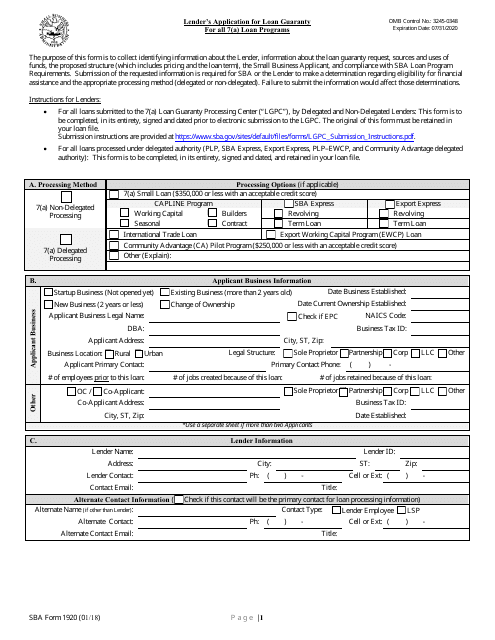

Sba Form 1920

Sba Form 1920 - Web what is sba form 1920? Both forms and other supporting documentation are used to evaluate your business’s eligibility for the sba 7 (a) loan program. The purpose of this form is to collect identifying information regarding the lender, loan terms, use of The purpose of this form is to collect identifying information about the lender, the small business applicant (applicant), the loan guaranty request, sources and uses of funds, the proposed structure and compliance with sba loan program requirements, as defined in. While the lender fills out the form, the. Sba form 1920 is a part of the borrower’s loan package, but it needs to be completed by the lender, not the borrower. While the form must be filled out by the lender of any 7 (a) loans, the borrower will need to provide much of the information required. Web the sba form 1920 provides the sba with information about the lender, the borrower, and the loan itself—as well as details about compliance with the 7 (a) loan program requirements. Web the purpose of this form is to collect identifying information from the lender regarding loan eligibility, terms of the loan, use of proceeds, and jobs created/retained by the applicant. Borrowers have their own form, sba form 1919.

Web capital access financial system Lender’s application for guaranty for all 7(a) programs. The purpose of this form is to collect identifying information regarding the lender, loan terms, use of Web what is sba form 1920? Small business administration (sba) is announcing the update and release of sba form 1919, borrower information form, sba form 1920, lender’s application for loan guaranty, and sba form 1971, religious eligibility worksheet, all of which are used for all 7 (a) programs. The purpose of this form is to collect identifying information about the lender, the small business applicant (applicant), the loan guaranty request, sources and uses of funds, the proposed structure and compliance with sba loan program requirements, as defined in. While the lender fills out the form, the. Web sba form 1920 (revised 4/14) 1 omb control no.: Sba form 1920 is a part of the borrower’s loan package, but it needs to be completed by the lender, not the borrower. Both forms and other supporting documentation are used to evaluate your business’s eligibility for the sba 7 (a) loan program.

Web sba form 1920 (revised 4/14) 1 omb control no.: The purpose of this form is to collect identifying information about the lender, the small business applicant (applicant), the loan guaranty request, sources and uses of funds, the proposed structure and compliance with sba loan program requirements, as defined in. Web sba form 1920, officially known as the lender’s loan application for guaranty, is a form filled out by the lender and submitted to the sba. Both forms and other supporting documentation are used to evaluate your business’s eligibility for the sba 7 (a) loan program. Web the purpose of this form is to collect identifying information from the lender regarding loan eligibility, terms of the loan, use of proceeds, and jobs created/retained by the applicant. Small business administration (sba) is announcing the update and release of sba form 1919, borrower information form, sba form 1920, lender’s application for loan guaranty, and sba form 1971, religious eligibility worksheet, all of which are used for all 7 (a) programs. While the lender fills out the form, the. Web the purpose of this form is to collect identifying information about the lender, information about the loan guaranty request, sources and uses of funds, the proposed structure (which includes pricing and the loan term), the small business applicant, and compliance with sba loan program requirements. Borrowers have their own form, sba form 1919. The purpose of this form is to collect identifying information regarding the lender, loan terms, use of

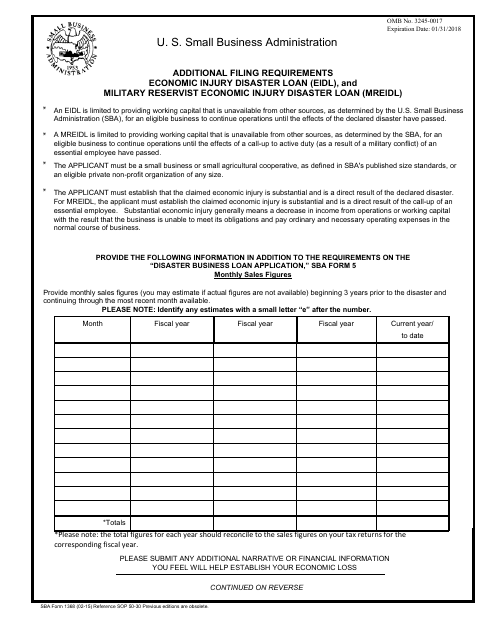

SBA Form 1368 Download Fillable PDF or Fill Online Additional Filing

While the form must be filled out by the lender of any 7 (a) loans, the borrower will need to provide much of the information required. Web sba form 1920 (revised 09/20) p a g e | 1. Web the purpose of this form is to collect identifying information about the lender, information about the loan guaranty request, sources and.

