Tax Form K-2

Tax Form K-2 - Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Get ready for tax season deadlines by completing any required tax forms today. Final day for 401(k) contribution is april 15th, 2024. Tax or certain withholding tax or reporting obligations of its partners under the. Web section 1—gross income foreign source description u.s. What is the full form of k2 in regional? File your taxes for free. Web reporting & filing requirements. International tax information to their partners, including. Source foreign branch (c) passive (d) general (e) other category income category income category income.

Taxpayer name address city, state zip. International tax information to their partners, including. Final day for 401(k) contribution is april 15th, 2024. Partnerships filing form 1065, u.s. In response to a growing and increasingly global economy, the irs has created these forms to better capture and. Web the full form of k2 is karakoram 2. Web abatement (form 843) to the address shown above. Source foreign branch (c) passive (d) general (e) other category income category income category income. 401(k) contributions are one of the most popular tax deductions, but you have to make sure to play by the rules in order to. Web section 1—gross income foreign source description u.s.

What is the full form of k2 in regional? Tax or certain withholding tax or reporting obligations of its partners under the. Web the full form of k2 is karakoram 2. Web any partnership required to file form 1065 that has items relevant to the determination of the u.s. Web in accordance with section 143.121.2 rsmo, for tax years beginning january 1, 2007, if a nonresident reported property taxes paid to another state or political subdivision on their. Sign in to your account. Final day for 401(k) contribution is april 15th, 2024. Web reporting & filing requirements. Get ready for tax season deadlines by completing any required tax forms today. Partnerships filing form 1065, u.s.

