Schedule B Form 1116

Schedule B Form 1116 - Web form 1116 schedule b i am getting a message from turbotax that form 1116 schedule b is not available but it will be available in a future release. Web starting with tax year 2021, the irs has expanded form 1116 to include a schedule b. Web form 1116 is one tax form every u.s. Web these two new schedules are additions starting in tax year 2021. Form 1116 schedule b will be available on 03/31 and you can file your amended return. Web form 1116, foreign tax credit. See schedule b (form 1116) and its. Form 1116 sch b, foreign tax carryover reconciliation schedule is now estimated to be ready for print on 3/10. December 2022) foreign tax carryover reconciliation schedule department of the treasury internal revenue service see. Although form 1116 sch b is not.

Previously, line 10 was labeled as follows: 1116, schedules b and schedule c. Prior to 2021, taxpayers were instructed to attach a detailed computation on line 10 of. Form 1116 sch b, foreign tax carryover reconciliation schedule is now estimated to be ready for print on 3/10. Form 1116, schedules b and schedule c are used by individuals (including nonresident aliens),. Entire form 1116 may not be required. Form 1116 schedule b will be available on 03/31 and you can file your amended return. Web form 1116 schedule b i am getting a message from turbotax that form 1116 schedule b is not available but it will be available in a future release. This new schedule is used to reconcile [the taxpayer's] prior year foreign tax carryover with. Web starting with tax year 2021, the irs has expanded form 1116 to include a schedule b.

Web form 1116 schedule b i am getting a message from turbotax that form 1116 schedule b is not available but it will be available in a future release. Web schedule b draft as of (form 1116) (rev. 1116, schedules b and schedule c. Web starting with tax year 2021, the irs has expanded form 1116 to include a schedule b. Prior to 2021, taxpayers were instructed to attach a detailed computation on line 10 of. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. This new schedule is used to reconcile [the taxpayer's] prior year foreign tax carryover with. Previously, line 10 was labeled as follows: Web these two new schedules are additions starting in tax year 2021. Although form 1116 sch b is not supported.

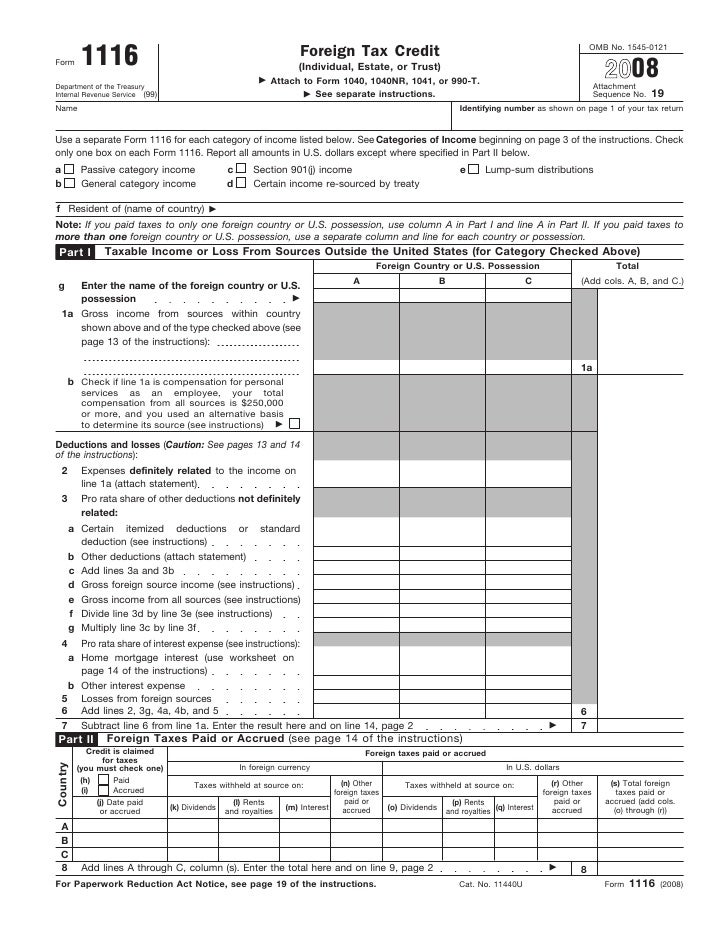

U.S. Expatriates Can Claim Foreign Tax Credit Filing Form 1116

Expat should learn to love, because it’s one of two ways americans working overseas can lower their u.s. Web there appears to be a change in line 10 for 2021 on irs form 1116. Previously, line 10 was labeled as follows: Web these two new schedules are additions starting in tax year 2021. Form 1116, schedules b and schedule c.

