Sc-40 Tax Form 2022

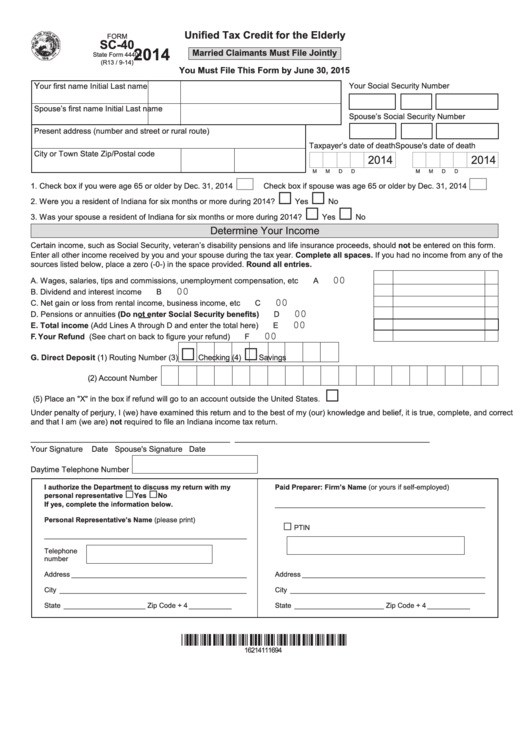

Sc-40 Tax Form 2022 - Who may use this form to claim the. Web 2022 south carolina individual income tax tables (revised 10/4/22) 2022 tax rate schedule for taxable income of $100,000 or more important: Web state of south carolina department of revenue 2022 individual income tax return sc1040 (rev. Web 1 enter federal taxable income from your federal form. Register for a free account, set a strong password, and. Make the steps below to fill out sc1040 online quickly and easily: 6 tax on your south carolina income subject to tax (see sc1040tt). For tax year 2022, unless you have a valid extension, the due date isapril 18, 2023 and the. Web this booklet includes instructions for filling out and filing your sc1040 income tax return. You may be able to claim the unified tax credit for the elderly if you or your spouse meet all the following.

10/25/21) 3527 2022 give this form to your employer. Web state of south carolina department of revenue 2022 individual income tax return sc1040 (rev. Web 2022 state of south carolina department of revenue individual declaration of estimated tax sc1040es (rev. Sign up and sign in. Register for a free account, set a strong password, and. Web this booklet includes instructions for filling out and filing your sc1040 income tax return. Web 2022 south carolina individual income tax tables (revised 10/4/22) 2022 tax rate schedule for taxable income of $100,000 or more important: This form is for income earned in tax year 2022, with tax returns due in april. Web 1 enter federal taxable income from your federal form. If zero or less, enter zero here dollars nonresident filers:

