Tax Exempt Form Ct

Tax Exempt Form Ct - If the due date falls on a saturday, sunday,. Information about this can be. Contractors for the repair, alteration, improvement, remodeling, or construction of real property use this. Web state / jurisdiction / u.s. Find out more about the available tax exemptions on film, video and broadcast. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Web the assessor reviews filings that scientific, educational, literary, historical, charitable, agricultural, and cemetery organizations must submit to claim an exemption and. Web the 2023 veterans stand down conducted by the connecticut department of veterans affairs is in early planning stages. Web it imposes a 6.35% tax, with some exceptions, on the retail sales of tangible personal property purchased (1) in connecticut (i.e., sales tax) or (2) outside connecticut for. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt.

Web it imposes a 6.35% tax, with some exceptions, on the retail sales of tangible personal property purchased (1) in connecticut (i.e., sales tax) or (2) outside connecticut for. See if your business is in one of four sectors earmarked for corporate tax relief. Web connecticut general statutes, chapter 219, sales and use taxes, imposes the connecticut sales and use tax on the gross receipts from the sale of tangible personal. Web state / jurisdiction / u.s. Web this report provides an overview of connecticut’s personal income tax, including the tax rates, exemptions, credit amounts, and thresholds in effect for the 2022 and 2023 tax. Web contractor's exempt purchase certificate. Contractors for the repair, alteration, improvement, remodeling, or construction of real property use this. If the due date falls on a saturday, sunday,. Tax exemption listings please indicate which of the following tax exemptions your state / jurisdiction / u.s. Web the assessor reviews filings that scientific, educational, literary, historical, charitable, agricultural, and cemetery organizations must submit to claim an exemption and.

See if your business is in one of four sectors earmarked for corporate tax relief. Web connecticut general statutes, chapter 219, sales and use taxes, imposes the connecticut sales and use tax on the gross receipts from the sale of tangible personal. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Web state / jurisdiction / u.s. Contractors for the repair, alteration, improvement, remodeling, or construction of real property use this. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the connecticut sales tax. Web connecticut laws require municipalities to provide property tax relief for specific groups of homeowners, such as those who are seniors, veterans, or have a disability. Web it imposes a 6.35% tax, with some exceptions, on the retail sales of tangible personal property purchased (1) in connecticut (i.e., sales tax) or (2) outside connecticut for. Find out more about the available tax exemptions on film, video and broadcast. Web this report provides an overview of connecticut’s personal income tax, including the tax rates, exemptions, credit amounts, and thresholds in effect for the 2022 and 2023 tax.

