Tax Form 4137

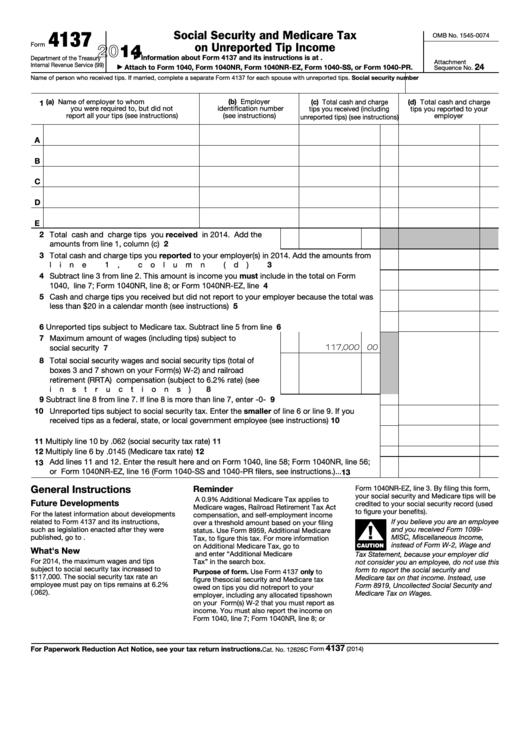

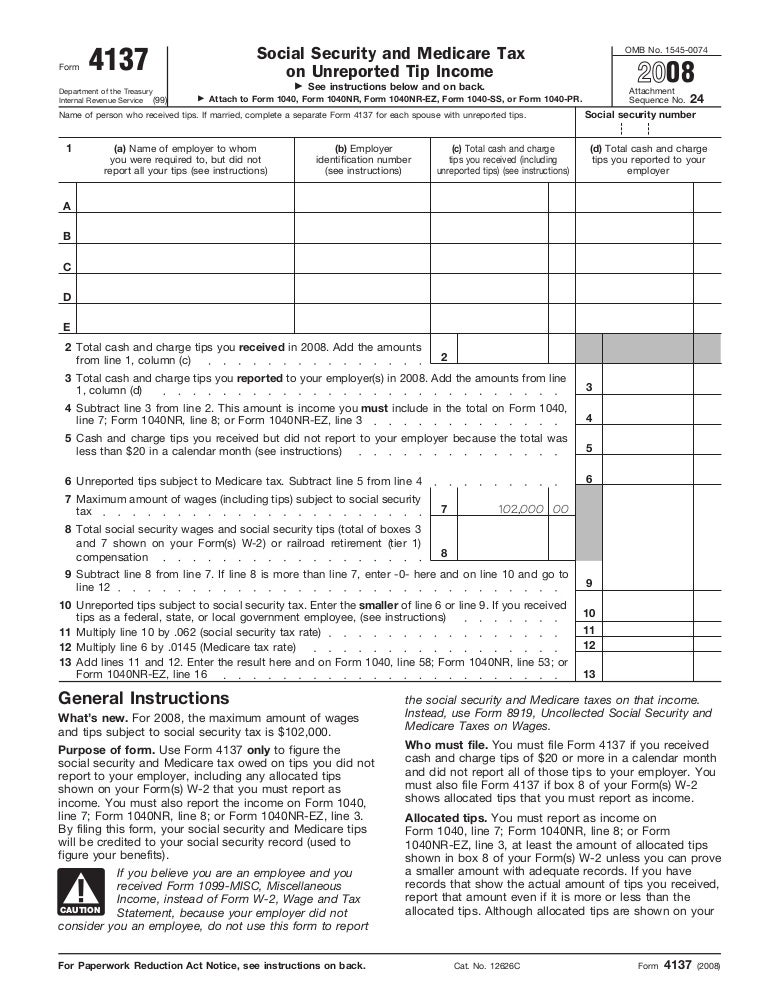

Tax Form 4137 - Web form 4137 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income go to www.irs.gov/form4137 for the latest. Web form 4137 helps to determine social security and medicare tax on unreported tip income taxpayers who earn tips are required to report all tip income each month and pay the. Web form 4137 2021 social security and medicare tax on unreported tip income department of the treasury internal revenue service (99) go to. These where to file addresses. Web form 4137 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income information about form 4137 and its. Web about form 4137, social security and medicare tax on unreported tip income. Web you must file form 4137 if you received cash and charge tips of $20 or more in a calendar month and did not report all of those tips to your employer. You must also file form 4137. Web find irs addresses for private delivery of tax returns, extensions and payments. For some of the western states, the following addresses were previously used:

Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in missouri. We help you understand and meet your federal tax responsibilities. These where to file addresses. For some of the western states, the following addresses were previously used: Department of the treasury |. Web form 4137 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income information about form 4137 and its. You must also file form 4137. Use form 4137 only to figure the social security and medicare tax owed on. Web form 4137 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income go to www.irs.gov/form4137 for the latest. Web social security and medicare tax on unreported tip income see instructions below and on back.

Private delivery services should not deliver returns to irs offices other than. Web form 4137 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income information about form 4137 and its. Use form 4137 only to figure the social security and medicare tax owed on. Web about form 4137, social security and medicare tax on unreported tip income. Find irs forms and answers to tax questions. Web report error it appears you don't have a pdf plugin for this browser. Department of the treasury |. Web income tax forms form 4137 federal — social security and medicare tax on unreported tip income download this form print this form it appears you don't have a pdf plugin. Web you must file form 4137 if you received cash and charge tips of $20 or more in a calendar month and did not report all of those tips to your employer. These where to file addresses.

Da Form 4137 Fill Out and Sign Printable PDF Template signNow

Web form 4137, social security and medicare tax on unreported tip income use irs form 4137 to determine the social security and medicare tax owed on tips you did not report. Web report error it appears you don't have a pdf plugin for this browser. Web form 4137 2014 department of the treasury internal revenue service (99) social security and.

Form 4137 Social Security and Medicare Tax On Unreported Tip

Web social security and medicare tax on unreported tip income see instructions below and on back. Private delivery services should not deliver returns to irs offices other than. Web report error it appears you don't have a pdf plugin for this browser. These where to file addresses. Web about form 4137, social security and medicare tax on unreported tip income.

Fillable Form 4137 Social Security And Medicare Tax On Unreported Tip

For some of the western states, the following addresses were previously used: We help you understand and meet your federal tax responsibilities. Web you must file form 4137 if you received cash and charge tips of $20 or more in a calendar month and did not report all of those tips to your employer. Use form 4137 only to figure.

Form 4137Social Security and Medicare Tax on Unreported Tip

Web you must file form 4137 if you received cash and charge tips of $20 or more in a calendar month and did not report all of those tips to your employer. You must also file form 4137. Web form 4137 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income go to.

