St3 Form Mn

St3 Form Mn - Web you do not need to charge minnesota sales tax when you: Web generally, atvs do not qualify for an exemption from sales tax. • electricity used in the operation of qualified data centers. Web fill online, printable, fillable, blank form st3, certificate of exemption (minnesota department of revenue) form. Web a completed form st3 is provided by colleges, universities, and the system office to vendors to exempt most official expenditures from minnesota sales tax. The exemption does not apply to purchases of meals, lodging, waste disposal services, and motor vehicles. If the customer uses an atv more than 50 percent of its operating time in agricultural production, it may qualify for the farm machinery exemption. Web see the form st3 instructions and exemption descriptions for more information about the following exemptions. Purchasers are responsible for knowing if they qualify to claim exemption from tax and will be held liable for any use tax, interest and possible penalties due if the items purchased are not eligible for exemption. Web minnesota or local taxing area.

Keep this certificate as part of your records. Web you do not need to charge minnesota sales tax when you: Web a completed form st3 is provided by colleges, universities, and the system office to vendors to exempt most official expenditures from minnesota sales tax. See the form st3 instructions and exemption descriptions for more information about the following exemptions. • electricity used in the operation of qualified data centers. Web see the form st3 instructions and exemption descriptions for more information about the following exemptions. Purchasers are responsible for knowing if If the customer uses an atv more than 50 percent of its operating time in agricultural production, it may qualify for the farm machinery exemption. The exemption does not apply to purchases of meals, lodging, waste disposal services, and motor vehicles. Once completed you can sign your fillable form or send for signing.

Web form st3, certificate of exemption purchaser: Once completed you can sign your fillable form or send for signing. This is a blanket certificate, unless one of the boxes below is. Receive a completed form st3, certificate of. Web form st3, certificate of exemption | minnesota department of revenue. Ship or deliver products to customers outside of minnesota; For other minnesota sales tax exemption certificates, go here. Complete this certificate and give it to the seller. Web a completed form st3 is provided by colleges, universities, and the system office to vendors to exempt most official expenditures from minnesota sales tax. Purchasers are responsible for knowing if they qualify to claim exemption from tax and will be held liable for any use tax, interest and possible penalties due if the items purchased are not eligible for exemption.

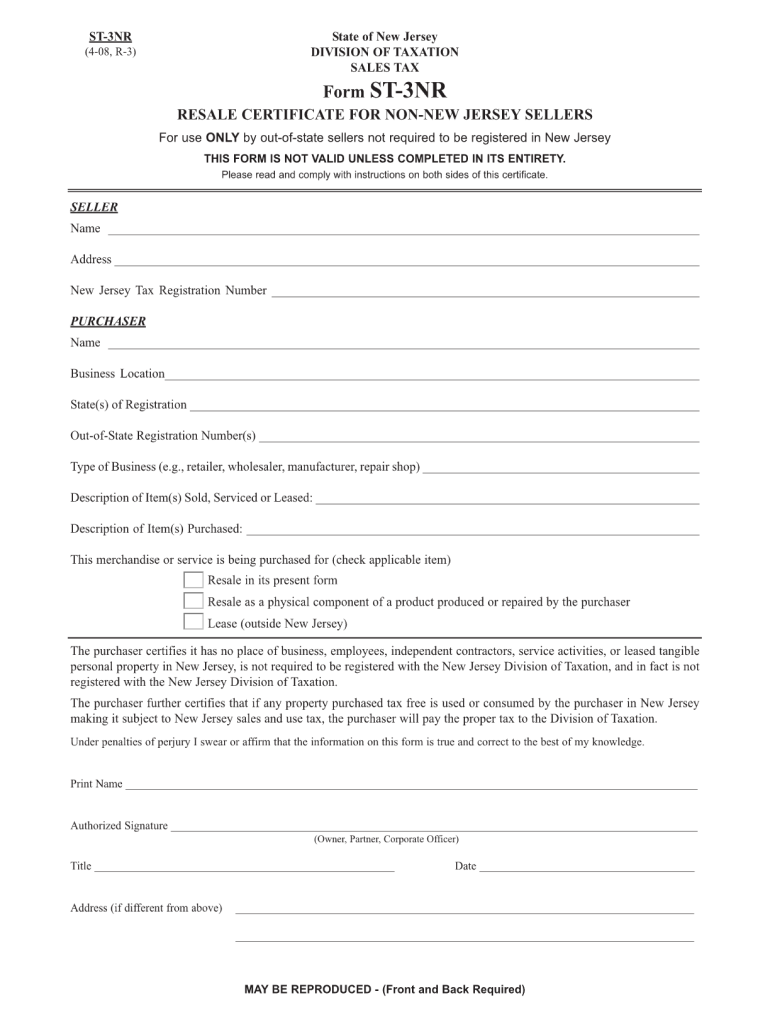

Printable Nj St3 Form Printable Form 2022

Web generally, atvs do not qualify for an exemption from sales tax. If this certificate is not completed, you must charge sales tax. This is a blanket certificate, unless one of the boxes below is. Web st3 this is a blanket certificate, unless one of the boxes below is checked, and remains in force as long as the purchaser continues.