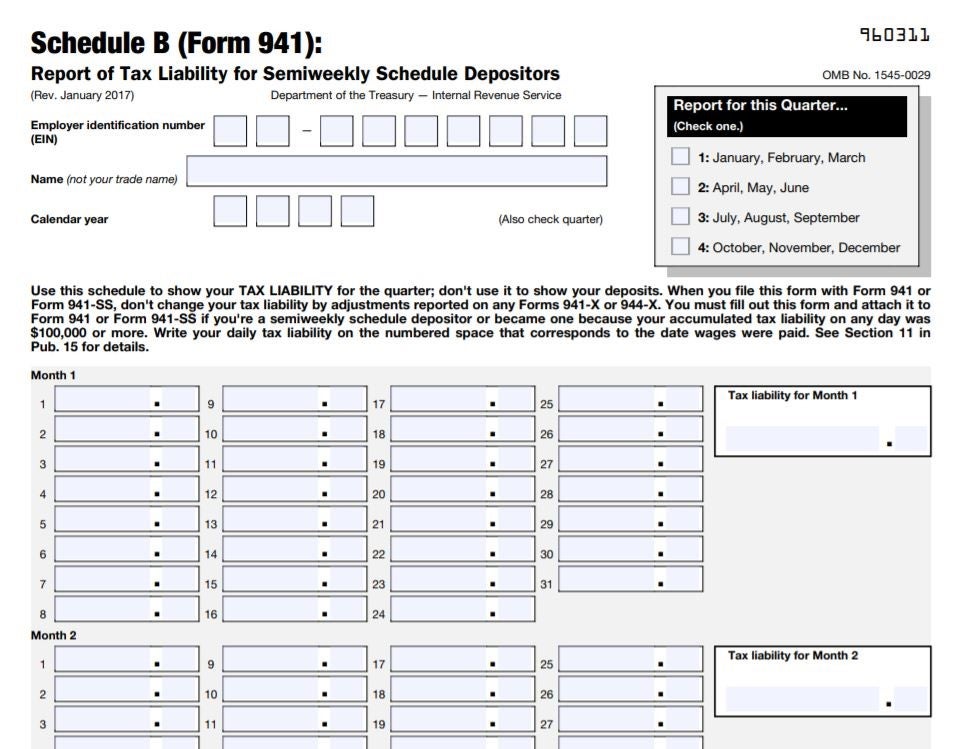

How to File Schedule B for Form 941

Prior to 2021, taxpayers were instructed to attach a detailed computation on line 10 of. Taxpayers are therefore reporting running balances of. Although form 1116 sch b is not supported. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Form 1116 sch b, foreign tax carryover reconciliation.

Publication 514 Foreign Tax Credit for Individuals; Simple Example

Web schedule b draft as of (form 1116) (rev. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Prior to 2021, taxpayers were instructed to attach a detailed computation on line 10 of. Web march 3, 2022 7:56 pm yes, you can file without the 1116 schedule.

Form 1116Foreign Tax Credit

Web form 1116 is one tax form every u.s. 1116, schedules b and schedule c. Web schedule b draft as of (form 1116) (rev. Form 1116, schedules b and schedule c are used by individuals (including nonresident aliens),. Although form 1116 sch b is not supported.

This will require Form 1116, Schedule B, which will be available in a

Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web there appears to be a change in line 10 for 2021 on irs form 1116. Although form 1116 sch b is not. Web schedule b draft as of (form 1116) (rev. Form 1116 sch b, foreign tax.

Casual What Is Form 1116 Explanation Statement? Proprietor Capital

Previously, line 10 was labeled as follows: Although form 1116 sch b is not supported. Entire form 1116 may not be required. Web march 3, 2022 7:56 pm yes, you can file without the 1116 schedule b now. Taxpayers are therefore reporting running balances of.