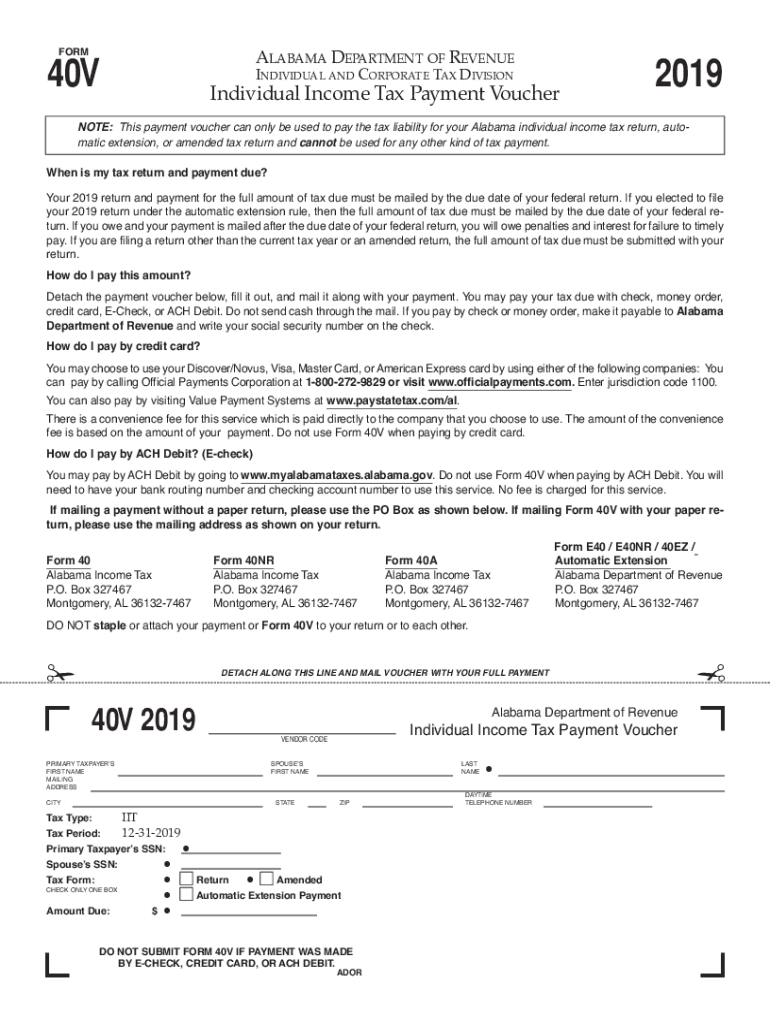

Iit book 2016 iit book 2015 iit book. Register for a free account, set a strong password, and. If zero or less, enter zero here dollars nonresident filers: For tax year 2022, unless you have a valid extension, the due date isapril 18, 2023 and the. Web sections will also be extended for south carolina income tax purposes. Web state of south carolina department of revenue 2022 individual income tax return sc1040 (rev. Web 1 enter federal taxable income from your federal form. This form is for income earned in tax year 2022, with tax returns due in april. 2018 individual income tax packet (iit book) for 2016 and older: Who may use this form to claim the.