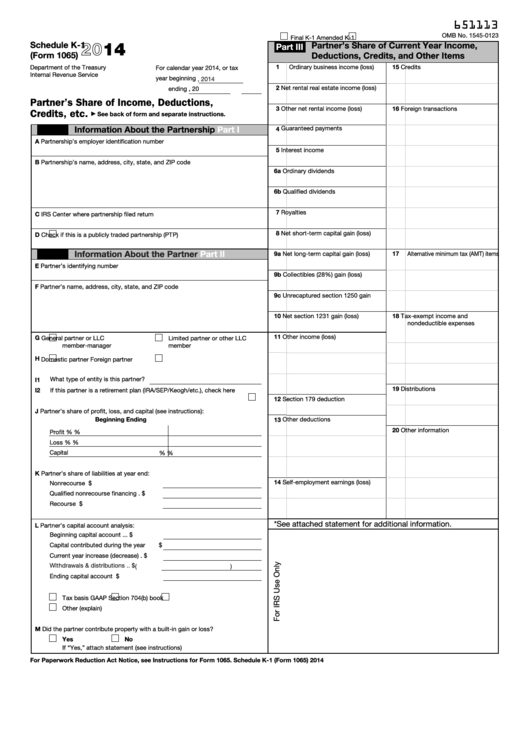

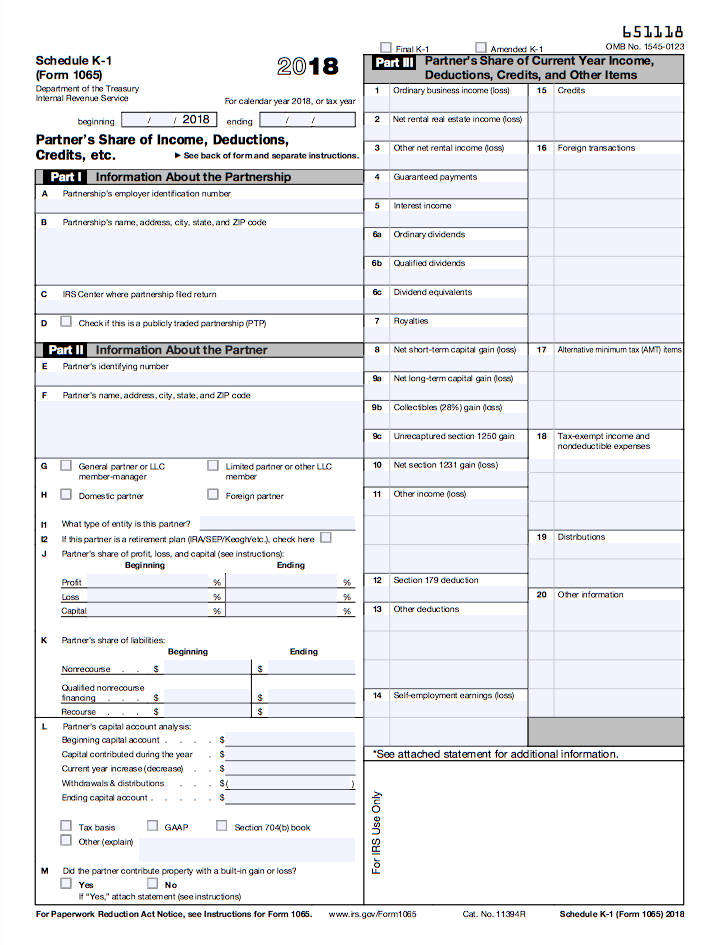

Schedule K1 Tax Form What Is It and Who Needs to Know?

What is the full form of k2 in worldwide? Sign in to your account. Web the full form of k2 is karakoram 2. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Web any partnership required to file form 1065 that has items relevant to the.

Tax Form K1 2018 Marie Thoma's Template

Web section 1—gross income foreign source description u.s. Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Tax or certain withholding tax or reporting obligations of its partners under the. What is the full form of k2 in regional? Partnerships filing form 1065, u.s.

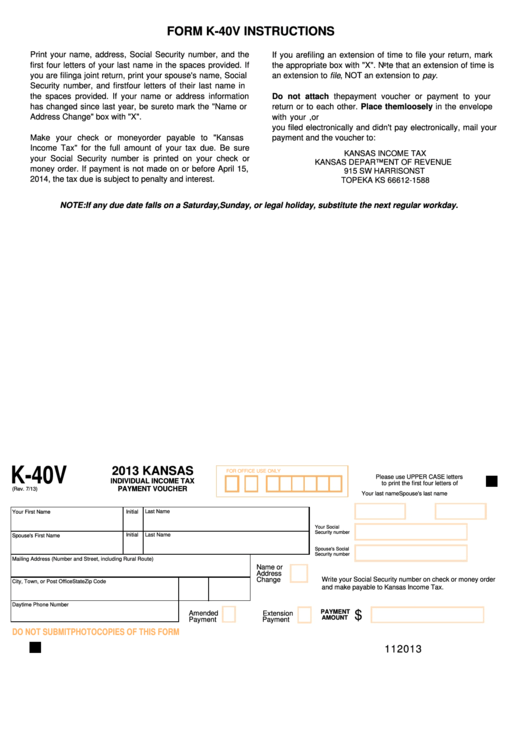

Fillable Form K40v Kansas Individual Tax Payment Voucher

Web in accordance with section 143.121.2 rsmo, for tax years beginning january 1, 2007, if a nonresident reported property taxes paid to another state or political subdivision on their. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Tax or certain withholding tax or reporting obligations.

Understanding Key Tax Forms What investors need to know about Schedule

Tax or certain withholding tax or reporting obligations of its partners under the. Web reporting & filing requirements. Final day for 401(k) contribution is april 15th, 2024. 401(k) contributions are one of the most popular tax deductions, but you have to make sure to play by the rules in order to. What is the full form of k2 in regional?

It 203 Instructions Fill Out and Sign Printable PDF Template signNow

Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Web section 1—gross income foreign source description u.s. Do not file draft forms. In response to a growing and increasingly global economy, the irs has created these forms to better capture and. Get ready for.

Irs Tax Form K 1 Instructions whichpermit

Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Web in accordance with section 143.121.2 rsmo, for tax years beginning january 1, 2007, if a nonresident reported property taxes paid to another state or political subdivision on their. Web the full form of k2 is karakoram.