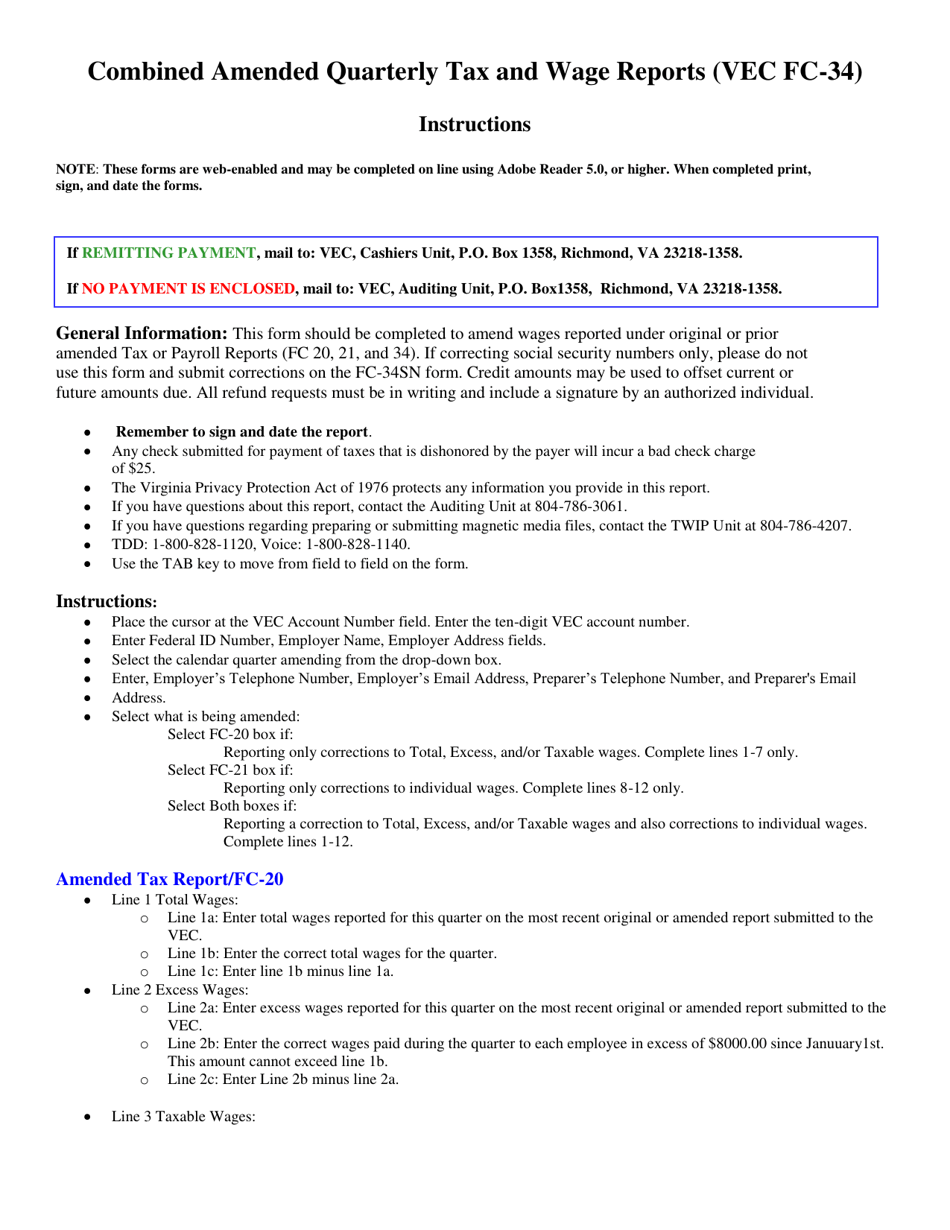

Fc 029 Form Pdf / Fc Form 4137 Fill Online, Printable, Fillable

Web form 4137 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income information about form 4137 and its. Web about form 4137, social security and medicare tax on unreported tip income. These where to file addresses. Web you must file form 4137 if you received cash and charge tips of $20 or.

Small Business Form —

For some of the western states, the following addresses were previously used: Web you must file form 4137 if you received cash and charge tips of $20 or more in a calendar month and did not report all of those tips to your employer. Find irs forms and answers to tax questions. Web form 4137 department of the treasury internal.

4137 Social Security and Medicare Tax on Unreported Tip Inco YouTube

Web form 4137 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income information about form 4137 and its. Use form 4137 only to figure the social security and medicare tax owed on. Web form 4137 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income.