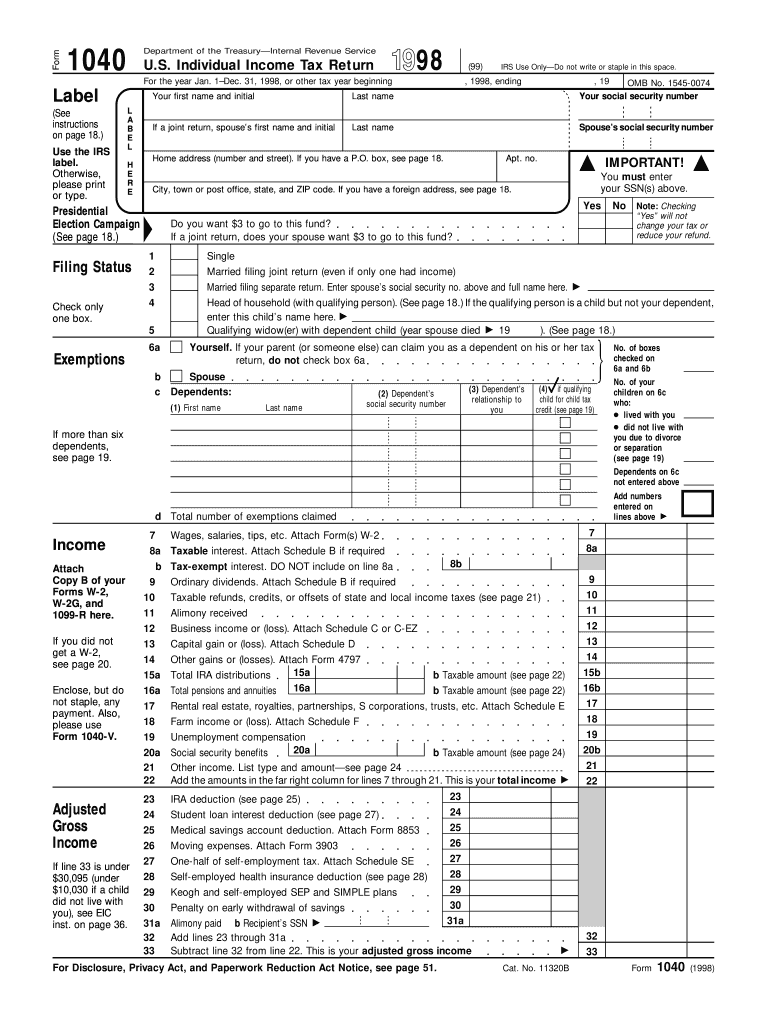

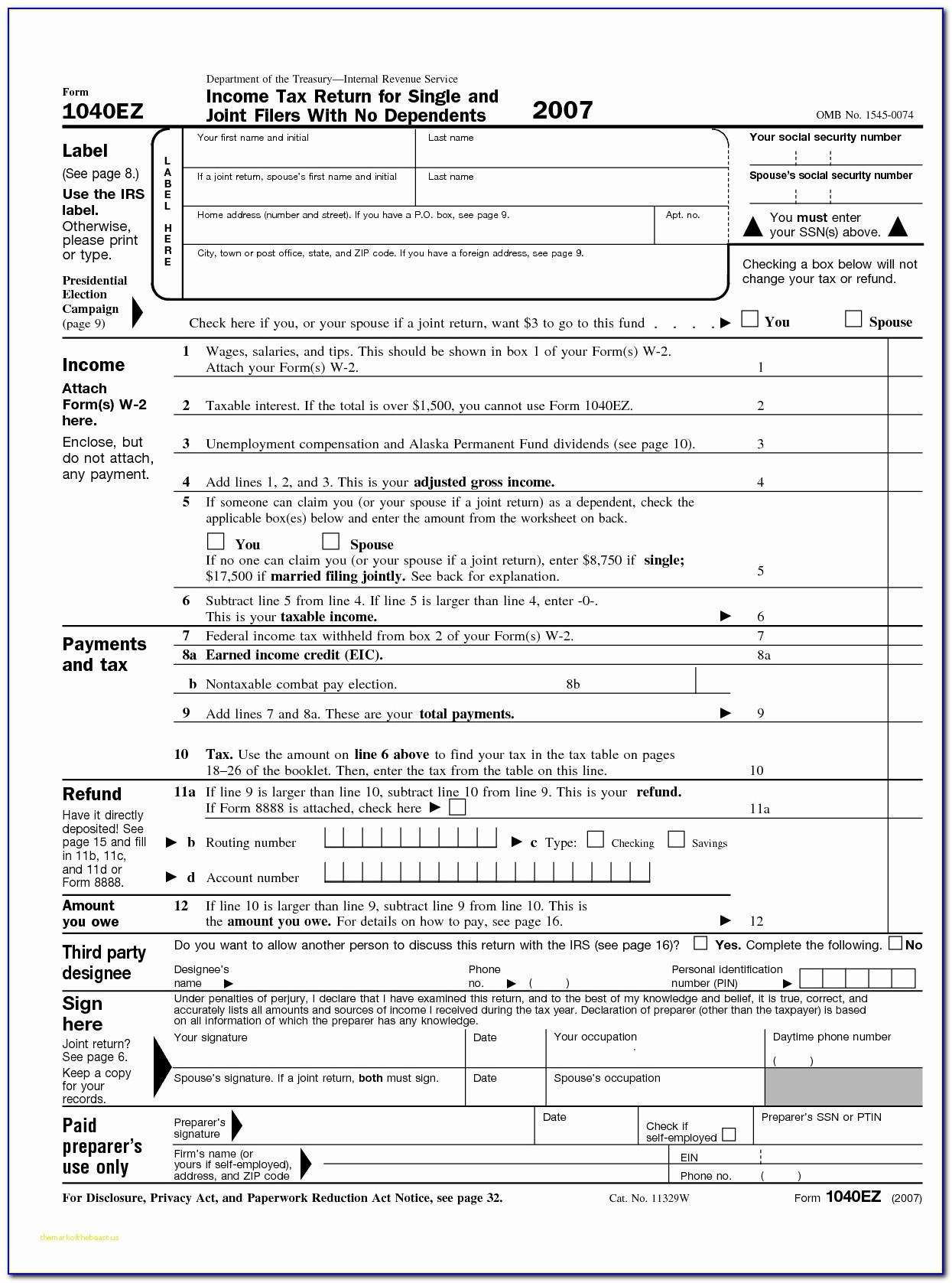

IRS Releases Form 1040 For 2020 Tax Year

If zero or less, enter zero here dollars. Complete schedule nr and enter total from line 48 on line 5. Web 1 enter federal taxable income from your federal form. 6 tax on your south carolina income subject to tax (see sc1040tt). Web 2022 south carolina individual income tax tables (revised 10/4/22) 2022 tax rate schedule for taxable income of.

IRS releases drafts of 2021 Form 1040 and schedules Don't Mess With Taxes

Complete schedule nr and enter total from line 48 on line 5. Web 1 enter federal taxable income from your