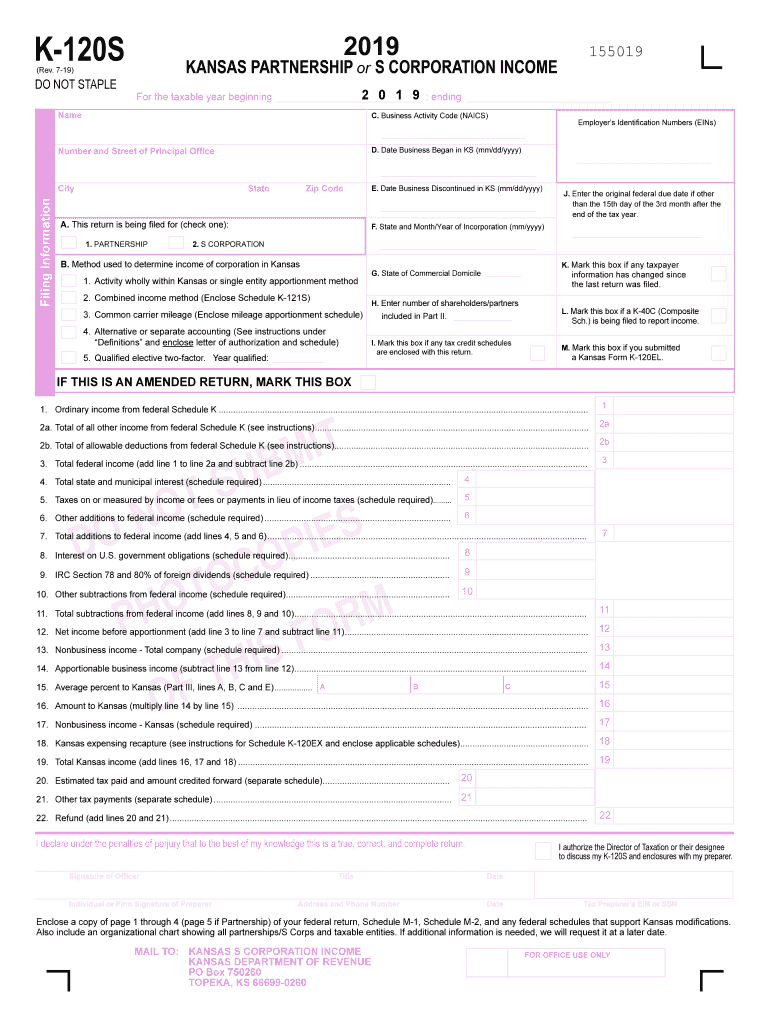

Form K2 Wage And Tax Statement Form printable pdf download

Sign in to your account. What is the full form of k2 in regional? Web section 1—gross income foreign source description u.s. Taxpayer name address city, state zip. Web abatement (form 843) to the address shown above.