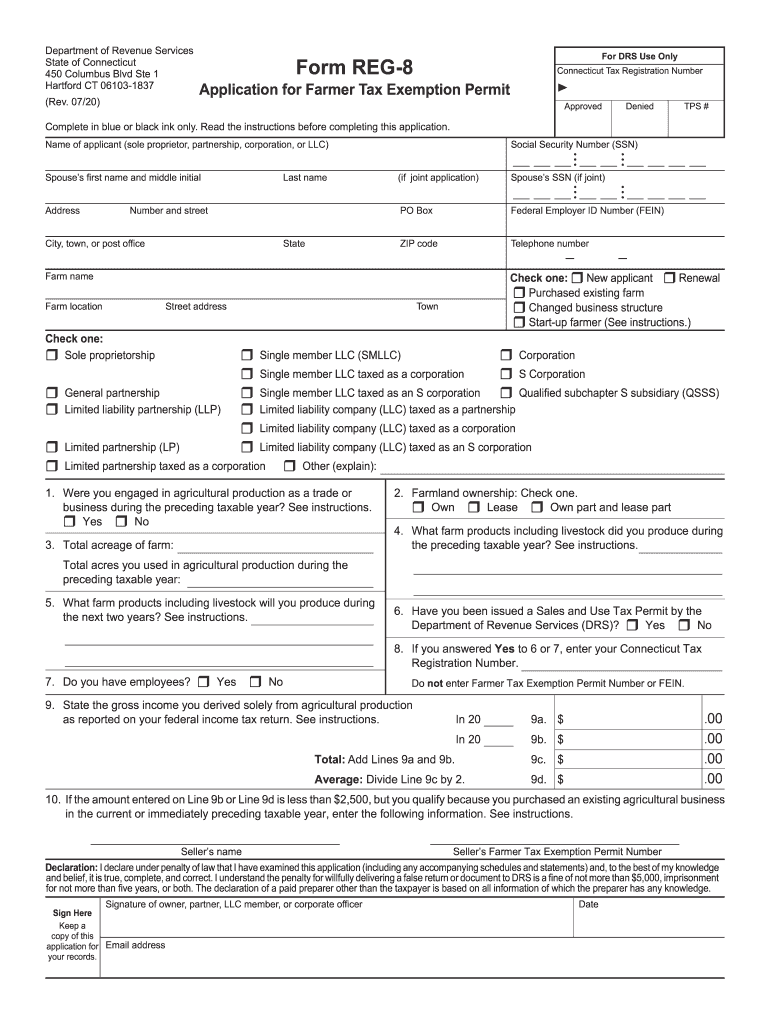

CT REG8 2020 Fill out Tax Template Online US Legal Forms

Web connecticut laws require municipalities to provide property tax relief for specific groups of homeowners, such as those who are seniors, veterans, or have a disability. Web tax exempt if your organization wants to be exempt from federal income tax, the organization must apply to the internal revenue service. Find out more about the available tax exemptions on film, video.

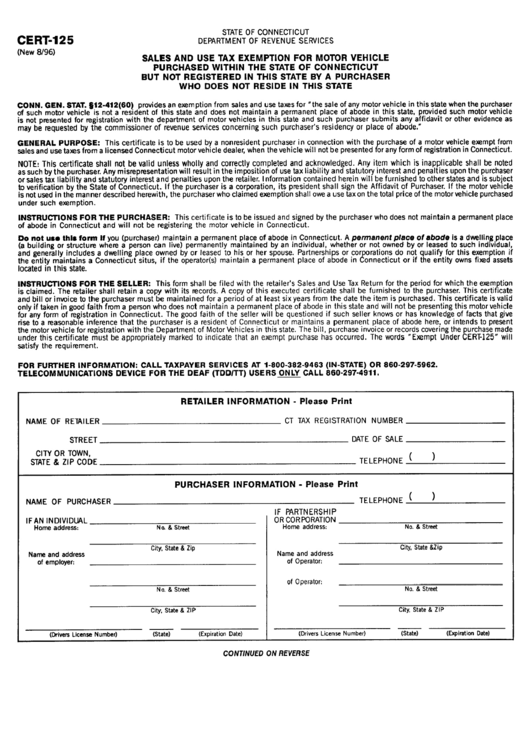

Ct Sales And Use Tax Exempt Form 2023

Web state / jurisdiction / u.s. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the connecticut sales tax. Contractors for the repair, alteration, improvement, remodeling, or construction of real property use this. Web tax exempt if your organization wants to be exempt from federal.