federal form. This form is for income earned in tax year 2022, with tax returns due in april. Make the steps below to fill out sc1040 online quickly and easily: You may be able to claim the unified tax credit.

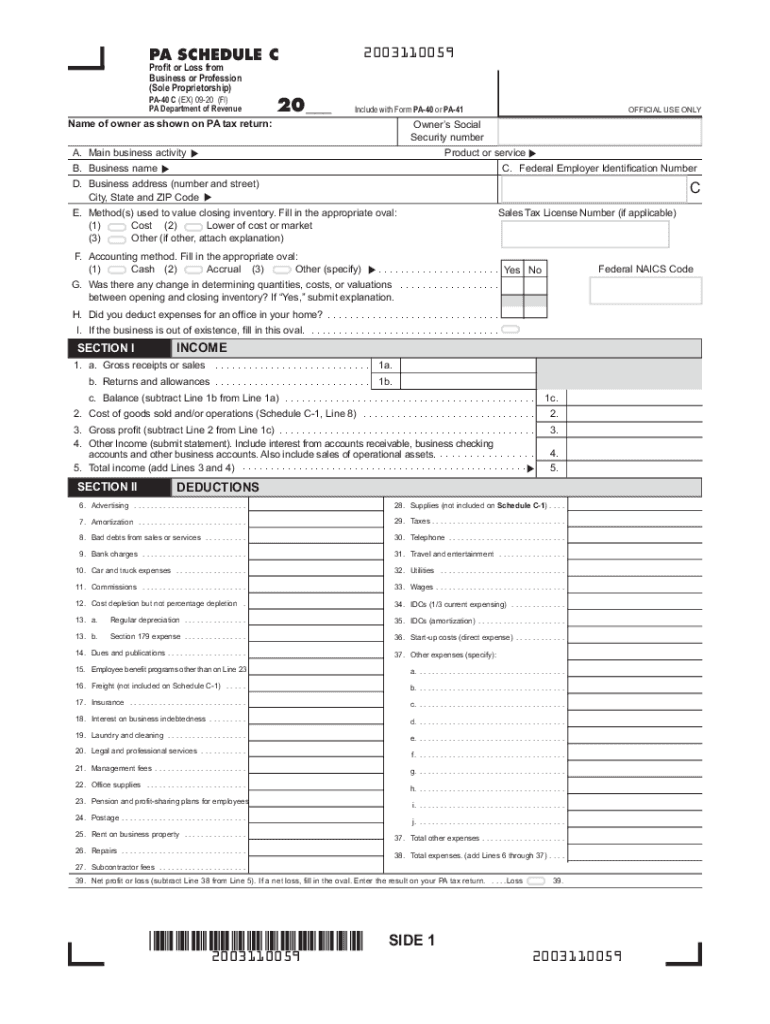

Pa Schedule C Fill Out and Sign Printable PDF Template signNow

Sign up and sign in. If zero or less, enter zero here dollars nonresident filers: Web 2022 state of south carolina department of revenue individual declaration of estimated tax sc1040es (rev. 2018 individual income tax packet (iit book) for 2016 and older: Web sections will also be extended for south carolina income tax purposes.

