Sc Sales Tax Exempt Form

Sc Sales Tax Exempt Form - 7/12/10) 5075 this exemption certificate. Notary public application [pdf] motor vehicle forms. Log in to your account. Web exempt prepared food 11% prescription drugs exempt otc drugs these categories may have some further qualifications before the special rate applies, such as a price cap. Web south carolina supports electronic filing of sales tax returns, which is often much faster than filing via mail. What you need to know: 7/2/07) 5009 schedule of exemptions found at chapter 36 of title 12 of the code of laws of south carolina 1976,. The scdor offers sales & use tax exemptions to qualified taxpayers. Web what is sales tax? Taxpayers owing $15,000 or more per month may be mandated to file their.

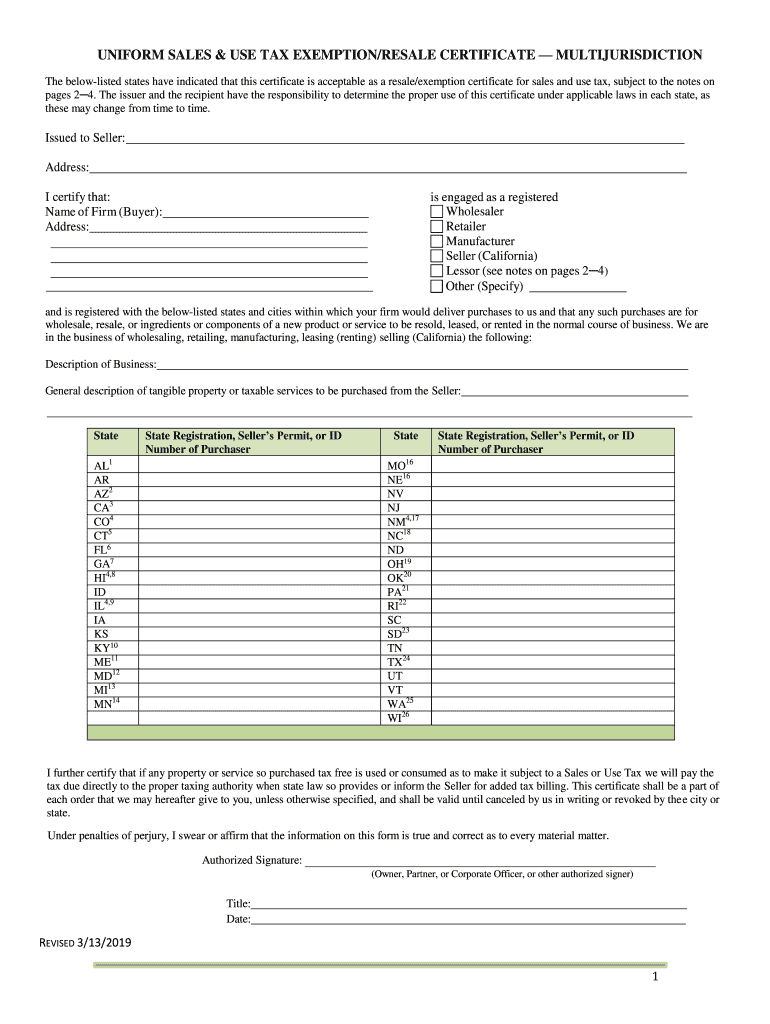

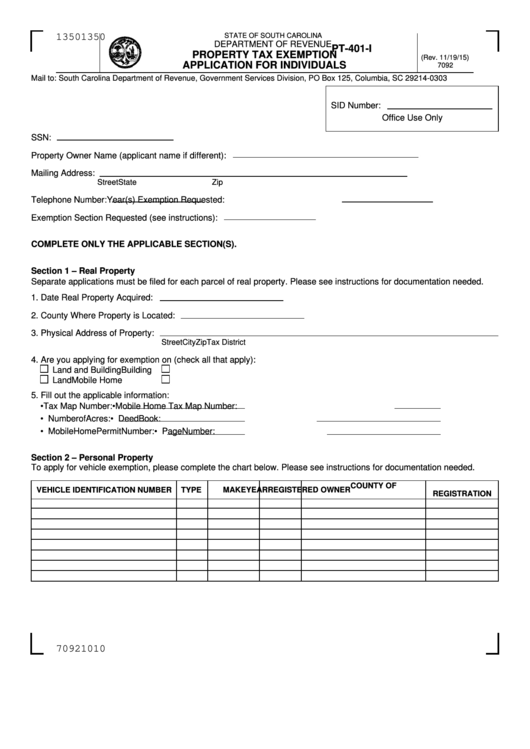

Web the state sales tax rate in south carolina is 6.000%. Web to claim agriculture sales tax exemptions in south carolina, you must have a south carolina agricultural tax exemption (scate) card. The scdor offers sales & use tax exemptions to qualified taxpayers. The statewide sales and use tax rate is six percent (6%). Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the south carolina sales. Log in to your account. 8/8/06) 5010 state of south carolina department of revenue resale certificate notice to seller: What you need to apply: Web applying for a sales & use tax exemption. South carolina has recent rate changes.