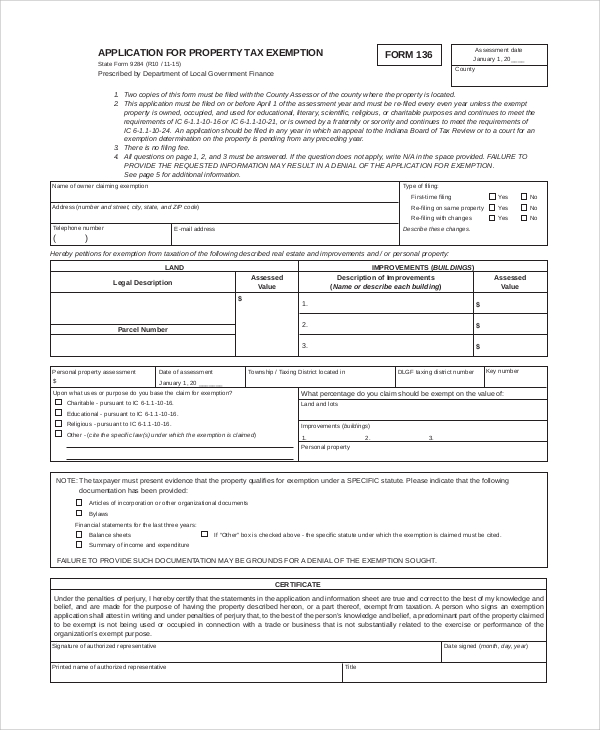

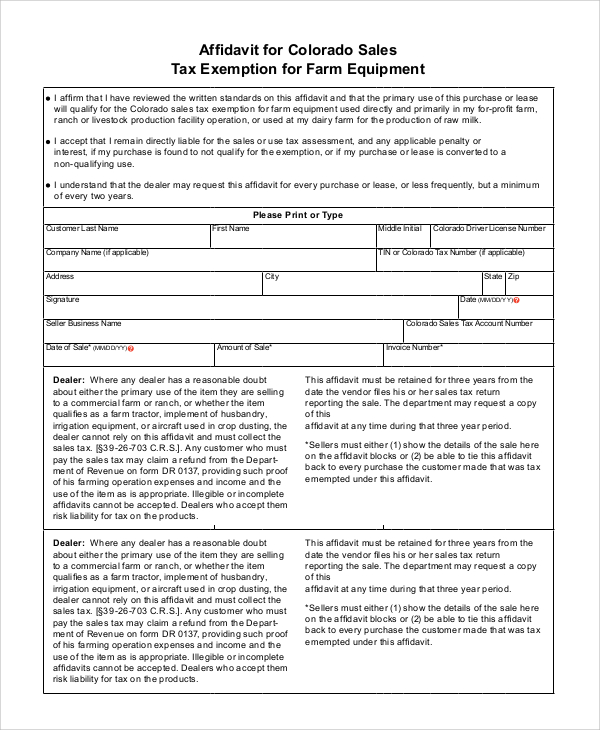

FREE 10+ Sample Tax Exemption Forms in PDF

Web this report provides an overview of connecticut’s personal income tax, including the tax rates, exemptions, credit amounts, and thresholds in effect for the 2022 and 2023 tax. Information about this can be. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Contractors for the repair, alteration,.

FREE 10+ Sample Tax Exemption Forms in PDF

Web tax exempt if your organization wants to be exempt from federal income tax, the organization must apply to the internal revenue service. Web connecticut laws require municipalities to provide property tax relief for specific groups of homeowners, such as those who are seniors, veterans, or have a disability. A sales tax exemption certificate can be used by businesses (or.

