South Carolina State Income Tax Form 2022

South Carolina State Income Tax Form 2022 - Download this form print this form. 2022 sc withholding tax formula. Web south carolina has a state income tax that ranges between 0% and 7%. Ad edit, sign and print tax forms on any device with signnow. Web state of south carolina department of revenue. South carolina income tax withheld because you expect to have. Web file & pay apply for a business tax account upload w2s get more information on the notice i received get more information on the appeals process check my business. For tax year 2022, unless you have a valid extension, the due date isapril 18, 2023 and the. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

If you make $70,000 a year living in south carolina you will be taxed $11,616. Web deadlines refund forms brackets, deductions amendment tax calculator instructions find south carolina state income tax brackets and rates, standard deduction. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web we last updated the amended sc individual income tax return in february 2023, so this is the latest version of form sc1040x, fully updated for tax year 2022. Web for tax year 2022 you expect a refund of. 6 00 7 tax on lump sum. 2022 sc withholding tax formula. Ad edit, sign and print tax forms on any device with signnow. Web instructions south carolina income tax forms for current and previous tax years. Web 2022 south carolina individual income tax tables (revised 10/4/22) 3,000 6,000 11,000 17,000 0 50 $0 3,000 3,050 $0 6,000 6,050 $85 11,000 11,100 $236 17,000 17,100 $450.

Web 1 sc1040 instructions 2022 (rev 10/13/2022) things to know before you begin: Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Ad edit, sign and print tax forms on any device with signnow. Taxpayers who withhold $15,000 or more per quarter, or who make 24 or more withholding. Web file now with turbotax we last updated south carolina income tax instructions in february 2023 from the south carolina department of revenue. Web deadlines refund forms brackets, deductions amendment tax calculator instructions find south carolina state income tax brackets and rates, standard deduction. Get ready for tax season deadlines by completing any required tax forms today. Web instructions south carolina income tax forms for current and previous tax years. You can download or print. • under the servicemembers civil relief act, you.

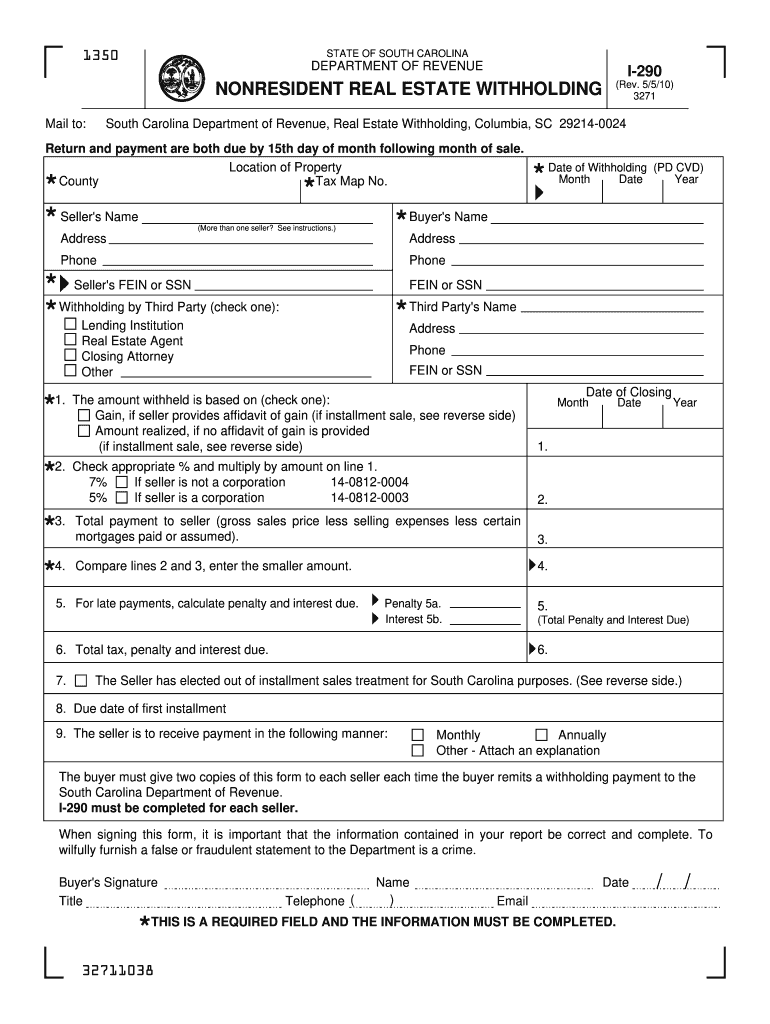

2010 Form SC DoR I290 Fill Online, Printable, Fillable, Blank pdfFiller

Web file & pay apply for a business tax account upload w2s get more information on the notice i received get more information on the appeals process check my business. Taxpayers who withhold $15,000 or more per quarter, or who make 24 or more withholding. Ad edit, sign and print tax forms on any device with signnow. Web for tax.