Web for payment, including installment and credit sales; South carolina has recent rate changes. 7/12/10) 5075 this exemption certificate. Driver's license renewal [pdf] disabled placards and. What you need to apply: Web adhere to the instructions below to complete south carolina sales tax exemption certificate online quickly and easily: A license to use or consume; Web the state sales tax rate in south carolina is 6.000%. Web tax and legal forms. And a transfer of title or possession, or both.

20162021 Form SC ST8 Fill Online, Printable, Fillable, Blank pdfFiller

Web the state sales tax rate in south carolina is 6.000%. Web applying for a sales & use tax exemption. The statewide sales and use tax rate is six percent (6%). 7/2/07) 5009 schedule of exemptions found at chapter 36 of title 12 of the code of laws of south carolina 1976,. And a transfer of title or possession, or.

Tax Exempt Form 2350 Fillable Fill Out and Sign Printable PDF

Log in to your account. Sales tax is imposed on the sale of goods and certain services in south carolina. With local taxes, the total sales tax rate is between 6.000% and 9.000%. 8/8/06) 5010 state of south carolina department of revenue resale certificate notice to seller: The statewide sales and use tax rate is six percent (6%).

FREE 10+ Sample Tax Exemption Forms in PDF

Web adhere to the instructions below to complete south carolina sales tax exemption certificate online quickly and easily: 7/12/10) 5075 this exemption certificate. Web exempt prepared food 11% prescription drugs exempt otc drugs these categories may have some further qualifications before the special rate applies, such as a price cap. What you need to apply: Notary public application [pdf] motor.

Tax Exempt Certificate Form Fill Out and Sign Printable PDF Template

A rental, lease, or other form of agreement; Web exempt prepared food 11% prescription drugs exempt otc drugs these categories may have some further qualifications before the special rate applies, such as a price cap. Web south carolina supports electronic filing of sales tax returns, which is often much faster than filing via mail. 8/8/06) 5010 state of south carolina.

