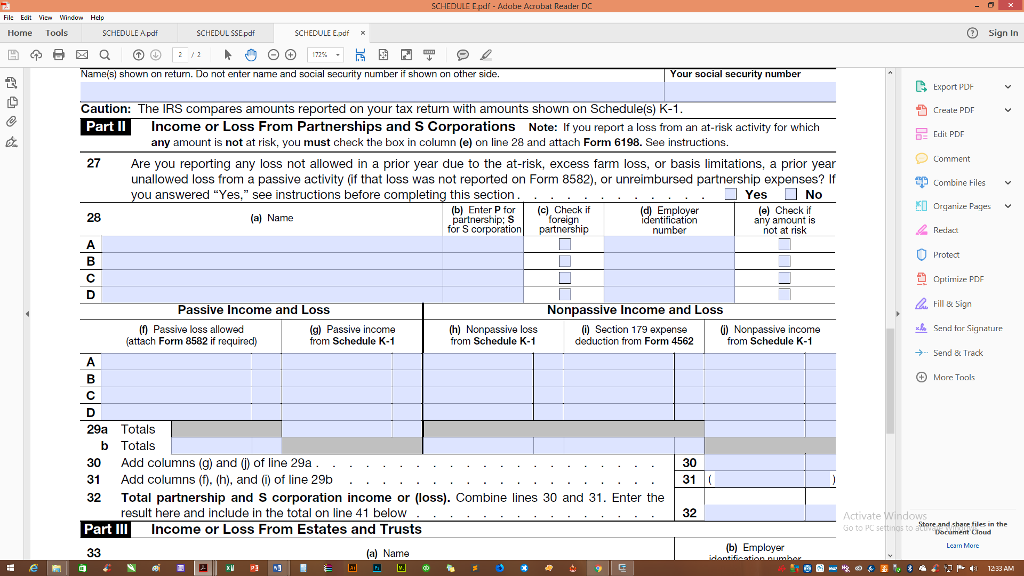

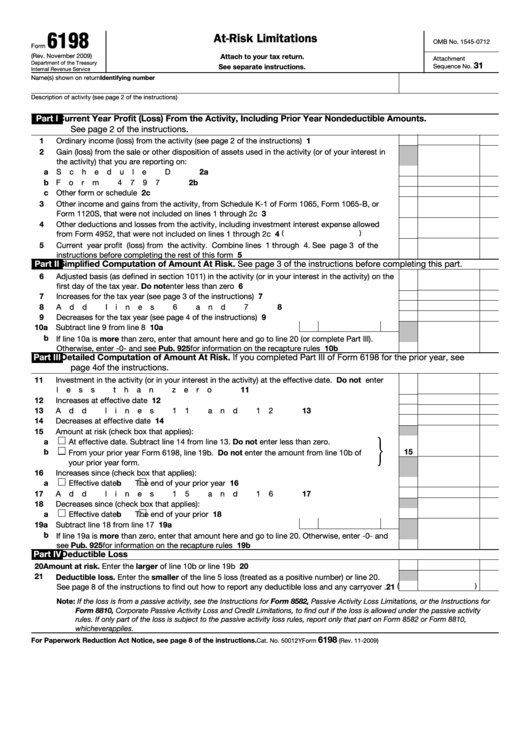

Tax Form 6198

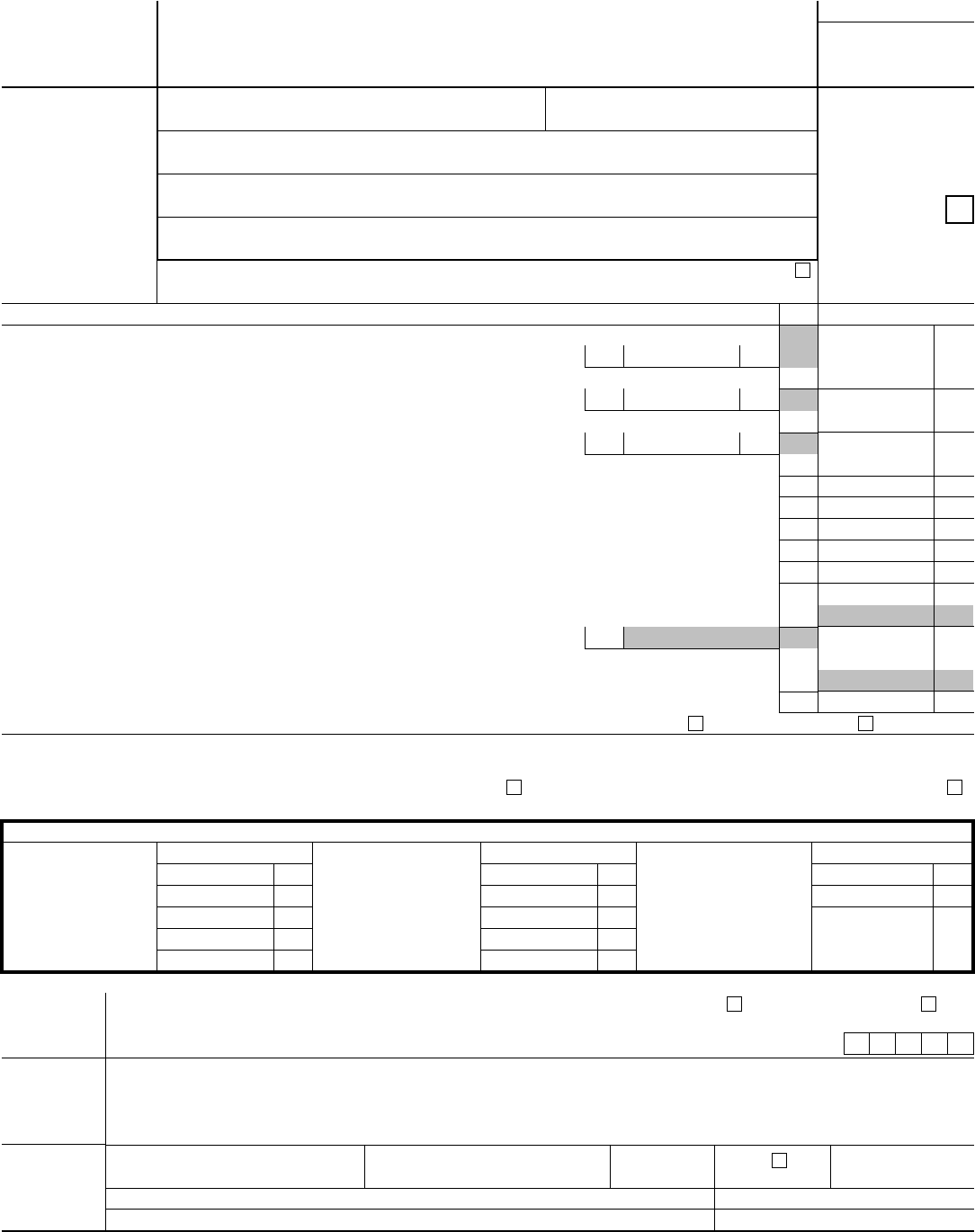

Tax Form 6198 - Our research has helped millions of users to get lowest prices from leading providers. You can download or print current or past. Form 6198 is used to determine the profit (or loss) from an. We have no way of. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Form 6198 should be filed when a taxpayer has a loss in a business. Generally, any loss from an activity (such as a rental). Real property (other than mineral (including filers of schedules c, e, and corporation. Side by side vendor comparison. If using a private delivery service, send your returns to the street address above for the submission processing center.

Form 6198 is used to determine the profit (or loss) from an. Real property (other than mineral (including filers of schedules c, e, and corporation. Web form 6198 is filed by individuals caution business of a qualified c! You can download or print current or past. Form 6198 should be filed when a taxpayer has a loss in a business. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Web 1973 rulon white blvd. Complete, edit or print tax forms instantly. Ad our experts did the work, so you don't have to! Web the internal revenue service (irs) lets taxpayers deduct cash spent on company expenses up to a specified amount.

Side by side vendor comparison. You can download or print current or past. Real property (other than mineral (including filers of schedules c, e, and corporation. Web form 6198 is filed by individuals caution business of a qualified c! Form 6198 is used to determine the profit (or loss) from an. Form 6198 should be filed when a taxpayer has a loss in a business. Sba.gov's business licenses and permits search tool. Complete, edit or print tax forms instantly. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. If using a private delivery service, send your returns to the street address above for the submission processing center.