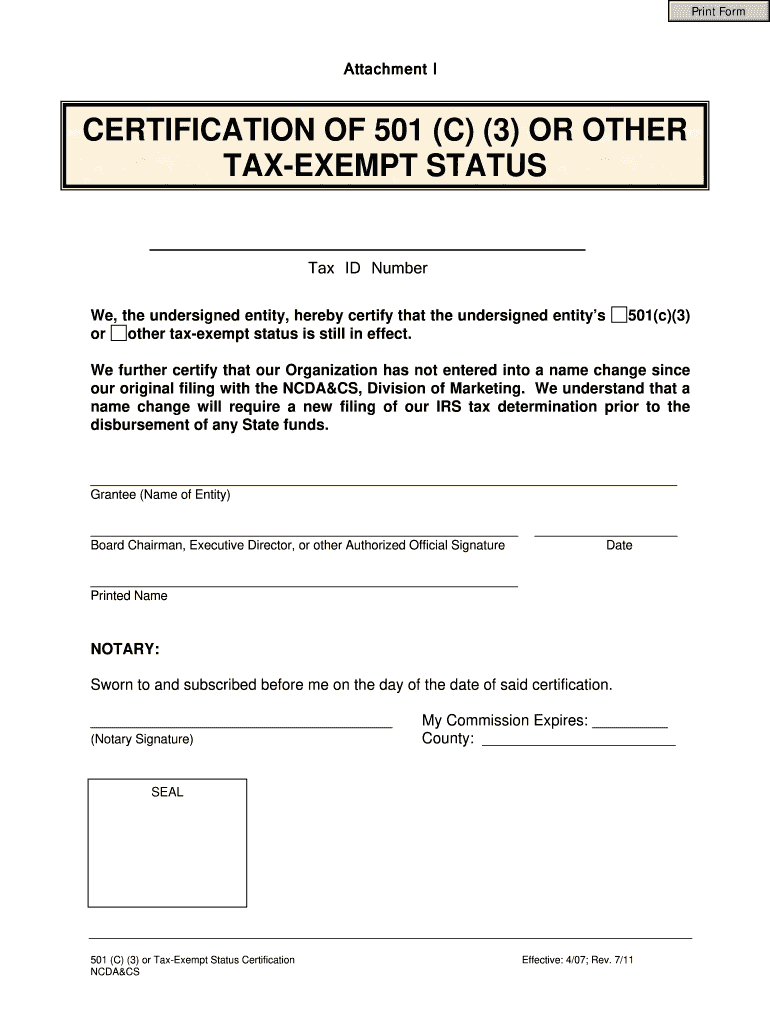

501c Form Fill Out and Sign Printable PDF Template signNow

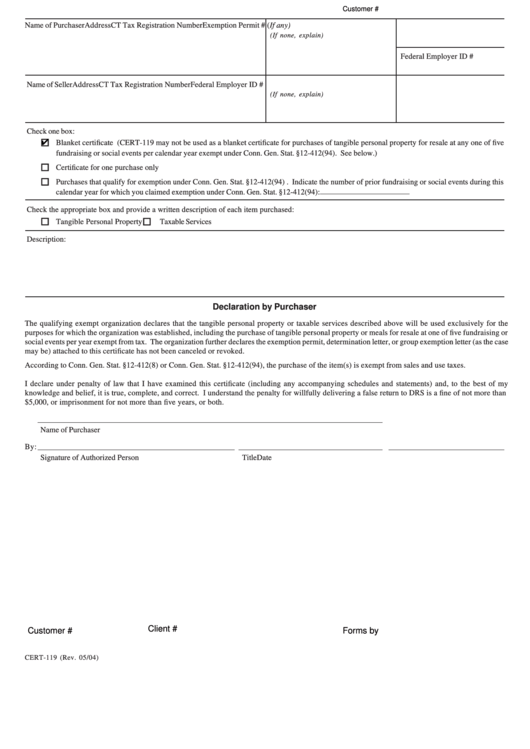

Web contractor's exempt purchase certificate. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the connecticut sales tax. Web any additional motor vehicle not exempted under this or another statutory provision is taxable in connecticut if the vehicle (1) is registered in the state or.

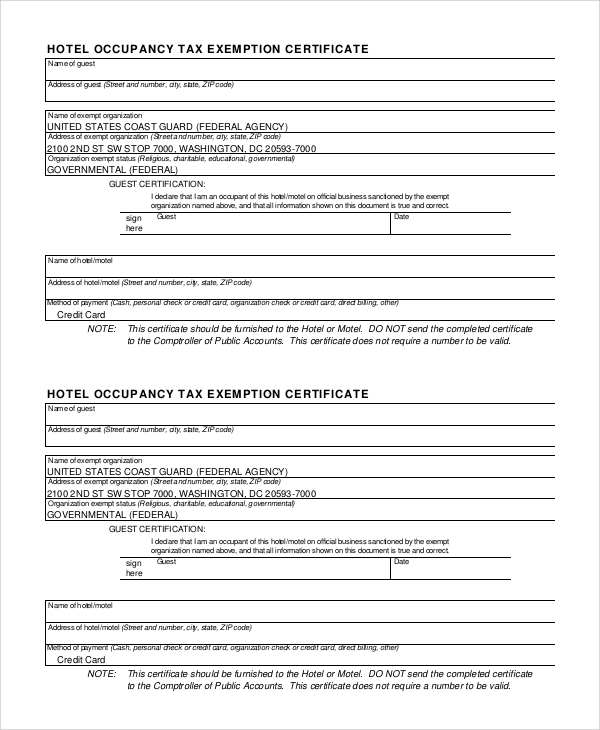

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller

Tax exemption listings please indicate which of the following tax exemptions your state / jurisdiction / u.s. Web general sales tax exemption certificate. Web this report provides an overview of connecticut’s personal income tax, including the tax rates, exemptions, credit amounts, and thresholds in effect for the 2022 and 2023 tax. A sales tax exemption certificate can be used by.