Fill Free fillable Minnesota Department of Revenue PDF forms

Web minnesota or local taxing area. The exemption does not apply to purchases of meals, lodging, waste disposal services, and motor vehicles. Web generally, atvs do not qualify for an exemption from sales tax. Ship or deliver products to customers outside of minnesota; This is a blanket certificate, unless one of the boxes below is.

ST3, English version) (Word)

Purchasers are responsible for knowing if they qualify to claim exemption from tax and will be held liable for any use tax, interest and possible penalties due if the items purchased are not eligible for exemption. Web a completed form st3 is provided by colleges, universities, and the system office to vendors to exempt most official expenditures from minnesota sales.

2009 Form MN DoR ST3 Fill Online, Printable, Fillable, Blank pdfFiller

• electricity used in the operation of qualified data centers. Web minnesota or local taxing area. This is a blanket certificate, unless one of the boxes below is. For other minnesota sales tax exemption certificates, go here. If this certificate is not completed, you must charge sales tax.

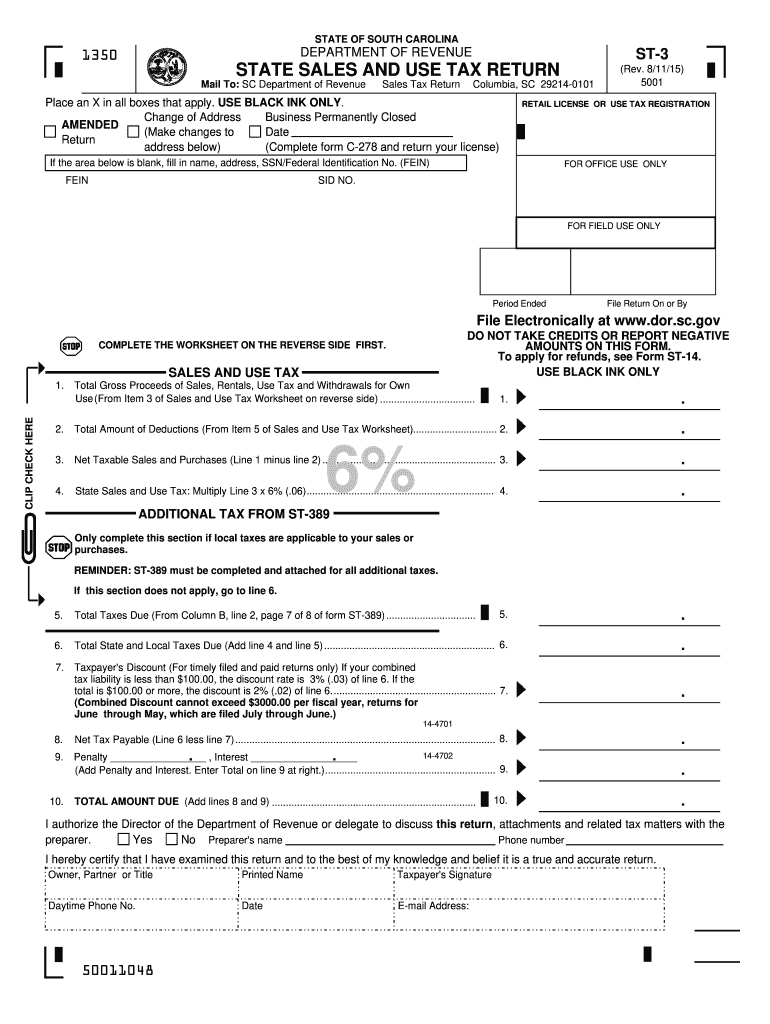

2015 Form SC DoR ST3 Fill Online, Printable, Fillable, Blank pdfFiller

If the customer uses an atv more than 50 percent of its operating time in agricultural production, it may qualify for the farm machinery exemption. See the form st3 instructions and exemption descriptions for more information about the following exemptions. This is a blanket certificate, unless one of the boxes below is. Receive a completed form st3, certificate of. Web.