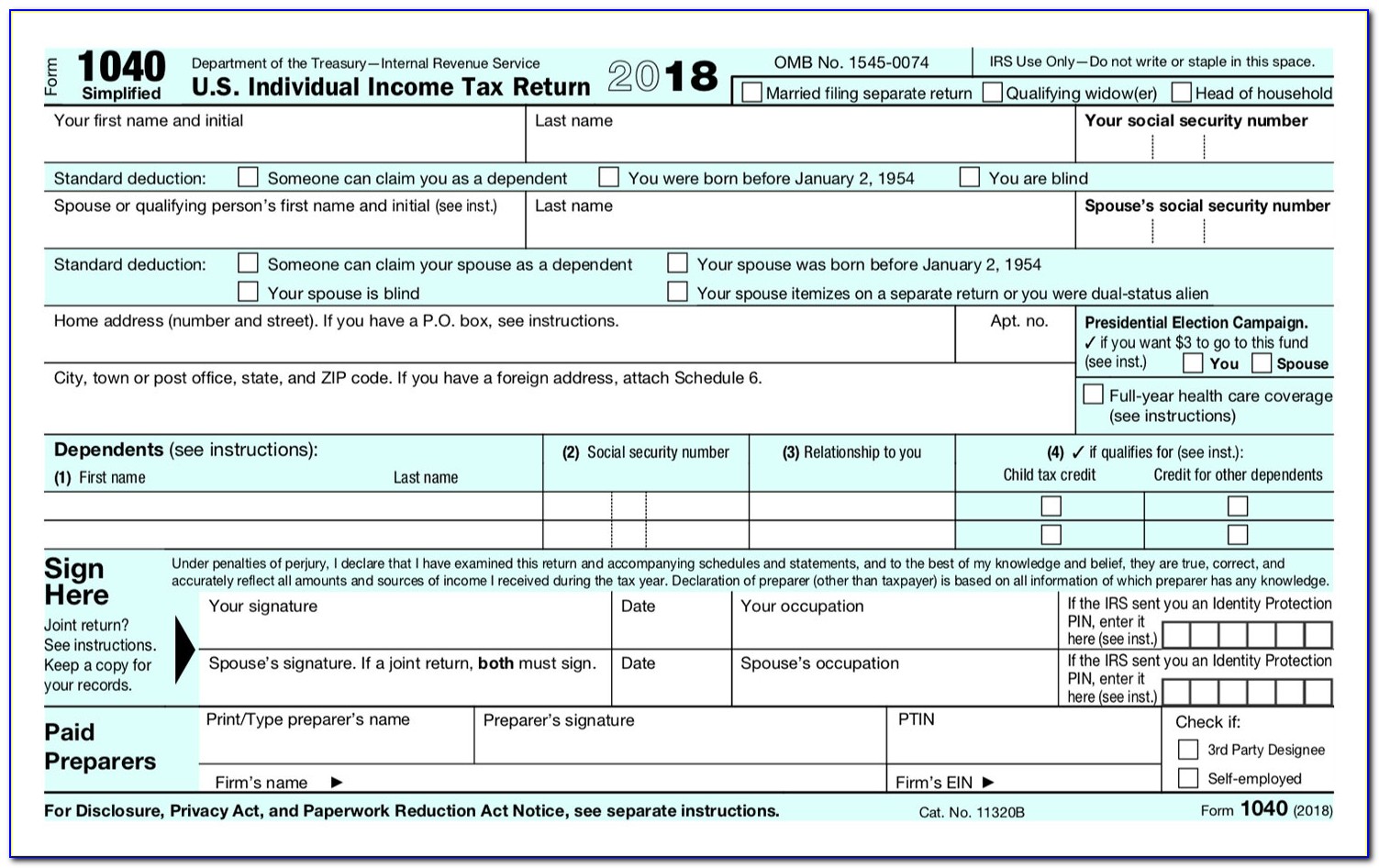

Nj 1040 Tax Form 2017 Form Resume Examples EVKYdBz106

Web this form is for income earned in tax year 2022, with tax returns due in april 2023. If you make $70,000 a year living in south carolina you will be taxed $11,616. 6 00 7 tax on lump sum. We will update this page with a new version of the form for 2024 as soon as it is made.

south carolina tax forms 2017 printable Fill out & sign online DocHub

Web state of south carolina department of revenue. Taxpayers who withhold $15,000 or more per quarter, or who make 24 or more withholding. We will update this page with a new version of the form for 2024 as soon as it is made available. Web we last updated the amended sc individual income tax return in february 2023, so this.