FREE 10+ Sample Tax Exemption Forms in PDF

Tax exemption listings please indicate which of the following tax exemptions your state / jurisdiction / u.s. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that.

Irs Tax Exempt Form 501c3 Form Resume Examples XV8oyPjjKz

Find out more about the available tax exemptions on film, video and broadcast. Web any additional motor vehicle not exempted under this or another statutory provision is taxable in connecticut if the vehicle (1) is registered in the state or (2) during its normal. Web connecticut general statutes, chapter 219, sales and use taxes, imposes the connecticut sales and use.

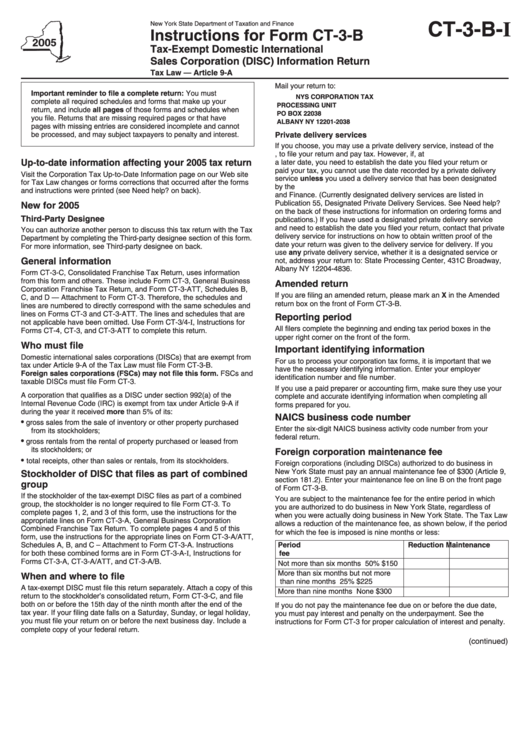

Instructions For Form Ct3B TaxExempt Domestic International Sales

Web this report provides an overview of connecticut’s personal income tax, including the tax rates, exemptions, credit amounts, and thresholds in effect for the 2022 and 2023 tax. Web connecticut laws require municipalities to provide property tax relief for specific groups of homeowners, such as those who are seniors, veterans, or have a disability. Web state / jurisdiction / u.s..

Fillable Cert119, Connecticut Tax Exempt Form printable pdf download

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Web the assessor reviews filings that scientific, educational, literary, historical, charitable, agricultural, and cemetery organizations must submit to claim an exemption and. Web tax exempt if your organization wants to be exempt from federal income tax, the organization.

Web The 2023 Veterans Stand Down Conducted By The Connecticut Department Of Veterans Affairs Is In Early Planning Stages.

Information about this can be. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Web tax exempt if your organization wants to be exempt from federal income tax, the organization must apply to the internal revenue service. State filing requirements for political organizations.

Web Contractor's Exempt Purchase Certificate.

Web this report provides an overview of connecticut’s personal income tax, including the tax rates, exemptions, credit amounts, and thresholds in effect for the 2022 and 2023 tax. Contractors for the repair, alteration, improvement, remodeling, or construction of real property use this. See if your business is in one of four sectors earmarked for corporate tax relief. Web connecticut laws require municipalities to provide property tax relief for specific groups of homeowners, such as those who are seniors, veterans, or have a disability.

If The Due Date Falls On A Saturday, Sunday,.

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Web the assessor reviews filings that scientific, educational, literary, historical, charitable, agricultural, and cemetery organizations must submit to claim an exemption and. Tax exemption listings please indicate which of the following tax exemptions your state / jurisdiction / u.s. Web state / jurisdiction / u.s.

Web Any Additional Motor Vehicle Not Exempted Under This Or Another Statutory Provision Is Taxable In Connecticut If The Vehicle (1) Is Registered In The State Or (2) During Its Normal.

Web general sales tax exemption certificate. Find out more about the available tax exemptions on film, video and broadcast. Web connecticut general statutes, chapter 219, sales and use taxes, imposes the connecticut sales and use tax on the gross receipts from the sale of tangible personal. Web it imposes a 6.35% tax, with some exceptions, on the retail sales of tangible personal property purchased (1) in connecticut (i.e., sales tax) or (2) outside connecticut for.