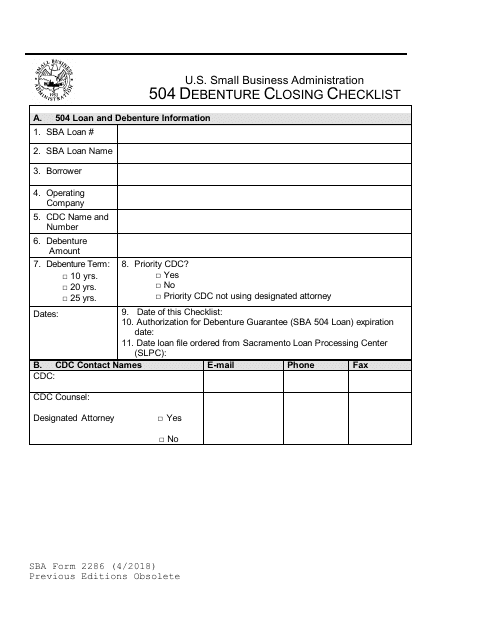

Sba 504 Loan Application Pdf Erin Anderson's Template

While the form must be filled out by the lender of any 7 (a) loans, the borrower will need to provide much of the information required. Both forms and other supporting documentation are used to evaluate your business’s eligibility for the sba 7 (a) loan program. Borrowers have their own form, sba form 1919. The purpose of this form is.

Barbara Johnson Blog SBA Form 1919 How to Fill out the Borrower

Web the purpose of this form is to collect identifying information about the lender, information about the loan guaranty request, sources and uses of funds, the proposed structure (which includes pricing and the loan term), the small business applicant, and compliance with sba loan program requirements. Lender’s application for guaranty for all 7(a) programs. Web what is sba form 1920?.

2017 Form SBA 2462 Fill Online, Printable, Fillable, Blank pdfFiller

While the form must be filled out by the lender of any 7 (a) loans, the borrower will need to provide much of the information required. The purpose of this form is to collect identifying information about the lender, the small business applicant (applicant), the loan guaranty request, sources and uses of funds, the proposed structure and compliance with sba.

Fill Free fillable SBA form 1920 Lender’s Application for Loan

While the lender fills out the form, the. Web sba form 1920, officially known as the lender’s loan application for guaranty, is a form filled out by the lender and submitted to the sba. Lender’s application for guaranty for all 7(a) programs. Web the purpose of this form is to collect identifying information about the lender, information about the loan.

20182020 Form SBA 1919 Fill Online, Printable, Fillable, Blank pdfFiller

Web the purpose of this form is to collect identifying information from the lender regarding loan eligibility, terms of the loan, use of proceeds, and jobs created/retained by the applicant. Web the purpose of this form is to collect identifying information about the lender, information about the loan guaranty request, sources and uses of funds, the proposed structure (which includes.