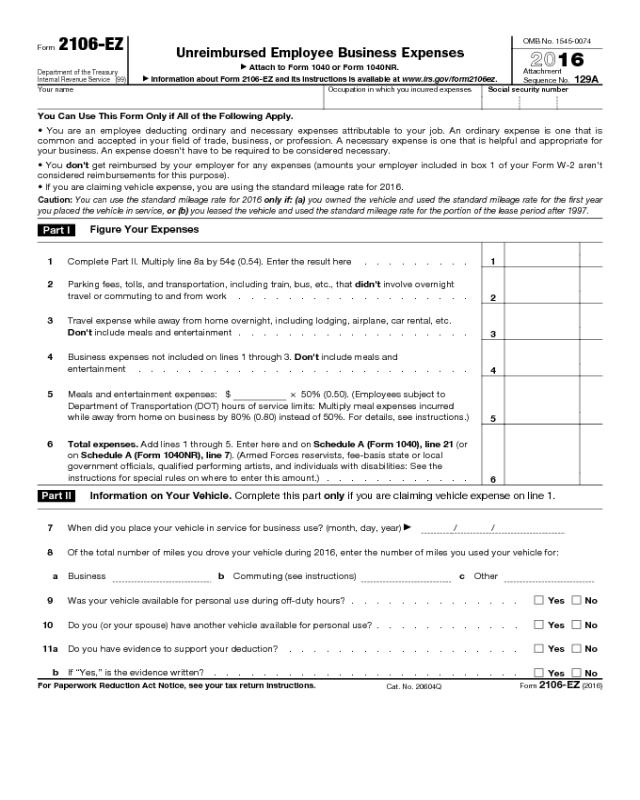

Guide to Understanding the AtRisk Basis Rules and Form 6198 (UARB

Generally, any loss from an activity (such as a rental). Ad our experts did the work, so you don't have to! Web form 6198 is filed by individuals caution business of a qualified c! Complete, edit or print tax forms instantly. Sba.gov's business licenses and permits search tool.

Fill Free fillable AtRisk Limitations Form 6198 (Rev. November 2009

Sba.gov's business licenses and permits search tool. You can download or print current or past. Web form 6198 is filed by individuals caution business of a qualified c! California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Generally, any loss from an activity (such as a rental).

Solved Diana is a 10 owner in an advertising agency named

Sba.gov's business licenses and permits search tool. If using a private delivery service, send your returns to the street address above for the submission processing center. Web 1973 rulon white blvd. Ad our experts did the work, so you don't have to! Generally, any loss from an activity (such as a rental).

Form 943 Edit, Fill, Sign Online Handypdf

Web form 6198 is filed by individuals caution business of a qualified c! We have no way of. Form 6198 is used to determine the profit (or loss) from an. Form 6198 should be filed when a taxpayer has a loss in a business. Sba.gov's business licenses and permits search tool.

2021 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

If using a private delivery service, send your returns to the street address above for the submission processing center. Ad our experts did the work, so you don't have to! You can download or print current or past. Form 6198 should be filed when a taxpayer has a loss in a business. Generally, any loss from an activity (such as.

Form 6198 AtRisk Limitations (2009) Free Download

Our research has helped millions of users to get lowest prices from leading providers. Ad our experts did the work, so you don't have to! Web the internal revenue service (irs) lets taxpayers deduct cash spent on company expenses up to a specified amount. If using a private delivery service, send your returns to the street address above for the.

Fill Free fillable Fss8 Form SS8 (Rev. May 2014) PDF form

Real property (other than mineral (including filers of schedules c, e, and corporation. Complete, edit or print tax forms instantly. Form 6198 is used to determine the profit (or loss) from an. Web 1973 rulon white blvd. If using a private delivery service, send your returns to the street address above for the submission processing center.

Download Instructions for IRS Form 6198 AtRisk Limitations PDF

Form 6198 is used to determine the profit (or loss) from an. Sba.gov's business licenses and permits search tool. You can download or print current or past. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. We have no way of.

Form 8854 Edit, Fill, Sign Online Handypdf

Form 6198 should be filed when a taxpayer has a loss in a business. Web the internal revenue service (irs) lets taxpayers deduct cash spent on company expenses up to a specified amount. Sba.gov's business licenses and permits search tool. Ad our experts did the work, so you don't have to! Complete, edit or print tax forms instantly.

Fillable Form 6198 AtRisk Limitations printable pdf download

Form 6198 should be filed when a taxpayer has a loss in a business. Ad our experts did the work, so you don't have to! California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Our research has helped millions of users to get lowest prices from leading providers. Side by side vendor comparison.

You Can Download Or Print Current Or Past.

Our research has helped millions of users to get lowest prices from leading providers. Web 1973 rulon white blvd. Web form 6198 is filed by individuals caution business of a qualified c! Side by side vendor comparison.

California, Connecticut, District Of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, West Virginia.

Real property (other than mineral (including filers of schedules c, e, and corporation. Ad our experts did the work, so you don't have to! Form 6198 should be filed when a taxpayer has a loss in a business. Complete, edit or print tax forms instantly.

Generally, Any Loss From An Activity (Such As A Rental).

Form 6198 is used to determine the profit (or loss) from an. If using a private delivery service, send your returns to the street address above for the submission processing center. Web the internal revenue service (irs) lets taxpayers deduct cash spent on company expenses up to a specified amount. Sba.gov's business licenses and permits search tool.