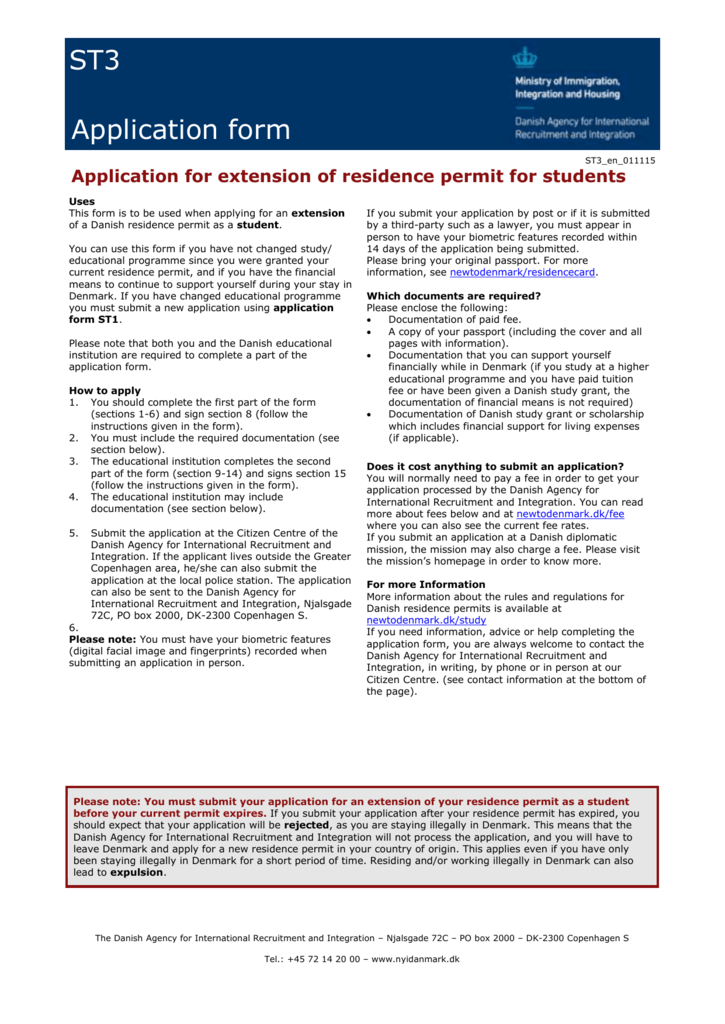

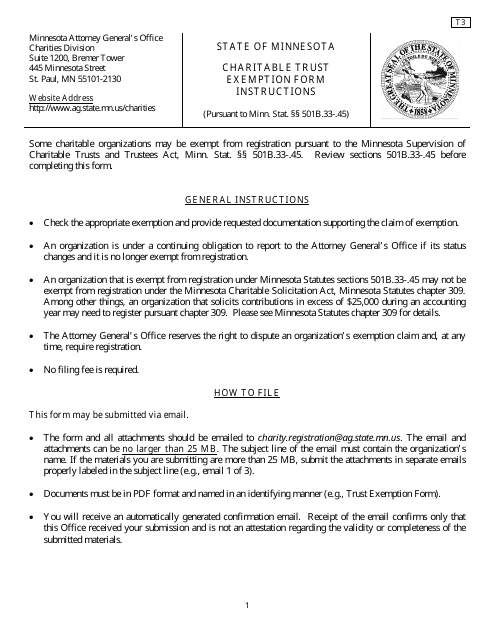

Form T3 Download Fillable PDF or Fill Online Charitable Trust Exemption

Purchasers are responsible for knowing if Complete this certificate and give it to the seller. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the minnesota sales tax. This is a blanket certificate, unless one of the boxes below is. Ship or deliver products to.

Service Tax Downloading and Opening ST3 Form utility YouTube

Sell items that are exempt by law; The exemption does not apply to purchases of meals, lodging, waste disposal services, and motor vehicles. If this certificate is not completed, you must charge sales tax. Keep this certificate as part of your records. Web a completed form st3 is provided by colleges, universities, and the system office to vendors to exempt.

MN DoR ST3 2015 Fill out Tax Template Online US Legal Forms

Web form st3, certificate of exemption purchaser: Once completed you can sign your fillable form or send for signing. Receive a completed form st3, certificate of. Web you do not need to charge minnesota sales tax when you: Purchasers are responsible for knowing if they qualify to claim exemption from tax and will be held liable for any use tax,.

