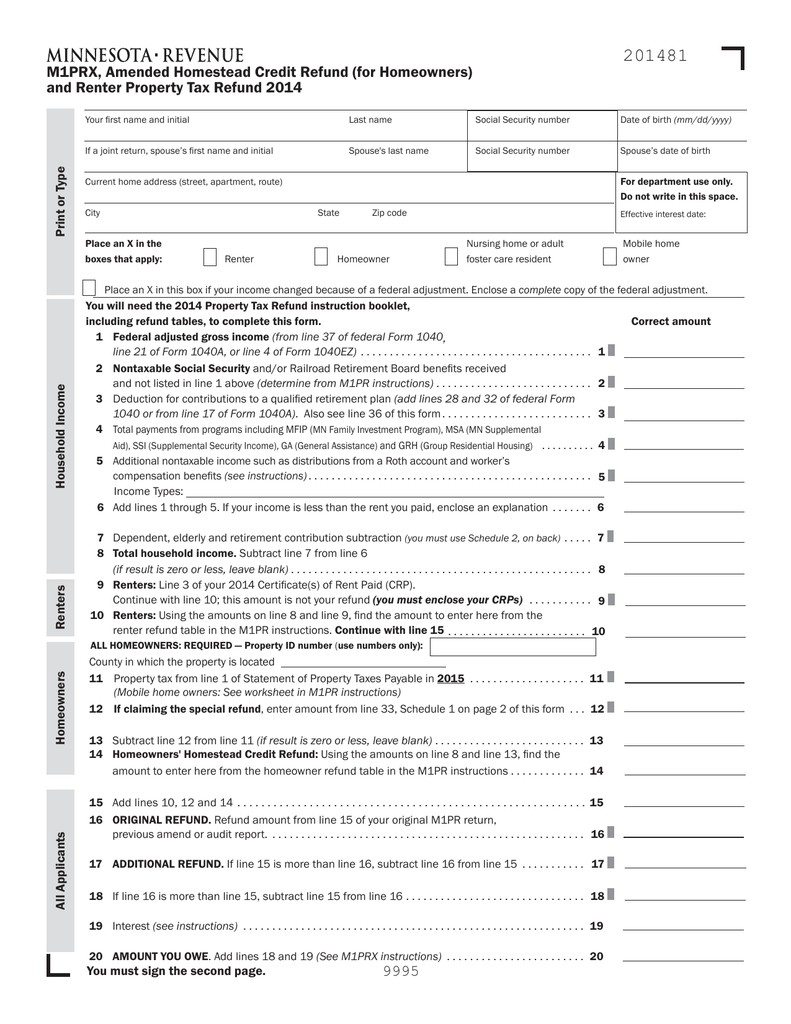

M1PRX, Amended Property Tax Refund Return

Renter homeowner nursing home or adult. Federal income tax deduction worksheet. When is the last day i can file my. From the table in the form m1 instructions. You will not receive a refund if your return.

Fill Free fillable M1pr 19 2019 M1PR, Property Tax Refund Return PDF form

Federal income tax deduction worksheet. Renter homeowner nursing home or adult. Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund: What do i need to do? Web only the spouse who owned and lived in the home on january 2, 2021, can apply as the homeowner.

MN DoR M1PR 2018 Fill out Tax Template Online US Legal Forms

If you filed 2022 form m1pr before june 14, 2023 if you. These forms have to be. Web taxpayers who already filed a 2022 form m1pr may see a larger refund than originally claimed. Web 2022 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund: You will not.

Form M1PR Download Fillable PDF or Fill Online Homestead Credit Refund

Web 5 rows minnesota usually releases forms for the current tax year between january and april. Web taxpayers who already filed a 2022 form m1pr may see a larger refund than originally claimed. Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Web only the spouse who owned and lived in the home on january.

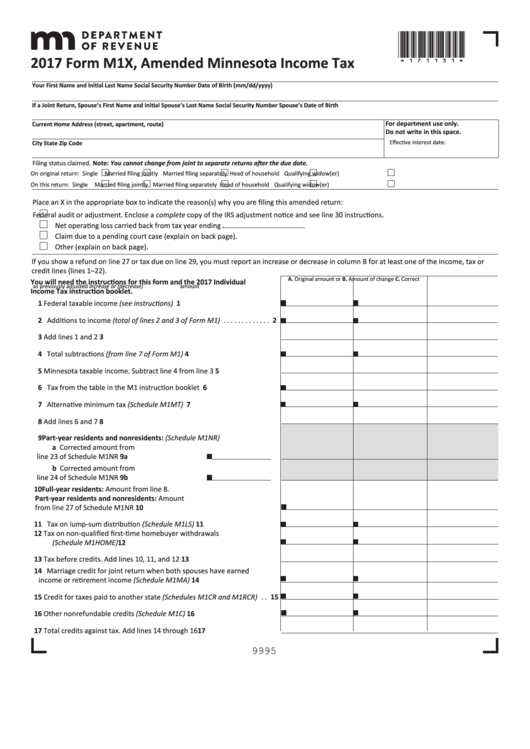

Fillable Form M1x Amended Minnesota Tax 2017 printable pdf

Web for details, see the instructions for form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. What do i need to do? Web taxpayers who already filed a 2022 form m1pr may see a larger refund than originally claimed. Web file by august 15, 2019 your 2018 form m1pr should be mailed, delivered, or electronically filed with.

Fill Free fillable M1pr 19 2019 M1PR, Property Tax Refund Return PDF form

Renter homeowner nursing home or adult. You will not receive a refund if your return. Federal income tax deduction worksheet. Web you will need the crp to determine your refund, if any, and you must include what is called a form m1pr with the crp when it is filed. Ira, pensions, and annuities c.

See Our Knowledgebase Article For More Information.

Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund: Ira, pensions, and annuities c. Web form m1pr is used by both homeowners and renters to claim a refund on property taxes that have either been paid directly to one's county (for homeowners) or indirectly via rent. Web file by august 15, 2022 your 2021 form m1pr should be mailed, delivered, or electronically filed with the department by august 15, 2022.

Web Only The Spouse Who Owned And Lived In The Home On January 2, 2021, Can Apply As The Homeowner For The Home.

Web for details, see the instructions for form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. Web 2019 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund place an x in boxes that apply: From the table in the form m1 instructions. If you filed 2022 form m1pr before june 14, 2023 if you.

Alabama Individual Income Tax Return.

Web taxpayers who already filed a 2022 form m1pr may see a larger refund than originally claimed. Web you will need the crp to determine your refund, if any, and you must include what is called a form m1pr with the crp when it is filed. When is the last day i can file my. Web file by august 15, 2019 your 2018 form m1pr should be mailed, delivered, or electronically filed with the department by august 15, 2019.

Enter The Full Amount From Line 1 Of Your 2021 Statement Of.

We'll make sure you qualify, calculate your. Life estate if you retain an ownership. Web 2023 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund 9995 *235211* your code spouse’s code state elections campaign fund: Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax.