Tax Form 210

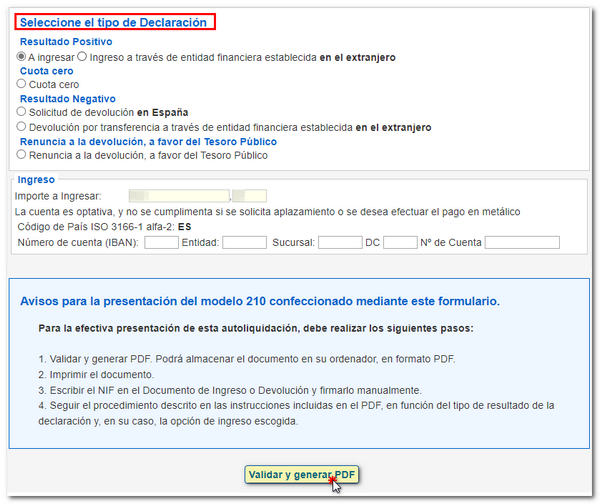

Tax Form 210 - Page last reviewed or updated: Your federal adjusted gross income (agi) is $41,000 or less regardless of age, or. Your federal agi was $73,000 or less and you served as active duty military. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. You are 57 years old or younger with a federal adjusted gross income (agi) of $60,000 or less, or. Web online filing of form 210. Web employer's quarterly federal tax return. We will compute the amount of your. Hours of operation are 7 a.m. Access to the electronic filing form requires an electronic certificate, dnie or cl@ve pin.complete the declaration making sure to include data in the fields marked with an asterisk, which are mandatory.pay particular attention to the accrual section.if there is any type of error related to the tax return period, we.

You must file your 2022 claim no later than april 15, 2026. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Your federal agi was $73,000 or less and you served as active duty military. Postal service, to mail in your form and tax payment. You are 57 years old or younger with a federal adjusted gross income (agi) of $60,000 or less, or. Web you may be eligible for free file using one of the software providers below, if: Hours of operation are 7 a.m. Web online filing of form 210. Web employer's quarterly federal tax return. We will compute the amount of your.

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Access to the electronic filing form requires an electronic certificate, dnie or cl@ve pin.complete the declaration making sure to include data in the fields marked with an asterisk, which are mandatory.pay particular attention to the accrual section.if there is any type of error related to the tax return period, we. Page last reviewed or updated: You must file your 2022 claim no later than april 15, 2026. Postal service, to mail in your form and tax payment. Web employer's quarterly federal tax return. Web you may be eligible for free file using one of the software providers below, if: All amounts required must be expressed in euros, placing the whole number in the left hand division of the corresponding boxes, and fractions (to two decimal points) on the right. We will compute the amount of your. Hours of operation are 7 a.m.

About Us Spanish Tax Form 210

Page last reviewed or updated: Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Your federal agi was $73,000 or less and you served as active duty military. We will compute the amount of your. Instructions for form 941 pdf

Tax AgencyForm 210 Form 210 for paper filing, 20132017

Hours of operation are 7 a.m. Web online filing of form 210. Page last reviewed or updated: Your federal adjusted gross income (agi) is $41,000 or less regardless of age, or. Web employer's quarterly federal tax return.

Form 5330 Return of Excise Taxes Related to Employee Benefit Plans

Instructions for form 941 pdf Your federal agi was $73,000 or less and you served as active duty military. Web employer's quarterly federal tax return. You are 57 years old or younger with a federal adjusted gross income (agi) of $60,000 or less, or. Hours of operation are 7 a.m.

Non Residents Tax in Spain. Form 210. Tax declarations

Postal service, to mail in your form and tax payment. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Web you may be eligible for free file using one of the software providers below, if: All amounts required must be expressed in.

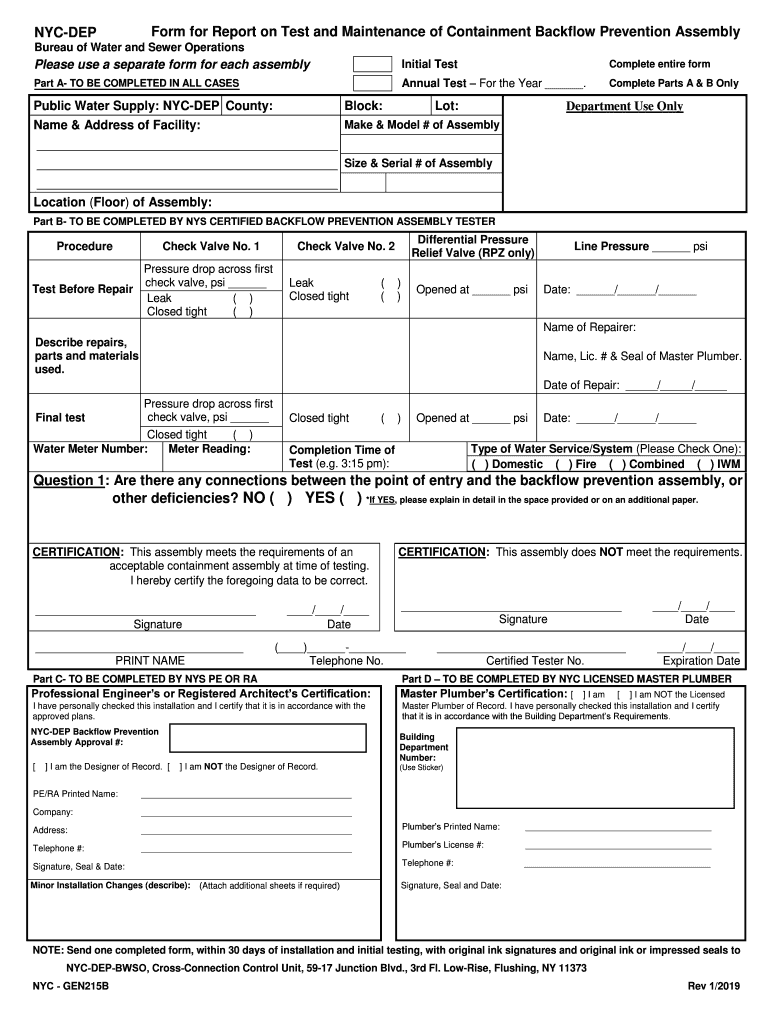

Nyc 210 Form 2020 Pdf Fill Online, Printable, Fillable, Blank pdfFiller

You are 57 years old or younger with a federal adjusted gross income (agi) of $60,000 or less, or. Hours of operation are 7 a.m. Access to the electronic filing form requires an electronic certificate, dnie or cl@ve pin.complete the declaration making sure to include data in the fields marked with an asterisk, which are mandatory.pay particular attention to the.

Form 210A Fill Out and Sign Printable PDF Template signNow

Page last reviewed or updated: You are 57 years old or younger with a federal adjusted gross income (agi) of $60,000 or less, or. Web employer's quarterly federal tax return. Postal service, to mail in your form and tax payment. All amounts required must be expressed in euros, placing the whole number in the left hand division of the corresponding.

Nyc210 Form 2021 Printable Printable Word Searches

We will compute the amount of your. Your federal agi was $73,000 or less and you served as active duty military. Instructions for form 941 pdf Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. You are 57 years old or younger.

Download Instructions for Form N210 Underpayment of Estimated Tax by

Your federal adjusted gross income (agi) is $41,000 or less regardless of age, or. You must file your 2022 claim no later than april 15, 2026. Web online filing of form 210. Hours of operation are 7 a.m. Web employer's quarterly federal tax return.