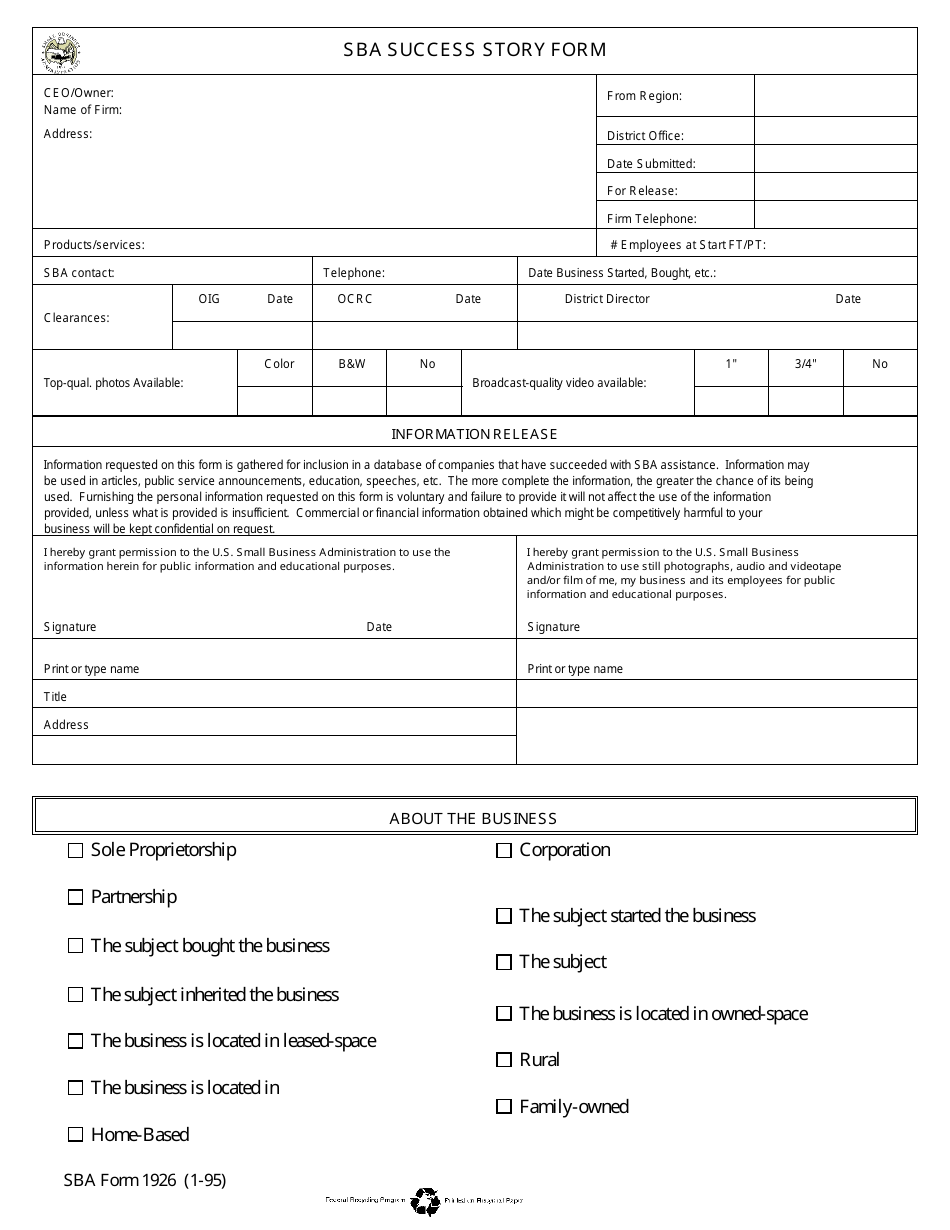

SBA Form 1926 Download Fillable PDF or Fill Online SBA Success Story

Web capital access financial system Web the purpose of this form is to collect identifying information from the lender regarding loan eligibility, terms of the loan, use of proceeds, and jobs created/retained by the applicant. While the lender fills out the form, the. Both forms and other supporting documentation are used to evaluate your business’s eligibility for the sba 7.

Fill Form 1920 and any SBA Loan Program Requirement (U.S. Small

Sba form 1920 is a part of the borrower’s loan package, but it needs to be completed by the lender, not the borrower. Web the purpose of this form is to collect identifying information about the lender, information about the loan guaranty request, sources and uses of funds, the proposed structure (which includes pricing and the loan term), the small.

SBA Form 1920 Download Fillable PDF or Fill Online Lender's Application

Small business administration (sba) is announcing the update and release of sba form 1919, borrower information form, sba form 1920, lender’s application for loan guaranty, and sba form 1971, religious eligibility worksheet, all of which are used for all 7 (a) programs. While the form must be filled out by the lender of any 7 (a) loans, the borrower will.

Fill Free fillable SBA form 1920 Lender’s Application for Loan

Both forms and other supporting documentation are used to evaluate your business’s eligibility for the sba 7 (a) loan program. Sba form 1920 is a part of the borrower’s loan package, but it needs to be completed by the lender, not the borrower. Web sba form 1920, officially known as the lender’s loan application for guaranty, is a form filled.

While The Lender Fills Out The Form, The.

Web capital access financial system Small business administration (sba) is announcing the update and release of sba form 1919, borrower information form, sba form 1920, lender’s application for loan guaranty, and sba form 1971, religious eligibility worksheet, all of which are used for all 7 (a) programs. The purpose of this form is to collect identifying information regarding the lender, loan terms, use of Web sba form 1920 (revised 09/20) p a g e | 1.

Web The Sba Form 1920 Provides The Sba With Information About The Lender, The Borrower, And The Loan Itself—As Well As Details About Compliance With The 7 (A) Loan Program Requirements.

While the form must be filled out by the lender of any 7 (a) loans, the borrower will need to provide much of the information required. Web sba form 1920, officially known as the lender’s loan application for guaranty, is a form filled out by the lender and submitted to the sba. Web the purpose of this form is to collect identifying information about the lender, information about the loan guaranty request, sources and uses of funds, the proposed structure (which includes pricing and the loan term), the small business applicant, and compliance with sba loan program requirements. Web sba form 1920 (revised 4/14) 1 omb control no.:

Borrowers Have Their Own Form, Sba Form 1919.

Lender’s application for guaranty for all 7(a) programs. The purpose of this form is to collect identifying information about the lender, the small business applicant (applicant), the loan guaranty request, sources and uses of funds, the proposed structure and compliance with sba loan program requirements, as defined in. Web the purpose of this form is to collect identifying information from the lender regarding loan eligibility, terms of the loan, use of proceeds, and jobs created/retained by the applicant. Sba form 1920 is a part of the borrower’s loan package, but it needs to be completed by the lender, not the borrower.

Web What Is Sba Form 1920?

Both forms and other supporting documentation are used to evaluate your business’s eligibility for the sba 7 (a) loan program.