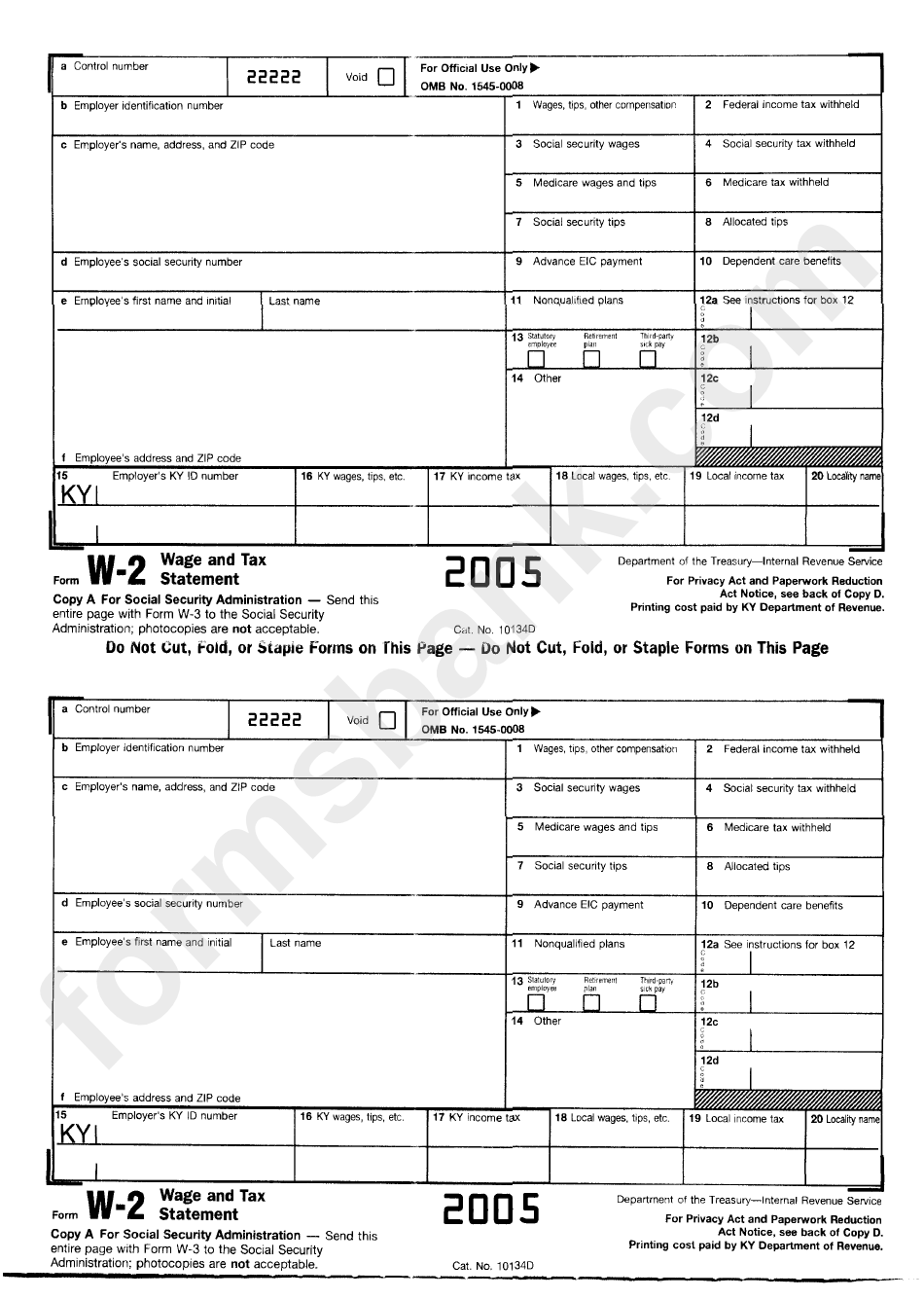

Fillable Schedule K1 (Form 1065) Partner'S Share Of

Web section 1—gross income foreign source description u.s. Web abatement (form 843) to the address shown above. Final day for 401(k) contribution is april 15th, 2024. Get ready for tax season deadlines by completing any required tax forms today. File your taxes for free.

Form 12 And K12 Everything You Need To Know About Form 122 And K12 AH

Web the full form of k2 is karakoram 2. Web abatement (form 843) to the address shown above. Get ready for tax season deadlines by completing any required tax forms today. 401(k) contributions are one of the most popular tax deductions, but you have to make sure to play by the rules in order to. Web in accordance with section.

Form K 1 YouTube

Web the full form of k2 is karakoram 2. Final day for 401(k) contribution is april 15th, 2024. File your taxes for free. Web in accordance with section 143.121.2 rsmo, for tax years beginning january 1, 2007, if a nonresident reported property taxes paid to another state or political subdivision on their. Tax or certain withholding tax or reporting obligations.

Web The Full Form Of K2 Is Karakoram 2.

Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. What is the full form of k2 in worldwide? Web section 1—gross income foreign source description u.s. Tax or certain withholding tax or reporting obligations of its partners under the.

Partnerships Filing Form 1065, U.s.

File your taxes for free. Final day for 401(k) contribution is april 15th, 2024. Web in accordance with section 143.121.2 rsmo, for tax years beginning january 1, 2007, if a nonresident reported property taxes paid to another state or political subdivision on their. Sign in to your account.

Taxpayer Name Address City, State Zip.

401(k) contributions are one of the most popular tax deductions, but you have to make sure to play by the rules in order to. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Source foreign branch (c) passive (d) general (e) other category income category income category income. Web abatement (form 843) to the address shown above.

International Tax Information To Their Partners, Including.

Get ready for tax season deadlines by completing any required tax forms today. What is the full form of k2 in regional? Web any partnership required to file form 1065 that has items relevant to the determination of the u.s. In response to a growing and increasingly global economy, the irs has created these forms to better capture and.