10 40 form Fill out & sign online DocHub

Web 2022 state of south carolina department of revenue individual declaration of estimated tax sc1040es (rev. You must use the tax. If zero or less, enter zero here dollars nonresident filers: This form is for income earned in tax year 2022, with tax returns due in april. Web 1 things to know before you begin:

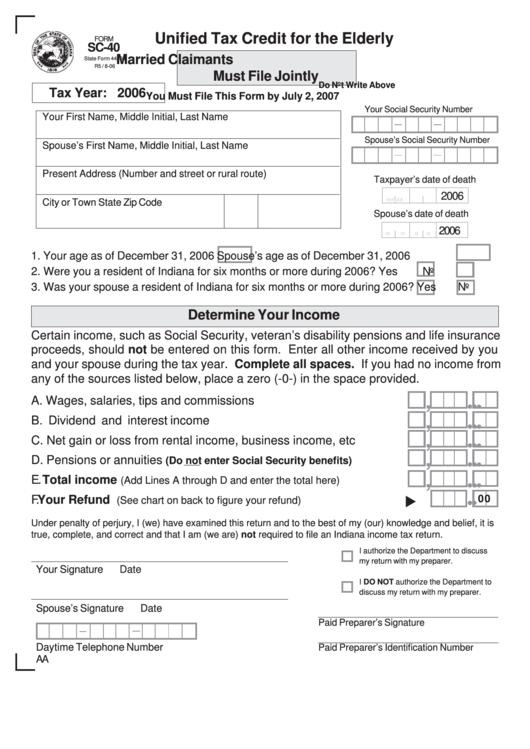

Form Sc40 Unified Tax Credit For The Elderly State Of Indiana

10/25/21) 3527 2022 give this form to your employer. Register for a free account, set a strong password, and. Web this booklet includes instructions for filling out and filing your sc1040 income tax return. Who may use this form to claim the. † for tax year 2020, unless you have a valid extension, the due date is april 15, 2021.