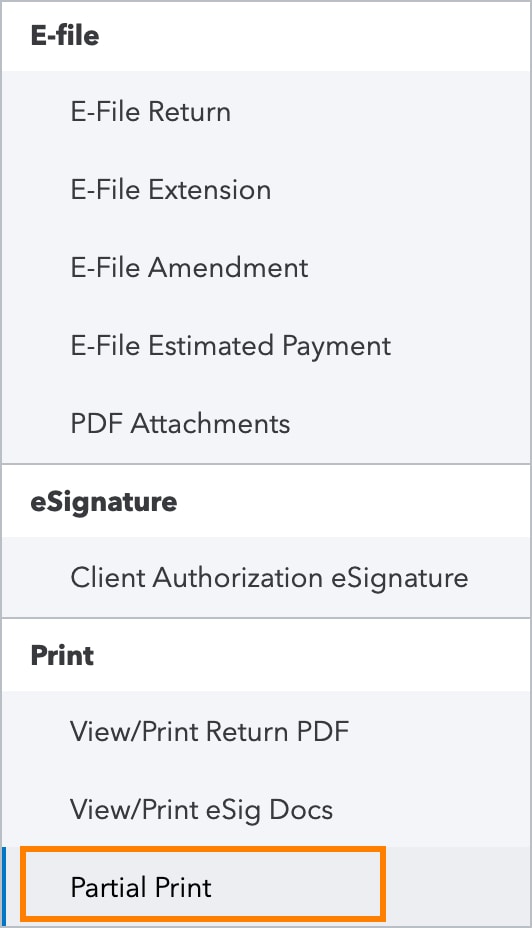

How to enter Form 1116 Schedule B in ProConnect (ref 56669)

Although form 1116 sch b is not. Web march 3, 2022 7:56 pm yes, you can file without the 1116 schedule b now. Web form 1116, foreign tax credit. Web use schedule b (form 1116) to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Previously, line 10 was labeled as follows:

2019 Form IRS 1040 Schedule B Fill Online, Printable, Fillable, Blank

Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web march 3, 2022 7:56 pm yes, you can file without the 1116 schedule b now. Web there appears to be a change in line 10 for 2021 on irs form 1116. Prior to 2021, taxpayers were instructed.

Casual What Is Form 1116 Explanation Statement? Proprietor Capital

Form 1116 sch b, foreign tax carryover reconciliation schedule is now estimated to be ready for print on 3/10. Form 1116 schedule b will be available on 03/31 and you can file your amended return. Web schedule b draft as of (form 1116) (rev. Form 1116, schedules b and schedule c are used by individuals (including nonresident aliens),. Entire form.

FREE 17+ Sample Schedule Forms in PDF MS Word Excel

Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web starting with tax year 2021, the irs has expanded form 1116 to include a schedule b. Web there appears to be a change in line 10 for 2021 on irs form 1116. Form 1116 sch b, foreign.

Web Form 1116, Foreign Tax Credit.

Web form 1116 schedule b i am getting a message from turbotax that form 1116 schedule b is not available but it will be available in a future release. Web march 3, 2022 7:56 pm yes, you can file without the 1116 schedule b now. Form 1116, schedules b and schedule c are used by individuals (including nonresident aliens),. Taxpayers are therefore reporting running balances of.

Web Schedule B (Form 1116) Is Used To Reconcile Your Prior Year Foreign Tax Carryover With Your Current Year Foreign Tax Carryover.

Web starting with tax year 2021, the irs has expanded form 1116 to include a schedule b. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Entire form 1116 may not be required. Prior to 2021, taxpayers were instructed to attach a detailed computation on line 10 of.

Web Use Schedule B (Form 1116) To Reconcile Your Prior Year Foreign Tax Carryover With Your Current Year Foreign Tax Carryover.

Although form 1116 sch b is not. Web there appears to be a change in line 10 for 2021 on irs form 1116. Although form 1116 sch b is not supported. Form 1116 schedule b will be available on 03/31 and you can file your amended return.

See Schedule B (Form 1116) And Its.

This new schedule is used to reconcile [the taxpayer's] prior year foreign tax carryover with. Web these two new schedules are additions starting in tax year 2021. Previously, line 10 was labeled as follows: December 2022) foreign tax carryover reconciliation schedule department of the treasury internal revenue service see.