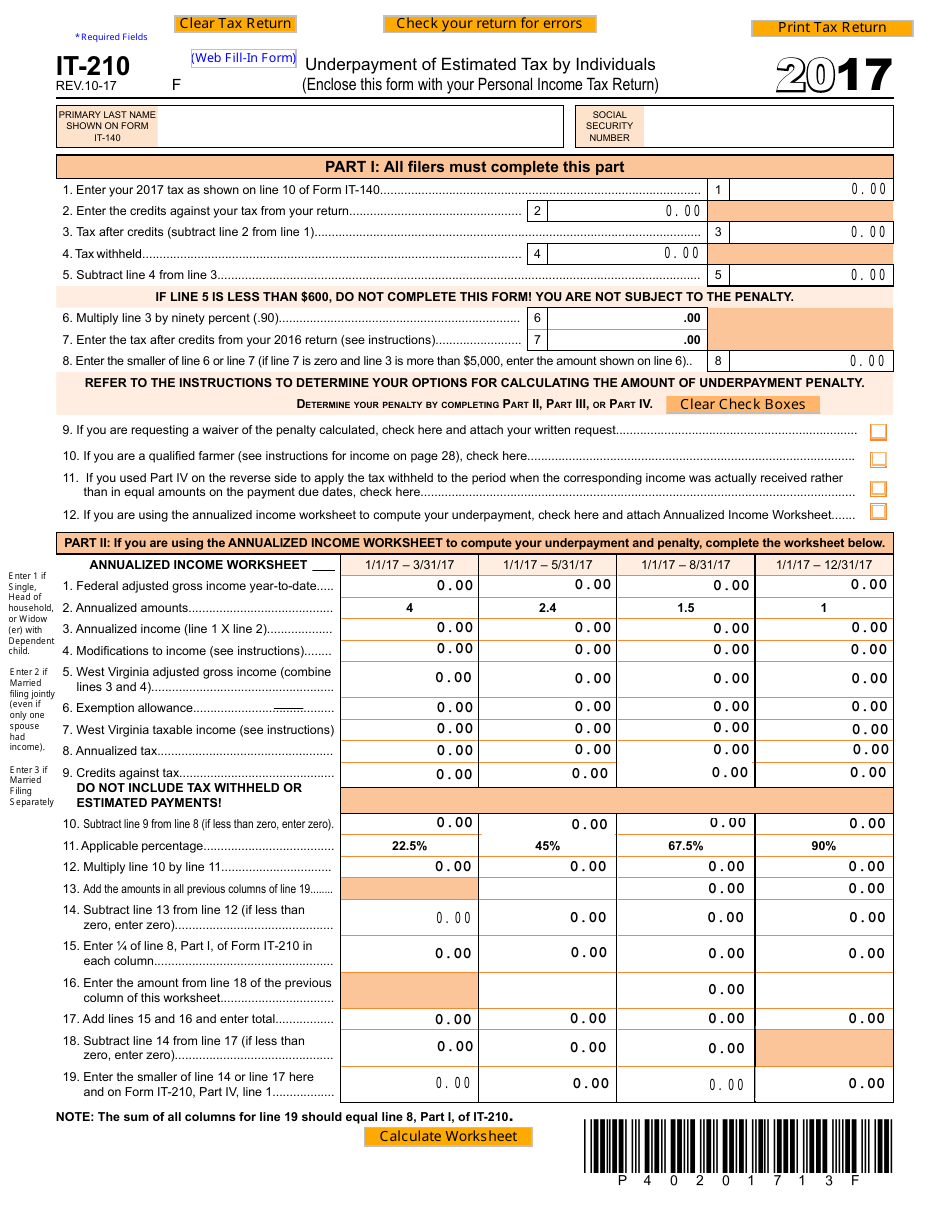

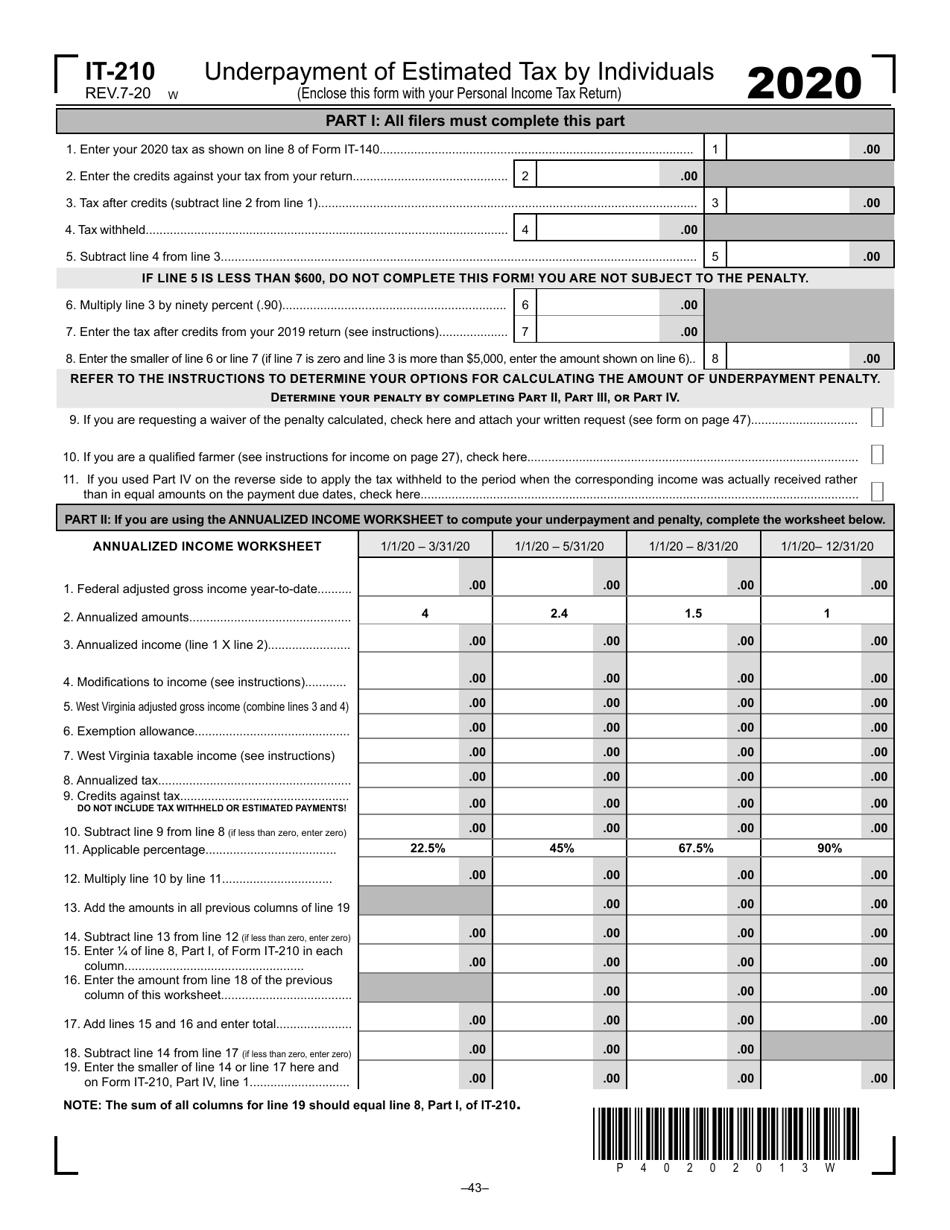

Form IT210 Download Fillable PDF or Fill Online Underpayment of

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Postal service, to mail in your form and tax payment. You are 57 years old or younger with a federal adjusted gross income (agi) of $60,000 or less, or. Web employer's quarterly federal.

Form IT210 Download Printable PDF or Fill Online Underpayment of

All amounts required must be expressed in euros, placing the whole number in the left hand division of the corresponding boxes, and fractions (to two decimal points) on the right. Instructions for form 941 pdf Web online filing of form 210. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the.

Web Online Filing Of Form 210.

Web form is used by an individual to notify the department of either the creation of or the termination of a fiduciary relationship for a decedent's estate. Web you may be eligible for free file using one of the software providers below, if: Hours of operation are 7 a.m. All amounts required must be expressed in euros, placing the whole number in the left hand division of the corresponding boxes, and fractions (to two decimal points) on the right.

You Are 57 Years Old Or Younger With A Federal Adjusted Gross Income (Agi) Of $60,000 Or Less, Or.

Postal service, to mail in your form and tax payment. Instructions for form 941 pdf Access to the electronic filing form requires an electronic certificate, dnie or cl@ve pin.complete the declaration making sure to include data in the fields marked with an asterisk, which are mandatory.pay particular attention to the accrual section.if there is any type of error related to the tax return period, we. You must file your 2022 claim no later than april 15, 2026.

Employers Who Withhold Income Taxes, Social Security Tax, Or Medicare Tax From Employee's Paychecks Or Who Must Pay The Employer's Portion Of Social Security Or Medicare Tax.

Page last reviewed or updated: Your federal agi was $73,000 or less and you served as active duty military. Web employer's quarterly federal tax return. Your federal adjusted gross income (agi) is $41,000 or less regardless of age, or.