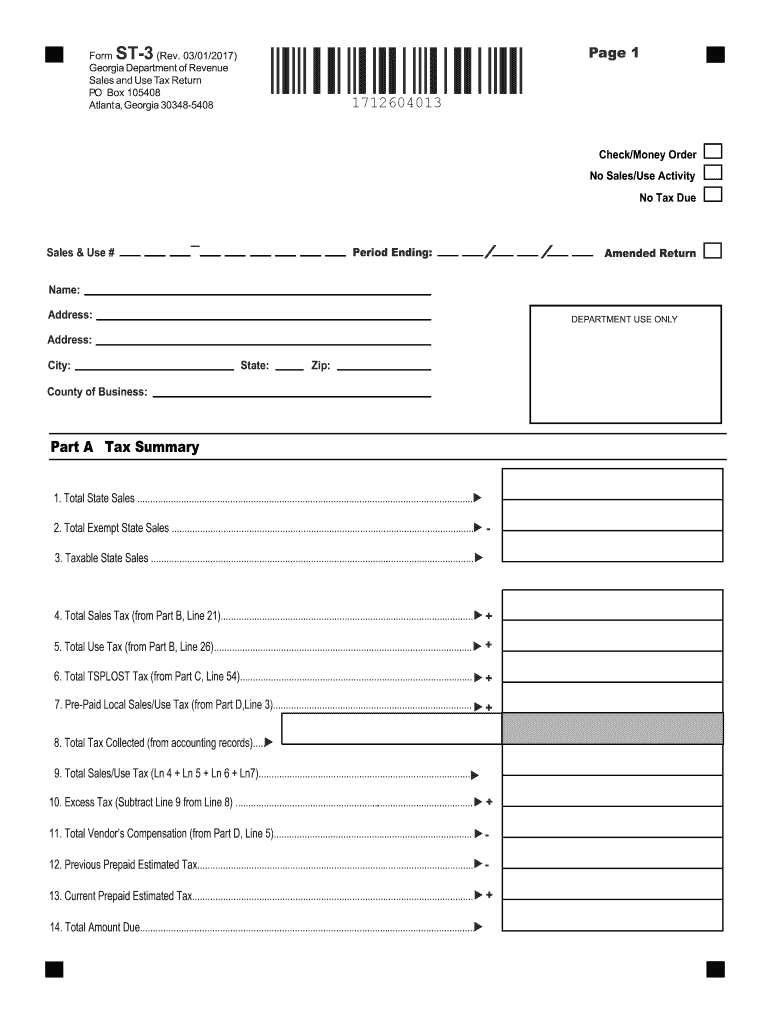

2017 Form GA DoR ST3 Fill Online, Printable, Fillable, Blank pdfFiller

Web see the form st3 instructions and exemption descriptions for more information about the following exemptions. Ship or deliver products to customers outside of minnesota; For other minnesota sales tax exemption certificates, go here. • electricity used in the operation of qualified data centers. Once completed you can sign your fillable form or send for signing.

Form ST3 Download Fillable PDF Or Fill Online Certificate Of Exemption

Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the minnesota sales tax. • electricity used in the operation of qualified data centers. Use fill to complete blank online minnesota department of revenue pdf forms for free. If this certificate is not completed, you must.

Web Fill Online, Printable, Fillable, Blank Form St3, Certificate Of Exemption (Minnesota Department Of Revenue) Form.

Sell items that are exempt by law; Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the minnesota sales tax. Keep this certificate as part of your records. Complete this certificate and give it to the seller.

Web See The Form St3 Instructions And Exemption Descriptions For More Information About The Following Exemptions.

For other minnesota sales tax exemption certificates, go here. Web you do not need to charge minnesota sales tax when you: Web minnesota or local taxing area. Use fill to complete blank online minnesota department of revenue pdf forms for free.

Purchasers Are Responsible For Knowing If They Qualify To Claim Exemption From Tax And Will Be Held Liable For Any Use Tax, Interest And Possible Penalties Due If The Items Purchased Are Not Eligible For Exemption.

Once completed you can sign your fillable form or send for signing. Web st3 this is a blanket certificate, unless one of the boxes below is checked, and remains in force as long as the purchaser continues making purchases, or until otherwise cancelled by the purchaser. See the form st3 instructions and exemption descriptions for more information about the following exemptions. Web a completed form st3 is provided by colleges, universities, and the system office to vendors to exempt most official expenditures from minnesota sales tax.

Web Form St3, Certificate Of Exemption | Minnesota Department Of Revenue.

Receive a completed form st3, certificate of. If the customer uses an atv more than 50 percent of its operating time in agricultural production, it may qualify for the farm machinery exemption. Ship or deliver products to customers outside of minnesota; This is a blanket certificate, unless one of the boxes below is.