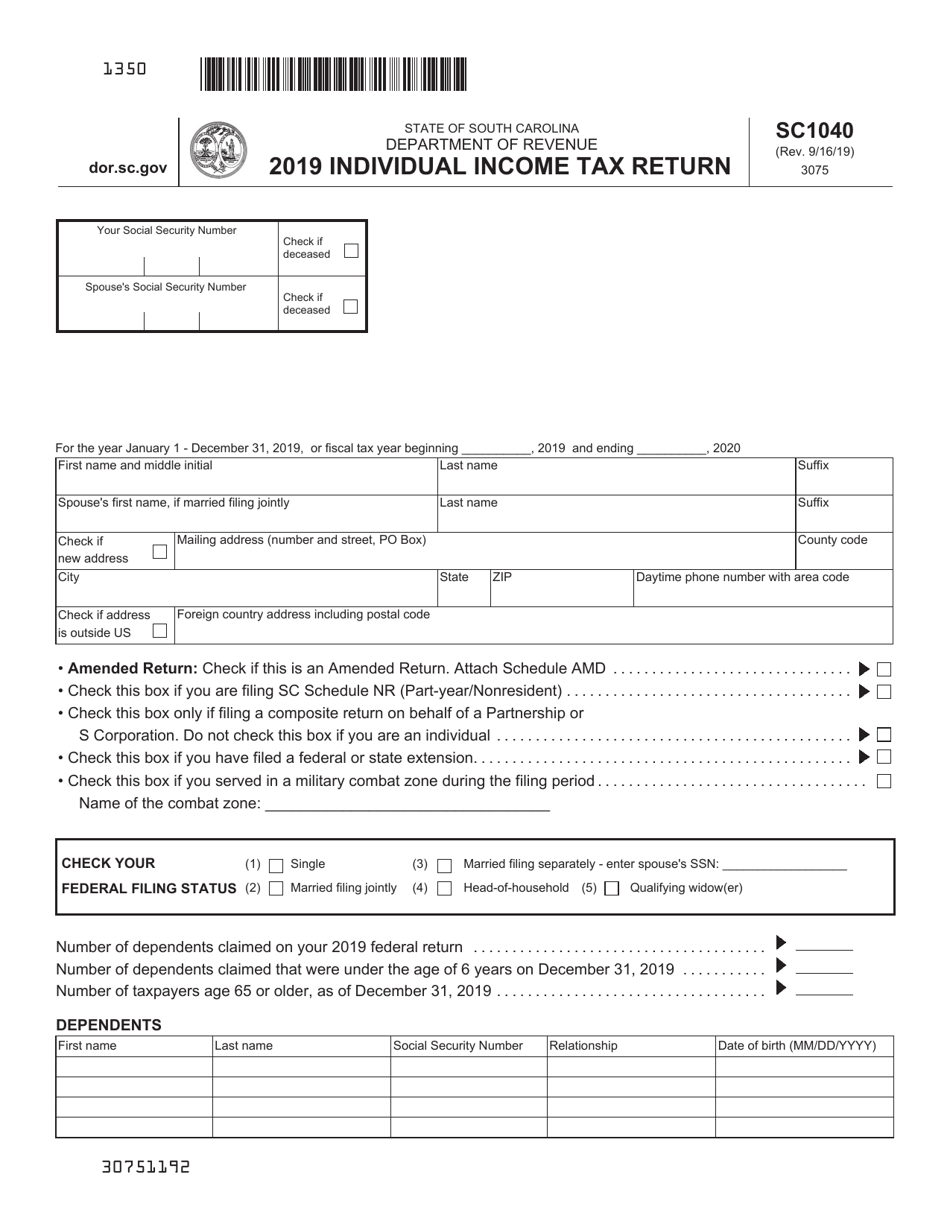

Sc State Tax Forms 2018 Form Resume Examples kLYrKBJOV6

Web 2022 south carolina individual income tax tables (revised 10/4/22) 3,000 6,000 11,000 17,000 0 50 $0 3,000 3,050 $0 6,000 6,050 $85 11,000 11,100 $236 17,000 17,100 $450. 2022 sc withholding tax formula. Web 1 sc1040 instructions 2022 (rev 10/13/2022) things to know before you begin: Web file now with turbotax we last updated south carolina income tax instructions.

South Carolina State Tax Forms 2016 Form Resume Examples

Web instructions south carolina income tax forms for current and previous tax years. 6 tax on your south carolina income subject to tax (see sc1040tt). Web file now with turbotax we last updated south carolina income tax instructions in february 2023 from the south carolina department of revenue. Web deadlines refund forms brackets, deductions amendment tax calculator instructions find south.

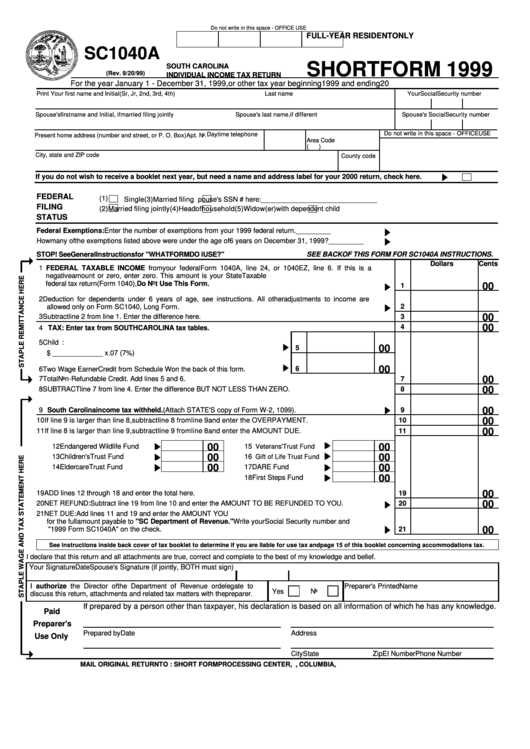

Form Sc1040a South Carolina Individual Tax Return 1999

Web deadlines refund forms brackets, deductions amendment tax calculator instructions find south carolina state income tax brackets and rates, standard deduction. 6 tax on your south carolina income subject to tax (see sc1040tt). Web south carolina has a state income tax that ranges between 0% and 7%. Complete, edit or print tax forms instantly. For tax year 2022, unless you.

SC DoR PT300 2021 Fill out Tax Template Online US Legal Forms

Web we last updated the amended sc individual income tax return in february 2023, so this is the latest version of form sc1040x, fully updated for tax year 2022. Web file now with turbotax we last updated south carolina income tax instructions in february 2023 from the south carolina department of revenue. 6 00 7 tax on lump sum. •.

Tax Return Form / ITR 6 Form Filing Tax Return

Web south carolina has a state income tax that ranges between 0% and 7%. We will update this page with a new version of the form for 2024 as soon as it is made available. Web state of south carolina department of revenue. Web instructions south carolina income tax forms for current and previous tax years. 2022 sc withholding tax.

Sc Tax Forms 2017 Form Resume Examples G28BVoe8gE

Web 1 sc1040 instructions 2022 (rev 10/13/2022) things to know before you begin: 6 tax on your south carolina income subject to tax (see sc1040tt). Web south carolina has a state income tax that ranges between 0% and 7%. South carolina income tax withheld because you expect to have. If you make $70,000 a year living in south carolina you.