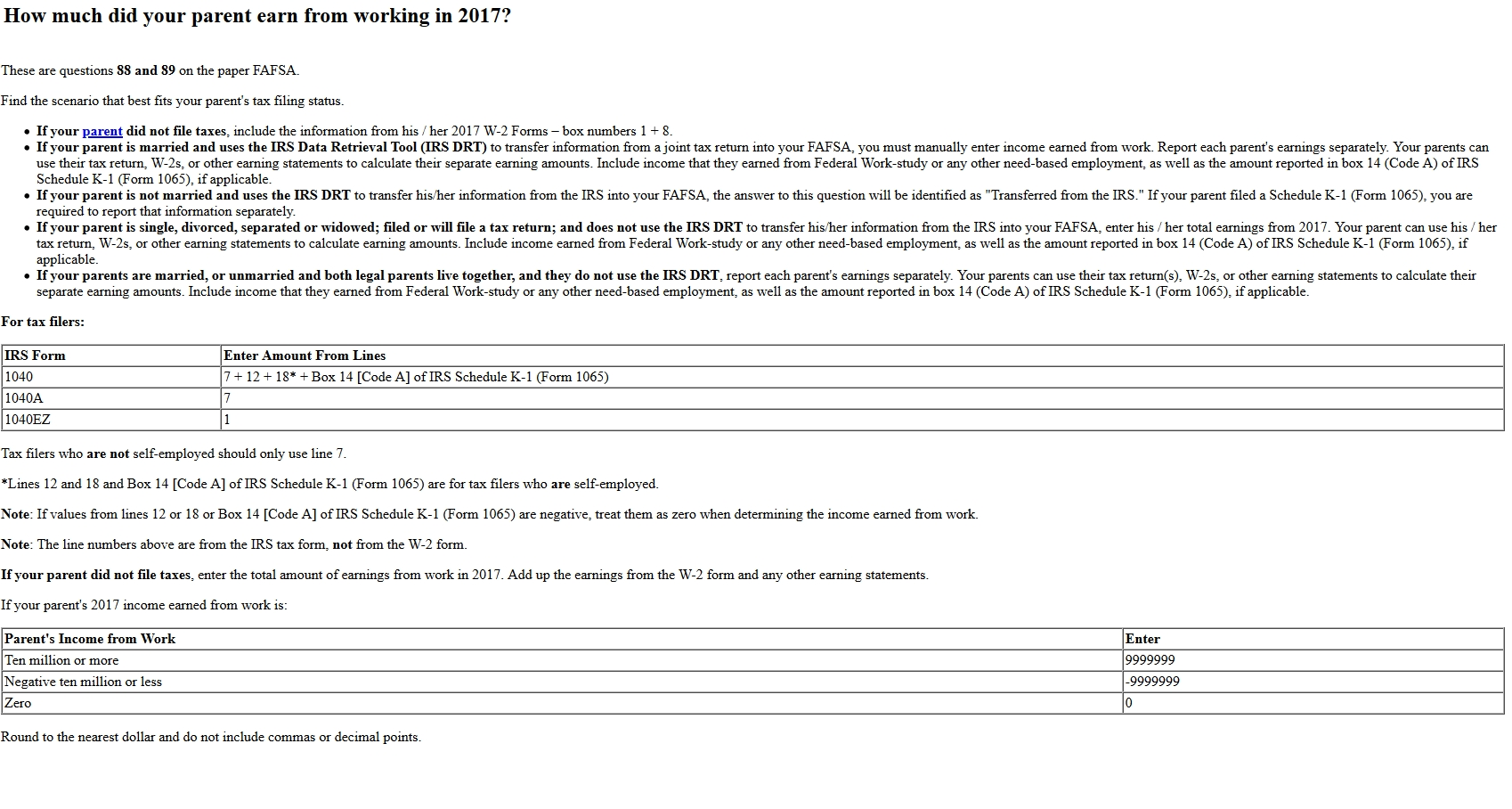

Irs 1040 Form Line 14 New For 2019 Taxes Revised 1040 Only 3

Web form 4137 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income go to www.irs.gov/form4137 for the latest. Web form 4137 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income go to www.irs.gov/form4137 for the latest. We help you understand and meet your federal.