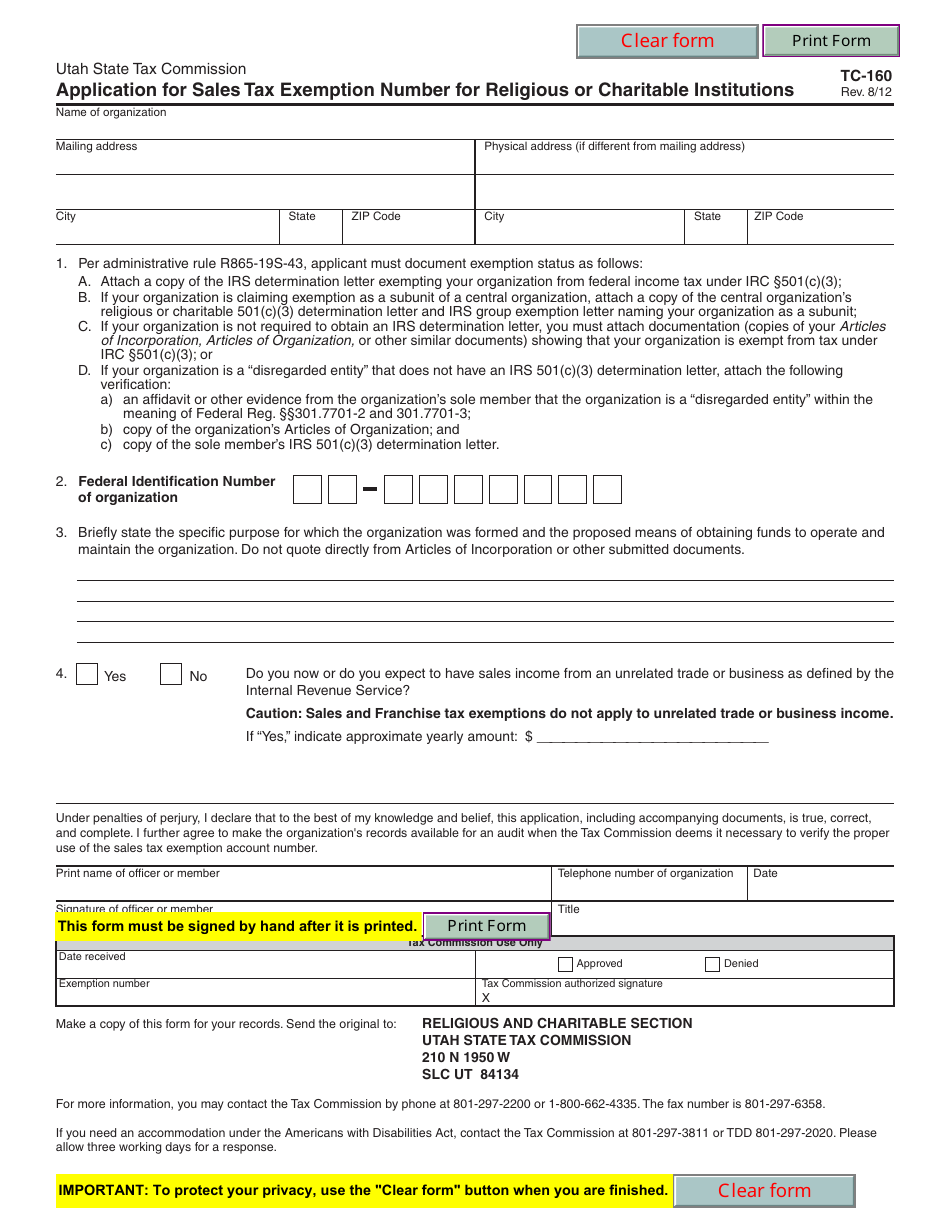

Form TC160 Download Fillable PDF or Fill Online Application for Sales

Web south carolina supports electronic filing of sales tax returns, which is often much faster than filing via mail. South carolina has recent rate changes. What you need to apply: Web adhere to the instructions below to complete south carolina sales tax exemption certificate online quickly and easily: Web a sales tax exemption certificate can be used by businesses (or.

Tax Exempt Forms San Patricio Electric Cooperative

Web state south carolina department of revenue agricultural exemption certificate for sales and tax (rev. Log in to your account. Web for payment, including installment and credit sales; Driver's license renewal [pdf] disabled placards and. Notary public application [pdf] motor vehicle forms.

2008 Form SC ST10 Fill Online, Printable, Fillable, Blank pdfFiller

Log in with your credentials or register. Web what is sales tax? Log in to your account. South carolina has recent rate changes. With local taxes, the total sales tax rate is between 6.000% and 9.000%.

Tax Exempt Form 2020 Fill Online, Printable, Fillable, Blank pdfFiller

Web the state sales tax rate in south carolina is 6.000%. Log in to your account. A rental, lease, or other form of agreement; Notary public application [pdf] motor vehicle forms. Web the south carolina department of revenue (scdor) no longer accepts paper copies of sales tax exemptions for exempt organizations.

Top 19 Sc Tax Exempt Form Templates free to download in PDF format

The statewide sales and use tax rate is six percent (6%). 7/2/07) 5009 schedule of exemptions found at chapter 36 of title 12 of the code of laws of south carolina 1976,. Web exempt prepared food 11% prescription drugs exempt otc drugs these categories may have some further qualifications before the special rate applies, such as a price cap. Web.

FREE 10+ Sample Tax Exemption Forms in PDF

What you need to apply: You will need to provide your file number when. Web state south carolina department of revenue agricultural exemption certificate for sales and tax (rev. Driver's license renewal [pdf] disabled placards and. A rental, lease, or other form of agreement;

And A Transfer Of Title Or Possession, Or Both.

You will need to provide your file number when. Web state south carolina department of revenue agricultural exemption certificate for sales and tax (rev. Driver's license renewal [pdf] disabled placards and. A license to use or consume;

Web Vehicles More South Carolina Agricultural Exemption Certificate A Sales Tax Exemption Certificate Can Be Used By Businesses (Or In Some Cases, Individuals) Who Are Making.

Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the south carolina sales. Log in with your credentials or register. Web exempt prepared food 11% prescription drugs exempt otc drugs these categories may have some further qualifications before the special rate applies, such as a price cap. What you need to apply:

Log In To Your Account.

Taxpayers owing $15,000 or more per month may be mandated to file their. Web south carolina supports electronic filing of sales tax returns, which is often much faster than filing via mail. Web applying for a sales & use tax exemption. Web for payment, including installment and credit sales;

7/2/07) 5009 Schedule Of Exemptions Found At Chapter 36 Of Title 12 Of The Code Of Laws Of South Carolina 1976,.

With local taxes, the total sales tax rate is between 6.000% and 9.000%. Notary public application [pdf] motor vehicle forms. Sales tax is imposed on the sale of goods and certain services in south carolina. Web the south carolina department of revenue (scdor) no longer accepts paper copies of sales tax exemptions for exempt organizations.