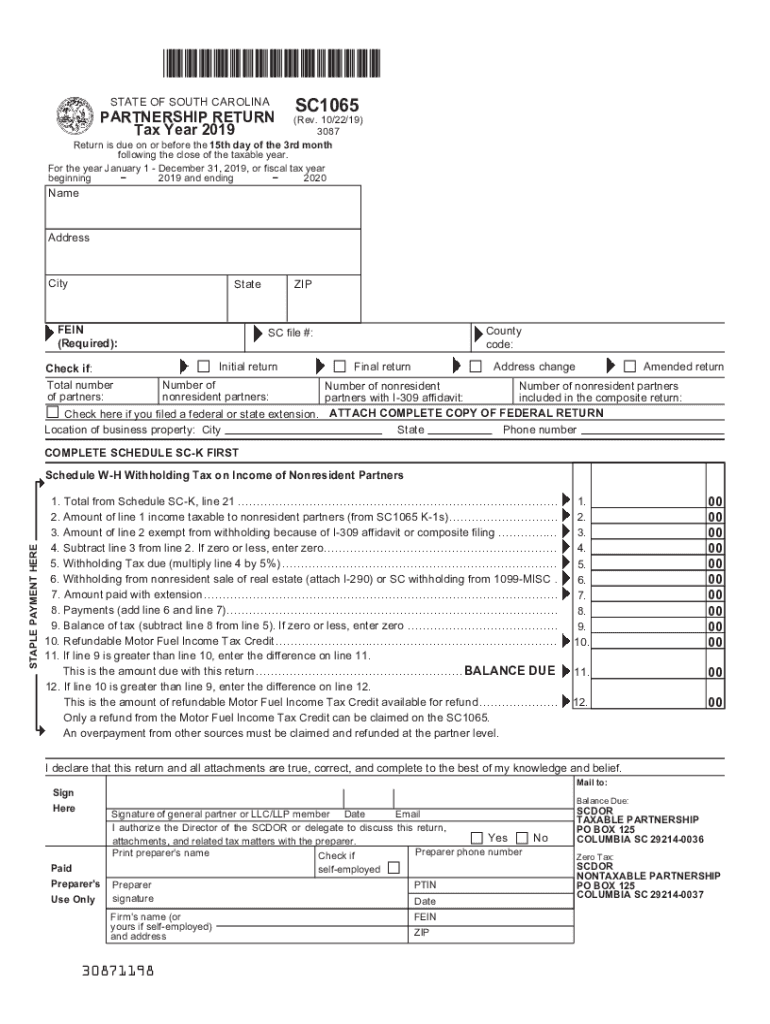

Sc 1065 Fill Out and Sign Printable PDF Template signNow

South carolina income tax withheld because you expect to have. For tax year 2022, unless you have a valid extension, the due date isapril 18, 2023 and the. Web deadlines refund forms brackets, deductions amendment tax calculator instructions find south carolina state income tax brackets and rates, standard deduction. Web file now with turbotax we last updated south carolina income.

Taxpayers Who Withhold $15,000 Or More Per Quarter, Or Who Make 24 Or More Withholding.

South carolina income tax withheld because you expect to have. Please use the form listed under the current tax year if it is not listed under the year you are searching for. Download this form print this form. Web state of south carolina department of revenue.

Web 2022 South Carolina Individual Income Tax Tables (Revised 10/4/22) 3,000 6,000 11,000 17,000 0 50 $0 3,000 3,050 $0 6,000 6,050 $85 11,000 11,100 $236 17,000 17,100 $450.

Web we last updated the amended sc individual income tax return in february 2023, so this is the latest version of form sc1040x, fully updated for tax year 2022. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today.

Web Deadlines Refund Forms Brackets, Deductions Amendment Tax Calculator Instructions Find South Carolina State Income Tax Brackets And Rates, Standard Deduction.

If you make $70,000 a year living in south carolina you will be taxed $11,616. For tax year 2022, unless you have a valid extension, the due date isapril 18, 2023 and the. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Ad edit, sign and print tax forms on any device with signnow.

• Under The Servicemembers Civil Relief Act, You.

6 tax on your south carolina income subject to tax (see sc1040tt). 6 00 7 tax on lump sum. 2022 sc withholding tax formula. Web file & pay apply for a business tax account upload w2s get more information on the notice i received get more information on the appeals process check my business.