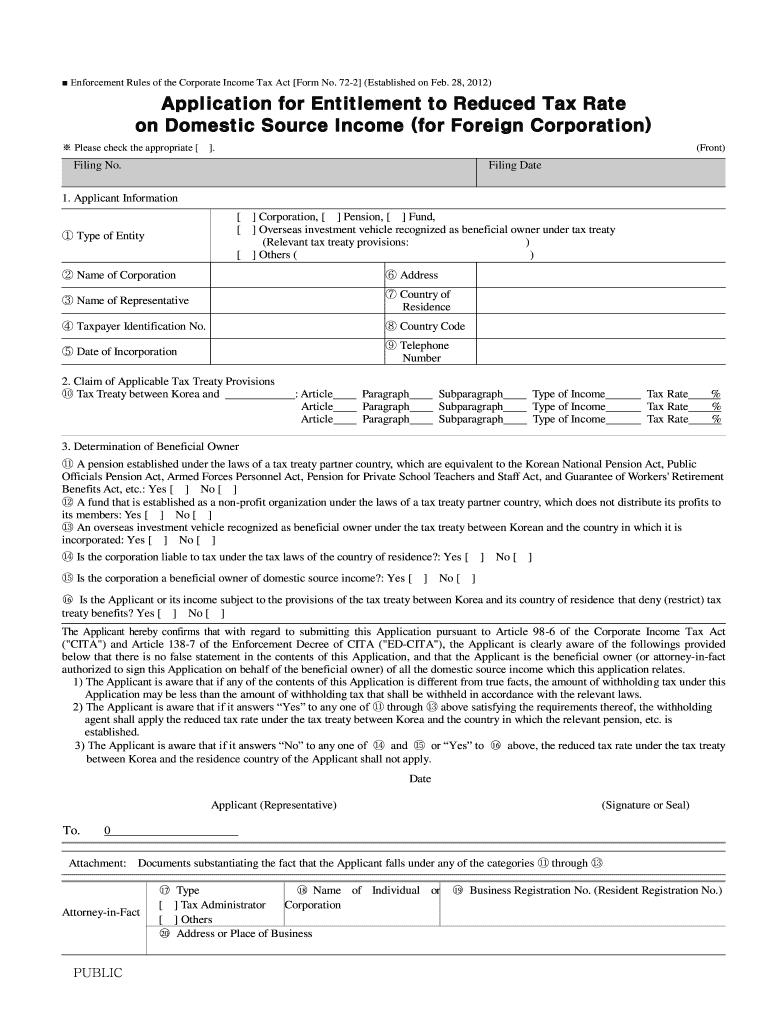

Application for Entitlement to Reduced Tax Rate on Domestic Source

Private delivery services should not deliver returns to irs offices other than. Web form 4137, social security and medicare tax on unreported tip income use irs form 4137 to determine the social security and medicare tax owed on tips you did not report. Use form 4137 only to figure the social security and medicare tax owed on. Web find irs.

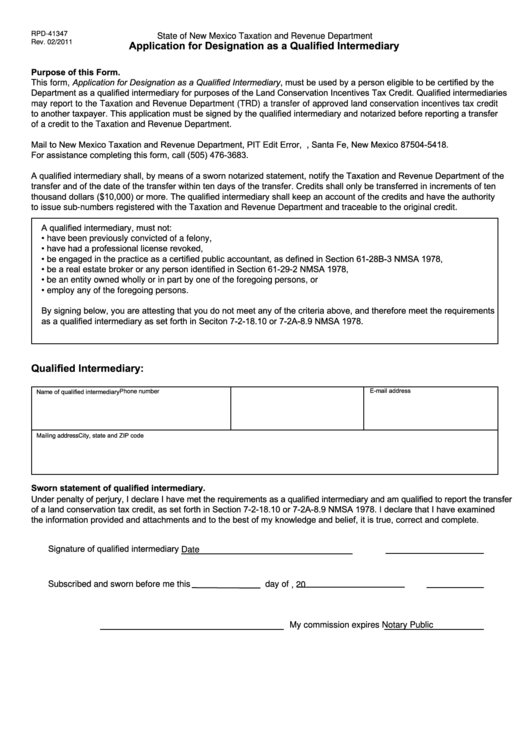

Form Rpd41347 Application For Designation As A Qualified

You must also file form 4137. Web about form 4137, social security and medicare tax on unreported tip income. Web income tax forms form 4137 federal — social security and medicare tax on unreported tip income download this form print this form it appears you don't have a pdf plugin. These where to file addresses. Web form 4137 department of.

Web Form 4137 2014 Department Of The Treasury Internal Revenue Service (99) Social Security And Medicare Tax On Unreported Tip Income Information About Form 4137 And Its.

Web social security and medicare tax on unreported tip income see instructions below and on back. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in missouri. Web form 4137 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income information about form 4137 and its. Use form 4137 only to figure the social security and medicare tax owed on.

Web Report Error It Appears You Don't Have A Pdf Plugin For This Browser.

These where to file addresses. We help you understand and meet your federal tax responsibilities. Web about form 4137, social security and medicare tax on unreported tip income. Web form 4137, social security and medicare tax on unreported tip income use irs form 4137 to determine the social security and medicare tax owed on tips you did not report.

Web You Must File Form 4137 If You Received Cash And Charge Tips Of $20 Or More In A Calendar Month And Did Not Report All Of Those Tips To Your Employer.

Web form 4137 helps to determine social security and medicare tax on unreported tip income taxpayers who earn tips are required to report all tip income each month and pay the. Web form 4137 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income go to www.irs.gov/form4137 for the latest. Department of the treasury |. Private delivery services should not deliver returns to irs offices other than.

Find Irs Forms And Answers To Tax Questions.

Web form 4137 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income go to www.irs.gov/form4137 for the latest. Web form 4137 2021 social security and medicare tax on unreported tip income department of the treasury internal revenue service (99) go to. For some of the western states, the following addresses were previously used: Web find irs addresses for private delivery of tax returns, extensions and payments.