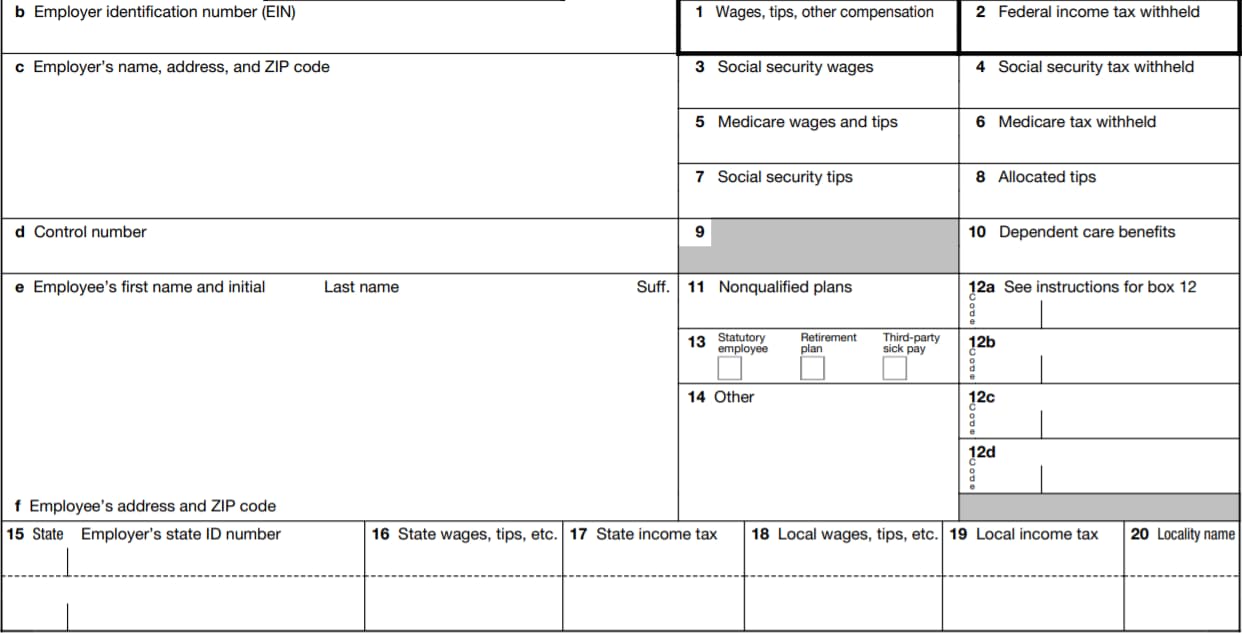

W2 Form 2022 Fillable PDF

You must use the tax. Web 2022 south carolina individual income tax tables (revised 10/4/22) 2022 tax rate schedule for taxable income of $100,000 or more important: 2018 individual income tax packet (iit book) for 2016 and older: Web 1 enter federal taxable income from your federal form. For tax year 2022, unless you have a valid extension, the due.

2021 PA Form PA40 ES (I) Fill Online, Printable, Fillable, Blank

We last updated the form sc1040 instructional booklet in february 2023, so this is the. Web sc1040 instructions 2022 (rev 10/13/2022) things to know before you begin: Web this booklet includes instructions for filling out and filing your sc1040 income tax return. 6 tax on your south carolina income subject to tax (see sc1040tt). Make the steps below to fill.

Fillable Form Sc40 Unified Tax Credit For The Elderly 2014

Web sections will also be extended for south carolina income tax purposes. 2018 individual income tax packet (iit book) for 2016 and older: We last updated the form sc1040 instructional booklet in february 2023, so this is the. Web state of south carolina department of revenue 2022 individual income tax return sc1040 (rev. † for tax year 2020, unless you.

Printable Tax Form 1040 Printable Form 2022

Web 1 enter federal taxable income from your federal form. Web 1 things to know before you begin: 2018 individual income tax packet (iit book) for 2016 and older: Complete schedule nr and enter total from line 48 on line 5. You may be able to claim the unified tax credit for the elderly if you or your spouse meet.

2015 Form 40 Alabama Fill Out and Sign Printable PDF Template signNow

Web adhere to this straightforward instruction to redact sc 40 tax form 2021 in pdf format online at no cost: Web sc1040 instructions 2022 (rev 10/13/2022) things to know before you begin: 10/25/21) 3527 2022 give this form to your employer. If zero or less, enter zero here dollars nonresident filers: Register for a free account, set a strong password,.

Iit Book 2016 Iit Book 2015 Iit Book.

† for tax year 2020, unless you have a valid extension, the due date is april 15, 2021 and the deadline to claim a refund is april 15, 2024. Who may use this form to claim the. If zero or less, enter zero here dollars. This form is for income earned in tax year 2022, with tax returns due in april.

Register For A Free Account, Set A Strong Password, And.

We last updated the form sc1040 instructional booklet in february 2023, so this is the. 2018 individual income tax packet (iit book) for 2016 and older: If zero or less, enter zero here dollars nonresident filers: 6 tax on your south carolina income subject to tax (see sc1040tt).

Web State Of South Carolina Department Of Revenue 2022 Individual Income Tax Return Sc1040 (Rev.

Sign up and sign in. Web this booklet includes instructions for filling out and filing your sc1040 income tax return. Log in to your account. Web 2022 south carolina individual income tax tables (revised 10/4/22) 2022 tax rate schedule for taxable income of $100,000 or more important:

Web Sc1040 Instructions 2022 (Rev 10/13/2022) Things To Know Before You Begin:

You may be able to claim the unified tax credit for the elderly if you or your spouse meet all the following. For tax year 2022, unless you have a valid extension, the due date isapril 18, 2023 and the. 10/25/21) 3527 2022 give this form to your employer. Complete schedule nr and enter total from line 48 on line 5.